At the end of a monetary era a number of dominoes will keep falling, initially gradually and then suddenly as Hemingway explained when asked how you go bankrupt.

Some of the important dominoes the world will see falling are: Political, Geopolitical, Currency, Debt and Investment Assets.

The consequences will be unthinkable – Social Unrest, War, Hyperinflation, Deflationary Implosion of Assets, Debt Defaults and much more.

But when things settle down, there will also be offsetting forces such as the emergence of powerful BRICS nations often backed by commodities.

Gold will play a major role during this process. Both central banks, sovereign wealth funds and investors will turn to gold as the most stable part of a crumbling system. This will lead to a fundamental revaluation of gold. As more gold cannot be produced, increased demand can only be satisfied by higher prices.

The likely result will be a revaluation of gold by multiples.

Fall of the leadership domino

Inept leaders and lack of statesmen are the typical prerequisites for these periods and thus one of the falling dominoes.

I have always argued that a country gets the leaders it deserves.

As we get to the end of one of the worst periods in history, both financially and morally, weak leadership exists in most major Western economies.

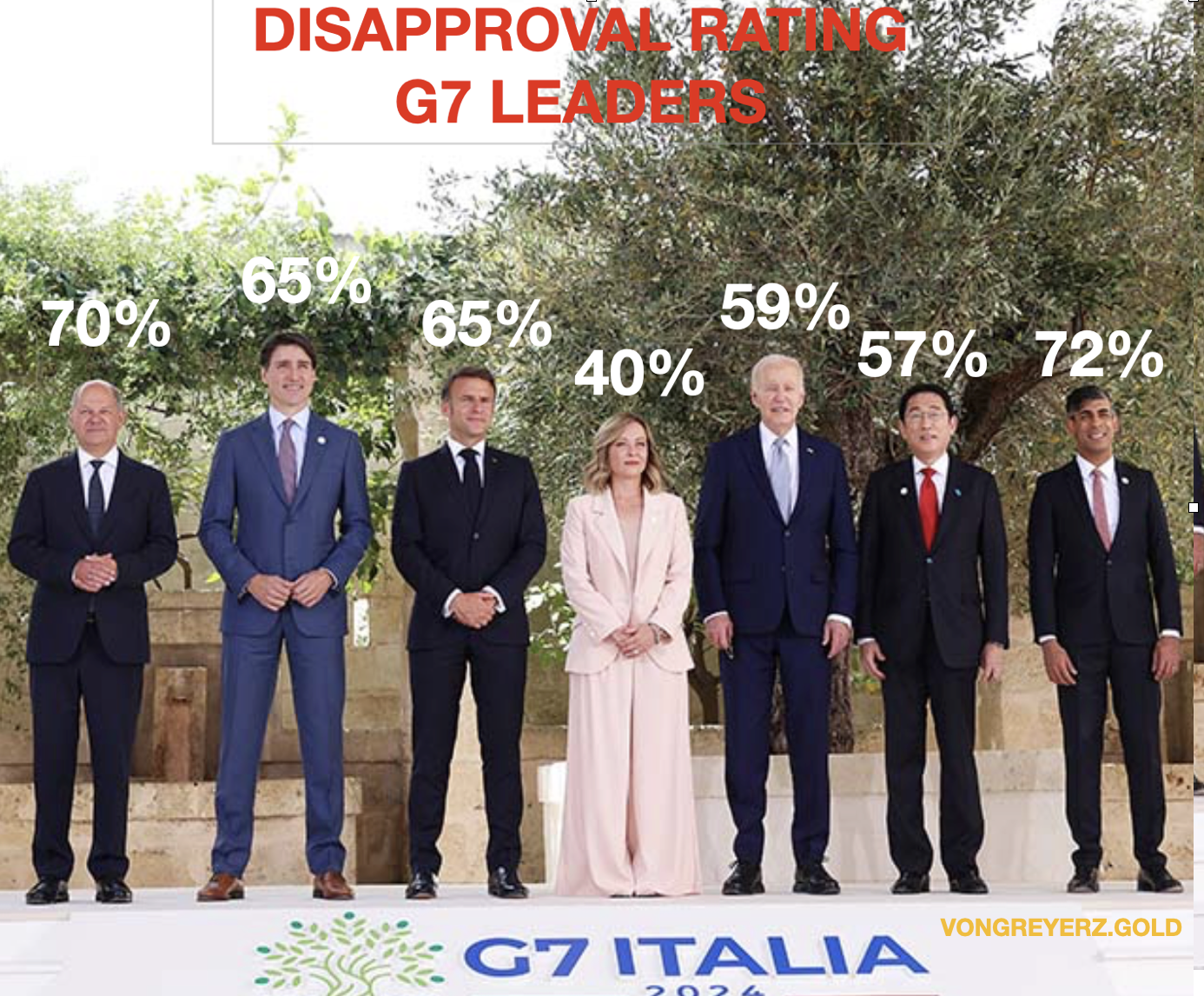

So, let’s look at the motley crew of world leaders and their unpopularity.

