The start of 2026 no longer looks like a simple cyclical slowdown. The downturn is now global and simultaneous: US consumption is running out of steam, unemployment is rising in Europe, household and business confidence is collapsing in China, while defaults are increasing and bond flows betray a growing flight for safety.

In the United States, retail sales are stagnating, the control group is declining, and the annualized rate has fallen to its lowest level in 20 months:

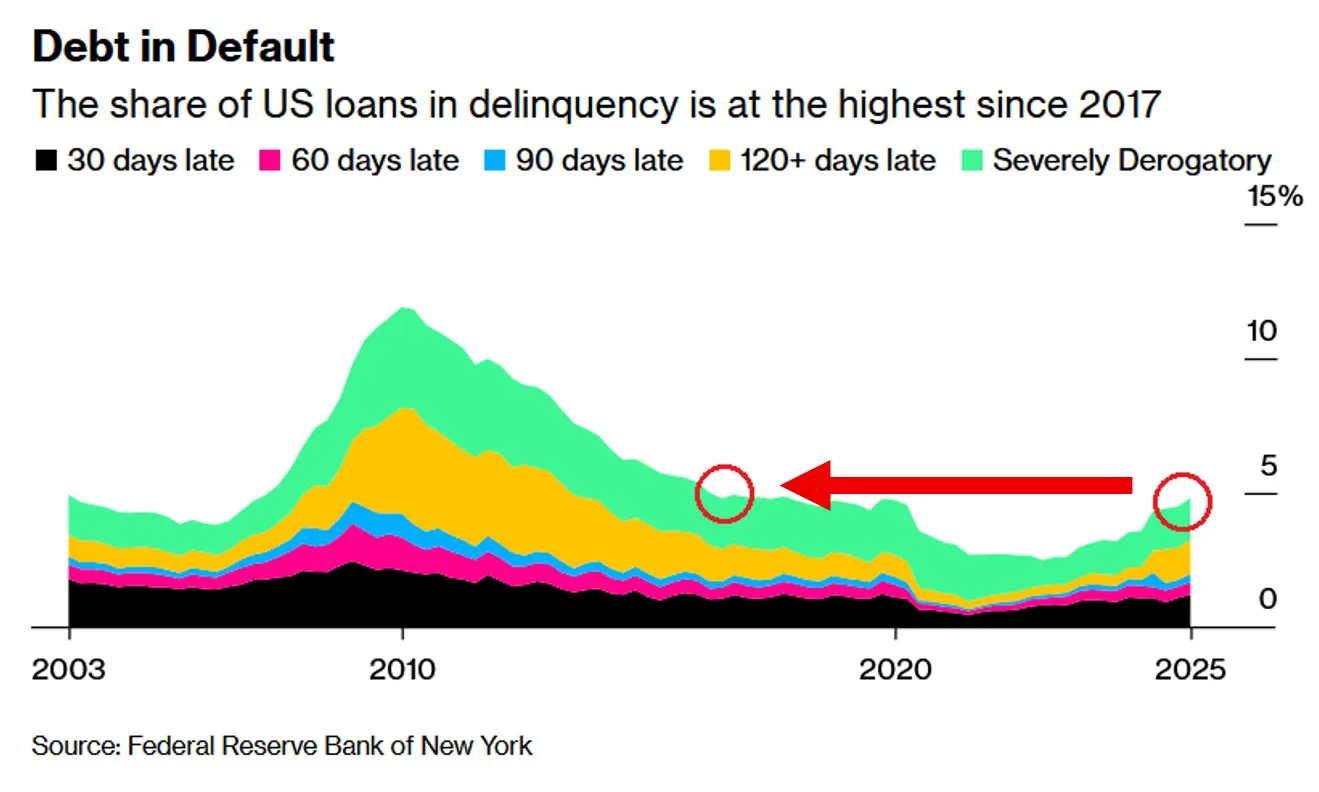

At the same time, loan defaults continue to rise and are approaching their highest levels since 2017. Delays in payment of 90 days or more are increasing significantly:

However, defaults precede write-offs, which then weigh on bank profits and, if the trend continues, on capital. Credit is deteriorating at the very moment when economic activity is slowing down—a historically unstable combination.

