On July 1, 2025, U.S. banks and financial institutions will be subject to the Basel III NSFR rules.

For the gold market, which is of interest to us here, this means that unencumbered physical gold in the capital of a bank will be considered a guarantee of financial solidity. Conversely, pledged gold, or gold held in the form of futures contracts and paper gold such as ETFs, will be considered a speculative product, and therefore as a risk for the banking institution.

This deadline alone explains the gold rush observed in the United States since the beginning of the year.

Between December 2024 and March 2025, 25.4 million ounces (Moz) of gold, or 720 tonnes, were delivered to COMEX warehouses. A few years ago, the COMEX was barely delivering around 40 tonnes per year.

Officially, the media attribute this gold rush to a panic fear of tariffs — Donald Trump's famous "tariffs." But this explanation is far removed from reality. It's simply more convenient to tell stories about tariffs than to address the implications of the Basel III rules.

For the sake of completeness, this story can be traced back to 1967, when the 7 central banks’s alliance, known as the "London Gold Pool," created to defend the dollar's value against gold, broke apart. The United States failed to maintain the price of an ounce of gold at $35, leading to a rise in the price of gold or a decline in the dollar's purchasing power. So much so, that in August 1971, Richard Nixon had to declare the end of the "Gold Exchange" system, established during the Bretton Woods Agreements in 1944 by international monetary authorities.

In this new context, where currency was no longer backed by gold, every countries experienced a very high inflation for several years. The central bankers of the G10 countries decided to create the "Basel Committee" under the aegis of the Bank for International Settlements (BIS). This committee's objective was to define rules to secure the banking system, particularly in the context of international trade. It was not until 1988 that the first "Basel Accords" were published. These rules were strengthened in 2008 with "Basel II", then again in 2010 with "Basel III", whose gradual implementation was phased in until 2019. Since then, these agreements have become more complex, particularly with the NSFR rules and provisions concerning gold, to the point that some were speaking of a "Basel IV Accords ». These new rules officially entered into force in Europe on January 1, 2023.

At the same time, it should not be forgotten that after the Lehman Brothers bankruptcy in September 2008 — an event that triggered a systemic crash and the collapse of global stock markets — the G20 meeting held in Washington in November of that year was particularly tense. Faced with the gravity of the situation, many major powers called for an overhaul of the international monetary system. So much so that some media dubbed this meeting "Bretton Woods 2." A few months later, China published an essay entitled "Reform the International Monetary System," in which it expressed regret that the Bancor project, proposed at Bretton Woods in 1944, had never been implemented.

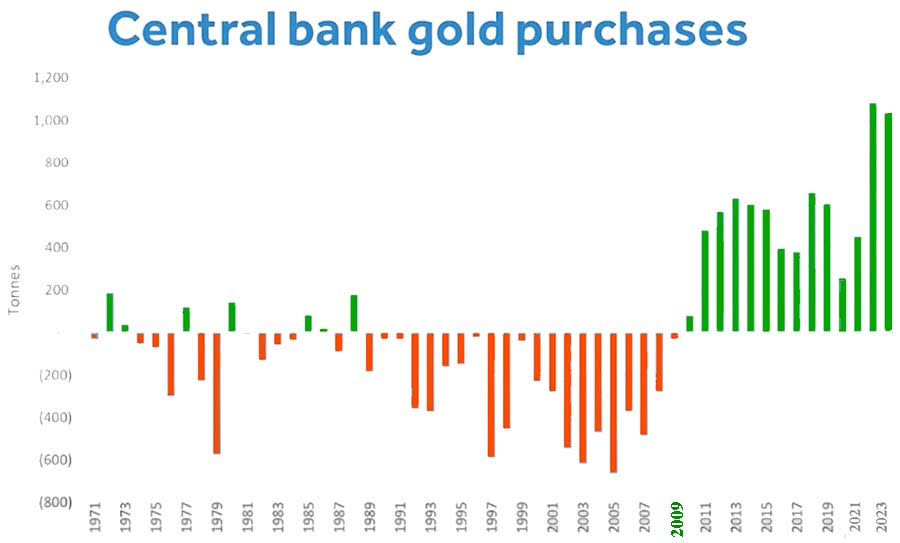

However, starting in mid-2009, Western central banks stopped selling their monetary gold reserves and began accumulating more and more of the yellow metal, as this chart shows:

It is interesting to note that the price of gold was firmly held below $2,000 per ounce for 12 years. During this period, central banks attempted to reclaim their national gold, which had been "leased" on the markets but very often sold after being misused. The BIS, the "central bank of central banks," itself held numerous gold swaps, which it worked to unwind.

