Due to global competition, mineral prices — regardless of the type of commodity — tend to decline over time. There comes a time when the operation of a mine becomes economically unprofitable due to low prices. Small firms, unable to withstand this pressure, are closed down or acquired by competitors with greater financial resources, who will also end up ceasing down operations if market conditions do not improve. This dynamic results in a period of consolidation within the mining sector, followed by a gradual reduction in the production of the affected mineral.

Until the industry discovers a new use for this ore, generating a new demand. However, due to the prior phase of declining supply, the market is now in a situation of shortage and manufacturers must compete on prices to obtain the ore they need. In the long run, this price surge captures the interest of investors, who recognize a profitable opportunity and choose to finance the reopening of previously closed mines, now economically viable thanks to elevated prices.

Reviving an old mine or creating a new one usually takes about ten years to reach full production. During this time, the shortage persists and prices continue to rise, attracting a growing number of investors excited by the mining adventure.

Several years later, supply eventually caught up with or exceeded demand, reintroducing competition and leading to a gradual decline in prices.

The cycle starts again.

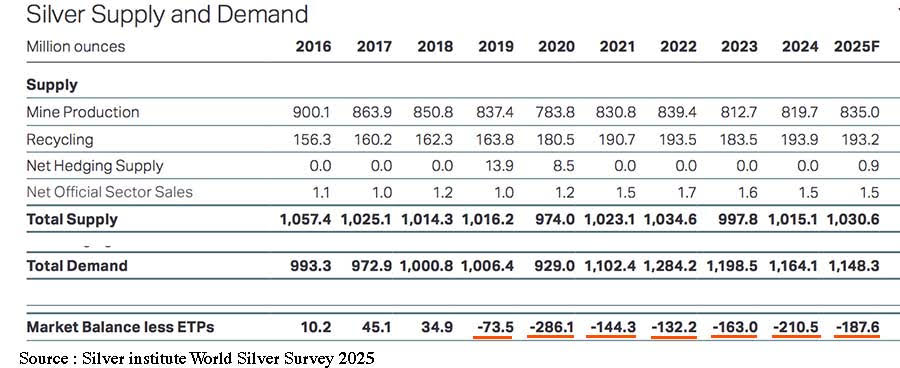

For at least the past seven years, silver supply has fallen short of demand. This is mainly due to the ongoing decline in the silver content of ores from older mines, along with rising energy and labor costs — partly driven by inflation. Faced with these constraints, many mining companies have shut down their least profitable sites and shifted to extracting other, more economically viable minerals.

Over the past decade, industrial demand for silver has risen sharply, driven in particular by the expansion of photovoltaic and other green technologies, as well as the growth of the arms industry — a factor consistently overlooked in Metals Focus’s annual analyses. Yet the war in Ukraine is being waged relentlessly in the air, with drones and missiles heavily reliant on electronic components that consume significant amounts of silver. Meanwhile, political discourse across Europe, advocating for substantial increases in defense budgets in anticipation of a potential conflict with Russia, points to a likely surge in silver demand in the years ahead.

On July 4, 2022, Peter Hambro, a prominent figure at the LBMA, gave a surprising interview to Reaction Life. He revealed that since the 1960s, the precious metals market had been manipulated by a Cartel — of which he was a member — through the creation of various forms of 'paper' gold and silver (derivatives). According to Hambro, the primary aim of this manipulation was to mask real inflation, namely the gradual erosion of currency purchasing power. He further claimed that this scheme was orchestrated by the Bank for International Settlements (BIS) through the London Gold Pool since the 1960s.

However, in 2022, the BIS gradually liquidated all its gold swaps just before gold was reclassified as a Tier 1 asset and the new Basel III NSFR rules came into effect.

Since then, the gold price has risen from $1,875 to $3,415 per ounce.

The silver price has gone from $17.70 to $36, but it is still not enough to make silver mining truly profitable. Given the ongoing depletion of known terrestrial deposits, a much higher price will be necessary — first, to reignite geological exploration efforts, and later, to enable the exploitation of subsea reserves.

Silver is thus on the verge of a major revaluation.

A recent Executive Order invoking the National Defence Production Act — the President’s main lever to direct economic activity toward military priorities — states:

“The United States possesses vast mineral resources that can create jobs, fuel prosperity, and significantly reduce our reliance on foreign nations. Transportation, infrastructure, defense capabilities, and the next generation of technology rely upon a secure, predictable, and affordable supply of minerals.

The United States was once the world’s largest producer of lucrative minerals, but overbearing Federal regulation has eroded our Nation’s mineral production.”

The Trump administration has made U.S. production and refining of critical minerals and rare earths a top priority, entering into mining agreements with various countries to secure essential elements needed for a wide range of products — from smartphones and electric vehicles to F-35 fighter jets.

More than raw mineral supplies, the U.S. needs refined products from these minerals ready for use in electronics, defence systems and batteries.

Although never explicitly named, the decree primarily concerns silver.

Thus, to stimulate domestic mining production, the U.S. government seems ready to initiate a new mining cycle by letting the price of silver appreciate.

Silver

The weekly silver chart points to a possible rise in prices to $38 over the next few days:

It should be noted that after the breakout of the major $35 resistance, we will likely see a pull-back to this multi-year resistance in the coming days or weeks.

Credit Crunch

Many precious metal analyts say, day after day, that gold and silver are destined to go to the moon, and they are right.

