Something is changing in the structure of the markets, and this movement goes far beyond metals alone. It concerns the global allocation of capital.

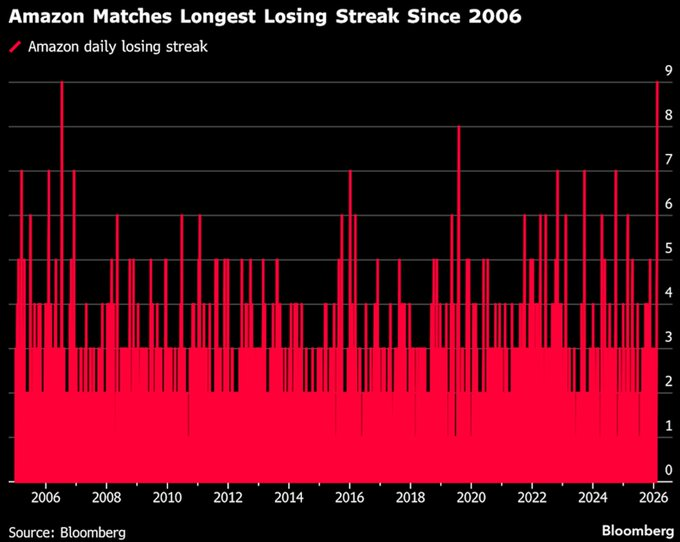

Amazon has just recorded its longest series of negative sessions since 2006. This is not insignificant. We are talking about a pillar of the Nasdaq, a symbol of the “long tech/short real assets” regime that has dominated for more than a decade.

When this type of stock suffers losses comparable to those seen in the run-up to the great financial crisis, it reflects at best a slowdown in stock market leadership and at worst a real shift in capital flows.

