The facts just don’t add up. US wages are falling, trade deficit is at 10 year high, debt is surging so are stocks and the US Government has again managed to publish a number of contradicting employment figures that make no sense whatsoever.

A CONFIDENT BUT UNEMPLOYED CONSUMER

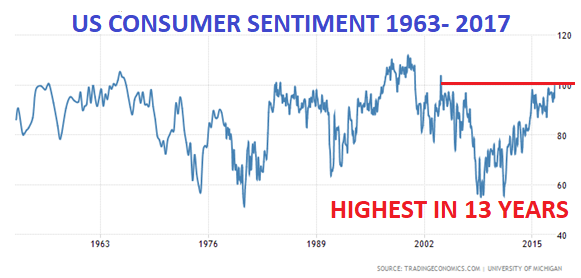

US Consumer Sentiment is the highest in 13 years. At the same time US October Household Employment Survey dropped 484,000 and the Labour Force shrank by 765,000. But due to manipulation of the figures, October payroll increased by 261,000 and the Unemployment Rate declined to 4.0% from 4.2%. The Labour Participation Rate is down to the 1977 level with only 62% of the population employed or looking for work.

How can anyone believe any of these figures which tell us Payroll increased and Unemployment declined at the same time as Employment and Labour force went down substantially. It must all be pure fantasy.

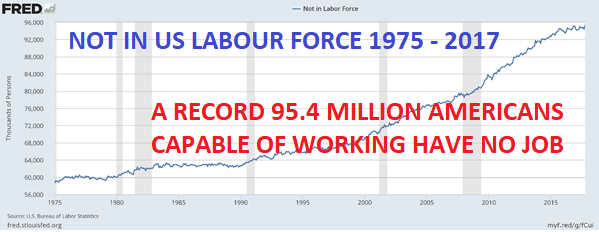

The Labour Participation rate is down from 67% in 1999 to 62% currently. The problem with the US labour statistics is that it conveniently disregards the 95.4 million people, a record level, who are able to work but are not working. The total US labour force capable of working is 256 million. Of those 161 million are actually working or actively looking for a job.

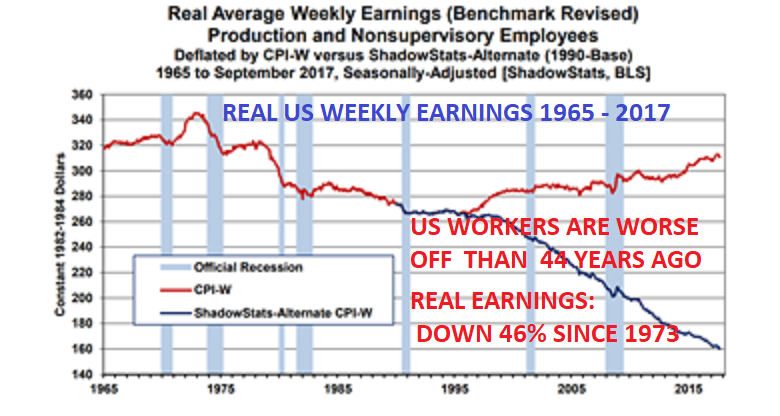

So the 95.4 million not working, many of which have given up looking for a job, represent 36% of the all those capable of working. So with fewer people working and with average workers’ real pay having declined since 1975, it is hard to understand that people in the US are feeling so optimistic.

THE CONFIDENT CONSUMER HAS STOPPED SHOPPING

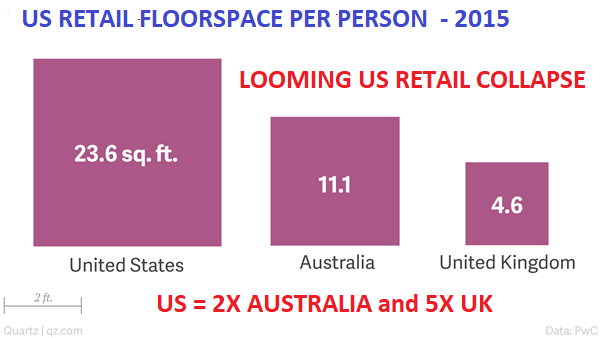

Having recently visited the US, it is difficult to understand that the US consumer is the most confident in 13 years. I visited a few shopping malls including a major mall in Boca Raton, Florida with all the major department store chains plus all the speciality chains. Boca is an affluent area but still, virtually all stores were dead with lots of staff who had nothing to do. There was only one store which was packed which was Apple. The Microsoft store was also totally empty. The state of US retailing is clearly dire with 5X as much retail space per person as in the UK, a country which is also over shopped. With 6,700 planned closures so far in 2017, this industry is clearly haemorrhaging.

Retail is hit by the decline in real disposable income and also the development of online sales. Although the Amazon valuation has looked ridiculous for many years, maybe it is justified as this company eventually will have a total monopoly in many areas of retail with the exception of some specialty chains such as non-branded fashion.

THE US IS CONTINUING TO LIVE ABOVE ITS MEANS

But the problem is not just retailing. The US Trade Deficit is continuing to balloon and is now at an annualised $750 billion which is the worst since 2007. Real construction spending is also declining and is the worst since 2011.

