How can ordinary people ever understand the importance of gold when they are continuously fed with false and distorted facts. The latest publication to publish false and ignorant propaganda on gold is the British weekly magazine The Economist. The article begins with a graph of gold starting in September 2011. Anyone who knows anything about gold recognises that this is the time when gold reached a peak of $1,930. Between 1999 and 2011 gold had gone from $250 to $1,930 which is an increase of almost 700%. During the same period, the Dow was virtually unchanged and the UK index, the FTSE 100 was down 3%. So whilst gold was up 8x during those 11 years, stock markets were static but the journalist did not mention this. Instead, he starts the graph at the very top of gold after an 8 year rally.

False propaganda and incompetence

In my article last week I talked about “Lies, Damned Lies and News” and this is the perfect example of the most blatant lies and misinformation that we find in the media today. It has now gone so far that I and many others don’t trust anything we read in the papers or hear on television or radio. And how can you, when journalists either deliberately publish biased and false news or by sheer incompetence cannot bother to find out the true facts. But that is not enough, the article goes on as follows:

“Although gold is seen as a hedge against inflation, it cannot be relied on to fulfil this function over the medium term; between 1980 and 2001, its price fell by more than 80% in real terms.”

Yet again, the author picks a point in time that is totally misrepresentative. For anyone who knows anything about gold, 1980 was a peak after a run from $35 per ounce in 1971 to $850 in 1980. The fact that gold had gone up 25x between 1971 and 1980 was of course not mentioned by this ignorant writer. Instead he starts from the peak in order to spread his false propaganda. I am not sure if it is a coincidence that the Rothschild family is a major shareholder in the Economist.

The author then comes up with a conclusion which is total proof of his ignorance of the role of gold:

“So buying bullion is really a bet that things will go spectacularly wrong: that events escalate in the Middle East and North Korea or that central banks lose control of monetary policy. It could happen, of course, but it helps explain why gold bugs tend to be folks with a rather gloomy attitude towards life.”

If you understand history and economics, you understand gold

What the author cannot grasp is that for the very small minority of people who understand the significance of gold, it is not a question of being gloomy. No, if you understand history and economics, you also understand that gold is the only money that has survived in history. Since fiat money begun, whether it was metal coins or paper money, governments have consistently destroyed its value by either diluting for example the silver in the coin from 100% to 0% as with the Roman Denarius in 180 to 280 AD. Or they have extended credit and printed money without any economic accomplishment in return. If you make a loan or print money without a compensating delivery of a service or goods, that money is by definition worthless. And this is exactly what governments are doing whenever they are under pressure. In the last few decades, over a couple of quadrillions of dollars of debt, unfunded liabilities and derivatives have been created out of thin air. Before this bubble period is over, those quadrillions of debts and liabilities will return to just air. And so will all the assets that were backed by this debt.

War drums are turning louder

The world is now entering the most dangerous period since the end of WWII. The sound of war drums is now becoming too loud to feel comfortable about the future. Trump’s declared policy until last week, was not to interfere in other countries politics. Since then the US has bombed Syria and Afghanistan and is continuing to bomb Iraq. All of these bombs are killing many more civilians than Syria allegedly killed a week ago. The bomb in Afghanistan is the biggest non-nuclear bomb ever dropped. North Korea is continuing with its nuclear bomb testing and the US is sending warships to the area and also threatening to strike. The conflict between China and the US regarding the islands in the South China Sea can easily escalate. Russia has not attacked any country outside its own territory for a very long time. But Russia is now feeling threatened from many directions. With US nuclear missiles directed towards Russia from both Eastern Europe and Turkey, the Russian bear is now feeling threatened. In Syria, Russia has been invited to assist in the fight against ISIS. Russia is unlikely to withdraw and if the US continues to bomb Syria, the outcome could be fatal. In addition, the whole of the Middle East is a time bomb. Saudi Arabia, for example, could be destabilised at any time.

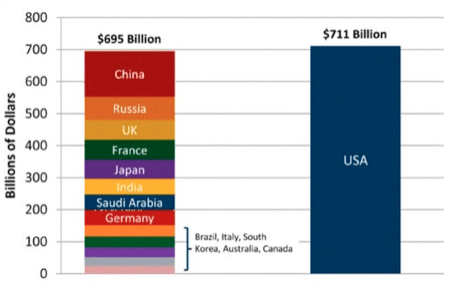

Looking at military spending, the US is as big as the rest of the world. But we have seen in Vietnam, Afghanistan, Iraq and Libya that with all its fire power, the US could not win any of those conflicts against powers with a fraction of its military resources. Nuclear bombs would of course be decisive, but Russia also has enough nuclear missiles to destroy most of the world, just like the US.

US military spending greater than the rest of the world

I am certainly no war expert but I am also aware that experts get it wrong most of the time. Throughout history very few people have forecast major wars or conflicts, just like no expert ever forecasts a financial crisis. But I do understand risk and it is absolutely clear to me that the risk is greater than ever for a major conflict. Let us hope that this risk does not materialise into a major nuclear war since that could be the end of life on earth for many people.

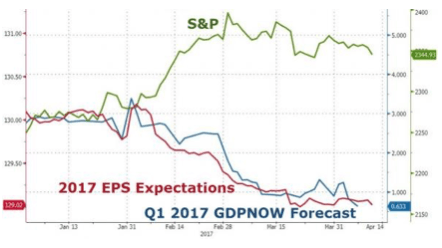

It was clear to me after the US election that Trump was never going to live up to all his promises to make America great again. He took over the country at the end of a 36-year era of continuous stock and bond market rally fuelled by the biggest credit expansion in US history. It would have been an impossible task for anyone to expand all the bubbles and it seems that Trump unsurprisingly has already failed at the first hurdle. After just under 100 days, he is already a lame duck president. This is why he has turned to war which is the last desperate attempt of a leader who fails on the home front in a bankrupt nation.

