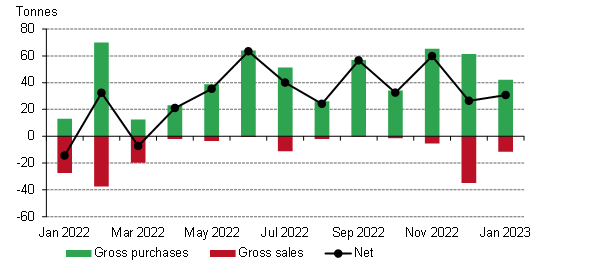

Central bank gold demand in 2023 picked up from where it left off in 2022. In January, central banks collectively added a net 31 tonnes (t) to global gold reserves (+16% m-o-m) [1]. This was also comfortably within the 20-60t range of reported purchases which has been in place over the last 10 consecutive months of net buying.

Central banks remained committed buyers of gold in January*

*Data to 31 January 2023. Please see footnote 1 for more information on the underlying data.

Source: IMF IFS, Respective Central Banks, World Gold Council

Activity was relatively concentrated during the month, with only three banks accounting for gross purchases of 44t and one bank offsetting this with 12t of sales. [2]

The largest reported purchaser in 2022 was also the largest buyer in January: the Central Bank of Türkiye (Turkey) added 23t to its official gold reserves, which now stand at 565t .[3] People’s Bank of China (PBoC) also bought again during the month, adding 15t on top of the 62t of gold reported between November and December 2022. Its gold reserves now total 2,025t (3.7% of total reserves). The National Bank of Kazakhstan increased its gold reserves by a modest 4t in January, taking its gold reserves to 356t.

The European Central Bank (ECB) reported a near 2t rise In Its gold reserves In January, however It was not an outright purchase by the bank. This was related to Croatia joining the currency union, as the country was required to transfer the gold, as part of a larger transfer of reserve assets, to the ECB.[4] For this, the country bought nearly 2t of gold in December.

The Central Bank of Uzbekistan was the only prominent seller during the month, reducing its official gold reserves by almost 12t (-3% m-o-m). Its gold holdings now total 384t, 66% of total reserves.

Focus on this sector of the gold market has been intense in recent months, owing to the record level of buying from central banks in 2022.[5] We have faced questions from some investors on whether central banks will sustain this appetite for gold. As we noted in our latest Gold Demand Trends report:

“Looking ahead, we see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023. However, by how much is difficult to call, as evidenced by our expectations at the start of 2022. But it is also reasonable to believe that central bank demand in 2023 may struggle to reach the level it did last year.”

The healthy January data we have so far gives us little reason, at this time at least, to deviate from this outlook either.

Notes :

[1] : Based on IMF data supplemented with data from respective central banks where available and not reported through the IMF at the time of publication. Figures may be revised in our next monthly update should more data become available.

[2] : Totals may not sum due to rounding.

[3] : Türkiye official sector gold reserves are the sum of central bank-owned gold and Treasury gold holdings. This is equivalent to gross gold reserves less all gold held at the central bank in relation to commercial sector gold policies (such as the Reserve Option Mechanism (ROM), collateral, deposits and swaps). For information on this methodology, see: https://www.gold.org/download/file/16208/Central-bank-stats-methodology-technical-adjustments.pdf

[4] : https://www.kitco.com/news/2023-02-07/Croatia-buys-nearly-2-tonnes-of-gold-to-transfer-to-the-ECB-as-it-becomes-the-latest-eurozone-member.html

[5] : We publish two series of central bank gold activity, which are drawn from different sources. Central bank demand reported in Gold Demand Trends is primarily sourced from Metals Focus, whose proprietary estimates of official sector activity incorporate the IMF data. The monthly time series of central bank holdings reported on goldhub.com uses IMF IFS statistics supplemented with data directly from central bank websites where needed and available. Both data sets are subject to revision as new information is made available and/or to accommodate late or updated data reported by official institutions to the IMF. IMF IFS data is reported with a two-month lag and most institutions report on a regular basis, although some will report with a – sometimes significant – delay. Metals Focus sometimes has insight into these transactions before they are reported and will incorporate these into their data, which will therefore not require a revision.

Original source: World Gold Council

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.