On May 1, the Federal Reserve published a financial accounting manual for regional banks in the Fed System — available for download here.

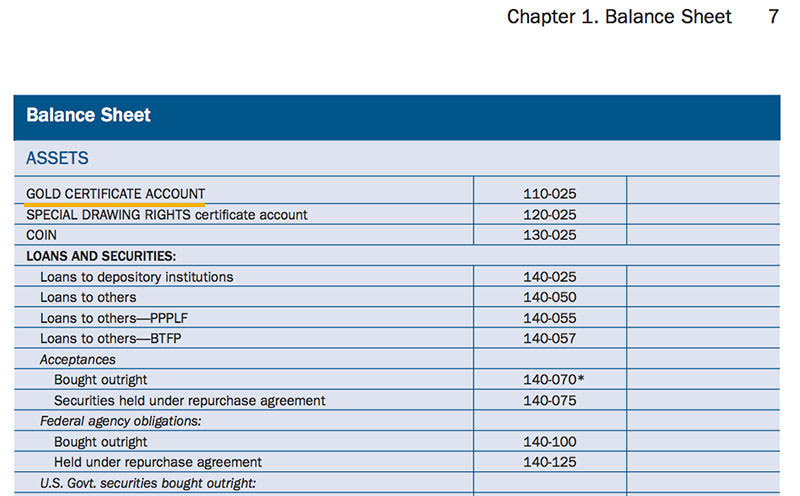

Starting on page 7, note that the very first line refers to the Gold Certificate Account:

"The Secretary of the Treasury is authorized to issue gold certificates to the Reserve Banks to monetize gold held by the U.S. Department of the Treasury (Treasury). At any time, Treasury may reacquire the gold certificates by demonetizing the gold.

Treasury maintains an account with the Board of Governors entitled “Gold certificate fund — Board of Governors of the FR System.” When the Treasury monetizes gold, it credits this account in return for deposit credit at the Federal Reserve Bank of New York (FRBNY). When demonetizing gold, Treasury decreases the account and authorizes the FRBNY to charge its deposit account. The offsetting entry in each case on the FRBNY’s books is made to the Gold Certificate account and the U.S. Treasury — general account. The FRBNY accounting staff sends an advice of these entries to the Board. Also, whenever the official price of gold is changed, Treasury adjusts the account and, simultaneously, the deposit account."

On the Federal Reserve's books, an ounce of gold is still recorded at $42.22. However, this figure could be revalued by a simple accounting entry, aligning it with the current gold price in London, on the COMEX, or even with a value arbitrarily set by the President of the United States, as permitted by the Gold Reserve Act of January 30, 1934. At the time, President Franklin D. Roosevelt had used this power to raise the legal tender price of gold from $20.67 to $35 per ounce, just after the passage of this law.

Such an accounting adjustment would instantly increase the book value of U.S. Treasury gold reserves, partially rebalancing the federal debt.

Today, the 260 million ounces of gold supposedly held by the U.S. Treasury are recorded at only $11 billion. At current prices, their value would approach $936 billion — still modest compared to the $37 trillion federal debt.

Some analysts go further, suggesting a possible revaluation to at least $20,000 per ounce.

On August 1, 2025, an article by Colin Weiss, Senior Economist at the Board of Governors of the Federal Reserve System, was published on the Fed's official website. It analyzes historical precedents for revaluations of official gold reserves.

In principle, the book value of gold on the Treasury’s balance sheet should remain as symbolic as today’s $42.22. In practice, however, this may not be the case.

One way or another, markets could be compelled to align with a price decreed by the President, triggering the kind of “reset” Christine Lagarde referred to at Davos in 2014. That same year, on December 23, 2014, a new rule for precious metals trading, Rule 589, was introduced. In a market where demand overwhelms supply (with only buyers and no sellers), gold prices can jump by up to $400 per day, and silver by $12. If banks fail to agree on a fixing price, the market closes after about ten minutes, with no transactions until the following day.

Should a U.S. president invoke the Gold Reserve Act, a global revaluation of gold would benefit all over-indebted nations holding significant reserves. Meanwhile, a severe bond crisis is unfolding not only in the U.S., but also in Japan, the U.K., and France. Signs suggest the global monetary and financial system is nearing a breaking point.

Wasn’t the recent meeting between Donald Trump, France’s Emmanuel Macron, Germany’s Friedrich Merz, the U.K.’s Keir Starmer, and Italy’s Giorgia Meloni an opportunity to address this urgent matter — and to accelerate the White House’s timetable?

A concerted monetary devaluation

A rise in the price of gold would essentially reflect a concerted monetary devaluation of all fiat currencies, carried out simultaneously.

If we assume this scenario as a given, a major question arises:

What could be the consequences for the population as a whole?

Will it trigger a generalized surge in commodity prices, followed by an erosion of household purchasing power?

Should we anticipate serious social unrest?

Will stock markets experience a “Caracas Syndrome” — soaring stocks in response to devaluation — or collapse under the combined weight of falling consumption and deepening recession?

The BRICS+

Since at least 2009, the BRICS have been actively preparing to avoid being drawn into the chaos of a possible collapse of the G7 monetary system.

By developing alternatives to SWIFT that allow banks to bypass the dollar system, establishing their New Development Bank as a counterweight to the World Bank, gradually reducing their exposure to U.S. debt, and investing heavily in gold and other precious metals, the BRICS have built a series of firewalls to protect themselves against future systemic shocks.

As early as August 2009, China began encouraging its population to invest in gold and silver, gradually modifying the rules of the Shanghai Gold Exchange (SGE) and those of the banks to facilitate access to precious metals for as many people as possible.

In the event of a gold revaluation, Chinese citizens could emerge among the biggest winners. The SGE itself has become a central player in the global gold market.

On Tuesday, September 2, the Shanghai Gold Exchange pushed prices higher, with London and New York aligning with Shanghai’s rate — a historic first.

Has China been preparing for a return to a gold standard all along?

To function, a gold standard would require a far higher price than today.

Will Donald Trump, willingly or not, help China and Russia rebuild the international monetary system?

The answer could come within weeks — or months at most.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.