This month we will discuss the illusion of gold going up. We will examine the destiny of the dollar and why it will reach its intrinsic value of zero. We will also demonstrate why money printing will accelerate rapidly in the next 12-24 months.

Paper Money Collapsing against Gold

The problem with paper money is that governments can create unlimited amounts. This is what they have done throughout history and especially in the last 100 years and which has led to the total destruction of most currencies. Most people don’t even understand that their government makes their money worthless. Money printing gives them the illusion of being richer whilst all they have are pieces of paper with more zeros on them. But there is one currency that governments can’t print which is gold. Gold has been real money for almost 5,000 years and it is the only currency that has survived throughout history. Gold can’t be printed and no government controls it. Therefore gold will, over time, always reveal governments’ fraudulent actions in creating money out of thin air. And this is what we are experiencing currently. Gold is not going up. Instead gold is doing what it has always done, namely maintaining its value and purchasing power.

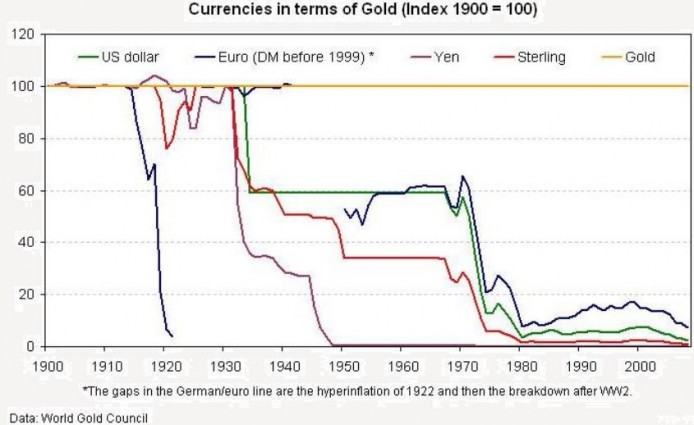

What we are seeing currently is the total annihilation of paper money whether it is Dollars, Pounds or Euros etc. The chart below shows the US dollar against gold. In the last 10 years the dollar has declined by 79% against gold. Most currencies have declined by similar percentages. So it is an illusion to believe that gold is going up when it is the value of paper money that is going down. All gold is doing is to reflect the virtually limitless printing of paper currencies. Since gold can’t be printed, it is the only honest currency that exists. This is why many governments don’t like gold increasing in value against their paper money since it exposes their total incompetence in running their country’s economy.

The chart above shows how the purchasing power of the dollar has declined in real money – gold – in the last 10 years. And if we take the period from 1909 to 2009 it shows the total destruction of paper money. In 1909, $1,000 bought 50 ounces of gold. Today it buys 0.83 ounces. This means that in the last 100 years the dollar has declined by 98.3% against gold. So in real money terms the dollar is now only worth 1.7% of what it was worth a century ago. Thus, the US government (as well as most other governments) has totally destroyed the value of real money by issuing unlimited amounts of paper money and in the next few years they will also kill off the remaining 1.7% of value to make the paper dollar reach its intrinsic value of zero. The chart below reflects various currencies fall against the dollar since from 1900 to 2004.

To talk about gold being over-extended at these levels is in our view absolute nonsense. As we will discuss later, money printing can only accelerate in the coming months and years. And when worthless pieces of paper are printed, gold will always reveal such a fraud by maintaining its value against the ever increasing supply of paper called “money”.

The Real Move in Gold is Still to Come

In our view we have not seen the real move in gold yet although we have gone from $250 to $1,226. The reasons are many:

- Money printing will accelerate as government deficits increase and problems in the financial system re-emerge.

- There is a high risk of default of major financial institutions or sovereign states with unpredictable consequences for the world economy.

- The fourfold increase in gold since 1999 has taken place without the participation of most investors. It has so far been a stealth market. But this will soon change and there is likely to be a major “gold rush” in the next couple of years.

- The average fund manager, pension fund manager, asset manager or individual investor has virtually no exposure to gold today but in the next couple of years they will all invest in gold.

- The gold market will soon become primarily a physical market because no one will trust paper gold or quasi physical gold such as Comex, ETF’s or unallocated gold. Nor will the market trust governments many of which might have lent out most of their gold. The last audit of the gold in Fort Knox was in 1953!

