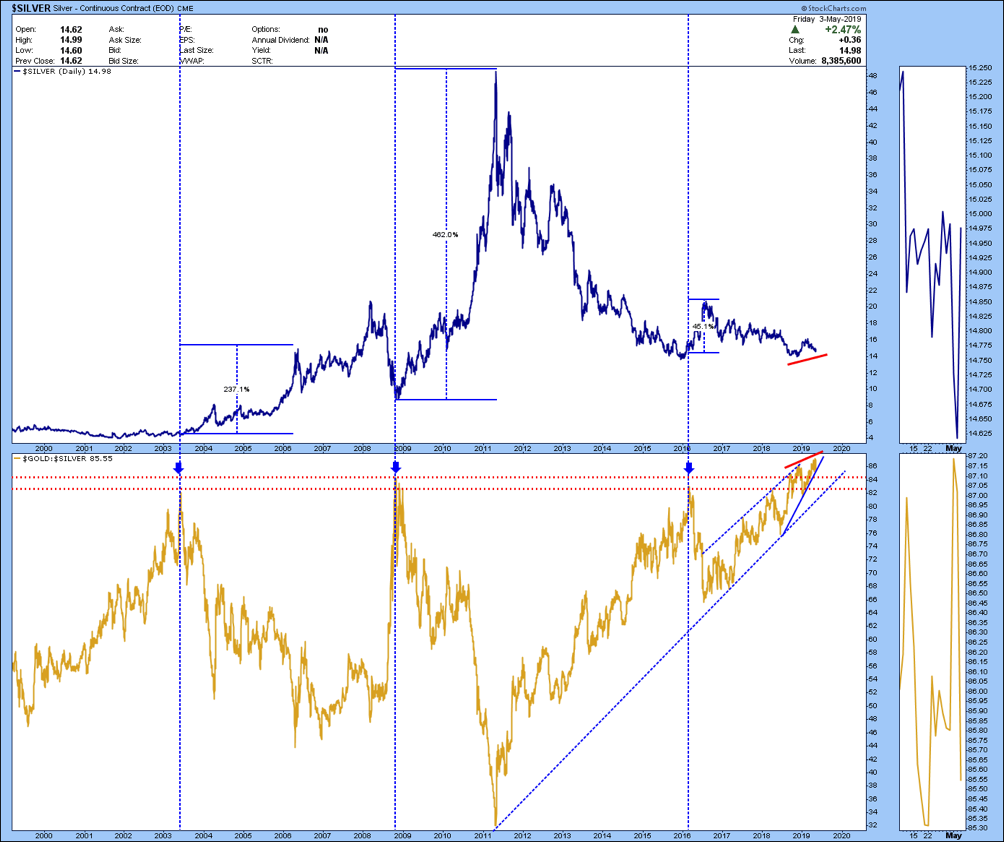

One of the most important indicators available in the precious metals sector is the ratio between gold and silver. In the last twenty years, the ratio has reached three times the value of 82 which has always represented an excellent buying opportunity, not only for the silver but also for the gold stocks sector. In the three years following the first two signals, silver has grown +230% and +460%, respectively, while in 2016, silver went up by only 45%.

In the last few months, the ratio has always remained in a range between 82 and 86, but the bearish wedge pattern makes possible a sudden fall in the ratio, which would favor silver in a surprising way. The positive divergence confirms the possible bearish reversal of the ratio that would favor the silver. The return below the level of 82 first and then 80 will be the confirmations we need.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.