On Thursday in New York, gold opened at $5,630. The following day, it hit a low of $4,700, a difference of nearly $1,000 in just 24 hours.

Meanwhile, in Shanghai, physical gold closed at $5,209.

How can we explain such price discrepancies between different markets? And above all, how can we justify such day-to-day volatility?

The price of silver plummeted by 33% in a single session in New York. A true market anomaly, especially since the CME’ rule 589 had just limited price fluctuations, both upward and downward.

Gigantic manipulation by margin call

Since December 12, the CME has been steadily increasing margin requirements, meaning the minimum deposit required to trade a contract.

For silver, margins were $11,500, representing only 3.7% of the contract value at the time, with silver trading at around $62 an ounce.

They were subsequently raised to $18,000, then $22,000, and finally $32,500.

On January 12, the CME abandoned the fixed margin system in favor of a percentage of the contract value, set at 9%.

Last Thursday, this percentage was abruptly increased to a total of 31,5% (16,5 margin and 15% maintenance) for silver, according to data published by CME Group.

As for gold, margins have increased from 5% to 16,8% (8,8% margin + 8% maintenance).

Paper gold and paper silver are dying

Until now, the cartel's bullion banks managed to influence physical metal prices through the paper market by depositing only about 4% of the value of the contracts they traded.

Now, with margin requirements increased to 31,5%, fewer and fewer speculators have the necessary cash to try and profit from the rise or fall of precious metal prices.

The alchemists are turning paper into lead. And this is happening before — as I predicted in my article of December 31 — margins can potentially be raised to 100%.

In such a scenario, the COMEX market would lose its unique character, as well as its ability to disrupt the formation of the true market price of precious metals. The Comex's paper market would then be transformed into a real physical metal market.

This dramatic rise in margins is a strong signal: we are approaching a "Reset", accompanied by a revaluation of gold and silver in all currencies, in other words a synchronized currency devaluation.

China puts the West in a corner

On December 31, representatives from JPMorgan and the Commodity Futures Trading Commission reportedly requested an urgent meeting with officials from the Shanghai Gold Exchange to negotiate a loan of tens of millions of ounces to support COMEX. This request was allegedly refused.

Furthermore, on January 1st, all silver shipments destined for export to the West were reportedly held up in Chinese ports.

With the implementation of new Chinese legislation, only a few companies are now authorized to obtain export licenses. In theory, the cumbersome administrative procedures would mean delays of approximately six weeks per authorization.

In any case, not a single ounce of silver reportedly left China during the month of January.

In October, the London market was effectively paralyzed after nearly defaulting on the delivery of 1,000 tons of silver purchased by India.

On November 30th, the New York market experienced a major incident: 7,330 contracts for 5,000-ounce silver were subject to delivery requests. Of this total, 6,816 contracts were ultimately canceled, settled in cash plus a $65 million bonus.

Since this episode, in New York, a significant portion of the officially registered silver stock has been reclassified as "eligible," meaning theoretically stored but not deliverable. By the end of December, 95% of delivery requests had resulted in cash settlements. London and New York now appear to be running low on the free float, in other words, on silver actually available for sale.

In my article "China Is the Absolute Master of the Silver Market," I asserted — and this has not been refuted — that Chinese banks are the true owners of a large portion of the silver bars held in London and New York. They lease them, but do not sell them.

Les ETF GLD et SLV

In an interview given July 4, 2022, a leading figure in the London Bullion Market Association, described in detail the mechanisms for manipulating the price of gold through derivatives.

He explained the evolution of the paper gold market in London and its fractional-reserve paper gold system, from the 1980s to the present day.

As part of this massive and coordinated manipulation, the SPDR Gold Shares (GLD) ETF was launched in November 2004.

The GLD is a financial product designed to replicate the price of gold, which can be bought and sold instantly, with just a few clicks, from a computer. The objective of its launch was clear: to divert investors from acquiring real, physical gold and offer them paper gold — purely financial and virtual.

The product's bylaws stipulate that no independent audit of the holdings can be required, nor can any physical delivery of the shares held be demanded.