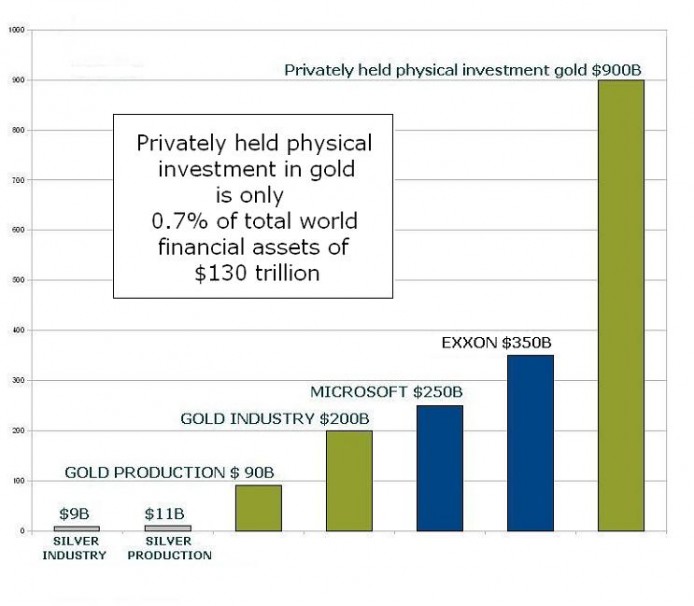

- Gold production is going down every year and is currently only $90 billion p.a. There will not be sufficient physical gold at current prices to satisfy increased demand.

- There is only $900 billion of physical gold held privately for investment purposes. This is circa 0.7% of world financial assets. A mere doubling of the allocation to gold, which is likely, would make the gold price surge. See chart below.

- Central banks are now net buyers of gold. Many countries which are underweight in gold such as China, India, Russia, Japan, Singapore Brazil, Korea and many more are major buyers of gold. This means that gold will be underwritten by several sovereign countries for many years to come. Central banks are not fickle investors and a policy decision to increase their gold holdings is unlikely to be reversed for a very long time.

- Although difficult to predict, the geopolitical risk in the next few years is substantial. Pakistan, Iran, Afghanistan, Al Qaeda, Middle East, Israel, acts of terrorism in the West etc. The preceding list is potentially explosive and the likelihood that something will happen in one these areas is very high. This would have a major effect on the gold price.

Gold has outperformed most stockmarkets

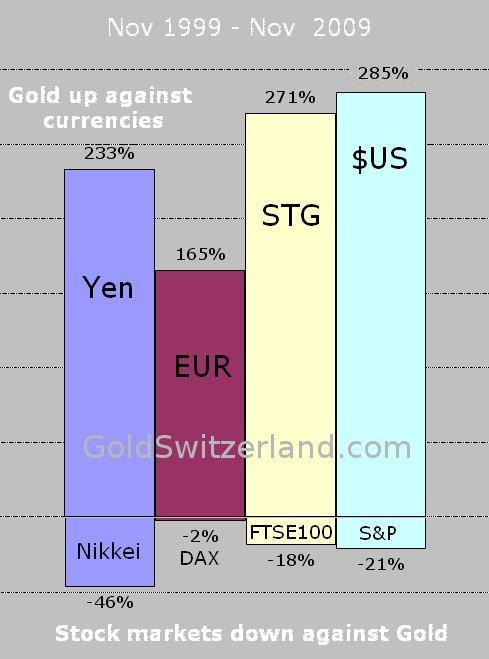

In the last ten years the Dow Jones has declined against gold by 80%. The graph below shows gold expressed in local currencies against the Nikkei, Dax, FTSE and S&P in the last 10 years (Nov 1999 – Nov 2009). For example gold in yen has appreciated by 233% whilst the Nikkei has fallen by 46%. The graph shows how badly most stockmarkets have performed measured in “real money” i.e. gold.

The Precious Metals market is minuscule

The graph below shows how small the gold and silver industries and markets are in relation to major US corporations and to total world financial assets. The market capitalisation of the silver industry is only $ 9 billion and of the gold industry $ 200 B whilst Microsoft is valued at $250 B and Exxon 350 B.

Both the silver and gold industries as well as the physical markets are so small that any increase in demand is likely to drive prices very substantially higher.

Quantitative Incr-easing

Governments and especially the US are making noises that money printing will soon cease. This statement is as credible as their statement about “a strong dollar policy”. Let us be very clear; just as there is no chance whatsoever that they actually want a stronger dollar or that the dollar can go up. There is even less of a chance that money printing or Quantitative Easing will be withdrawn. Instead we will have what we call QI – Quantitative Incr-easing. The Fed will in the next couple of years do what Helicopter Bernanke always promised; i.e. print unlimited amounts of worthless paper which will complete the move of the dollar to its intrinsic value of zero. This will totally destroy the US economy, thereby creating a frightening political and social climate.

The reasons for an acceleration of money printing are manifold:

1. Unemployment increasing

US unemployment adjusted for short- and long-term discouraged workers is now 22% as shown in the chart below. This is an absolute disaster and will have very severe ramifications for the US economy. And it is likely to get a lot worse. During the 1930s depression non-farm unemployment reached 35%. Since the real problems in the economy have not started we would expect the US unemployment to reach at least 35% in the next 2-3 years and possibly a lot higher. With over 30 million people unemployed, this will put enormous strain on the US economy with a major reduction in GDP and tax revenues and a major increase in social payments. A country that is already bankrupt today is unlikely to cope with this additional burden. Currently 36 million Americans receive food stamps, an increase of almost 3 million in the last 6 months.

