Since the beginning of World War I and the disappearance of the convertibility of currencies into precious metals, monetary policy has been largely state-run and left to the power of central banks. Since 1971 and the removal of the last remaining link between the U.S. dollar and gold, currencies have been a political convention, based on the imposition of forced currency by governments.

The 20th century and the beginning of the 21st century were marked by various monetary policies, depending on the period and the country, which led to hyperinflations as well as to periods of monetary orthodoxy and controlled inflation. Monetary policies are often analyzed in terms of their impacts or correlations with macroeconomic indicators, such as GDP, unemployment or the balance of payments. They are more rarely analyzed according to the consequences they generate at the individual level.

This paper proposes to study the repercussions that inflation has on households and how it impacts personal life choices. We define inflation here as the increase in the money supply by a central bank, outside of a free market. Rising prices are only one of the many consequences of this increase in the money supply.

Inflation Destroys Confidence and Weakens Social Ties

Every society is based on the trust of the people who constitute it. A society involves some people in it and excludes others. Those who constitute it are called upon to respect implicit rules that allow for living together. Deviant behavior such as murder, theft, adultery or lying destroys the harmony of common life and the bonds of trust and respect necessary for peaceful coexistence. From an economic point of view, a society is only viable and can only prosper if basic conditions are met, such as respect for the implicit or explicit contract that binds several parties, such as respect for the right to property and, more broadly, the will to live and work together. Pope Benedict XVI took up this idea when he spoke of "social capital," which he defined as "the network of relationships of trust, dependability, and respect for rules that is indispensable for any form of civil coexistence."[1]

The Bible sets out in the Ten Commandments the principles for a peaceful life. It also calls for honest business practices. "You shall have just and accurate balances, just weights, a just ephah, and a just hin."[2] "A false balance is an abomination to the Lord but a just weight is his delight."[3]

In an economy that has gone beyond the primitive stage, economic exchanges are made in exchange for money, which represents half of each transaction. Money therefore has a central place in economic life. The perversion of money has negative consequences for the entire economic system. Precious metals have naturally emerged centuries ago as monetary carriers, above all gold and silver. These metals have the advantage of being rare, infinitely fungible and of a consistent quality over time. For thousands of years, trade had been conducted in exchange for these metals. This was enough to create confidence and stability in the economic system. Naturally, deviations have occurred that have challenged the stability of the monetary system. Alloys were made so that the coins or ingots were made of gold or silver and other less precious metals. We have thus inherited coins made of pure metals and less noble coins, which is reflected in their current price. For example, the Canadian Maple Leaf coin is 99.99% silver, while the 1 franc Semeuse coin is only 83.5% silver. Governments have also depreciated the coins by reducing the actual weight of the coins in relation to the face value of the coin. To make a coin with nine grams of silver when it is supposed to contain ten grams is undoubtedly a theft, which has been commonplace in history.

Despite these attacks on the integrity of currencies, gold and silver have been the basis of the economic system for millennia. It was not until the First World War and the suspension of the convertibility of currencies into gold that inflation structurally entered the economy. Inflation certainly did not start in 1914. The systems of John Law or the assignats episode in the 18th century were certainly periods of strong inflation, but they lasted only a short time and did not replace precious metals for long. By 1915, inflation was approaching 20%. This was the beginning of a new economic era marked by structural inflation. As long as currencies were based on precious metals, there was no monetary policy. Money was not a political fact, but a geological one. Central banks have only recently become key players in the economy because they decide arbitrarily and without countervailing power on the money supply created.

Inflation Creates Crises and Economic Cycles

Inflation is inherently bad for the economy and society. It disrupts the economic calculations of companies and households. Calculating the long-term profitability of a project is made difficult, if not impossible by inflation. Lending money against interest is risky because large money printing can make the inflation rate higher than the interest rate and lead to a negative profitability.

Making long term economic plans, which is a family affair, is undermined by inflation. Households, like companies, are encouraged to turn away from ambitious projects with a long time horizon in order to refocus on shorter-term projects, which are less dependent on the hazards of monetary policy.

The emergence of monetary policies over the past century has gone hand in hand with the accentuation of economic cycles. There is a natural part in the existence of economic cycles of growth and recession. However, the 20th century has seen phenomena that have been greatly amplified, or even created ex nihilo by the discretionary monetary policies of central banks.

In 2000, the key rate of the Fed, the central bank of the United States, was 6.5%. The stock market crash of the Internet bubble and the attacks of September 11, 2001 led to a sudden change in monetary policy by the Fed. In 2003, the rate was lowered to 1%. It was brought back to 5% in 2006, then lowered to 0.16% at the end of 2008, after the explosion of the so-called subprime crisis.[4] Such sudden variations necessarily generate phases of euphoria, followed by phases of austerity. In times of low interest rates, companies and households are encouraged to borrow to invest. The illusion of easy money leads to debt for risky or normally unprofitable projects. When the economy eventually turns around, which it always does, the most fragile projects fail and economic resources are wasted. Conversely, when rates are artificially high, economic agents have no incentive to invest. Only the most profitable projects can see the light of day, the others cannot succeed, which deprives society of innovations.