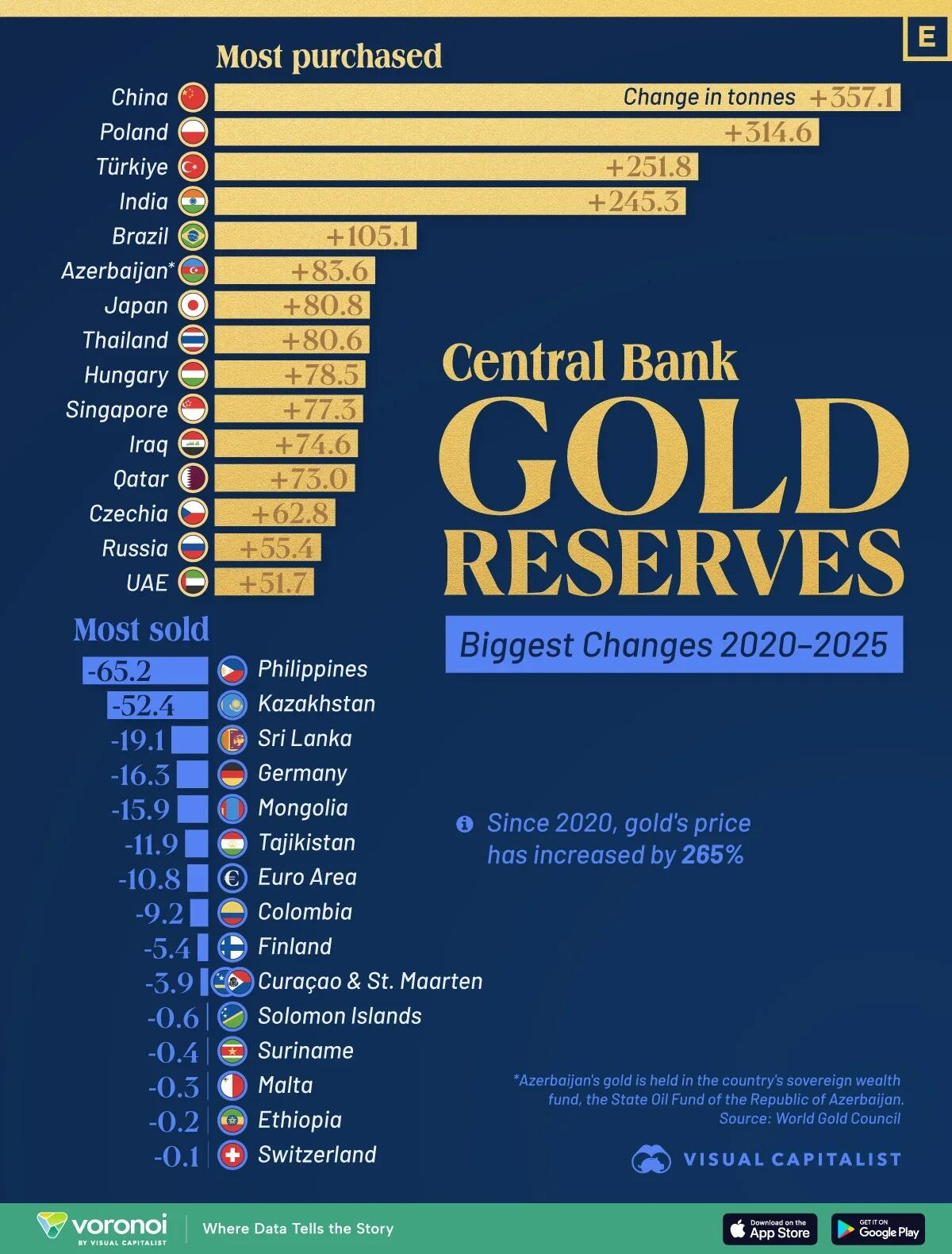

At the same time, gold is not only rising in price; it is attracting capital at a rate that is now difficult to ignore. According to Bank of America, cumulative flows into gold funds have reached approximately $127 billion since 2020.

What is particularly striking is the recent momentum: nearly $120 billion has reportedly flowed in since the beginning of 2025. In other words, most of the inflows in this cycle have been concentrated in the most recent period. We are no longer in a phase of gradual accumulation, but rather one of marked acceleration.

This acceleration comes at a time when the gold price has already risen sharply in recent years. This means that investors are not chasing a nascent uptrend; they are seeking protection. Scotiabank believes that the bull cycle is not over. The structural drivers remain in place: sustained purchases by central banks, persistent trade uncertainties, high geopolitical tensions, and a lack of credible fiscal discipline.

Collectively, they still hold less than 30% of global stocks, leaving significant potential for diversification.

Private investment demand is reinforcing this trend. In January, gold-backed ETFs recorded $19 billion in inflows, the strongest month on record. Total assets under management jumped 20% to $669 billion, while physical holdings climbed to 4,145 tons, an all-time high.

This is no longer a marginal phenomenon: gold is once again becoming a key asset in capital allocation.

This signal is not coming solely from Western markets. In India, flows into gold ETFs exceeded those into equity funds in January. This is a key factor. When Indian investors, traditionally fond of domestic equities, turn to gold, it reflects a growing preference for stability in the face of geopolitical and monetary uncertainties. In a country where gold is already deeply rooted in the culture, this financial shift further strengthens structural demand.

Another player deserves attention: Tether. According to estimates by Jefferies, the stablecoin issuer holds approximately 148 tons of physical gold, valued at around $23 billion. This would place it among the world's thirty largest holders. Digital finance is now seeking a tangible anchor.

