Will the autumn of 2021 be the end of the everything bubble?

Are investment markets very soon coming to the end of market insanity?

Since there is very little sanity left in markets or the in the world economy, we have now reached a point where we must accept madness as sanity, as George Bernard Shaw said:

“When the world goes mad, one must accept madness as sanity; since sanity is, in the last analysis, nothing but the madness on which the whole world happens to agree.” — George Bernard Shaw

Investment markets today are all about instant gratification and getting rich quick.

“Stocks always go up” and so does property in the everything bubble. Even the normally boring bond market has had a 40 year rise. And then we have the supercharged tech stocks, many of which have gained 1000s of percent in this century.

And we mustn’t forget the SPAC stocks (Special Purpose Acquisition Companies) or Blank Cheque Companies where shell companies are used to acquire existing companies to inflate their share price.

None of these things are new of course. During the South Sea Bubble in the 1720s for example, companies were formed and capital raised with just the purpose of “Making Money”.

We mustn’t forget the cryptocurrencies which are now worth valued at $2 trillion. They were just over $1 billion 8 years ago. Is that the bubble of the century like tulip bulbs in the 1600s or is it the money of the future. Well, most readers know or can guess my opinion on this!

VALUE INVESTING & WEALTH PRESERVATION IS FOR “WIMPS”

In a world where everything is based on “get rich quick” neither value investing nor wealth preservation enters the equation. Why worry about preserving your wealth when you could have made 14x your money on the Nasdaq since 2009 or 5,000x your investment on Bitcoin since 2011.

Calling tops is a mug’s game. Some of us who look at risk have been worried about the everything bubble economy for quite a while. To us, since the end of the Great Financial Crisis in 2009, the world economy and asset markets have been an illusion.

It is as if we are watching a virtual reality game in which some people automatically increase their wealth by millions or even billions of dollars every time they pass GO.

But as the rich are getting richer, the masses are just getting poorer and more indebted.

Although we see the wealth that has been acquired by many as an illusion that will soon evaporate, for the ones who have benefited, this is all very real.

Anyone who believes that these gains are real and sustainable will have the shock of a lifetime in coming years. As I showed in a recent article about the the End of the US Empire, the wealth of the 400 richest Americans has gone from 2% of GDP to 18% in the last 40 years.

This concentration of wealth is of course spectacular but also very dangerous for the world. Trees can always grow taller but they never grow to heaven!

AT THE END OF AN ERA – FALLS OF 90%

So as Shaw said, we are now in “the madness on which the whole world agrees”.

As I have often stated, I believe that we are at the end of a very major economic cycle. Not only are markets insane, but so are deficits, debts and currency debasements.

But also moral and ethical values have now vanished into thin air and been replaced by lies, deceit and the golden calf.

We are now in a very critical period for the world since excesses of the magnitude we are now seeing must be corrected.

Exponential moves in one direction are always corrected. And the corrections will be of a similar magnitude to the rise but happen much quicker. We are talking about falls of 90% or more in all major asset and debt markets.

Nobody believes such moves are possible with central banks and governments standing by with unlimited money printing combined with new Central Bank Digital Currencies that will save the world.

ILLUSIONS ARE JUST ILLUSIONS

We must understand that illusions cannot rescue the world economy. This despite whatever concoctions central banks or Schwab (World Economic Forum) and his billionaire cronies come up with.

Virtual illusions in the form of fake money or empty promises can never repay debt, nor can they change the laws of nature.

Clearly all these “evil forces” will use their power to orchestrate fake resets to “save the world” in an attempt to tighten their grip on the world economy and the financial system. But a heavily indebted and fake system can never be reset in an orderly manner.

In my view, any artificial or fake reset will only have a very limited effect. It is just not possible to solve a debt problem with more debt whatever way the PTB (Powers That Be) try to dress it in sheep’s clothing.

So an orderly reset is bound to fail very quickly. A new digital Fiat and thus fake currency will not solve the world’s debt problem.

Writing off the debt is just another illusory act. If you write off the debt, the assets on the opposite side of the balance sheet will also implode in value. And since the debt is leveraging the assets, they will have a very long way to fall.

This is why asset implosions of 90-100% are very likely. Few people believe this to be possible but with debt collapsing so will the bubble assets which are all inflated by worthless debt.

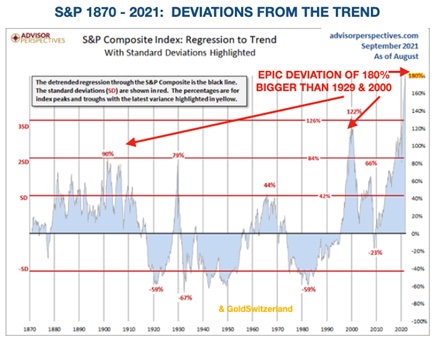

We must remember that the big stock market crash in 1929-32 saw the Dow lose 90% of its value. It then took 25 years for the Dow to get above the 1929 high. And today 92 years after that peak, debts, deficits, and asset bubbles are far greater than at the end of the 1920s.