ALICE IN WONDERLAND FANTASY

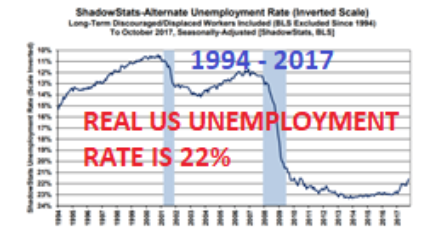

Either Americans are misled by the continuous bubble highs in stock markets or by the government propaganda which the media, without analysis, just publishes as fact although virtually all of it is Alice in Wonderland Fantasy. Or maybe the bullish Consumer Sentiment figures are just as fake as most of the figures produced by government. How else can the official unemployment figures be 4% when according to proper analysis by John Williams of Shadowstatistics, it is 22%.

As the British Prime Minister Disraeli stated: “There are Lies, Damned Lies and Statistics”. But markets love these lies since they continue to drive valuations exponentially higher whether it is the FAANG stocks or Cryptocurrencies.

EVERY WORKING AMERICAN OWES $1.5 MILLION

The US working population of 154 million have the responsibility for the US total debt which currently is $70 trillion. That excludes unfunded liabilities of anywhere from $120 trillion to $200 trillion which also must be funded.

But if we just take the $70 trillion debt, that amounts to $454,000 of debt for each person working. Adding the unfunded liabilities, we are looking at anywhere between $1.2 and $1.7 million debt per US working citizen. Since the average US person is one wage check from bankruptcy, he is hardly in a position to pay anywhere from $454,000 to $1.7 million on an average gross wage of less than $50,000. If every working American paid used his gross wage to pay off this debt, it would take over 50 years to pay off including interest and inflation. But the average American couldn’t even afford to allocate 10% of his wage to repay the debt and liabilities. Thus Americans couldn’t even afford a 500 year repayment plan.

But the US isn’t alone. Japan and many countries in Europe are in the same situation. Global debt can never be repaid. And when interest rates increase to 10%, 15%, 20% which is very likely, the financial system will implode.

ELEPHANTS WILL FLY

So everyone knows that the US, like the rest of the world is bankrupt. But who cares with stock markets and Consumer Sentiment at highs. Every new President or Chairman of the Fed just hopes that nothing will happen on their watch. In the meantime, they will just print as much money as possible, so they can pass the parcel to their successors.

But at some point, the music will stop and someone will get stuck with the parcel. And this parcel includes total debt and liabilities, including derivatives, of $2 quadrillion. Anyone who gets landed with such a parcel will print money in the quadrillions. Or perhaps he will just issue a cryptocurrency backed SDRs. Maybe the world at that point will value the 21 million bitcoins at $95 million each. This would take care of the $2 quadrillion debt. At that point, we will most likely also see elephants fly and many other miracles.

IT JUST DOESN’T ADD UP

The coming global financing requirement hardly rhymes with central banks reducing global liquidity by $2 trillion by the end of 2018 and more thereafter. The coming collapse of stock and bond markets, probably starting in 2018, will force central banks to a massive about turn. But at that point the added liquidity will have no effect. The world will then have reached a point when printing worthless fiat money will no longer have any effect. And why should it. If money printing could create real wealth, why would anyone ever work.

THE WORLD’S LARGEST HEDGE FUND

The Fed is of course not the only Central Bank that is conducting a disastrous policy. The Swiss National Bank (SNB), which used to be a bastion of safety and conservatism, is now the world’s biggest hedge fund. The balance sheet of the SNB continues to explode and is up 9% so far in 2017 as at the end of September.

Total assets of the SNB are now CHF 813 billion (same in $). That is 123% of Swiss GDP and, on a relative basis, bigger than the central bank of Cyprus when it went under.

A massive CHF 760 billion is held in foreign currency positions. CHF 90 billion of that is in stocks, most of it in US stocks such as Apple, Alphabet (Google), Microsoft, Facebook and Amazon. CHF 670 billion is in currency speculation, mainly Euros and dollars. With stocks rising and the Swiss Franc weakening against the Euro and the Dollar, the SNB has done well in 2017 so far. But they are unlikely to get out of these positions when stocks Euro and dollar collapse, creating massive losses and more money printing. At that point, the Swiss Franc will compete in earnest with other major currencies in the race to the bottom.

No wonder stocks are going up when most central banks including the ECB, SNB and the Bank of Japan are printing masses of fake money and buying stocks in the $100s of billions. What they are doing should be classified as criminal but Central Banks stand above any law like many US investment bank chiefs.

EDGE OF THE PRECIPICE

We are standing at the edge of a precipice and very little is required to push the world over the edge. Just like in 1929 or in 1987, it will come out of the blue with no one being prepared or having the time to react. Since markets for decades have been saved by central bank printing, investors will initially see any decline as a buying opportunity. But any liquidity injection by central banks will have a very short-term effect. The fall in the next few years will be of the same magnitude and the reverse of the exponential moves that I discussed in last week’s article.

With most markets at highs, gold buying is very subdued in many countries like the US. It is hard for investors to avoid the seductive powers of surging stocks and cryptocurrencies. But German gold buying is very strong. As usual Russia and the East continue to absorb most of the annual scrap and mine production regardless of price.

When confidence turns and fear returns to markets sometime between now and 2018, gold and silver will surge. Due to lack of supply, very few investors will be able to get hold of physical gold and silver at that point. For the few who then will be fortunate enough to acquire precious metals, it will be at prices which are multiples of current prices. The time to think of wealth preservation and to buy insurance is of course today when physical gold and silver can be found at very low prices. At some point, the gold and silver price rises will dwarf the current surge of Bitcoin.

To be left behind will be a fatal mistake.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.