However, when they claim that mining shares will multiply this move by five, in the manner of simple CALL options, they are wrong.

A mine is primarily a publicly traded company on the stock market.

Speaking at the Reagan National Economic Forum on 30 May, JP Morgan's chairman, Jamie Dimon, said that a bond crash was inevitable. According to him, it was no longer a matter of "if" but of "when" — he didn’t know exactly when this would happen, but he knew for sure.

Jamie Dimon of JPMorgan, $JPM: "You are going to see a crack in the bond markets. It is going to happen. I am telling you it's going to happen, and you're going to panic. I'm not going to panic" pic.twitter.com/ehkni4EoFi

— unusual_whales (@unusual_whales) June 7, 2025

During a bond or stock market crash, the rapid decline in asset values leads to a destruction of the money supply.

On the stock exchange, almost all securities are bought on credit, since it is often enough to pay 20% of the value of the assets purchased to have 100% in portfolio.

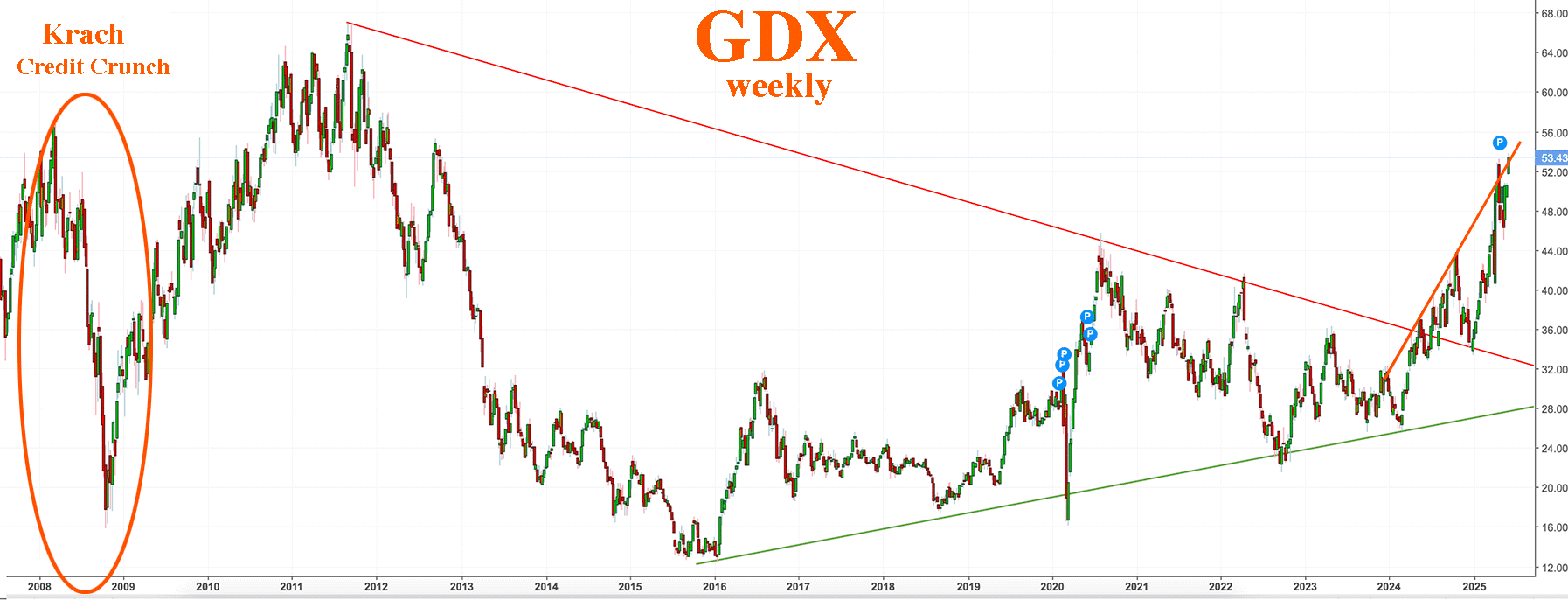

As seen during the 2008–2009 crisis, the steeper the fall in stock prices, the more brokers require their clients to increase their collateral deposit to cover their positions — a process known as a margin call. To meet a margin call, investors must urgently raise liquidity, often by selling off their most resilient assets.

In 2009, some of the most promising junior mining stocks collapsed, losing as much as 95% of their value.

There is little doubt that a bond market crash is imminent — the early warning signs are already emerging. In Japan, the Bank of Japan (BoJ) has begun reducing its balance sheet and is now dismantling the massive financial structure of the yen carry trade, which has persisted for over two decades.

Each rate hike by the Bank of Japan over the past 18 months has compelled yen borrowers to make emergency repayments, triggering shocks in global markets — most notably sharp declines on Wall Street.

A bond market crash is highly likely to trigger a sharp correction in stock markets. This massive destruction of the money supply will sweep away everything in its path. Mining stocks, in particular, are likely to be heavily impacted by the coming credit crunch, just as we have seen in 2008-2009 — but given the expansion of global debt since then, the fall-out could be even more brutal.

Therefore, investments in physical metals — gold or silver — with guaranteed personal ownership are strongly recommended.

In the face of ongoing currency devaluation, which will only accelerate in the coming months, your physical metals are an essential form of wealth preservation.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.