Do Microsoft's results mark the end of a cycle for growth stocks?

For the second quarter of 2024, Microsoft ($MSFT) announced impressive financial results. Earnings per share (EPS) amounted to $2.95, exceeding expectations of $2.90. Sales reached $64.7 billion, against an estimate of $64.52 billion.

However, it was the figures for Microsoft Azure and Microsoft Cloud that disappointed the markets.

Microsoft's cloud business generated revenues of $36.8 billion, slightly below the forecast of $36.84 billion. The Intelligent Cloud division reported sales of $28.52 billion, also below expectations of $28.72 billion.

This slight drop in results compared with the IT giant's forecasts cooled investors' spirits. MSFT shares have now fallen four times in a row.

Graphically, MSFT has just broken down its support, interrupting the uptrend that began in 2023 :

Technology stocks are selling off, unlike small caps. The Russell 2000 - Nasdaq 100 chart is drawing the biggest monthly green candle since 2016:

We all know that, whatever the sector, when a cycle change is underway, it's very difficult to go against the new underlying trend. When market sentiment changes, it's hard to go back!

There are now doubts about the technology sector's ability to re-launch an uptrend.

Particularly against the backdrop of an increasingly pronounced economic slowdown.

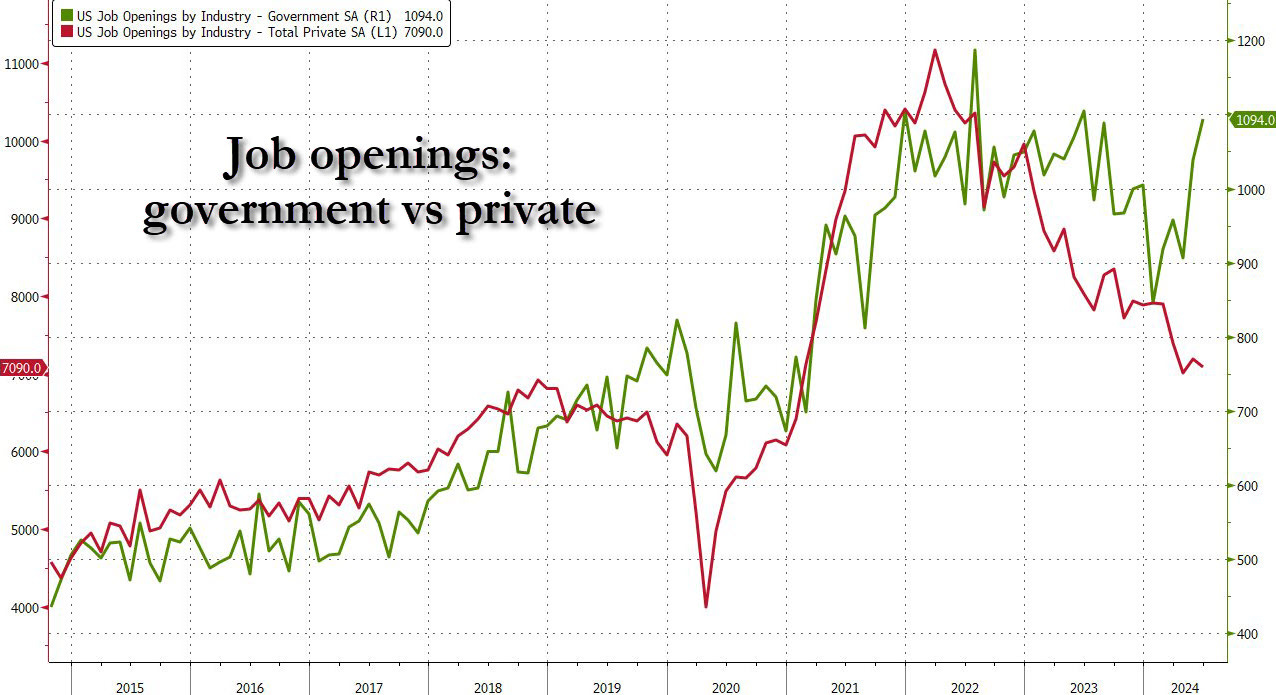

Private-sector employment in the US, which benefited from the government's stimulus package, has been declining at a similar rate to public-sector employment in recent months, returning to pre-Covid levels. Currently, only public employment is keeping unemployment figures in the green:

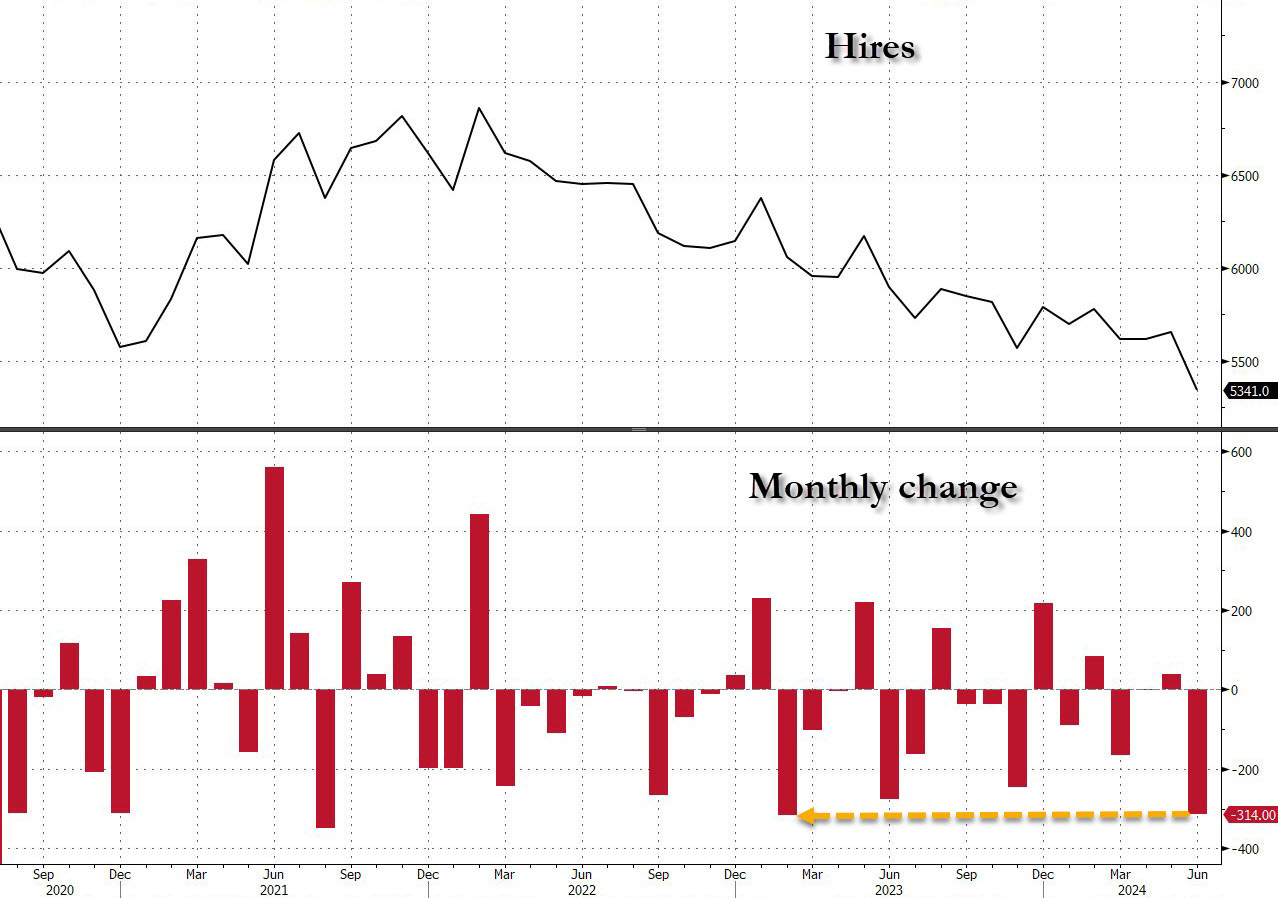

More worryingly, hiring figures plummeted in July, reaching levels comparable to those seen during the Covid crisis:

