The Everything Bubble is about to turn to the Everything Collapse!

This is the inescapable outcome for the Western world.

The world economy should have collapsed in 2008 were it not for a massive Hocus Pocus exercise by Western central banks. At that time, global debt was $125 trillion plus derivatives. Today debt is $325 trillion plus quasi-debt or derivatives of probably $2+ quadrillion.

The US is today running bigger deficits than ever at a time when:

- The interest rate cycle is strongly up

- There is only one buyer of US debt – the Fed

- Dedollarisation will lead to a rapid decline of the dollar.

The financial system should have been allowed to collapse 15 years ago when the problem was 1/3 of today. But governments and central bankers prefer to postpone the inevitable and thus passing the batten to their successors thereby exacerbating the problem.

Falsehood is the motto

The world is now desperately clinging on to a false prosperity, based on false money, false moral values, false financial values, false politics and politicians, false media, false reporting of reality whether vaccines, climate, genders or history etc.

Let’s look at some synonyms to false or falsehood according to Thesaurus:

Cover-up, deceit, deception, dishonesty,

fabrication, fakery, perjury, sham etc.

Yes, all of the above fits today’s West and especially the US. But as I often point out, history repeats itself so this is nothing new. But since most major cycles can take 100 years from boom to bust and back again, very few people experience a severe depression in their lifetime.

In the West, the last major depression was in the 1930s followed by WWII.

Yes, I have repeated a similar message for quite a while. My purpose with this repetition is obvious. The world and in particular the Western economies are facing a wealth destruction never before seen in history and very few people are prepared for it.

As the Romans said: “Repetition is the mother of learning”.

Let’s just look at a couple of quotes from the Greek philosopher Plato 2,500 years ago.

Debt is the consequence not the cause

So nothing has changed but just as we have climate cycles, there are also well defined economic cycles of boom and bust.

Major economic cycles normally have a similar ending as von Mises said: “a final and total catastrophe of the currency system involved.”

Or as Voltaire expressed it: “Paper money eventually returns to its intrinsic value – ZERO.”

Debt is not the reason for the problems which the world is now facing. Instead debt is a consequence of the falsehood culture that that is toxifying the world.

Unacceptable increases in sovereign debt arises when governments can no longer tell the truth, if they ever could!

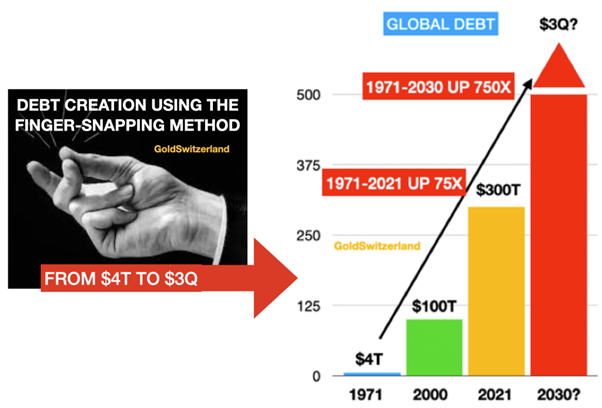

So the end of the current economic cycle started when Nixon closed the gold window on August 15,1971. At that point, he realised that the US could no longer continue to run budget deficits as they had done since the early 1930s. To get rid of the disciplinary shackles of gold allowed the US government and most central banks to create “finger-snapping” money. This is what a Swedish Riksbank official called creating money out of thin air.

When In 1971, global debt was a “mere” $4 trillion. In 2023 global debt is $325T excluding derivatives. This is clearly a major timebomb as I wrote about recently.

By 2030, debt could be as high as $3 quadrillion. This assumes that the quasi debt of global derivatives of $2 – $2.5 quadrillion has been “rescued” by central banks in order to stop the financial system from imploding.

First we will obviously see major pressures in the on balance sheet credit market. Corporate bankruptcy filings are increasing in most countries. In the US it is on a 13 year high for example, up 53% from 2022. Moody expects global corporate defaults to keep surging as financial conditions tighten.

The US banks are grappling with deposit flight, higher rates and major risks in the property sector.

The pressures in the commercial property market and in housing will lead to a wave of defaults necessitating further money printing. S&P reports that 576 banks are at risk of overexposure to commercial property loans and surpassing regulatory guidelines.

Borrowers will default and banks go bankrupt

The bank failures in mid-March starting with Silicon Valley Bank were just a warning shot.

Banks need high rates and a reduction in the loan portfolio to survive.

But borrowers, both commercial and private, need lower rates and more credit to survive.

This is a dilemma without solution. It will end up with both sides losing. Borrowers will default and banks will go bankrupt.

Before that there will be the biggest debt feast in the history of the world.

Luckily it requires no skill, no assets, no security to create the quadrillions of dollars which will temporarily defer the problem.

All that is needed is a bit more finger-snapping.

It will all happen first gradually and then suddenly as Hemingway described the process of going bankrupt. I have described this gradual/sudden process in previous articles, the first time I believe in 2017 when I talk about “Exponential moves as terminal”.

Imagine a football stadium which is filled with water. Every minute one drop is added. The number of drops doubles every minute. Thus it goes from 1 to 2, 4, 8 16 etc. So how long would it take to fill the entire stadium? One day, one month or a year? No it would be a lot quicker and only take 50 minutes! That in itself is hard to understand but even more interestingly, how full is the stadium after 45 minutes? Most people would guess 75-90%. Totally wrong. After 45 minutes the stadium is only 7% full! In the final 5 minutes the stadium goes from 7% full to 100% full.

