The Context

It seems necessary to first recall the letter from the CME, COMEX's parent company, sent in 2021 to the New York Stock Exchange regulator, the CFTC. It stated that official silver stocks considered "eligible" for COMEX trading should be reduced by 50% because, although stored in CME-approved warehouses, they have no actual connection to the market itself.

As a reminder, since March 2022, Russian gold and silver bars have been banned from trading in both London and New York. At the time, SLV held 39,451 1,000-ounce Russian silver bars, totaling 39.4 million ounces worth approximately $1 billion, which could not be sold. A similar search could be conducted at PSLV, ZKB, JPM, HSBC, or even in the COMEX and LBMA inventories. Have the authorities reversed course?

On October 8, 2025, an order for 1,000 tons of silver placed by India triggered an immediate freeze in the London silver market. Silver lease rates instantly skyrocketed from 0.25% to 200%. All traders immediately withdrew from the market, and the Swiss refiner METALOR – which operates in 17 countries – even announced that it would not return before January 2026.

The London Barnet Market Association (LBMA), which oversees the London precious metals market, reported in October a stockpile of 844 million ounces of silver in its vaults – that's 23,926 tons. Yet, the market was unable to deliver 1,000 tons. Isn't that surprising, to say the least?

In reality, we know that four-fifths of this stockpile is registered in the name of various ETFs, and that these reserves are not intended for sale. Do these ETFs actually own these silver bars, or are they leased to a bank, which would thus receive a return on its investment?

In any case, JPMorgan Chase had to lease 4,000 tons from ICBC, the world's largest Chinese bank, an LBMA member and clearing house. These 4,000 tons did not come from the Shanghai stockpiles, which anyone can consult daily. Did they then come from the vaults of Chinese banks in London? That's very likely. And some of the silver allocated to ETFs probably also belongs to Chinese banks.

The physical silver leased by JPMorgan Chase to ICBC must be returned after three months, at the beginning of January. This seems highly unlikely.

Meanwhile, India is known to be significantly behind on its annual orders and is expected to request an additional 2,000 tons before the end of the year.

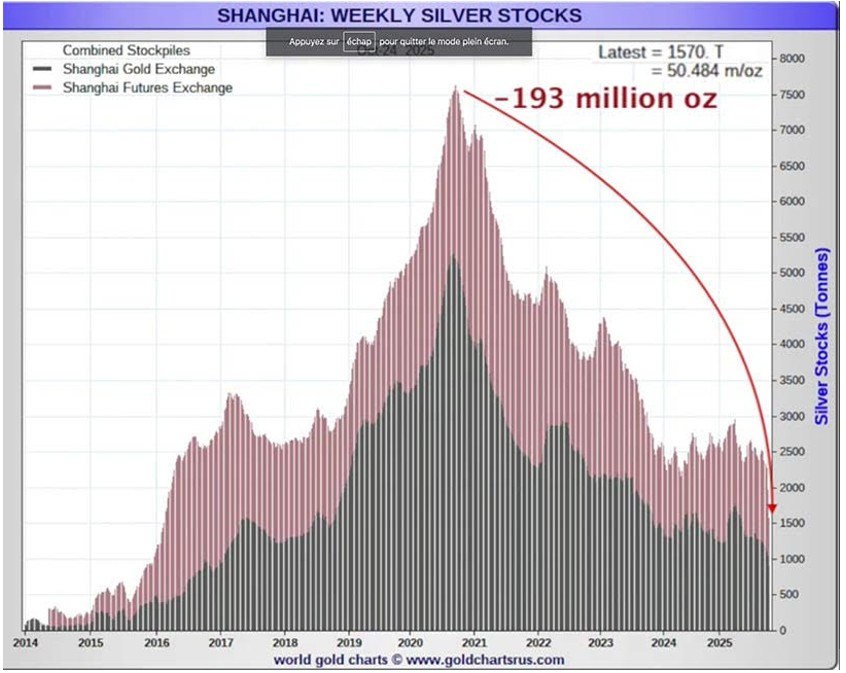

South Korea has negotiated a $76 billion order of precious metals, gold and silver, directly with Shanghai Gold Exchange (SGE). This could explain the drop of over 1,000 tons of silver in Shanghai's silver stocks in three months, representing two-fifths of the total.

So much so that China severely restricted all silver exports on November 3rd.

The market is extremely tight.

The facts

The Chicago Mercantile Exchange (CME), parent company of COMEX, announced that due to a problem affecting the cooling system of its CyrusOne data center, the servers had to be shut down, leading to the closure of the silver futures market.

A rather implausible explanation.

On Friday, silver prices rose sharply:

Why the surge?

