China has just abruptly closed the crypto chapter. Twelve ministries and central authorities — including the People's Bank of China, Public Security, Cybersecurity, Justice, Financial Supervision, Capital Markets Regulator, etc. — have signed a document that leaves no room for ambiguity: all activities related to cryptocurrencies remain illegal.

China's central bank vows crackdown on virtual currency, flags stablecoin concerns https://t.co/KKjVjhexTu https://t.co/KKjVjhexTu

— Reuters (@Reuters) November 29, 2025

Stablecoins are explicitly classified as high-risk instruments associated with money laundering and illicit capital flows. Beijing is simultaneously tightening its exchange controls and KYC/AML requirements. In practical terms, China has disconnected cryptocurrencies from its financial system.

This decision creates a gaping void for Asian counterparties. The crypto portfolios of Chinese desks are becoming disconnected assets, impossible to repatriate legally and impossible to value properly. Hybrid desks — structures that combine crypto arbitrage, offshore financing, and digital collateral — are left with immovable assets that are inconvertible when it comes to “onshore → offshore” flows. Balance sheets continue to show these assets as liquid, but some of them are worthless in terms of regulatory convertibility. The market knows that a margin call is coming, but does not yet know where it will fall.

At the same time, bitcoin purchase flows observed on Binance over the past five days tell a completely different story: a wave of regular, fragmented purchases typical of Chinese retail investors. These purchases are not speculative: they are a strategic retreat, a reflex to preserve savings in the only asset that can still be bought and transferred despite regulatory closures. Bitcoin is becoming the last accessible gateway, and individuals are rushing to take advantage of it.

However, Asian professional sellers are absent. Desks can no longer sell: they can no longer refinance, mobilize their collateral, or balance their positions in a banking system that is now closed to cryptocurrencies. Any sale would put them at structural risk. The result is a market where strong Chinese demand meets non-existent professional supply.

Conditionally speaking, everything indicates that the rise in bitcoin over the last few days is overwhelmingly due to Chinese purchases. Western volumes are not insignificant, but they are a side effect of the initial movement, not its driving force.

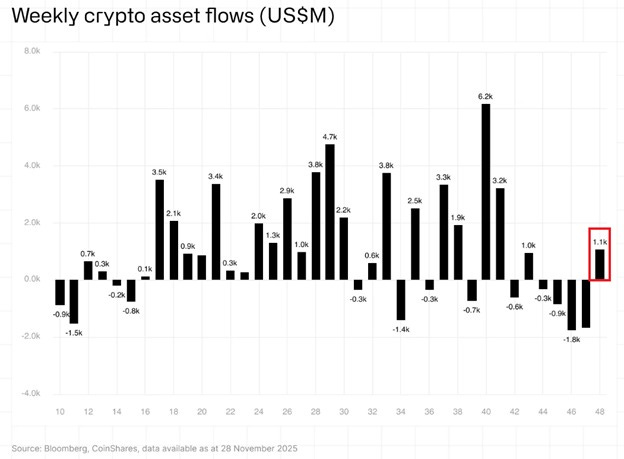

This dynamic has spread to Western ETFs: as soon as robots and quant desks detected persistent buying pressure from Asia and a lack of Asian supply, they triggered mechanical purchases of US and European bitcoin ETFs.

These ETF flows are real, but they are responding to Chinese momentum: the locomotive is in the East, with ETFs in the West merely acting as train cars. The biggest buyer this week is clearly Chinese.

This rise in bitcoin was interpreted by the markets as a sign of relief. Not because the situation in Asia is improving — quite the contrary — but because traditional markets saw this rise as a sign that there was no immediate systemic panic. Equity indices, already overloaded with gamma positions and waiting for a technical excuse to rebound, reacted instantly: Nasdaq, S&P 500, EuroStoxx, everything took off in the wake of this. A mere respite, but a revealing one: the rise in bitcoin served as a reassuring indicator for a market that feared an explosion.

For Asian hybrid desks, however, the situation remains dire. They can no longer mobilize their assets, meet margin calls, refinance their positions, or liquidate them properly. They are stuck, strangled by collateral that has now become toxic, with a growing risk of margin calls triggered by the slightest market movement.

An international shock for the entire crypto ecosystem

This episode weakens the entire global crypto market. First, because it exposes a brutal reality: all it takes is a regulatory decision in one key country to shatter the myth of an asset that is truly “independent” from governments. The market is discovering that cryptos are not outside the system; they depend on conversion infrastructures and financial intermediaries, which are subject to national law.

Next, this episode could have repercussions for Asian exchange platforms, whose trading volumes have historically depended in part on Chinese flows that were more or less tolerated. With stricter regulations, these flows are becoming harder to process, which could lead to an invisible yet very real segmentation between different types of stablecoins:

- International USDT, still in circulation;

- China-originated USDT, whose convertibility now appears more uncertain and which may no longer be accepted as collateral by certain market participants.

This would lead to the emergence of two ‘categories’ of stablecoins — fully accepted tokens and those that have become more sensitive from a regulatory standpoint. Such fragmentation would reduce overall liquidity, widen spreads, and introduce a new type of risk: the value of a stablecoin would no longer depend solely on its issuer, but also on its geographic origin.

Conclusion: gold, the big winner

Gold emerges as the big winner in this episode. By cutting domestic demand for cryptocurrencies, Beijing is automatically redirecting savings diversification toward the only officially approved alternative asset: physical metal. Gold is once again becoming a strategic, institutional, and encouraged asset.

For Chinese individuals, physical gold is becoming the only remaining option for protecting their assets. Those who already hold bitcoin cannot convert it directly into metal: there are no legal channels for doing so. But it is almost certain that an unofficial but pragmatic gray market will emerge in the coming months: a channel allowing Chinese bitcoin holders to gradually convert their assets into gold without going through the controlled banking system.

If this channel materializes, it will propel gold as the dominant safe-haven asset in China:

- it will capture new demand,

- it will absorb the conversion of immobilized crypto holdings,

- it will confirm that whatever China closes in the digital realm, it opens in the metal realm.

The shift is already underway, even if the global market has yet to grasp its full significance.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.