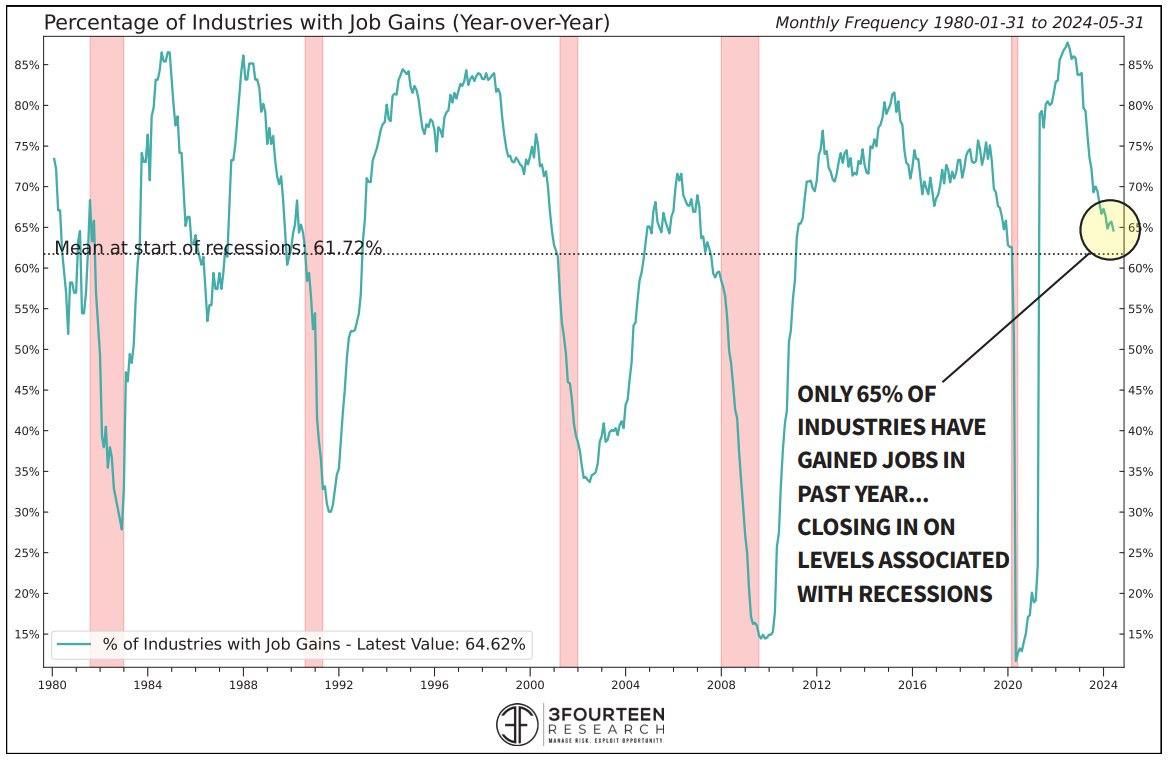

Research firm 3Fourteen has published a study revealing that the percentage of industries that have created jobs is now below 65%. Every time this threshold has been crossed since 1980, the US has experienced a recession within a few months:

Hiring is down, and at the same time, the number of resignations is falling. Is the "quiet quitting" phenomenon we've often talked about in these bulletins suddenly coming to an end? Faced with a new economic context, would American employees be tempted to cling to their jobs more than they did in 2022?

These latest data confirm a clear shift in the US economy.