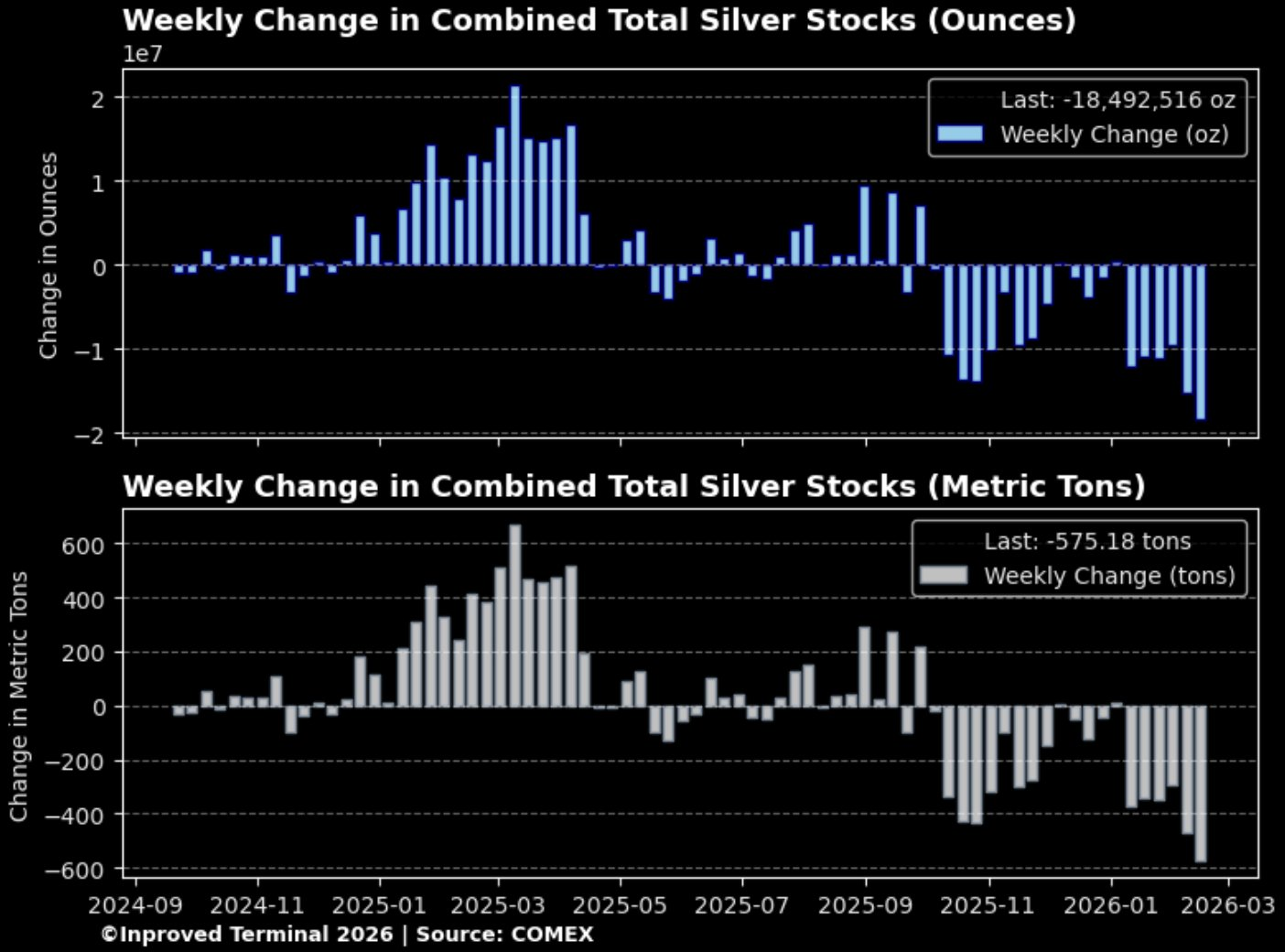

Meanwhile, silver is showing more visible tensions on the physical side. Combined stocks fell by around 18.5 million ounces, or nearly 575 tons, in a single week:

Metal outflows from COMEX vaults have been intensifying since January. In Shanghai, stocks are hovering around 353 tons, with slight positive weekly variations. However, the prevailing trend remains one of gradual depletion of reserves:

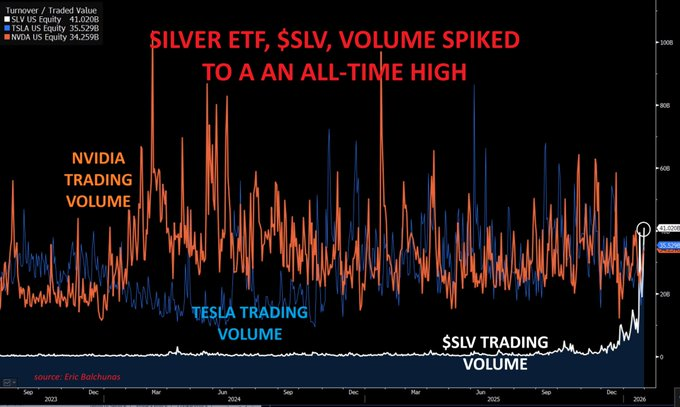

At the same time, the volume of the SLV ETF has reached an all-time high, a sign that silver is now attracting unusually deep flows. In some recent sessions, trading volumes on the SLV have even exceeded those of Nvidia and Tesla, two of the most actively traded stocks on the US market. Seeing a ETF backed by physical silver rival—and occasionally surpass—tech giants in terms of activity is a strong signal. It means that silver is no longer a peripheral market reserved for a niche group of specialized investors: it is now attracting attention and capital comparable to that of the Nasdaq leaders.