To prepare against war is extremely difficult for most people. Very few have the financial means or the inclination to leave their country for some remote region or island. So let’s hope that the war drums will go quiet. However, many more people can prepare for financial Armageddon which is guaranteed to come in the next few years.

“Stocks and Property prices always go up”

Very few investors understand the meaning of wealth preservation. For most people, “the stock market always goes up.” They are of course right since with a few major exceptions, stock markets worldwide have appreciated for over 100 years. Same with the property market: “Property prices always go up.” This is why it has been so easy to grow generational wealth for the last century. What few investors understand is that this massive asset price inflation is a function of credit growth and money printing. Even fewer investors understand that this period is now coming to an end. No trees grow to heaven even though many believe that this trend will go on for ever.

In coming years, we will not only see a credit and asset collapse, but also a wealth destruction of devastating proportions. But since 0.1% of the richest own the same as the bottom 90%, only a few will experience losing most of their wealth. But for the masses it will still be devastating because many will lose their jobs, house and pensions. The social security safety net will disappear since governments will be bankrupt with massive debt, interest expenses, and entitlements with very little tax revenue.

Stocks and property = wealth destruction

So in coming years, stocks, bonds and property will not constitute wealth preservation assets but instead wealth destruction assets. This is something that very few people will realise until it is too late.

A house has been an ATM for the last few decades with people borrowing against it to spend on holidays or cars, or just to live. In coming years, a house will not be an asset but a liability. For people who have a mortgage loan, it will be impossible to keep up with interest payments. In addition, most home owners will not be able to afford property taxes, maintenance, electricity, heating etc. The same with investment properties. Tenants will leave or stop paying rent and the buildings will be impossible to sell.

Stock valuations totally unrealistic

As regards stocks, I have not changed my mind that against gold, they will decline 90-95% in the next 5 years or so. One exception will be precious metal stocks. But investors must of course worry about custodial risk. Another sector which is benefitting is the weapons industry.

Bonds – the riskiest investment ever

Investment advisors today recommend bonds as wealth protection assets. I cannot understand how anyone can invest one penny in a bond. Governments are bankrupt and will never repay their debts.

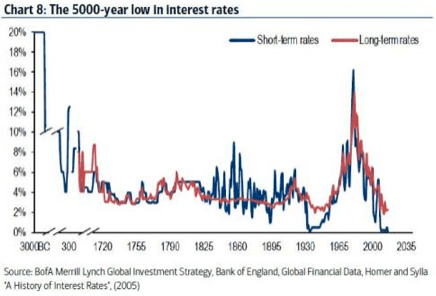

They might attempt to repay them with worthless paper money or they will declare a 100-year moratorium. Same with corporate bonds. Corporations will not have sufficient earnings power to even pay the interest. The other factor which will make bonds worthless is that rates will go from a 5,000-year low to levels in double figures or to infinity as bonds become worthless.

Cash will of course be a terrible form of wealth preservation as governments will destroy the value by printing unlimited amounts of paper money.

Agricultural land in a safe jurisdiction and a safe area that you can protect will be a good investment.

A true wealth preservation asset has many important characteristics:

- It must be recognised as money anywhere in the world

- It must be portable

- It must be physical

- It must be liquid

- It must be indestructible

- It must have a high value to weight

- It must be divisible

- It must be scarce

- It must represent stable purchasing power

- It must have a long tradition of being real money

And this brings us to gold and silver. No other wealth preservation asset has these characteristics. Certainly not bitcoin and not even diamonds.

Gold and silver can and should be kept outside your country of residence. This means you can flee to it if necessary. This certainly is not the case with a property for example.

All currencies will soon start the next phase of downward acceleration in their race to the bottom. The dollar is likely to be the next currency to fall. The effects of the dollar’s collapse will be devastating for the global financial system. As currencies decline, governments will introduce exchange controls and it will be impossible to transfer money, gold or other assets outside your country. That is why it is imperative to own gold and silver outside the country you live, in private vaults and in safe jurisdictions.

How much gold

Many people ask what percentage of their assets should be held in gold and silver. This clearly depends on the size of their assets. My personal view is that you should hold sufficient metals to last for many years if other assets or income disappear. So this could be 10% if you are very wealthy or it could be over 50%. Personally, I consider 25% to be a minimum but since I believe there is no better form of wealth preservation, I would be quite comfortable with a much higher percentage.

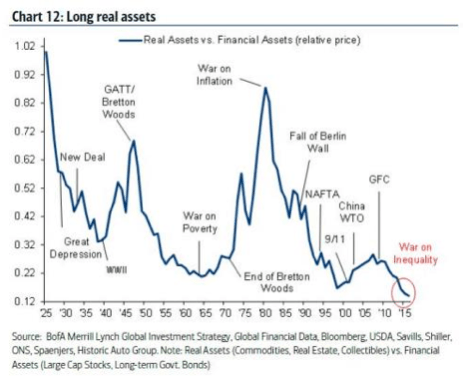

Own real assets – Sell financials

Real assets are at historical low against financial assets. Since the graph below includes real estate, which is a bubble asset, remaining real assets such as commodities (including gold and silver) are even more oversold.

Investors still have a unique opportunity to acquire physical gold and silver at prices which will not be seen for a very, very long time, if ever.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.