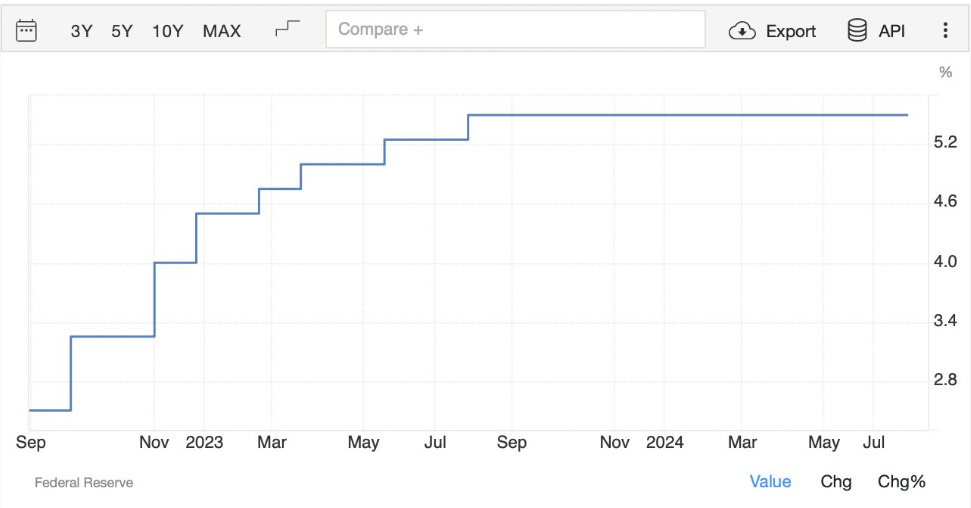

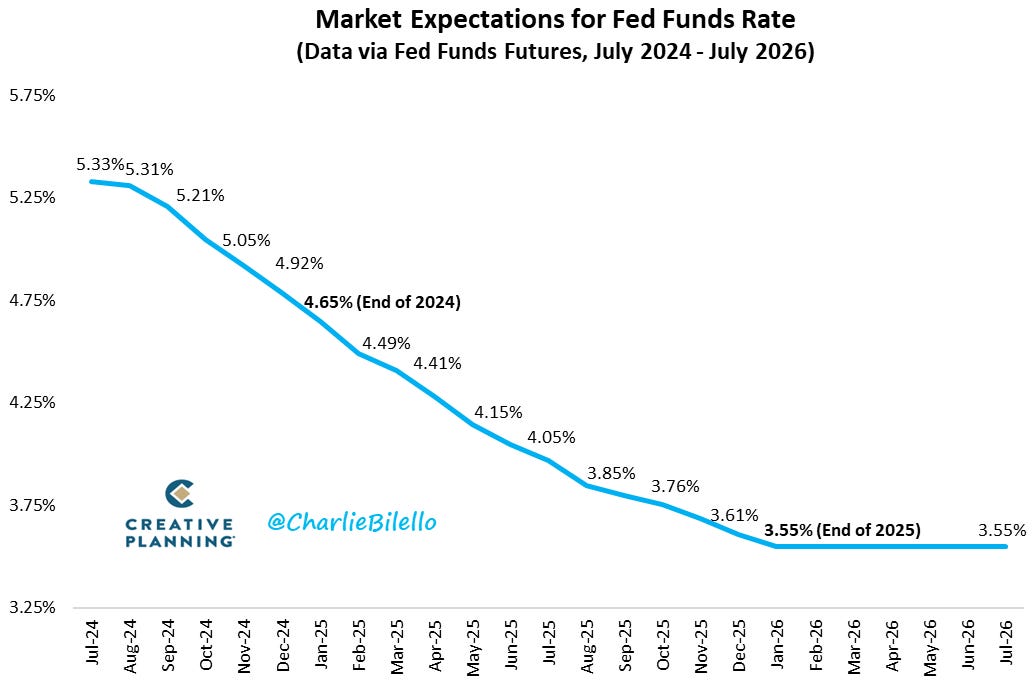

The Fed's decision to keep its key rates unchanged for the eighth time in a row points to a near-certain rate cut at its next meeting in September. At least, that's what Powell is suggesting.

The market is now anticipating a significant reduction in interest rates at the Fed's next meetings, due to the institution's very accommodating stance:

Will the prospect of lower rates be enough to reverse the current trend in investor sentiment towards technology stocks?

For the time being, the NAS100's bullish support is holding firm, despite the fall in Microsoft's share price. It's technically possible that the tech stock index will reach a new high:

Microsoft's decline signals that the Nasdaq is approaching a peak.

Long tech investors will have to fight hard to invalidate the powerful harmonic reversal pattern about to be triggered on the Nasdaq:

The peak of the ABCD pattern, which began in 2020, has just been reached, with an evening star forming. It will take a lot of energy to invalidate this pattern, which points to a first correction target for the Nasdaq at 16,000.

The price of gold benefits from Jerome Powell's very accommodating speech to end July with a record monthly close:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.