After nearly a year of surprising political developments, odds-on-favorite Emmanuel Macron’s victory in France last month was a welcome change and a relief for many. As the the United Kingdom general election took place last week and with negotiations with the EU expected to begin later this month, the issue of whether Brexit will be of the “soft” or “hard” variety remains in the foreground. The Eurozone project has long had its fair share of detractors, and for many Eurosceptics the Brexit referendum last year further reinforced the view that the eurozone is destined to fail.

To be sure, there’s nothing really new about this. Back when the European Currency Unit (“ecu”) was officially replaced by the euro in January 1999, I was in my first year of university in the UK. In those days, Labour was in power and Prime Minister Tony Blair’s europhilia was juxtaposed with the “five economic tests” set by then-Chancellor Gordon Brown, who was far less enthusiastic about the eurozone’s prospects. The issue of British euro membership has long been a fairly divisive one, and the key question of sovereignty remains a central concern with regards to deepening the Union as a whole until this day. Traditionally, uncertainty has tended to be positive for gold.

GOLD PERFORMANCE IN EUR TERMS

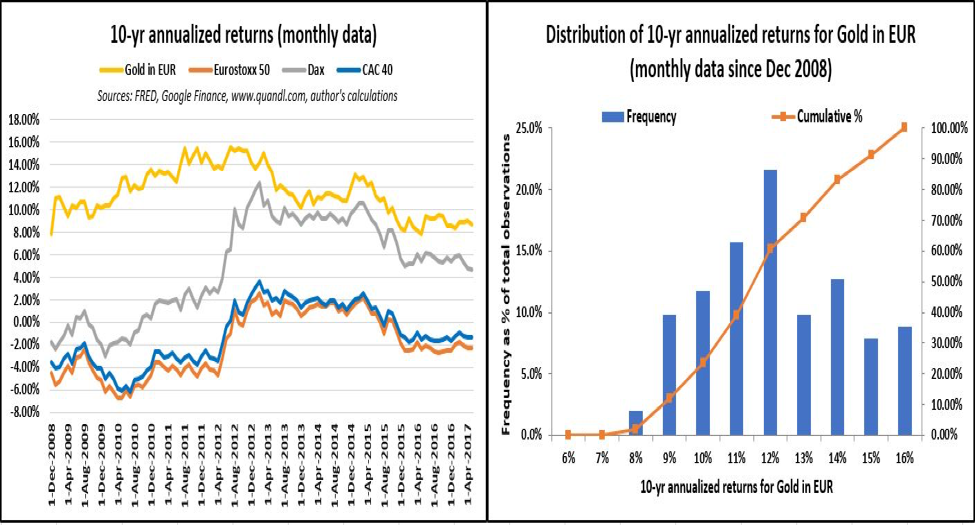

Since the inception of the single currency, being long gold has been a good proposition for eurozone investors, with better risk-adjusted returns than those on main equity indices such as the DAX, CAC, and Eurostoxx 50. In fact, since January 1999, when LBMA prices traded at 250.90 in euros, gold has seen a compound annual growth rate of some 8.7% compared to 5.4% for the DAX, 1.5% for the CAC 40 and around 0.15% on the Eurostoxx 50, using monthly data and closing prices from May 31.

Over a 10-year holding period, gold in EUR terms had annualized monthly returns of 11.6% with a standard deviation of 2.1%. Meanwhile, the DAX returned an average of 4.9% with a standard deviation of 4.3%, while both the CAC and the Eurostoxx 50 lost money. The French index recorded a loss of nearly -1.1% with a volatility of 2.6%, while the European benchmark performed even worse with -1.9% and standard deviation of 2.7%. In contrast to stocks, since the euro became legal tender gold has not experienced negative returns over a 10-yr horizon. In other words, the precious metal has performed better than equities, with lower volatility to boot.

In addition to quantitative easing, in recent years the eurozone began to experiment with something that was considered impossible before the global financial crisis of 2008: a negative nominal interest rates policy, or NIRP. An oft-cited argument against gold, namely that the metal does not provide a yield, simply does not work in a NIRP environment. Since the ECB instituted a negative deposit facility interest rate in June 2014 gold has appreciated over 21% in EUR terms, and since 3-month Euribor rates turned negative in May 2015 the metal has rallied some 7% in EUR terms.

