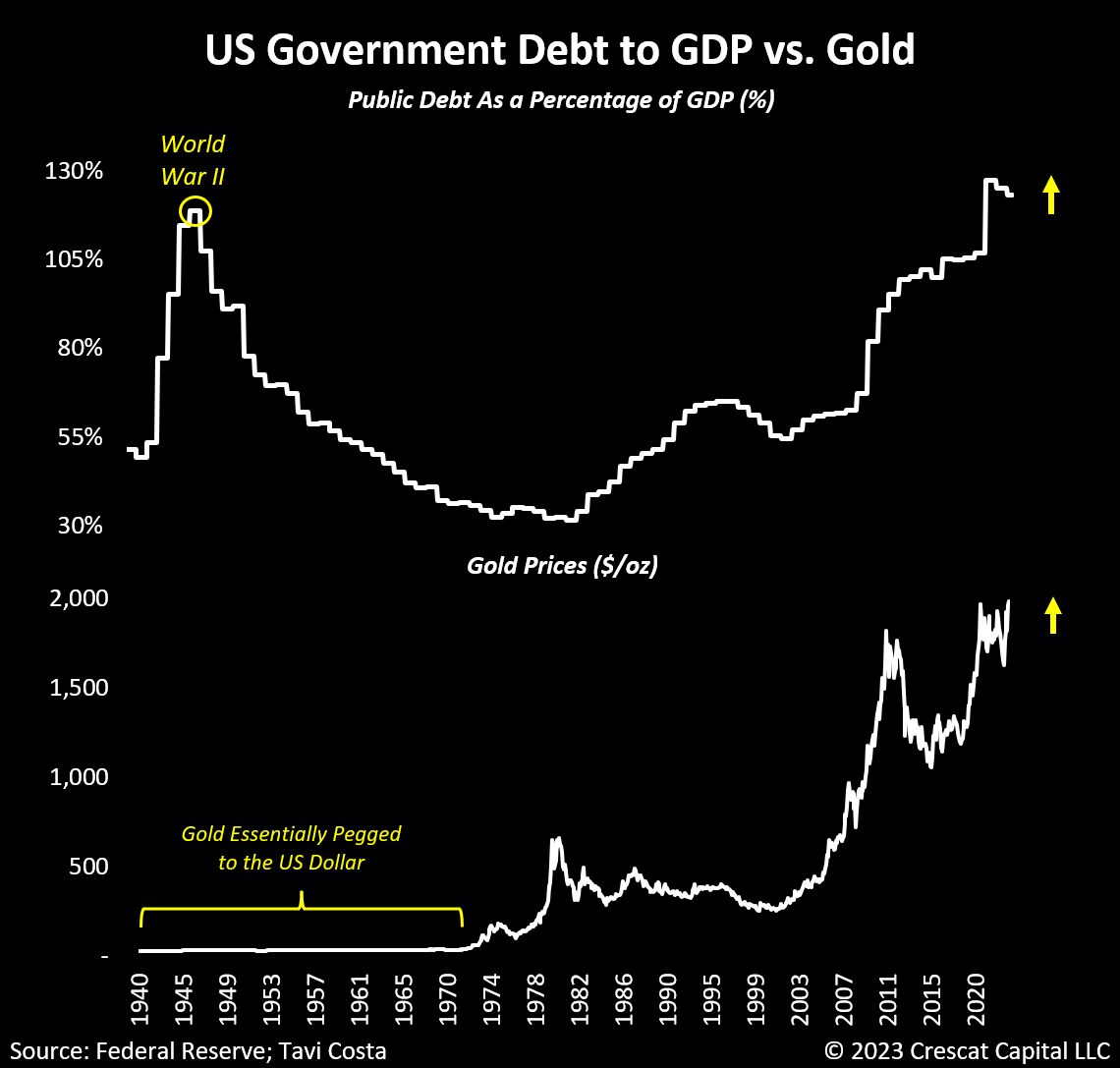

Investors often use the 1940s period as a compelling historical analogy to today given the severity of the current debt problem.

However, there is one major distinction that is often ignored:

During that time, the US dollar was effectively tied to gold prices, making the metal an unfeasible investment alternative.

Today, with prices unpegged, it is highly probable that capital will divert away from US Treasuries and flow into gold.

This becomes particularly crucial at a time when the government is about to issue a flood of debt instruments into the market after ultimately extending the debt limit.

If the rationale for owning US Treasuries today is solely based on the premise that the system cannot endure substantially higher interest rates, then gold is a far superior choice.

It’s a neutral asset with no counterparty risk that also carries centuries of credible history as a safe haven and monetary alternative.

Original source: @TaviCosta

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.