By Elizabeth Burden

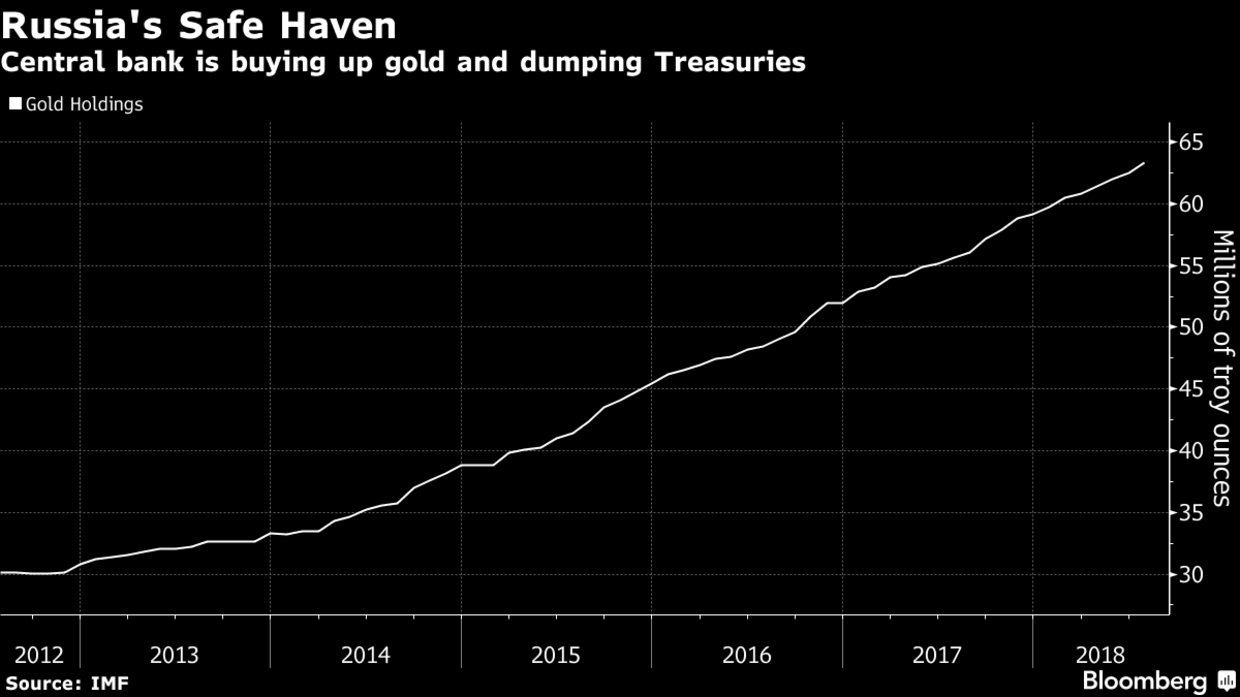

Russia added more gold reserves in July than any other month this year as it continues to buy up the metal in the face of U.S. sanctions.

The Russian central bank added 26.1 tons last month, bringing its holdings to 2,170 tons, according to International Monetary Fund data compiled by Bloomberg. The stockpile was valued at $77.4 billion at the end of the month, according to the central bank’s website. The last time Russia bought more gold in a single month was in November.

In April and May, Russia reduced its holdings of U.S. bills, notes and bonds by about four-fifths, and bought more gold, leading to speculation that the nation was dumping American assets to shield itself from the growing risk of harsher sanctions. Gold is “a 100 percent guarantee from legal and political risks,” the central bank’s First Deputy Governor Dmitry Tulin said at the time.

“This is a very smart move from Putin,” Jim Rickards, author and editor of newsletter Strategic Intelligence, said in an interview. “Russia is in a financial war. They’re getting out of U.S. dollars and getting into gold. This insulates them from U.S. dollar freezes and sanctions.”

The pressure on Russia is mounting, with the U.S. stepping up sanctions and the U.K.’s top diplomat Jeremy Hunt on Tuesday calling on the European Union to follow suit in response to the poisoning of a former Russian spy on British soil last year.

“The Americans are weaponizing the U.S. dollar, and it’s absolutely right for Russia to want to persify its foreign currency holdings,” said John Meyer, a partner at SP Angel in London. “Gold is the ultimate liquid investment if you don’t want exposure to the dollar.”

Original source: Bloomberg

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.