2. Financial system still very vulnerable

The $12 trillion which the US government has injected to stave off an implosion of the financial system and economy has only benefited the financial sector. Banks that have received these funds have not lent them on to the real economy.

All they have done is to prop up their balance sheets and pay out record bonuses. But even with this massive injection of funds into the banking system virtually all banks are still bankrupt if their assets are taken at market value:

- With the blessing of the government, banks have been allowed to value their toxic assets at totally phoney amounts. Instead of valuing these assets at market value they can be valued at expected maturity value which of course banks assume is 100%. This is just another fraudulent collusion between government and banks.

- Mortgage loans are deteriorating at a rapid rate. In October 2009 another 330,000 properties went into foreclosure. There are 7 million US homes waiting to be repossessed. Resets of interest rates on Option ARM and ALT A mortgages in 2011-12 will lead to a massive increase in foreclosures and mortgage lender losses.

- Commercial property values are declining fast and vacancy rates and defaults are surging. Values have declined by 35-50% but banks are so far not recognising the full reduction in values. For smaller banks, which make up 90% all US banks, 74% of loans are in commercial real estate. There is $1.4 trillion to be refinanced in the next four years much of which is property which is in negative equity or empty. It will be virtually impossible to refinance this amount.

- More derivatives are being issued by the banks. The top four US banks now have $200 trillion outstanding. A big percentage of this could not be sold at anywhere near market value.

- Over 130 US banks have failed so far in 2009. Values realised when the assets are sold are substantially below the stated values, making a mockery of the current valuation rules. Not to value at market is a crime and against all sound accounting principles. But this is of course done with the total blessing of the government since, if assets were valued at market, there would be no banking system.

3. Government Deficits will escalate

The increase in unemployment and the continued problems in the financial system are two of the major contributing factors that will make government deficits surge. But there are many other problem areas that will necessitate acceleration in money printing:

- Tax revenues are falling rapidly

- Many states in the US are already bankrupt and most others will follow.

- Cash for clunkers and tax credits to new housing buyers are just two of many schemes that the government will launch to support failing industries.

- Pension fund deficits will escalate rapidly and the government will need to subsidise pensioners.

- Insurance companies will fail and the government will need to step in.

The list of areas which will need government support is endless and the US government will inevitably print money to “save” the economy.

Zero percent interest rates and unlimited money-printing = Lunacy

To artificially set interest rates at zero and to print whatever money is needed goes against every single principle of sound money and a sound economy. Interest should be set by the market in order not to violate the laws of supply and demand. And money printing should be totally illegal. So why is it done? For governments to stay in power and bankers to prosper! Nobody else is prospering. Normal people are being conned into taking enormous debts that they will never be able to repay. And the value of their paper money is being totally destroyed as we have demonstrated above.

We have in the last few years made clear to our investors and readers that there will be very serious consequences arising from the actions of the government:

- Government deficit will surge. The current borrowings of $12 trillion are likely to increase to over $30 trillion as we have discussed in previous reports. Interest rates could then be 20% or more and the US government would have absolutely no possibility to finance the interest on this debt.

- The dollar will collapse. It is only due to the fact the dollar is the reserve currency of the world that the US has been able to dupe the rest of the world into accepting its worthless currency and financing its enormous debts. But this will not last much longer.

- There will be hyperinflation. A deflationary implosion of credit and assets financed by a credit bubble is the necessary precondition to hyperinflation. In order to counteract these deflationary factors, the government will be printing unlimited amounts of money. It is the fall of the currency that causes hyperinflation and the US will be no exception. The fall of the dollar will lead to a hyperinflationary depression in the US.

- There will be major social and political consequences. The economic devastation caused by the mismanagement of the economy will not only create poverty and famine but also social unrest. There will be major changes in the political system and leadership.

Protection

This report has mainly discussed the United States since what happens there has major consequences for the rest of the world. But what is likely to happen in the US is just as likely to happen in the UK and many other countries.

Many investors now feel that the worst is over with stockmarkets recovering. In our January 2009 Newsletter we forecast that the stockmarket could have a 50% recovery. We have now had that recovery, mainly fuelled by massive liquidity injection by the government and cost savings in corporations. In our view the resumption of the downtrend could start at any time.

It is not our purpose to frighten investors or to be sensational in our views and reports. Our purpose is to warn investors of the major dangers which make asset protection absolutely vital for financial survival in the next few years.

« THERE IS NO MEANS OF AVOIDING THE FINAL COLLAPSE OF A BOOM BROUGHT ABOUT BY CREDIT EXPANSION. THE ALTERNATIVE IS ONLY WHETHER THE CRISIS SHOULD COME SOONER AS THE RESULT OF A VOLUNTARY ABANDONMENT OF FURTHER CREDIT EXPANSION OR LATER AS A FINAL AND TOTAL CATASTROPHE OF THE CURRENCY SYSTEM INVOLVED. » Ludwig von Mises – Austrian Economist (1881- 1973)

Original source: Matterhornassetmanagement

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.