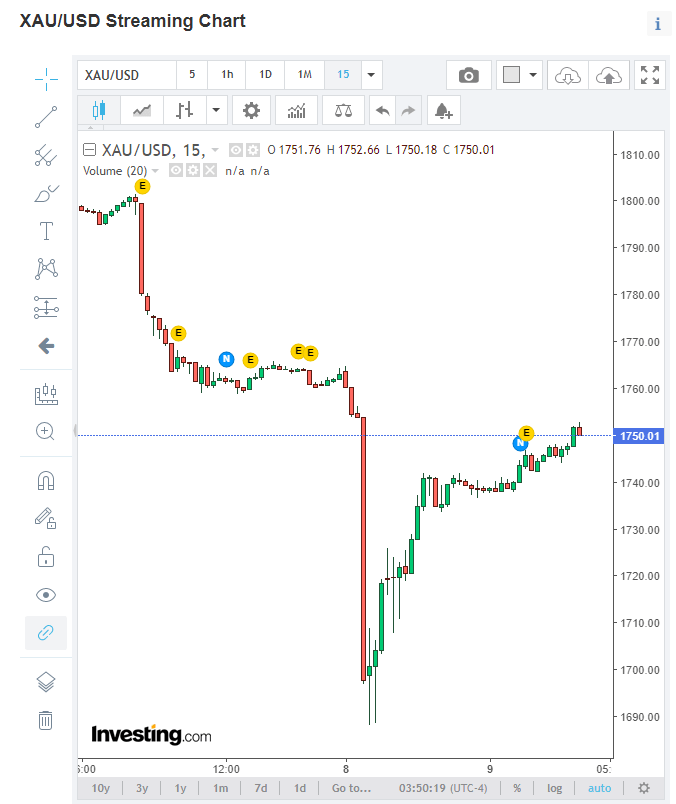

At the opening of the commodity market, gold has been under a major attack.

In 2015, I told you about a violent downward opening ($1050 per ounce) and then confirmed the increase to come when the price was still at $1300.

What happened this morning very strongly looks like a “cleaning” of stop losses and “weak hands”.

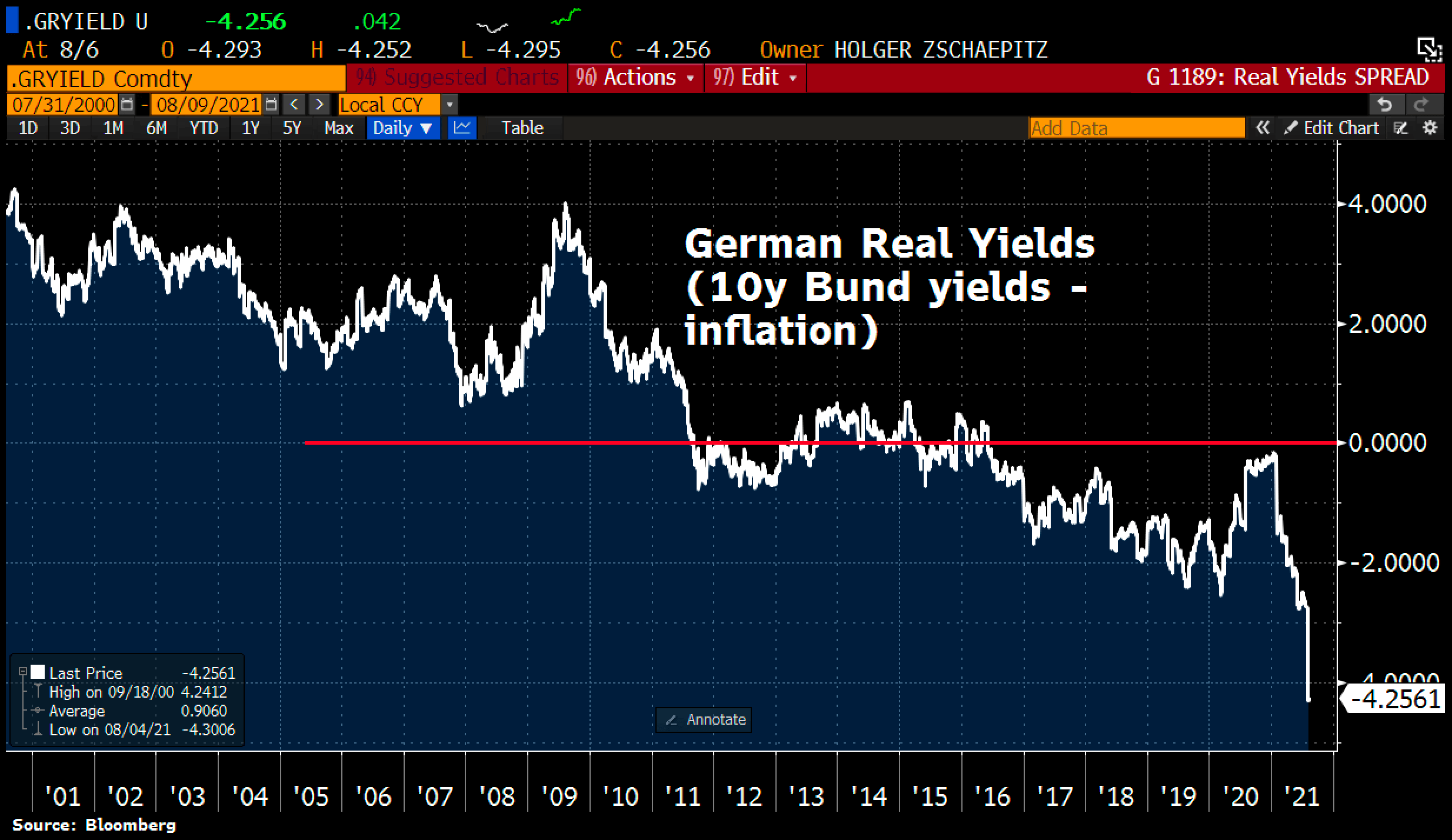

Another positive argument that militates for gold (and incidentally silver) is that real rates are diving:

Money savers are super stuck between negative return on their accounts and inflation coming out of the woods.

