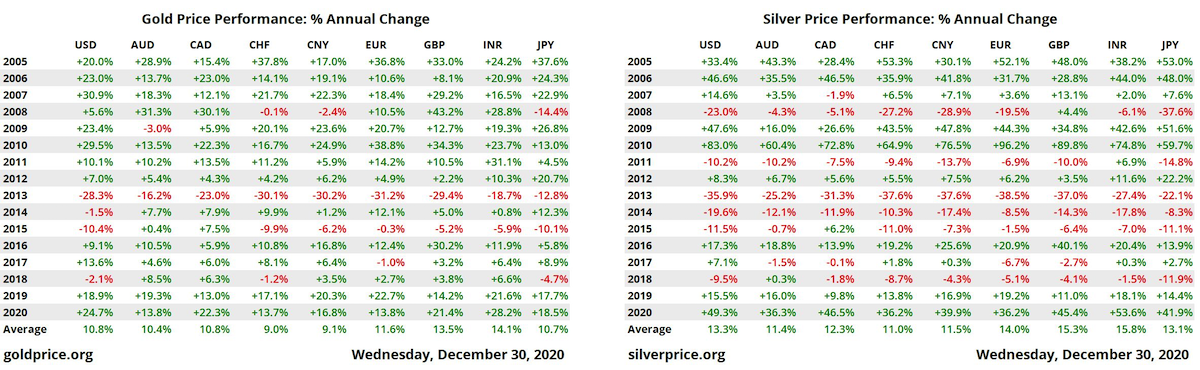

Gold and silver closed out their best years since 2010 following a year of unprecedented volatility brought on by the Covid-19 pandemic.

7 reasons you should invest in gold for 2021

Gold- an asset that never goes out of fashion. In 2020, Gold was one of the most sought after asset classes due to the uncertainty in the global markets. Gold is one of least available common metals on the earth.

For the last two years gold has appreciated considerably due to various reasons. What are the various factors that could influence the price of gold going forward?

- Reemergence of Covid-19

- World Economic Situation

- US Dollar Value

- US-China-Reset of the World Relations

- Inflation/ Interest Rates

- Printing of Money

- Other Factors

Gold prices will depend on the above factors in general. Although the vaccination for Covid-19 has started making its way to the markets, the emergence of the new strain of Coronavirus can lead to gold moving up. In general, any pandemic will create havoc in the global economy and in those uncertain times gold’s price will move up. Although the chance of this scenario happening in the near future is minimal, one never knows for sure.

At present, economies are in a buoyant mood with the relaxation of Covid-induced lockdowns and hence in the near term gold could be in a slow path. However, there are many other factors that work in favour of gold.

US Dollar value plays an important role in deciding the price of gold. Due to flow of dollars to emerging markets, the dollar could weaken in the short term which will drive the price of gold upwards. This has already started happening and could play out in the short to medium term. Since gold is priced in dollars, a weaker dollar makes gold less expensive in other currencies allowing it to rise.

Even before the pandemic, US-China relations were one of the reasons for gold prices to move up. However, under the new US President one can expect the tensions to be lower. Nonetheless the relationship will not smoothen out completely. Hence under this scenario as well, still there is a chance for gold prices to go up.

Trillions of dollars are being printed by the US and other countries across the world in a bid to boost their economies. This will ultimately stoke inflation. Inflation is a friend of gold and will increase its price. Under the current scenario, there is a good possibility for this. Other than printing of money, general inflation will also help the price of gold to move up.

Other factors such as mining of gold and gold reserves held by various central governments also play a major role in deciding the prices of gold. In the current scenario we don’t see countries selling their gold reserves. In contrast, many countries have increased their holdings. Hence, these other factors are not expected to exert a downward pressure on the price of gold.

Will silver prices go up in 2021 ?

Silver tends to loosely track gold. Like the yellow metal, it is benefiting from investors’ jangled nerves, with the global economic recovery looking slow and the risk of new waves of Covid-19 outbreaks. Rock-bottom borrowing rates have also reduced the opportunity cost of holding a non-interest-bearing asset, and there’s no sign of a change.

Unlike the gold market, where the metal is predominantly an investment vehicle, around two-thirds of silver demand comes from physical industrial applications, such as semiconductors and solders in electronics, solar panels, water purification, batteries and LED lighting as well as jewellery.

Rising industrial demand and continued investment interest are expected to combine with falling production from silver mining companies to support the silver 2021 forecast.

Analysts at Heraeus Precious Metals said in a recent report: “Global silver mine supply is forecast to contract by 6.3 per cent to 780.1 Moz [million ounces] this year (source: The Silver Institute), reflecting the impact of operational shutdowns in response to the pandemic. While this is a steeper decline than in previous years, silver mine supply has been dropping since 2016 owing to falling ore grades across major silver operations and a lack of new projects.”

“Despite silver’s rally this year, producers will be hesitant to increase supply on the price alone. The majority of silver is mined as a by-product of other metals (such as gold), which is the main source of revenue for many silver producers. Silver, like gold, typically sees stronger prices from mid-December and into the first quarter. If the trend holds, silver can continue to outperform gold.”

In the meantime, analysts at Australia’s ANZ bank note that “silver has largely outperformed gold for the past two quarters, normalising the gold/silver price ratio to 80x. Investment demand has been the key driver, with ETF holdings rising to a record high of 871 Moz (+250 Moz net flows) this year. The retail investment was not left behind, as coins and bars increased by more than 15 per cent. These strong investments have offset weaker fabrication demand amid contracting economic activity. Mine supply contracted by 5 per cent y/y to 795 Moz, this has also played a role in keeping the market balance tight.”

The analysts commented on their projected silver prices 2021: “While investment has been the key driver this year, we expect industrial and jewellery demand to recover strongly in 2021. Electronics and solar panels will be the major source of incremental demand growth amid rebounding industrial activity. Overall, the constructive fundamentals of silver should sustain investment interest, pushing the price towards $26.5/oz over the next 6-12 months.”

Ole Hansen, the head of the commodity strategy at Saxo Bank, is bullish on the outlook for the silver price in 2021: “Silver has always been a wily beast for investors due to its dual precious metal/industrial metal uses, and 2021 sees silver rising on both... Turbocharging the rise in the silver price in 2021, even relative to gold, is the rapidly rising demand for silver in industrial applications, especially those driving the green transformation such as photovoltaic cells used in solar panel production.”

Hansen added: “In fact, a real silver supply crunch is on the cards in 2021, and it frustrates the full-throttle political support for solar energy investments under a Biden presidency, the European Green Deal, and China’s 2060 carbon-neutral goal, among other initiatives.”

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.