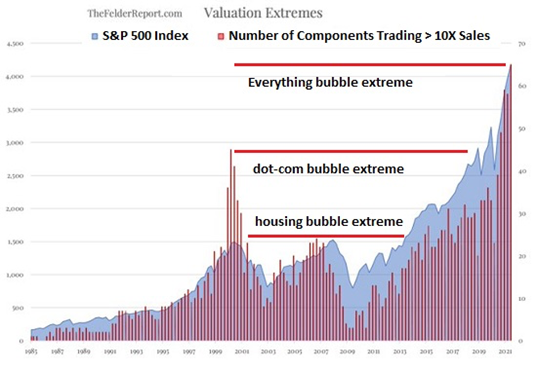

Below are a number of graphs that all point to the everything bubble.

THE BUFFETT INDICATOR

So there we have it, incontrovertible proof that this is the mother of all bubbles.

But as we have learnt in this century, bubbles can always grow bigger and especially if we are looking at the end of a major super cycle which could be as big (or long) as 2,000 years.

Nevertheless, the evidence keeps mounting of an epic asset bubble. In addition to the charts above that point to illusions never seen before in markets, we have a number of technical indicators that all point to the end of the everything bubble.

In the chart below, the RSI (Relative Strength Index) momentum indicator for example topped in 2017 and the major rise in the Dow since then has not been confirmed by the indicator. This is a very bearish sign albeit not a short term indicator.

Many other technical indicators including Elliott wave or Dow Theory all point to that a top to the everything bubble is imminent. Whether that means a top next week (which is possible), or in the next few months, time will tell. Some important cycle indicators point to potential turns between now and Sep 24.

SURVIVING THE EVERYTHING BUBBLE IS ALL ABOUT PROTECTING FROM RISK

But what is much more important than pinpointing the exact timing of the top is to understand the risk involved.

If, as we believe, we are now at the end of the everything bubble, nobody needs to time it. Investors should understand the upside might be 10% and the downside 90%+.

Who is foolish enough to accept such a risk? Maybe a 10% move up but a more certain 90% fall.

We are talking about a fall in real terms. If we get hyperinflation stocks and other assets can rise in nominal terms but fall in real terms when measured in stable purchasing power, like gold.

Well, that question is easy to answer. The whole investment world which has been spoilt by tens of trillions of dollars of fake money to fuel the Epic Everything Bubble will expect much more of the same in coming months or years.

Yes, much more money will be created but this time it will have very little effect. Instead the dollar, euro, yen etc will accelerate the falls that we have seen since 1913. They have all fallen 98-99% since then and by similar percentages since 1971 when Nixon closed the gold window.

The final 1-2% fall will soon start and take most currencies to their intrinsic value of ZERO. But don’t forget that this final fall is 100% from here.

Remember that measuring your assets in for example dollars is a futile exercise in self indulgence. You are just flattering your investment skills when you measure your performance in a currency that has lost 98% since 1971 and 84% since 2000.

If you use the same method in coming years, your paper wealth might look ok but be worthless in real terms. Just ask anyone who has lived in a hyperinflationary economy like Yugoslavia, Argentina or Venezuela.

So what is a Sleeping Beauty investment. Not difficult to guess. It is an investment that you can forget about for 100 years and when you wake up, it will have maintained its purchasing power.

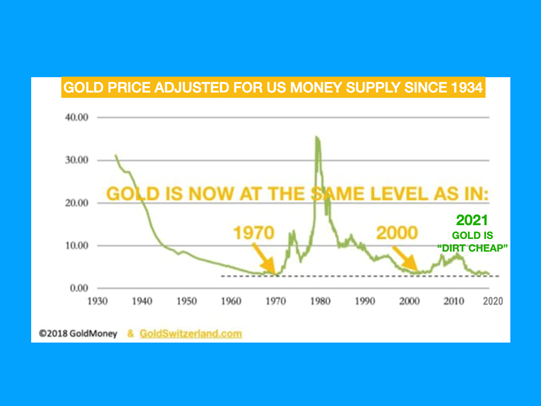

GOLD

If we get the expected stock market crash, it is possible that gold and the precious metals continue to correct a bit further like in 2008. As opposed to today, gold had then had a major bull run from $250 in 1999 to $1,000 in 2008. Weak gold hands then needed to get liquidity against a crashing stock market and the everything bubble.

Gold has now been in consolidation for years and there are a lot fewer speculative investors compared to 2008. Therefore I expect a much smaller and shorter correction, if any.

Coming back to the Sleeping Beauty, there is one investment which you could safely put away and forget about for 100 years. It is of course physical gold, safely stored.

As long as you store gold in a safe place and safe country, you know that it will maintain its REAL value as it has for 5,000 years. Yes, there are fluctuations, but gold’s history tells us that it is not just the only money which has survived but also the only money which has maintained real purchasing power.

Gold today at $1,750 is as UNLOVED AND UNDERVALUED as in 1971 at $35 and in 2000 at $288.

I will continue to show the chart below until that situation is rectified.

This reminds me of the Roman Senator Cato during the Punic Wars (around 150 BC) who finished every speech in the senate with “Furthermore I consider that Carthage must be destroyed”.

In the end Cato got his way as Carthage was destroyed.

I have no doubt that gold will soon rectify the current undervaluation and reach levels that few can imagine. This is what both technicals and fundamentals are clearly indicating.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.