Political leaders will not only be thrown out at elections but also before their period is finished.

The recent European election is a typical example of a failed system. Most ruling parties are being rejected and in many cases parties on the right gain popularity.

Just look at the picture above from the recent G7 meeting in Italy. With the exception of Italy’s Meloni, the remaining G7 leaders have disapproval ratings of 57% to 72%.

With elections in the UK & France this year, the ruling parties are guaranteed to lose. The French Presidential election is not until 2027 so Macron could be a lame duck for 3 more years. The French people are unlikely to accept that and might force him out before then.

Whoever is elected in France, the powerful trade unions are likely to bring the country to a halt.

UK’s Sunak is one of Britain’s most ineffective leaders in history. But the new Labour Prime Minister, Kier Starmer was not even seen to stand a chance 2-3 years ago. He will not be voted in, but Sunak will be voted out by the people. Next will be a very dark period in UK history with high taxes, high debt, poor leadership and political instability and hard times.

The US situation today is even worse, with a president who seems incapable of taking any decisions. Instead, the US is led by an unelected and unaccountable group of neocons who tell the president what to say and what to do. But even that is difficult for Biden to execute. Just his recent appearance in Italy at the G7 meeting confirms that.

He can obviously not be blamed for being senile. But he should no longer have the ultimate power.

The US election is likely to be a disaster. Looking at the poor health of Biden, it is unlikely that he will stand for re-election in November. Kamala Harris will clearly not stand for election. It would not be surprising to see Hillary Clinton ushered in as the Democratic candidate. Although Trump is loved by around half of the people, he is hated by the other half and thus a very divisive choice. And a rerun of the Clinton – Trump election could easily lead to trouble or insurgence in the US whoever wins.

Germany’s Scholz’ coalition might not make it to the 2025 election due to its unpopularity and the decline of the German economy.

In summary, the political stage will be a total mess in coming years and lack of strong leadership will not only bring political unrest but also social unrest.

Fall of the currency & debt dominoes

The currency domino has been falling ever since Nixon closed the gold window in 1971.

With high spending and deficits on top of Debt to GDP above 100% in many nations, the West in particular is facing a very dark period with galloping debt growth and collapsing currencies.

This will lead to debt defaults, bank defaults, more printing, higher interest rates and still higher deficits.

All currencies will accelerate their debasement process.

In such a scenario, there will be no winner. It is possible that the dollar due to demand will be slightly stronger than other Western currencies at least for a period.

But a temporary relative strength of the dollar should be totally ignored. There is no prize for coming 2nd or 3rd to the bottom. All currencies will lose dramatically in real terms which means against gold.

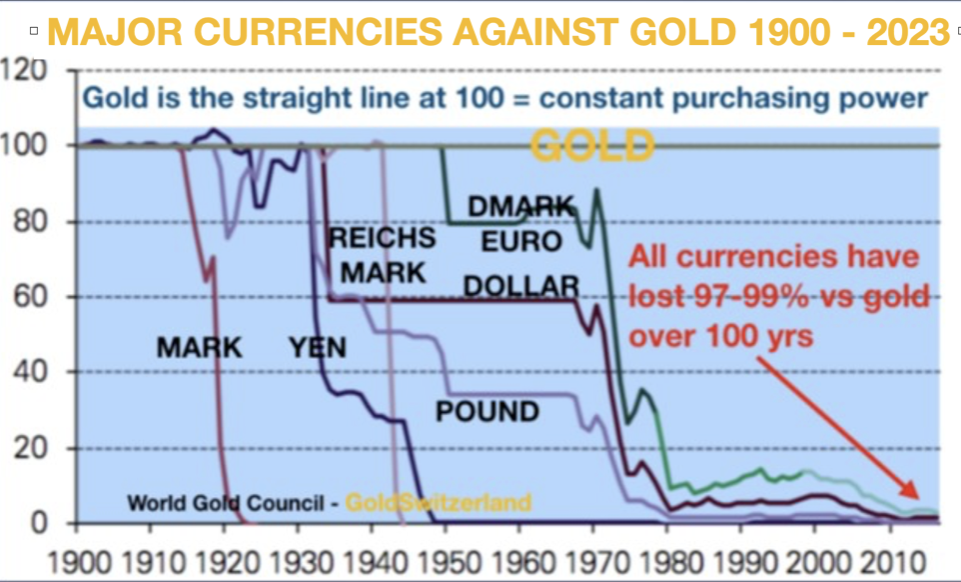

We must remember that we are now in the final collapse of the current monetary system. Since 1971 all currencies have lost 97-99% in real terms which means GOLD!