“HARD” BREXIT AND WEAKER GBP LIKELY BULLISH FOR GOLD

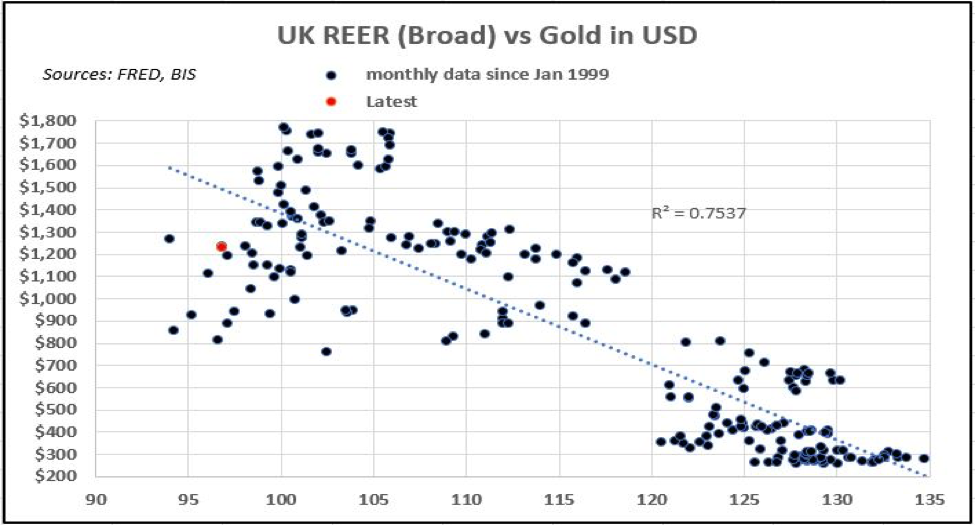

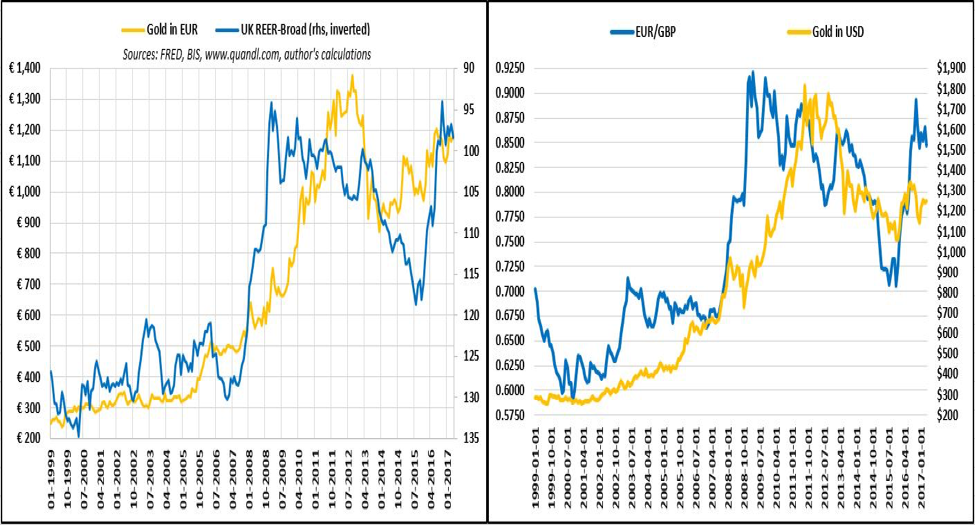

Although it’ll be years before the impact can be fully assessed, one of the most evident adverse consequences of Brexit for now has been the broad depreciation of the sterling. Interestingly, gold has also historically performed well on the back of a weaker pound. In real effective terms, current levels of GBP already suggest a higher price for gold in USD terms.

Furthermore, over the past two decades a stronger EUR/GBP has likewise been generally associated with higher gold prices, in USD terms as well as in EUR and GBP, which may be particularly significant in the event of a “hard” Brexit. This relationship may yet change going forward of course, but for now it remains statistically significant.

HEDGING CURRENCY DEPRECIATION AND TAIL RISK

Concerns about continued divergence between core and peripheral eurozone countries and the Union’s long-term survivability are unlikely to wane anytime soon. Greece, once again in recession, has debt repayments of some 7.3 billion euros due in July and is clearly in need of debt relief, while the Italian banking sector is teetering on the brink of disaster and is soon likely to test the Bank Recovery and Resolution Directive and its new bail-in mechanisms. While the wave of populism seems to have receded somewhat recently in “core” Europe, a resurgence cannot be ruled out. In Italy for instance, the growing popularity of the eurosceptic Five-Star Movement looms large. A victory for the party in the next election would most likely be seen as negative for peripheral bonds, eurozone equities and the euro itself.

Delving into detail of the myriad of concerns and challenges facing the eurozone is well beyond the scope of this piece. Suffice it to say that, however improbable, a breakup of the monetary union will remain a tail risk for the foreseeable future and gold will remain relevant in terms of asset allocation as a potential hedge. Thus far, the precious metal has done well for eurozone investors, holding up its reputation as an effective tool for wealth preservation.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.