In a free economy, guided by the meeting of a free and unconstrained demand and supply, we would not see interest rates, that is to say essentially the price of time, multiplied or divided by six in a few years by a handful of technocrats. The purchase of a home by a family or the use of consumer credit is strongly influenced by the monetary policy of central banks. The purchase of a primary residence and the size of this residence, which often determines the number of children the household can accommodate, depends largely on the arbitrary monetary policy of central banks.

Inflation Changes the Place of Women in the Family and in Society

The acceleration of inflation from the 1970s to the mid-1980s made it necessary for most families to have both spouses working. The labor force participation rate of women aged 30-34 rose from 38.7 percent in the 1962 census to 42.2 percent in 1968, 55.3 percent in 1975, 67.1 percent in 1982, and 76.3 percent in 1990. A correlation is observed between the sharp rise in the female labor force participation rate from 1975 to 1990 (+11 points) and the strong period of inflation from the early 1970s to the mid-1980s. From 1973 to 1983, annual inflation in France was consistently above 9%. Simultaneously with the increase in women's employment, fertility declined. The number of births fell sharply from 916,000 in 1971 to 747,000 in 1976. Through marriage, most men can no longer allow a woman to give up salaried employment to devote herself to raising children. In order to obtain competitively priced home loans and insurance, having two salaries is often a necessity.

By entering the paid labor market in large numbers, women have gained financial independence, which makes marriage less necessary. The choice of a spouse and the establishment of a household is thus postponed.

Contrary to the Keynesian idea that inflation could move in the opposite direction to unemployment, we know that this is not the case. The 1970s and 1980s saw the simultaneous rise of inflation and unemployment. The unemployment rate rose from 3% in 1975 to 9% in 1985. The precariousness of the labor market weakens the constitution of a family and the solidity of marriages. During economic crises, household fertility declines. In the United States, the impact of the 1929 crisis was significant. The number of births fell from 2,909,000 in 1925 to 2,377,000 in 1935. The birth rate per 1,000 inhabitants dropped from 25.1 in 1925 to 18.7 in 1935.