The final 1-3% fall (100% from now) will take place in the next 3-8 years. So, yet another currency system will be laid to rest.

This one lasted since 1913 so a bit over a century. Its demise was predestined the day it was born. It was only a matter of time. As always in history, the consequences will be much more far reaching than just the death of Money.

Debt and currency collapses happen hand in hand. They are partners in crime and are the inevitable consequence of sustained government deficit spending.

After a period of unlimited currency printing, the financial system will fail partly or totally.

Political and social unrest also follows, possibly civil war.

Governments under economic pressure normally start a war or escalate an existing one to divert the attention from domestic problems. A war is also a good excuse for printing more money.

Fall of the asset domino

Initially there will be high inflation, possibly hyperinflation and high interest rates. Thereafter as the system implodes, inflated asset prices in stocks, bonds, property etc will crash by 50-100% in real terms.

Most sovereign bonds (if they are printed) will serve best as wallpaper.

I rate the chances of this chain of events taking place as very high, especially in the West.

Financial, economic, political and social collapses of this kind are nothing new as they have happened throughout history, albeit not on a scale of this magnitude.

Fall of the nuclear war domino

Will we have a nuclear war?

We obviously don’t need to worry about this option since if we have a global nuclear war, there will be very few, if any, people left on earth.

As the world potentially moves as close to a nuclear war as it can without starting one, we must ask ourselves, WHO IS RUNNING THE WORLD?

Well, no one individual of course. But the US leadership is probably the main contender when it comes to dictating, at their whim, to any country in the world.

This can be starting wars in a country which is no threat to the US. It can be controlling the global financial system through the dollar or regulating the banking system via edicts like FATCA requiring the world to report any dollar transaction to the US authorities. It can also involve coups in countries which the US leadership finds unacceptable or even eliminating enemies.

It can be sanctions or freezing of assets against countries whose actions the US leadership disapprove. The list is endless.

What is interesting is that the US people never has a say in any of these decisions. All the actions above and many more are taken by the US president and his advisors with zero accountability to the people.

None of that would be possible in for example Switzerland where people power rules through direct democracy.

What the world should ask itself is: How does it solve the extremely serious situation the world is in?

I am not talking about the Ukrainian war which, as Trump has indicated, could be stopped within a few days if the US stopped sending weapons and money to the US.

Putin recently made it clear that what Russia wants is to keep the Russian speaking areas of Eastern Ukraine and no NATO membership for Ukraine. But no one is interested in exploring this.

Instead, there has just been a peace conference in Switzerland where neither Russia nor China was present. Such a conference is a total waste of time and money.

Without two of the mightiest military and economic powers on earth, one of which (Russia) is directly involved in the war, this conference will achieve absolutely nothing.

This is just posing for the cameras with a bland meaningless statement at the end.

So instead of these useless conferences, the leaders of China, Russia and the USA should get together to end the Ukraine war and then tackle the real problems facing the world like poverty, famine, crime, drugs, debt etc, etc.

Imagine what the combined brain power and resources of these countries could achieve assisted by many more nations.

But sadly, that is a dream that is unlikely to be realised.

Much easier to print money and start a war rather than to find REAL and sustainable solutions to the major global problems that the world is facing.

So, world leaders have a choice – pick up the phone and talk to your fellow leaders or start a war.

What sane leader would choose nuclear war before a small loss of ego and peace?

Wealth preservation for financial survival

So, what can investors do to protect themselves?

Some DONT’S are obvious, like:

Don’t keep most of your wealth in a fragile banking system whether in cash or in securities –

With many banks likely to default, it might take too long before your assets are released, if ever!

Bail ins or forced investments are likely in government securities at low interest rates and for extended periods like 10 years or more.

Don’t hold sovereign bonds.

Many governments will default.

Don’t bet on inflation reducing your debt.

High interest rates or indexation of loans might make it impossible to repay borrowings.

Don’t forget that stocks have been inflated by massive credit expansion which will end.

The list of don’ts in the biggest global debt and asset bubble in history and is of course endless.

So, some DOs could be more useful.

Do hold a lot of physical gold and some physical silver in safe jurisdictions like Switzerland and possibly Singapore outside the banking systems.

Precious metals must be held in very safe non-bank vaults, in your name with direct access to the metals.

To minimise confiscation or freezing of your metals, best to keep them outside your country of residence.

Hold a meaningful amount of physical gold and silver.