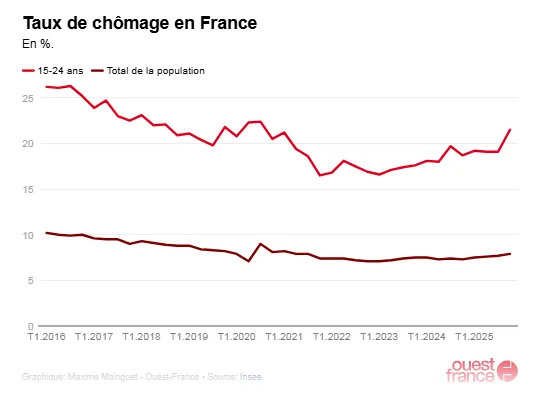

In Europe, French unemployment has risen to 7.9%, with youth unemployment at 21.5%:

Germany is seeing an increase in industrial orders, but this is largely driven by defense spending financed by public debt. Excluding the budgetary effect, private sector momentum remains sluggish and construction continues to contract. Growth is becoming administrative.

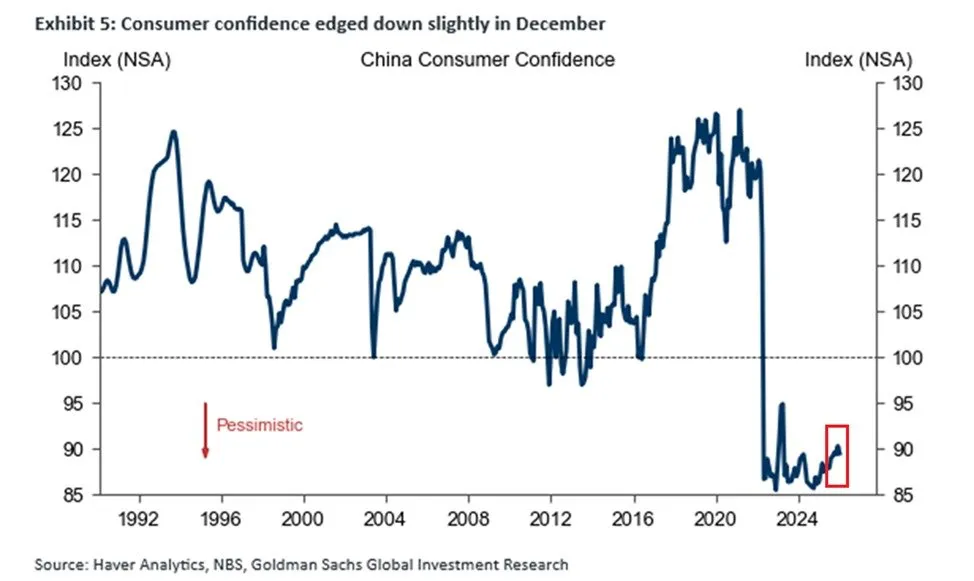

In China, household confidence remains close to historic lows, around 90, following the bursting of the real estate bubble:

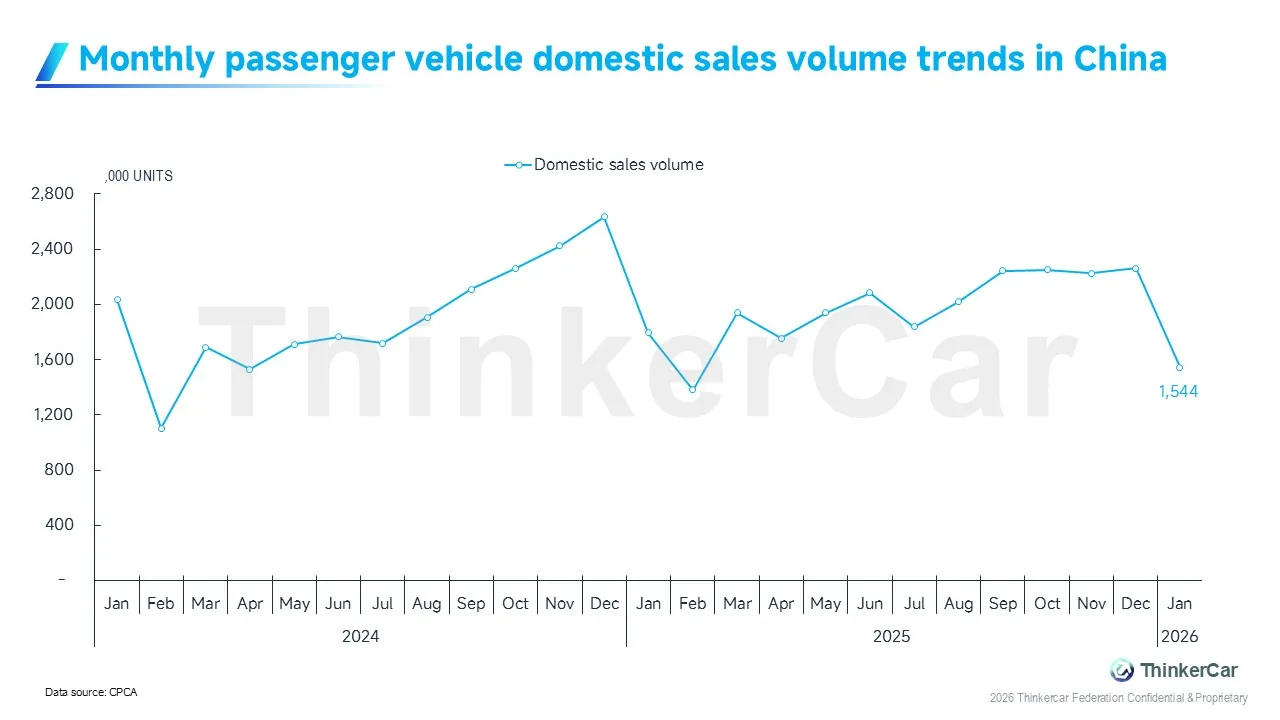

Home sales remain 50% below 2021 levels. The auto market fell 19% in January, with widespread double-digit declines.

Chinese consumers remain paralyzed by the destruction of real estate wealth.

In the United Kingdom, manufacturing output also confirms the slowdown in activity. It fell by 0.5% month-on-month, compared with an expected decline of 0.1%, after rising by 2.1% the previous month (revised to 1.9%). The reversal is sharp and more abrupt than anticipated. After a technical rebound at the end of the year, the British industrial sector is plunging again, suggesting that both domestic and external demand are rapidly running out of steam. This type of negative surprise, in an environment already marked by the slowdown in the US, China, and Europe, reinforces the idea of a downward synchronization of the global manufacturing cycle.

In this context, the resilience of Treasuries in the face of European sales is a strong signal. Nordic pension funds have certainly reduced their positions, but yields remain contained. This indicates that overall demand for duration is far outweighing political noise.

The bond market is now pricing in a more pronounced slowdown and a growing risk of monetary policy pivoting. It is not geopolitics that is dominating, but rather the economic cycle.

Gold is gaining ground in this same environment. When growth slows, defaults rise, and real rates plateau, the asset with no counterparty risk fully regains its insurance function. This movement is not inflationary: it is primarily defensive.

Added to this is now a structural factor: the extremely rapid deflationary effect of AI. Every week, a new sector is hit with a “one-shot.” After insurance brokers, it is now asset managers and financial intermediaries who are under pressure, faced with AI solutions capable of replacing a significant portion of human advice.

The mere launch of an AI-driven financial planner by Altruist was enough to put an entire listed segment under pressure. LPL Financial (LPLA), Raymond James (RJF), Charles Schwab (SCHW), Stifel (SF), and Morgan Stanley (MS) all recorded significant sales.

This is not simply a sector rotation, but an anticipated compression of margins. AI acts as a brutal productivity shock, but also as a deflationary shock: it lowers barriers to entry, compresses commissions, and undermines business models historically based on human intermediation. After legal software publishers and certain segments of SaaS, traditional finance is now directly exposed.

The paradox is obvious: AI increases long-term productivity potential, but in the short term, it exerts deflationary and destabilizing pressure on revenues, skilled employment, and margins. In an economy already in a slowdown phase, this shock does not offset the cycle—it accelerates the transition and amplifies tensions.

We are therefore facing a complex configuration: a synchronized slowdown in the three major blocs, a gradual rise in defaults, a bond market that remains buoyant despite foreign sales, rising gold prices, and a technological shock that is squeezing margins in high value-added services.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.