This was achieved in November 2022, just a few weeks before the gold was officially classified as "Tier One" for all European banks and the Basel III NSFR rules were implemented on January 1, 2023.

London's gold market fought a rearguard action for months, particularly by clearing house officials, to delay the implementation of these extremely restrictive rules. However, the LBMA and its bullion banks eventually complied. Since then, the price of gold has risen from $2,000 to $3,300 in just fifteen months.

This rise is far from over, especially since the rush to obtain physical gold has begun in the US, but it will intensify from July 1st and continue thereafter, as it will become impossible to meet demand. Auctions are therefore likely to become even more heated.

What will happen to ETFs, which will lose all interest for financial players?

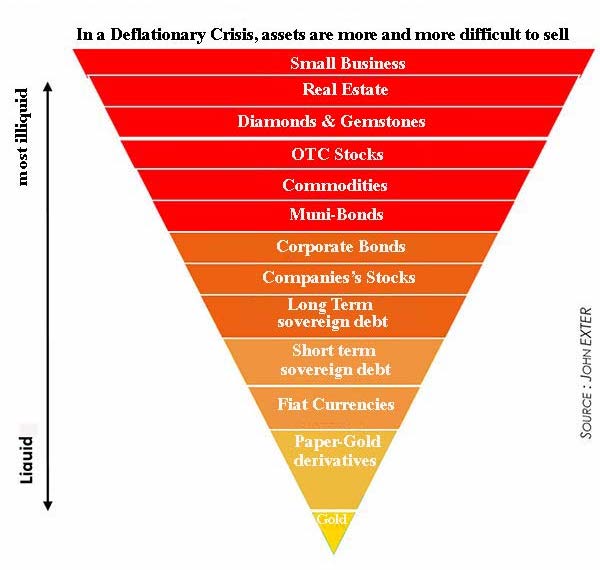

In the Exter's inverted pyramid, gold derivatives were close to the base. However, this layer is crumbling, endangering the layer just over, which is fiat money, which, as its name suggests, is based on trust.

A priori, in geopolitics at this time, there is no longer any trust. The basic currency of international trade has been the dollar since 1944, but everything seems to have been done to force nations to move away from it and seek alternative currencies. This is what the BRICS nations have been working on since 2009.

At the next level up, we find sovereign debt.

The day after his inauguration, Trump searched to renegotiate the United States' debt by transforming current debt into 100-year coupon-free bonds! A century's worth of unpaid IOUs. Isn't this a form of default on the American debt? At the same time, there appears to be a bond crisis in the United Kingdom and Europe, among leading countries including Germany.

The whole system has started to unravel.

At the same time, the new governor of the Bank of Japan is in the process of ending the Yen Carry Trade. This system, established in 1999, allowed banks and hedge funds to lend tens of thousands of billions of dollars ($27 trillion) at rock-bottom rates, and even negative rates. This money, borrowed in yen, was converted into dollars and invested in anything that yielded more than the initial rate. Some of it was invested on Wall Street, inflating speculative bubbles.

Since last April, then in July 20024 and January 2025, the BoJ has ended negative rates and gradually raised its rates. With each new decision, there has been a massive sell-off on Wall Street, as borrowers hastened to sell to repay their debts to the BoJ. In doing so, selling dollars to buy yen, the latter reversed its downward trend, increasing panic among those who had previously profitably played this Yen Carry Trade. If the BoJ continues its policy, the immense financial bubble will burst, plunging the world into deflation.

Silver

It is highly likely that the inability to meet the demand of physical gold by the actual paper-gold holders, will lead to a shift to physical silver, even if it is non-Tier One. Given that the silver market is less deep than that of gold, and has already been facing a significant shortage for several years, we should see a sharp rise in silver prices from the end of May through the end of the year, well above the historic highs of 1980 and 2011.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.