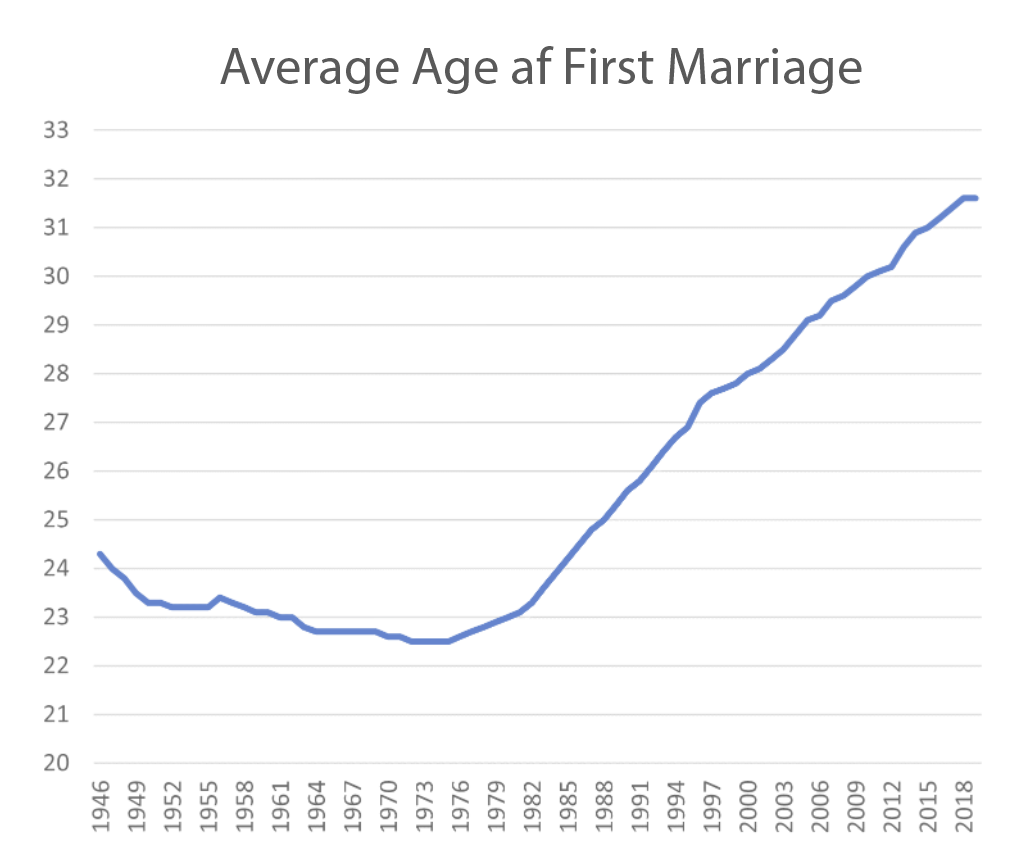

In France, we observe that the Trente Glorieuses were correlated with earlier marriages. From 1946 to 1975, the average age at marriage fell from 24.3 to 22.5 years. From 1975 onwards, and especially since 1981, the age at which people first marry has been constantly delayed. From 23.1 years in 1981, it has been pushed back to 31.6 years in 2019.[5] That is 8.5 years, 10% of a woman's life. This additional 8.5 years of marriage delay in a young woman's life has a strong impact on society. This is a time of life when most women who have had an education have completed it. The period from 23 to 31 years of age is, for most women, a period of professional activity and therefore of financial autonomy. Marriage is no longer a means of achieving financial security for a woman. Moving back the age of marriage from 23 to 31 means that a woman is depriving herself of the period of her life when the probability of having children is the highest. Delaying the age of marriage limits the number of children a woman can have. Late pregnancy attempts are more unlikely and put the woman's health at greater risk.

In addition to the increase in the age at which people marry for the first time, the proportion of the population that is married has fallen sharply. At age 35, 88.7% of women born in 1949 were married. For women born in 1969, 61.8% were married at 35. Only a minority of women born in 1984 had already been married at 35 (42%). We are therefore now in a generation where being married is no longer a matter for the majority, but for a minority.

The causes are obviously numerous and complex, but it seems reasonable to believe that part of these evolutions comes from the economic environment, strongly impacted by the monetary policies of central banks. A stable monetary system, in which money retains its purchasing power over time, provides the security needed to make a confident decision to start a family.

Inflation is Forcing Households to Change the Way They Manage Their Assets

In a monetary system dominated by central banks, inflation becomes a structural fact. A household, in order to build up and preserve its wealth, cannot be satisfied with keeping savings in a current account, as inflation would gradually destroy their value. Investments historically considered "risk-free" such as the Livret A (an interest-bearing savings account with funds available at any time), the PEL (housing savings plan) or life insurance with funds in euros have become investments with negative returns, as interest rates have become lower than inflation. Real estate, described as a "safe haven", is often a difficult investment for a household to make. Outside of large urban areas that have benefited from large capital gains, expenses, property taxes, rental income taxes, maintenance work and vacation periods between two tenants can generate a negative return, especially in rural areas.

In order not to see their savings gradually absorbed by inflation, households have the obligation to find more risky alternatives in the use of their savings. This can be in stocks, corporate bonds, precious metals or crypto-currencies. Many households do not have the knowledge, time or desire to invest in these media. In order not to lose their wealth, they are forced to do so, sacrificing time from hobbies that were more enjoyable to them or paying wealth management advisors who will charge them for their advice, without guaranteeing a positive return. An inflationary system forces households to reallocate their time, which is their most precious and most constrained resource.

Inflation has the effect of discriminating between households according to their consumption patterns. Spending households, which favor consumption over savings, experience changes in their purchasing power, depending on the level of inflation, but no profound change in their lifestyle. Thrifty households, on the other hand, who make efforts to sacrifice immediate consumption in the hope of greater satisfaction in the future, are structurally harmed by inflation. In addition to suffering from higher prices on current consumption expenditures, saving households are doubly penalized because the value of their savings is eroded by inflation. Inflation encourages people to consume and spend in the present and to sacrifice the future. Inflation invites people to turn away from the behavior of a responsible and far-sighted family man to indulge in the satisfaction of immediate and temporary desires. Pope Leo XIII, the founder of modern social doctrine in the encyclical Rerum Novarum, wrote "It is a most sacred law of nature that a father should provide food and all necessaries for those whom he has begotten; and, similarly, it is natural that he should wish that his children, who carry on, so to speak, and continue his personality, should be by him provided with all that is needful to enable them to keep themselves decently from want and misery amid the uncertainties of this mortal life."[6]

The tax system makes this situation even worse. Unlike many economically developed countries, France taxes direct inheritance. Among countries that tax inheritance, France's rates are among the highest. Even a gift from a living parent to his or her child is subject to tax, except under strict conditions and at spaced intervals. The tax thresholds for gifts and inheritances are not re-evaluated over time, which means that an increasing portion of the wealth that a parent wishes to pass on to his or her children is absorbed by the tax system, to the detriment of a free transmission between family members. The donation between a parent and a child benefited from a tax allowance of 159,325 € and could be made every ten years. Since 2011, the frequency of donations not subject to taxation has been increased to fifteen years. In 2012, the tax deduction threshold was lowered to 100,000 €. Until 2011, within thirty years a couple could make three donations of 159,325 € from a parent to a child, i.e. a total of 955,950 €. Since 2012, within thirty years, the maximum donation for a couple is now only 400,000 €, i.e. two donations of 100,000 € per parent. The 100,000 threshold has not been re-evaluated, despite a cumulative official inflation of 10% since 2012. It can be said that the tax-free transferable purchasing power has decreased by 10% in ten years.