The GLD ETF has been remarkably successful, resulting in the issuance and sale of a very large number of shares representing “virtual” gold bars. The proceeds from these sales allowed managers to display an impressive theoretical gold stock, which reportedly peaked in 2020 at approximately 3,400 tonnes.

In reality, this does not represent fully available tonnes of physical gold, but rather shares representing equivalent tonnes of gold, held within a primarily financial system.

What is true for the GLD ETF is even more so for the SLV ETF.

The tipping point came on January 30, amid tensions emanating from Asia.

In China, the UBS SDIC Silver Futures Fund, the main vehicle for local investors to gain exposure to silver, was trading at an exceptional premium of 36% to 64% compared to Shanghai futures contracts.

Faced with these distortions, the Shenzhen Stock Exchange decided to urgently suspend trading on the SDIC Silver LOF for the entire day.

This decision triggered a liquidity trap: Chinese investors, unable to sell their domestic positions, turned to international markets to raise capital.

They are then forced to sell futures contracts on the SLV and COMEX, triggering a wave of cascading liquidations on Western markets…

According to Morgan Stanley's Quant department: "The rebalancing needs of leveraged ETFs currently amount to approximately $3.5 billion for SLV and approximately $650 million for GLD. These forced liquidations are occurring on a historic day for silver, which has fallen 35% to its session low."

These ETFs, along with their highly leveraged derivatives, have become the primary instruments for price manipulation, now that bullion banks, lacking available physical metal, are no longer able to short gold or silver.

On Friday, the plunge in precious metal prices caught speculators off guard, as they were heavily exposed by massive leverage.

We have entered a phase of precious metal price reset, a period that necessarily involves very high volatility.

History reminds us that such movements are far from exceptional. In the 1970s, the price of Gold has experienced three corrections of nearly 30%.

Between 1971 and 1975, the price of an ounce of gold increased sixfold, rising from $35 to $200. In 1975, the price then plummeted from $200 to $100.

Those who sold at $100 missed the next phase of the bull market, which propelled gold to $850 in January 1980.

Given the usual practices of bullion banks, it would not be unreasonable to expect, at some point, a pullback in silver prices towards the former resistance zone of $50, in order to verify that it is now fully acting as support.

Such a move would allow all market participants who have accumulated short positions around this level to exit them under better conditions.

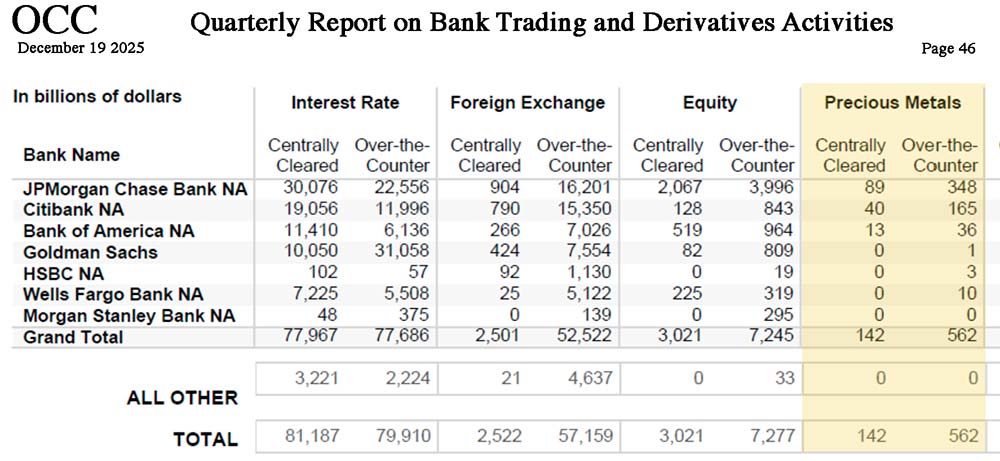

According to the latest report of the Office of the Comptroller of the Currency (OCC), banks hold approximately $700 billion in derivatives related to these markets — a veritable powder keg.