Most of our clients who are HNW wealth preservation investors have more than 20% of their investment assets in gold and with a smaller percentage in silver due to its volatility.

Gold is up 9-10x in this century in most currencies, still.

The real move in gold and silver hasn’t started yet

The move away from the dollar as the global trading currency is likely to accelerate over the next few years.

BRICS countries are whenever possible settling bilateral trading in their local currencies with gold as the ultimate settlement money. This will be a gradual move away from the dollar. At some point the move will accelerate as the need for trading via another nation’s currency will be seem superfluous, especially since final settlement can be in gold.

As I have made clear many times, the US confiscation of Russian assets will lead to central banks no longer holding dollar reserves but instead gold will be the only acceptable reserve asset.

The move by Central Banks to gold as a reserve asset will lead to a fundamental revaluation of gold over the next few years to a price which will be multiples of the current price.

The major increase in demand can only be satisfied by higher prices and not by more gold since the world cannot produce more than the current 3,000 tonnes p.a.

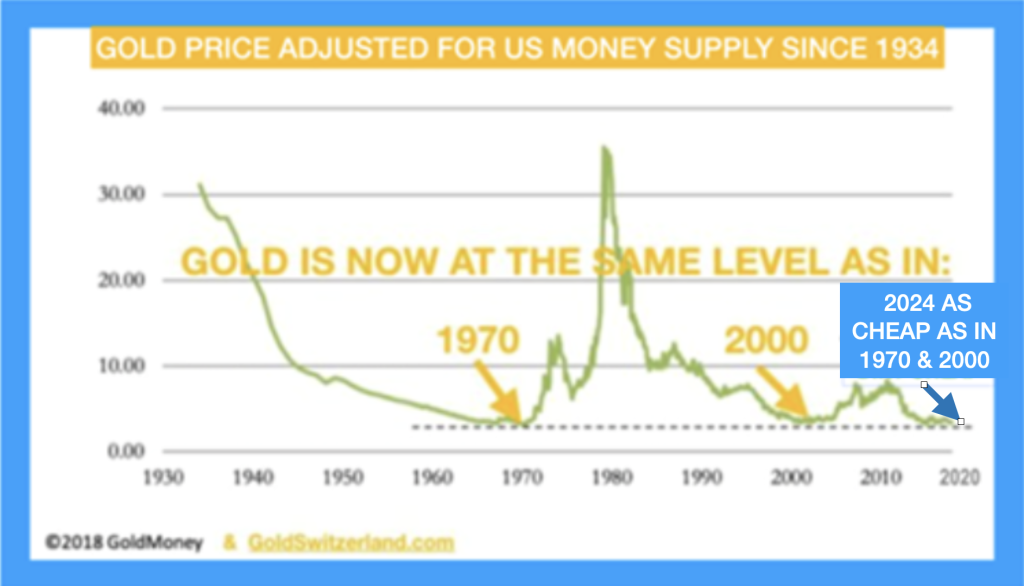

In my 55-year working life I have experienced 2 major bull markets in Gold.

The first one was from 1971 to 1980 with gold up 25X from $35 to $850.

The second one started in 2001 at $250 and has only started a move which will reach multiples of the current price.

But my 55 years of gold history is just over 1% of the long-term bull market in gold.

Since the emergence of the fiat money system, the gold bull market is sadly more a reflection of governments’ mismanagement of the economy leading to ever growing deficits and debts. In such a system, the price of gold mainly reflects the chronic debasement of paper money.

Governments and central banks are gold’s best friend.

They have without fail always destroyed the value of fiat money, by debasing the currency through deficit spending and debt creation.

For example, in the Roman Empire around 180 to 280 AD the Denarius Silver coin went from almost 100% silver content to 0%, replacing the silver with cheaper metals.

This obviously leads to the question, why should anyone hold fiat or paper money?

Well, in a sound economy with no deficits, virtually no inflation and a balanced government budget, holding cash that yields an interest return is absolutely fine.

But the world has not experienced such Shangri-La times since 1971 when Nixon closed the gold window.

Still, even at $2,320 today, gold in relation to money supply is as cheap as in 1970 when it was $35 or in 2000 when the gold price was $300.

Wealth preservation and life’s priorities

With the falling of the dominoes outlined above, most people in the world will experience a lot more hardship than currently.

For anyone with savings, whether it is $100 or $100 million, wealth preservation should be a top priority. Gold and some silver in physical form safely stored outside the banking system should be an absolute priority.

As we encounter difficult times, helping family and friends is more important than anything else. This will be extremely important in order to deal with the trials which we will all encounter.

And please don’t forget that in addition to family and friends, some of the best things in life are free such as nature, books, music and hobbies.

Original source: VON GREYERZ AG

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.