Inflation, coupled with the French tax system, hinders the constitution of a patrimony and its free transmission to one's heirs. Thus, a person who works hard and makes efforts to save during his life is not free to leave his wealth to his children as he wishes. Their children are heavily taxed and part of their inheritance is used to support the state system, distribute public money to citizens they do not know and finance public expenditures they may not approve of.

This situation does more than deprive individuals of property that should rightfully be theirs. It does more than weaken family wealth and the natural solidarity that is attached to it. Inflation hinders the constitution and growth of capital. This capital is, however, necessary for economic development. It allows the financing of investments, innovations that will generate productivity gains and new services that will increase the general standard of living of the population. Preventing wealthy households from freely passing on an inheritance is not only an act of social and economic violence, it is ultimately depriving society as a whole of economic growth and dragging living standards down.

Family entrepreneurs, who create and develop businesses with the aim of passing them on to their children, are replaced by managers or civil servants, who are guided by the pursuit of short-term interests and positions.

Family relationships, which are the foundation of a society, are not limited to administrative filiation on a civil register. Families represent the sharing of feelings, beliefs, moral values, ways of life, world views, cultural and intellectual knowledge. They are also the sharing of material wealth, which exists only through the work of previous generations. Families teach their children, by their example, that work and savings allow for a more economically developed life, while idleness and careless management of material goods limit the capacities of future generations. Leo XIII affirmed that "the true worth and nobility of man lie in his moral qualities, that is, in virtue; that virtue is, moreover, the common inheritance of men, equally within the reach of high and low, rich and poor".[7]

The attack on family assets brought about by inflation tends to weaken the solidity of family ties, solidarity between generations and moral responsibility towards future generations. The family carries within it a moral code that encourages respect for private property and the fructification of assets. The family is also the social structure that allows the allocation of wealth. Within a family, children of different ages, sexes, aptitudes, aspirations and physical or intellectual abilities may have different needs. Parents are in a better position to know how to care for their children than officials in a ministry responsible for administering social policy.

Inflation Weakens Households and Causes Poverty

Inflation does not only destroy the purchasing power of money. It limits family formation by increasing the cost of living. This is especially true of rising real estate prices, which delay the decision to move into a family home. By making families economically fragile, inflation is also a source of instability and separation. A study by INSEE in Nouvelle Aquitaine shows that divorce results in a 22% loss of standard of living for women and 3% for men[8]. Following a divorce, 20% of women and 8% of men fall into poverty. In the case of divorce, the decline in women's standard of living increases with age: it is twice as great at age 65 and over (-31%) as between 25 and 34 (-16%). At the national level, INSEE concludes that the loss of standard of living directly attributable to a breakup is about 20% for women and 3% for men[9].

Nobel Prize-winning economist Gary Becker has shown that the economy affects the structure and decisions of families.[10] Studies in the United States have shown that during periods of rising prices, there was a greater dissolution of marriages.

Alan Greenspan, chairman of the US central bank for almost twenty years, admitted that the inflationary system was indispensable for the survival of the welfare state. The government's structural deficits need a constant devaluation of the currency, printable on demand.[11] Once it has taken a central role in the life of society, the welfare state makes it less necessary to form a family and facilitates its dissolution.[12] The men of the government participate in the dissolution of the family structure, the basic cell of society, by replacing family charity with state-sponsored redistribution.

Inflation is much more than a deleterious monetary phenomenon. It is a scourge that undermines and destabilizes the very foundations of a society. To restore a healthy society, on solid family foundations, it is necessary to put an end to the inflationary monetary system and to restore monetary freedom.

Etienne Chaumeton

Member of Association des économistes catholiques

[1] Caritas in veritate, 32

[2] Lévitique, 19, 36

[3] Proverbes 11, 1

[4] https://fred.stlouisfed.org/series/FEDFUNDS

[5] https://www.insee.fr/fr/statistiques/5007696?sommaire=5007726

[8] https://www.insee.fr/fr/statistiques/3631116

[9] https://www.insee.fr/fr/statistiques/2017508?sommaire=2017528&q=divorce

[10] Becker, Gary S., and Kevin M. Murphy. 1988. “The Family and the State.” Journal of Law and Economics 31, no. 1: 1–18.

[11] Greenspan, Alan. The Age of Turbulence, Penguin Books, 2008

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.