In any case, once this potential pullback is complete, we should see a rise in precious metals of a much greater magnitude than what we have seen so far.

And if this consolidation scenario does not materialize, I will be the first to welcome it.

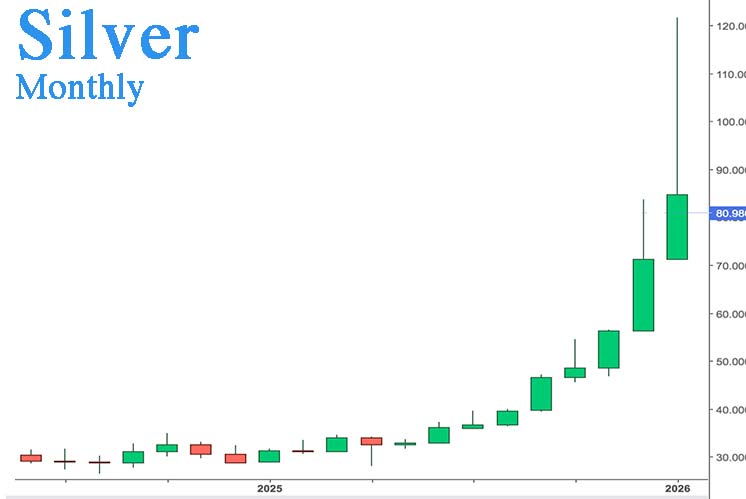

A silver market still bullish

The first chart, showing monthly data, highlights a continuous bull market over the past nine months.

The long upper wicks indicate recurring attacks by bankers aimed at driving prices down at the end of the month.

On this weekly chart, all the red candles correspond to the last week of the month, a period during which banks intervene to limit the gains of traders betting on a rise.

The attack in the last week of January 2026 was more pronounced than in previous weeks, but it did not prevent the month from closing with a significant gain.

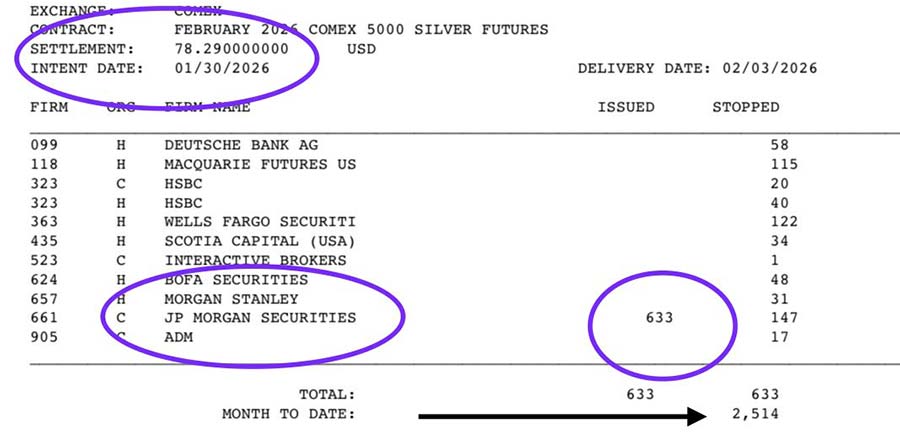

The report published Friday by the CME Group indicates that JPMorgan Chase was the main player — and beneficiary — of this market manipulation.

However, I still believe that this intervention was not carried out on its own behalf, but most likely on behalf of its clients.

A dislocated market

Today, manufacturers in China, Japan, India, and Dubai are scrambling to buy up available physical silver, regardless of the price.

In recent days, the spread between the price of paper silver in New York and the price of physical silver in other markets has reached historic premium levels, revealing extreme pressure on the actual supply.

Most mints no longer have any stock available for sale. As for the United States Mint its prices have become surprisingly high, and no product is currently available.

Isn't COMEX losing all credibility in the precious metals market?

Hold on to the physical silver you already own: the rally is only just beginning.

And if you find some to buy, increase your positions.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.