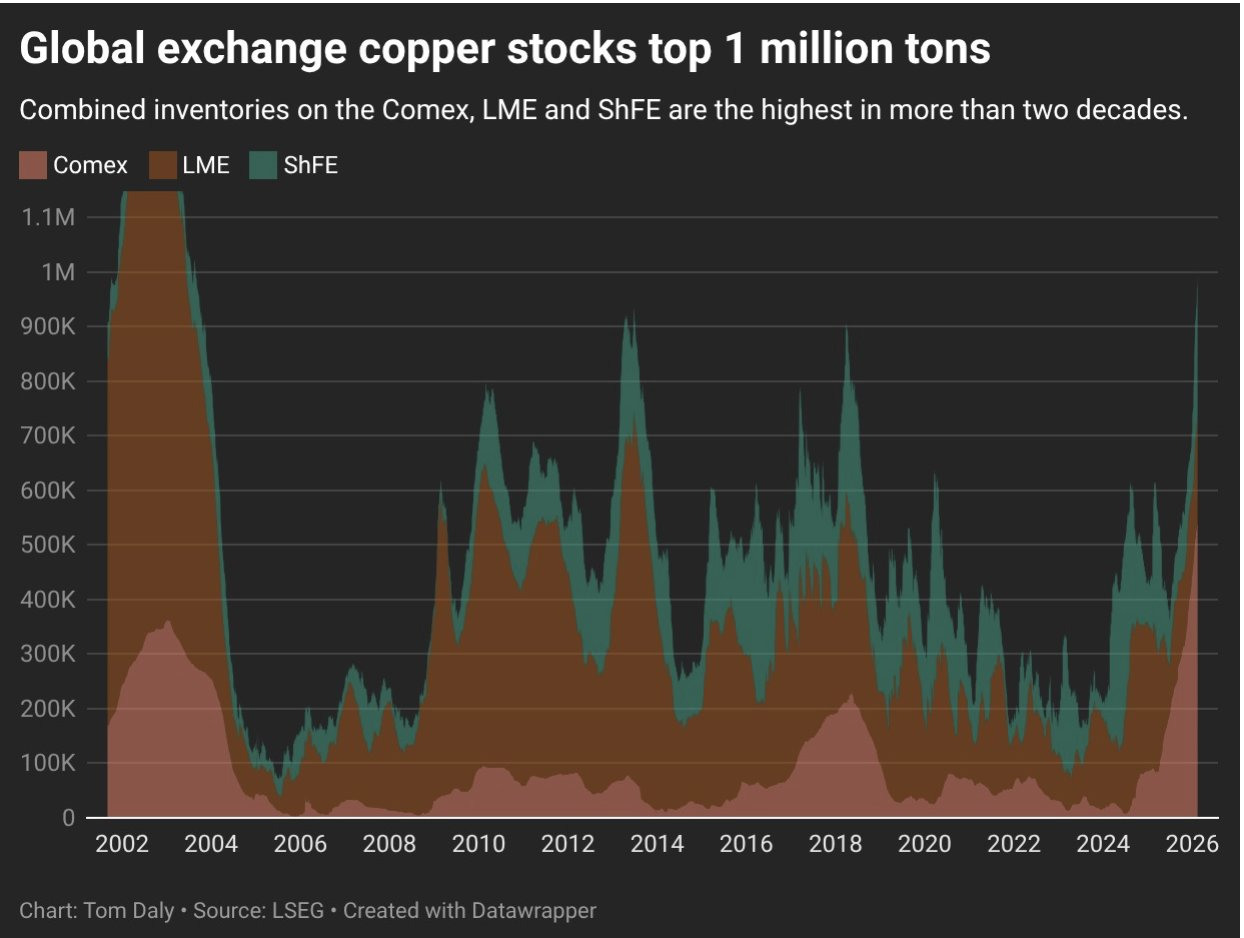

Copper, on the other hand, presents a more mixed picture. Global stocks recorded on the main trading centers have exceeded the million-ton mark for the first time in more than 20 years:

In the past, such levels often signaled a slowdown. But copper has now become a strategic metal, essential for electrification, networks, and energy infrastructure. Part of this accumulation could therefore be driven by a desire to secure supplies, rather than simply reflecting a cyclical excess.

We are therefore operating in an environment of gradual rotation. Major technology stocks are showing signs of running out of steam. Conversely, flows into gold are taking on an almost parabolic momentum. Central banks are continuing their purchases, and ETFs are setting new records.

In India, allocation seems to favor gold over stocks. The silver market is showing growing tensions in the physical segment. Even players from the crypto ecosystem are now strengthening their metal reserves.

This is not panic, but a shift in gravity. Capital seems to be gradually leaving the world of abstract financial growth to re-anchor itself in that of tangible assets.

When flows converge towards monetary metals while the pillars of the Nasdaq falter, we are no longer facing a simple tactical arbitrage, but perhaps the beginning of a real regime change.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.