Zimbabwe has replaced its local dollar, which collapsed after less than 5 years in existence, with a new gold-backed currency. This is the latest step taken by President Emmerson Mnangagwa's government to end decades of monetary chaos.

"From today, banks shall convert the current Zimbabwe dollar balances into the new currency which shall be called Zimbabwe Gold (ZiG)," said Central Bank Governor John Mushayavanhu at a press conference on April 5.

This measure is designed to promote "simplicity, confidence and predictability" in Zimbabwe's financial system, he added, as he presented the new colorful banknotes. Adorned with designs depicting gold bars and the country's iconic rocks, the bills come in eight denominations ranging from ZiG 1 to ZiG 200. Zimbabweans have 21 days to exchange the old currency. The official starting exchange rate is set at 1 dollar for 13.56 ZiG.

The central bank also announced a drastic cut in its interest rate from 130% to 20%.

The southern African country has one of the highest inflation rates in the world, officially at 55% in March after reaching triple-digit rates last year during an episode of hyperinflation that wiped out savings and devastated the economy.

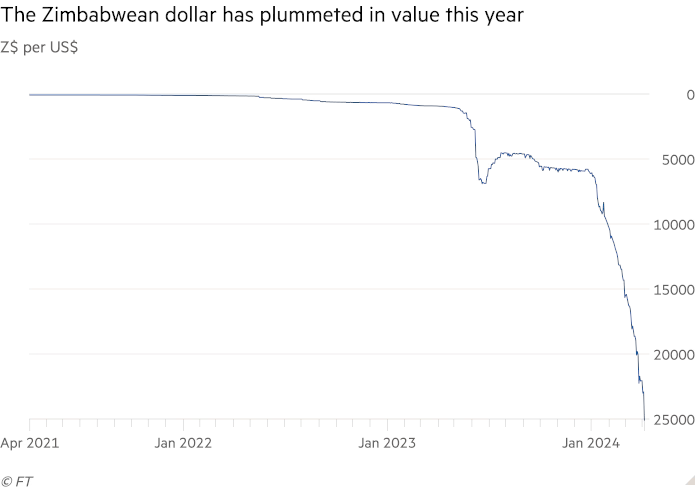

The local currency has lost almost 100% of its value against the US dollar over the past year. On April 6, the Zimbabwean dollar was trading at around 30,000 to the US dollar, and 40,000 on the black market, according to Zim Price Check.

John Mushayavanhu, governor of Zimbabwe's central bank, admitted that money printing had destroyed the Zimbabwean dollar. "We want a solid and stable national currency... it does not help to print money," he said.

Unique since the end of the gold standard in 1971, the new structured currency "will be backed by a basket of foreign exchange reserves and precious metals, mainly gold. ZiG shall at all times be anchored and fully backed by a composite basket of reserves comprising foreign currency, precious metals mainly gold received by the RBZ as part of in-kind royalties and kept in vaults by the central bank," Mushayavanhu said.

Zimbabwe has vast deposits of gold and other precious metals, which accounted for nearly 25% of exports in January, according to official figures. However, experts doubt whether the country holds enough reserves to support the new currency in the event of gold price volatility.

President Emmerson Mnangagwa inspected the central bank's reserves, whose vaults are said to contain 1.1 tonnes of gold. The bank also has almost 1.5 tonnes more abroad, as well as $100m in cash and precious minerals – such as diamonds, that if converted into gold would account for another 0.4 tonnes. Altogether, the reserves’ value totals $285m.

"We obviously need more.The more the reserves, obviously, the more the confidence and the more your capacity to be able to defend your currency against any shocks," said economist Prosper Chitambara.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.