I found some very interesting comments from specialists such as:

Classic Sunday nite attack(low liquidity period) by massively levered futures traders. Pure manipulation meant to try to stampede real physical gold owners. These futures traders don't own any physical gold - just paper. I won't be a victim of their attempts to drive prices lower https://t.co/FAxXVu7pQo

— fred hickey (@htsfhickey) August 8, 2021

— Garic Moran (@GaricMoran) August 8, 2021

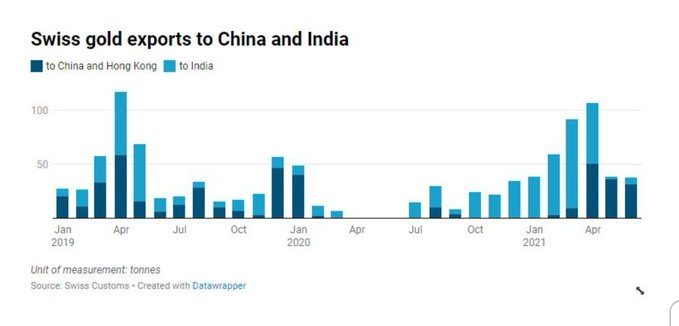

We can see that Switzerland is exporting more and more gold, to China in particular:

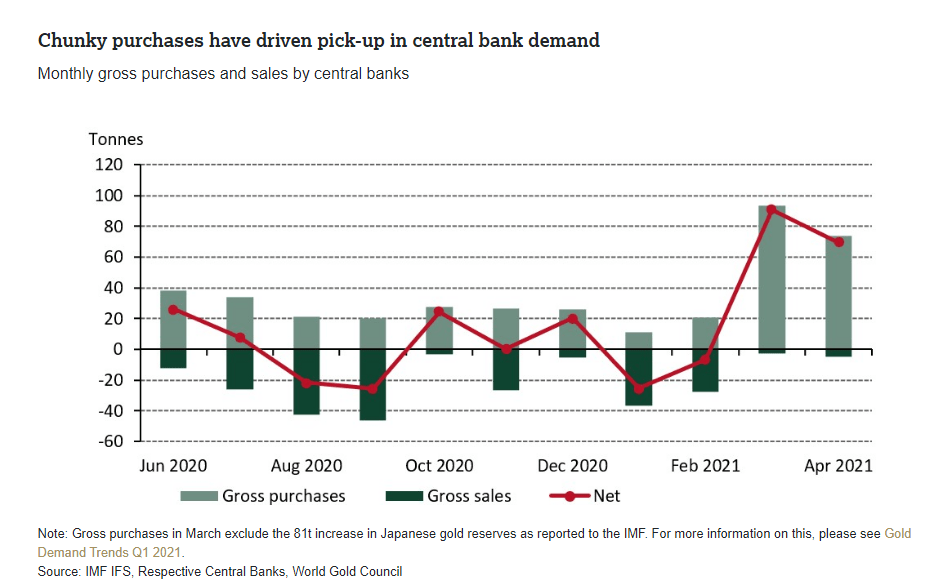

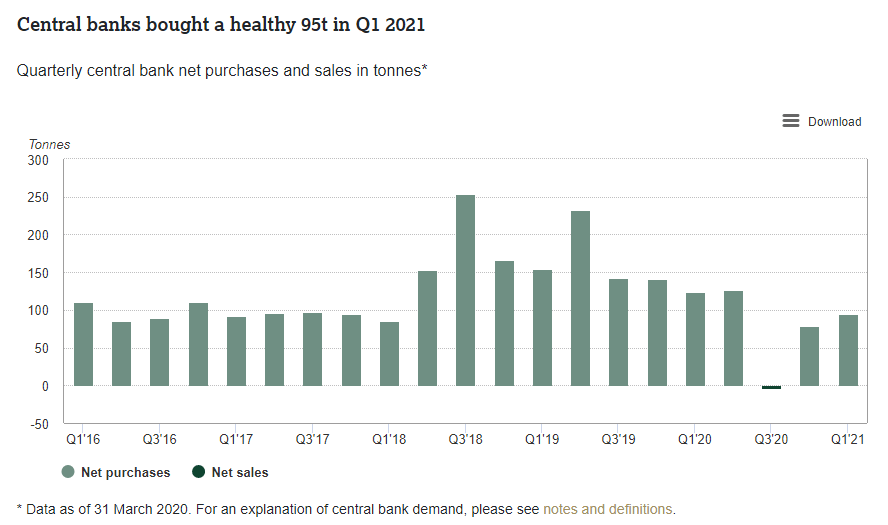

Some central banks are buying, and this is physical!

India has already accumulated 36 tonnes since the beginning of the year:

In summary, I think it’s a good signal for bullish people on gold.

Original source: Crottaz-finance

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.