Several Chinese sources close to the SGE and SHFE revealed that a massive buy order for 400 million ounces – equivalent to 12,441 tons of silver – been placed.

Some claimed it was a short seller desperately seeking to cover his short positions after a main resistance was broken the previous day. According to these sources, the short seller immediately offered a price 3 to 4% higher than the previous close.

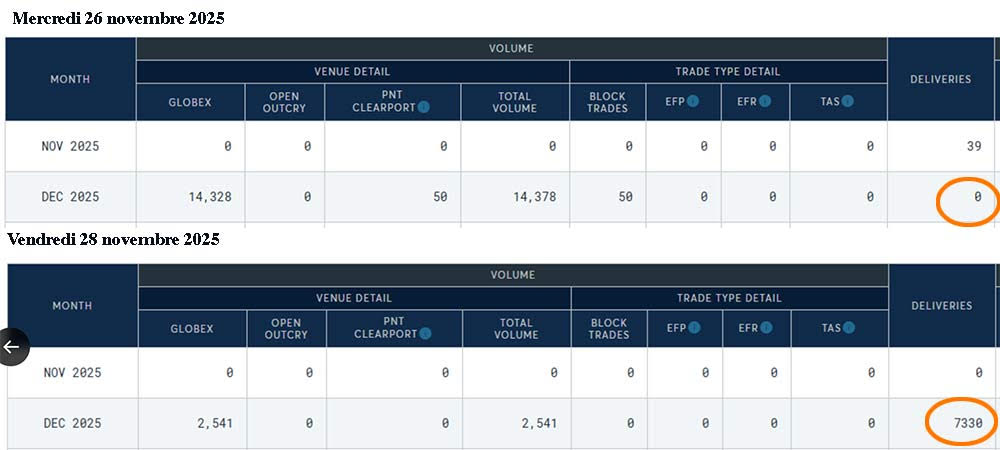

Simultaneously, at the opening of Comex futures trading on Friday morning, there was an order to deliver 7,330 contracts of 5,000 ounces of silver or 36.65 Moz.

In the market, most transactions are executed by high-frequency trading (HFT) robots, capable of executing trades in 0.113 milliseconds. These algorithms are programmed to buy back their short positions if prices rise – to limit their losses (stop-loss) – and to buy when resistance is broken by a rise in the underlying asset. This extraordinarily large order, allowing for an immediate increase of 3 to 4%, could only send trading robots into a frenzy. They all liquidated their short positions to try to reposition themselves on the long side, even as prices were already surging upwards.

Faced with this exceptional buying frenzy, CME officials had no choice but to shut down the servers to halt the surge. The automated trading systems had to be deactivated, and human intervention was required to regain control of the exchanges. This was accomplished.

Nevertheless, one trader placed a buy order for 400 million ounces, with an authorized price 3 to 4% above the previous day's close – $53.61, or approximately $55.75.

The total order amounted to $22.3 billion.

First observation

According to the Silver Institute, global mining production is expected to reach 835 million ounces in 2025.

According to the U.S. Geological Survey (USGS), global mining production in 2024 amounted to 25,000 tons.

A buyer reportedly placed an order on Friday for nearly half of the world's annual silver production in a single transaction.

For such an order to be credible, the buyer – willing to spend $22.3 billion – must necessarily be a recognized and trustworthy player in the eyes of market professionals. This reduces the number of possible candidates to a dozen banks or large corporations at most.

Those familiar with the precious metals market and who monitor the charts daily, know that at certain times, market participants sell off staggering quantities of silver – several million ounces. These sell orders aim to trigger a sharp drop in prices within minutes. It's a well-known technique, however deplorable it may be.

This player used the same technique, but in reverse, with a massive order designed to drive the share price up sharply. This is highly unusual.

Why?

In my article of July 14, 2025, entitled "China and the Revaluation of Precious Metals," I mentioned a Chinese government document published on June 23, which gave directives to all ministries and administrations to develop mineralogical research, reopen mines considered exhausted, improve refining and recovery techniques, etc.

And I commented, saying:

"All of this would be a waste of public money, unless China intends to significantly raise the price of gold and silver. If that were the case, investors would be delighted to fund geological research, which would finally become profitable for both gold and silver. Old, exhausted mines would regain their purpose, and new extraction techniques, such as deep-sea mining, could become economically viable. To achieve this, the price of gold would have to be allowed to rise, while the price of silver would have to be supported in order to restore a more balanced ratio between the two metals.”

Is China leading the ball?

The "Regulations of the People's Bank of the Republic of China on the Control of Gold and Silver," published on June 15, 1983, states:

Article 4.

"The People's Bank of China is the state agency responsible for the control of gold and silver in the People's Republic of China.

