Probably one of the most important new secular theses in global macro today.

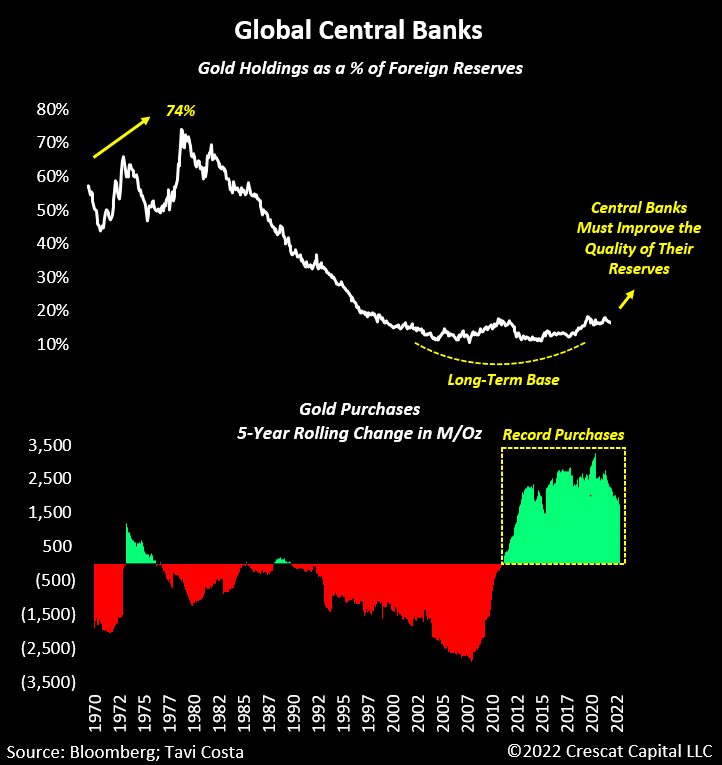

Gold is in the early stages of becoming the preferred asset among central banks looking to improve the quality of their international reserves.

Very bullish for the metal.

The BoJ news is incredibly relevant for gold long term.

It adds to the question: Why should central banks accumulate sovereign bonds to their FX reserves?

"Ever since the global financial crisis, gold has become a bit more interesting to central banks as a reserve asset. Unlike default-able sovereign bonds, gold has no counterparty risk if they custody it themselves, and over the long term it historically keeps up with inflation", Lyn Alden says.

Gold as a % of their international reserves peaked at 74% in ‘80. It’s now less than 18%.

Probably headed much higher.

Original source: @TaviCosta

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.