33 years ago, The Economist published an article announcing a new global currency for "around 2018".

On the cover of the magazine, the Phoenix, rising from the ashes of fiat currencies, features a 2018 gold coin.

The Economist: "Get Ready For A World Currency By 2018" https://t.co/9V2YyK0VWZ pic.twitter.com/uF9Slr7GRv

— GoldBroker (@Goldbroker_com) September 1, 2017

How could anyone be sure enough to bring forward such a specific date 33 years in advance for an event of global significance? Isn't that amazing?

This event is currently underway. What will happen at the end of this month of June should indeed have happened in 2018. That is why.

1988 - 2008 - 2018: The history of the Basel III NSFR

The bankruptcy of the German Herstatt Bank in 1974, which brought to light serious dysfunctions in the banking system, could have led to systemic risks. To remedy this, the central banks of the G10 and then the G13, under the Basel Committee, have worked on new banking and financial rules to ensure the security of the system. After 14 years of work, the members of the G13 signed a series of protocols, which were called "Basel Accords". It was in 1988.

Only a few weeks later, an extremely knowledgeable person wrote this famous article: “Get ready for the world currency”. The body of the article talks about a perfectly stable currency, not allowing governments to use inflation to finance their budget deficits. Gold is the only currency offering this stability of purchasing power.

The gold withdrawn from the international monetary system in 1971 by President Nixon, for the benefit of a purely fiduciary dollar, is therefore the mythical phoenix which must rise from its ashes. That's what the magazine cover image proclaims.

But by what way?

After 1988, the Basel Committee continued its work, when the world seemed to be in chaos. Savings and loan crisis around 1987, bankruptcy of the USSR in 1991, Mexican crisis of 1995, Asian crisis with the bankruptcy of the little dragons in 1997, Russian financial crisis in 1998, systemic crisis due to the bankruptcy of LTCM in 1998… In 2004, after 16 years of work, the central bankers of the G13 signed the “Basel II Accords” revising the capital standards in relation to credit and market risks. These recommendations were to be gradually implemented from 2007 to 2008.

But in 2007, the american real estate bubble was inflated by subprime mortgage loans. Banks transform batches of mortgages into very complex financial products that are supposed to have high yields, which will be sold to almost every bank on the planet. When the real estate market turns around and investors realize that these financial products are junk bonds, the market crumbles. One of New York's biggest banks goes bankrupt, causing dominoes to fall around the world and a global systemic crisis.

After the successive crises of the 1990s, the emerging countries have come together and formed an alliance behind their leaders - Brazil, Russia, India and China - called the BRICs. Representing 41% of the world's population, these countries believe that international bodies (IMF, World Bank, etc.) favor the Western economy, in particular United States, to their detriment. The G13 thus became the G20. It was in November 2008, in the midst of the financial crisis, under the presidency of the United States, that for the first time the G20 brought together heads of state and their finance ministers in addition to central bank governors. The Financial Times called the meeting the "New Bretton Woods" because the heads of state of most of the major countries called for far-reaching reform of the monetary system.

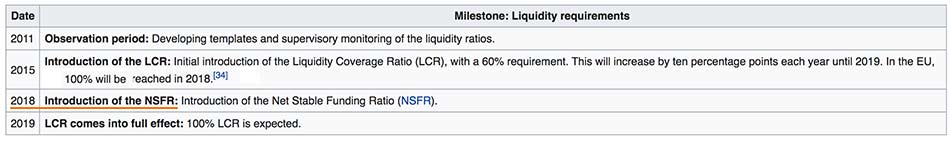

From the next G20 in London in 2009, the Financial Stability Board was enlarged to include all members of the G20. It was at this time that new work by the G20 financial authorities began, leading to the “Basel III Accords” which will be signed on December 16, 2010. These new rules deal with liquidity ratios and in particular the NSFR (Net Stable Funding Ratio), which should be mandatory on January 1, 2018. (See page 9 of the original 2010 BIS document or its simplification on Wikipedia.)

As we have known for a few months, the implementation of the NSFR, in particular on allocated or unallocated gold and on its derivative products will cause an earthquake on the market, which should lead to a serious revaluation of the price of ounce of physical gold. As for the gold-paper game, it will no longer interest the banks and will only be addressed to a few professionals looking to hedge a future delivery.

#Gold And Basel III: What To Consider

— GoldBroker (@Goldbroker_com) March 9, 2021

➤ Read: https://t.co/ytzGJLbAWW pic.twitter.com/Iy0VwNyoJV

Some rare chess players are able to predict their victory 20 moves in advance.

The Economist's author is of this caliber, having anticipated 33 years in advance what would happen following the first Basel III Accords.

Somehow, he probably "advised" the Committee members to make the game go as originally planned.

These Basel III rules apply to all major banks around the world

Major Chinese banks meet Basel III standards. The NSFR has been the rule since March 2019.

In India, the big banks have been Basel III compliant since 2019. The NSFR will be mandatory there on 1st October 2021.

And in Russia, banks are also already up to Basel III standards.

As a reminder, the major U.S banks will have to apply the NSFR on July 1, 2021. (See the directive of the OCC, the Federal Reserve and the FDIC.)

This rule applies to U.S banks, savings and pension funds and their subsidiaries with assets exceeding $ 100 billion. Ditto for subsidiaries of foreign banks.

Either the 39 largest banks in the United States.

The reset announced in Davos in 2014 by the director of the IMF, Christine Lagarde is already underway. The pace will pick up next month.

The interminable negotiations at the IMF on the content of the SDR basket of currencies must imperatively be concluded before the end of the first half of 2022, for implementation on August 1, 2022.

I wouldn't be surprised if gold took up 20% of the shares in this basket, as in Russia's currency reserves or in those imposed on the Russian National Wealth Fund since last Thursday. (Source)

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.