It is responsible for controlling the state's gold and silver reserves; buying and selling gold and silver; cooperating with the commodity pricing authority to establish and manage the purchase and sale prices of gold and silver; cooperating with the relevant department to review and approve the operations (including processing and sale) of units (hereinafter referred to as "management units") dealing in gold and silver products, chemicals containing gold and silver, and the recovery of gold and silver from residual liquid and solid waste; and monitoring and inspecting the market for gold and silver and to oversee the implementation of this regulation."

Unlike the West, which has attempted to erase from collective memory the undeniable fact that silver is a rare and precious metal – and that it served as currency for six thousand years – the Chinese government systematically links gold and silver.

This is further demonstrated by the official document of June 23, 2025, mentioned above.

Chentong Precious Metals

Before 1978, China operated under a planned economy: the state controlled the supply and distribution of all raw materials. The Ministry of Raw Materials of the State Council was responsible for this and implemented a unified policy for buying and selling precious metals, such as gold and silver. With the exception of companies under this ministry, no institution, company, or individual was permitted to participate in this market.

Following reforms and the opening-up policy, the Chinese government gradually abandoned this Stalinist-inspired system in favor of Western-style market economy mechanisms.

In 1993, during the institutional reform of the State Council, the Ministry of Raw Materials was abolished, and its affiliated companies merged to form China Chengtong Holdings Group Ltd. Most of the former ministry's operations, including the precious metals supply chain, were taken over by Chengtong Holdings. Subsequently, China Chengtong Holdings handled storage and transportation logistics from the mine to final distribution.

Chengtong Precious Metals cooperated with the People's Bank of China and other leading institutions to design and establish the Shanghai Gold Exchange, spearhead the historic transition of silver – from a planned economy to a market-oriented system – organize the listing of silver products, and participate in the design of silver contracts on the Shanghai Futures Exchange.

The company's silver supply chain extends from upstream to downstream. Its clients include major gold and silver mining companies, refineries, China Gold Coin Corporation, China Mint Corporation, China Banknote Printing Corporation, and other leading institutions. Public banks, Sinopec, military companies, and various government agencies are among its customers. It also supplies industries that use silver: electrical alloys (the world's largest consumer), photovoltaic pastes, electronic components, banknote printing, aeronautics and aerospace, 5G, semiconductors, automotive, high-speed trains, pharmaceuticals, welding consumables, targets, and investments. The famous Chinese Silver Panda is one of their products. The company proudly states that its materials and components equip new fighter jets, next-generation radars, aircraft carriers with electromagnetic catapults, the Shenzhou spacecraft, the Tiangong space station, and many other strategic programs.

China Gongmei Supply Chain is a subsidiary of Chengtong PM, primarily engaged in warehousing, transportation, delivery, and other related activities. At this point, we can understand the question posed at the beginning of this article: why are silver stocks decreasing at the State Silver Exchange (SGE) while simultaneously experiencing a comparable increase at the State Silver Exchange (SFE)? The answer is simple: China Gongmei Supply Chain is the sole delivery vault designated by the SGE and the SFE's primary silver warehouse. Therefore, it is the only entity capable of transferring the metal from the SGE to the SFE.

The company not only buys and sells directly to miners and industrial companies, but it has also established a reverse supply chain and acts as an agent for its clients' import-export operations. This includes importing silver ores and concentrates to domestic refineries and exporting various finished silver products to Europe and the United States. The volumes involved are unprecedented.

Chengtong PM is simultaneously a supplier, agent, and service provider. In short: they manage everything.

The company buys gold and silver on international markets – COMEX (USA), TOCOM (Japan), and the LBMA (UK). It also states that it maintains close and long-term strategic partnerships with major international banks, gold and silver mining companies, and key players such as Standard Chartered Bank, ANZ Bank, several LBMA market makers, and Heraeus. Information published on Chengtong Precious Metals' official website indicates that European and American investment banks, as well as LBMA market makers, are paying close attention to such a significant client.

It is highly likely that the Chengtong PM group initiated this order for 400 million ounces, either directly or through one of its regular partners, with the aim of triggering the revaluation of the silver price decided by the Chinese government.

So yes, China is definitely leading the Ball.

Silver vs. Gold Price

Despite Friday's rise – and those of previous weeks and months – it still takes 78 ounces of silver to buy one ounce of gold.

This is an absurd level when you consider that the gold and silver mining production ratio is close to 1/8.6, and that the derivatives ratio reported in BIS statistics hovers around 1/10.

Regardless of how the price of gold evolves over the next six months, the rise in silver is expected to be, relatively speaking, far more spectacular.

Many will be surprised by the highs the metal could reach in 2026.

Hopefully, you've already made your purchases of physical silver: this could become impossible sooner than you think.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.