So if we take 1971 as the beginning of the debt explosion we can see that the real exponential phase happens in the final 5 minutes which are still to come.

And this is how global debt can explode in the final phase of a credit boom.

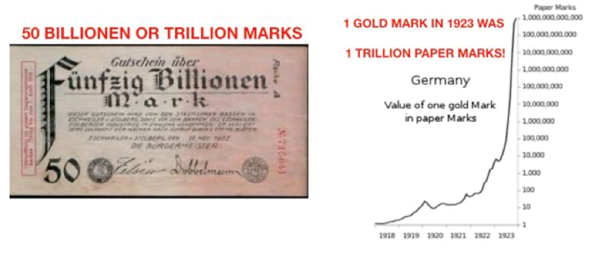

The hyperinflation in Weimar Germany in the early 1920s show a similar pattern:

As the graph above of the gold price in marks shows, the price of an ounce of gold went from below 10,000 marks at the beginning of 1923 to over 1 trillion by the end of the year.

No one should expect gold to go to $1 trillion but everyone should expect the dollar and most currencies to fall precipitously.

The perfect wealth destruction scenario

So we now have a perfect setup for the coming wealth destruction scenario:

- Global debt has gone up 80X between $4T in 1971 to $325 trillion in 2023

- Bursting of the derivatives bubble could push debt to $3+ quadrillion

- High interest rates and high inflation lead to sovereign and private defaults

- Bubble assets like stocks, bonds and property will fall dramatically in real terms

- Major debasement of USD and most currencies

- Real assets – commodities, metals, oil, gas, uranium etc will rise strongly

- Higher taxes, bail-ins, failure of pension and social security system

- Central banks will fail to save the system leading to debt implosion and defaults

- A deflationary depression will hit the West worst in a long term decline

- The East and South (BRICS, SCO etc) will also suffer but emerge much stronger

So we now have a perfect vicious circle of debt eventual leading to default:

Desperate governments take desperate actions

Yes, the West led by a bankrupt USA will try all tricks in the books. That will include CBDCs (Central Bank Digital Currencies), much higher taxes especially for the wealthy, bank bail-ins (forcing depositors to buy 10-30 year government bonds), martial law and many more measures to restrict people’s everyday lives.

These government bonds will have zero value since there will be no buyers.

CBDCs will also soon become worthless as they are just another form of unlimited paper or finger-snapping money.

I doubt ordinary people will accept these draconian measures. Thus there will be civil unrest which governments will be unable to control. Neither police nor the military will accept to turn against suffering fellow citizens.

Protecting risk is essential - Timing is not

I am obviously aware that the consequences I have outlined above of the biggest global debt bubble in history can be wrong.

I have not specified the timing of these events. I have learnt that forecasting timing is a mug’s game.

Interestingly mug comes from the Swedish MUGG which is a drinking cup with the alcohol turning you to a mug or fool.

Personally I believed that the system was ready to collapse after the 2006-9 subprime crisis but today 14 years later, the system is still standing but only JUST!

But since we are most probably in the final 5 minutes as I explained above, timing becomes irrelevant. We need to take all the measures we can before events start to unravel.

We are now talking about financial survival and for many also physical survival.

In a world with financial and economic misery, high unemployment, a collapsing support system whether social security or pensions, a failing health system, social unrest and possibly war, we are all going to suffer.

How to protect your wealth

Since we can’t forecast when the greatest wealth destruction in history will start, we need to prepare today. As I often repeat, you can’t buy fire insurance after the fire has started.

So now is the time to put your house in order.

Forget about gluttony or greed. Forget about trying to get out of stocks at the top. Forget about the old axioms that stocks and property always go up. Forget about the notion that sovereign debt is always safe.

Just remember one thing the next however many years is all about economic survival.

If you haven’t made your money from ordinary investments in the last 20+ years, you are very unlikely to make it now.

And if you hang on to your portfolio of conventional investments like stocks, bonds and investment properties, you are standing the risk of a severe decline of 50-90% of your portfolio for a very, very long period.

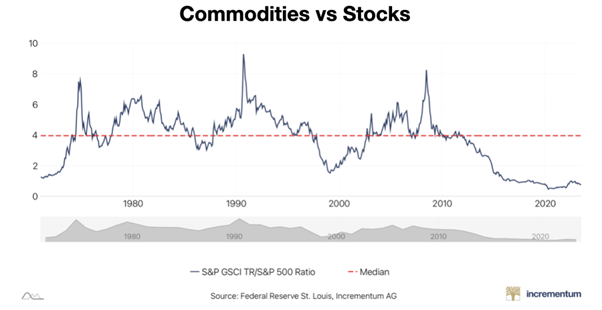

More safe investments in the current climate are commodities.

Look at the chart below showing Commodities versus Stocks (S&P) years. We are looking at a 50+ year low.

Best stocks to hold would be in precious metals, oil, and uranium.

The king of wealth preservation is gold. Silver is very undervalued and thus has more upside potential than gold but is much more volatile.

For the best protection, gold and silver should be held in physical form directly by the investor and stored in the safest private vaults in the safest jurisdictions.

After having organised our financial affairs, we must think about the people that need our help in whatever form.

Then enjoy life with family, friends as well as nature, books, music etc which are all free pleasures.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.