Some pro-bitcoin people claim that crypto will downgrade and absorb gold to become the sole store of value in the future. I've never bought into this scenario. How can we seriously envisage that gold — recognized, hoarded since the earliest civilizations, and which has proved its autonomy and value, notably since the end of its convertibility with the dollar on August 15, 1971 — could one day be worth nothing?

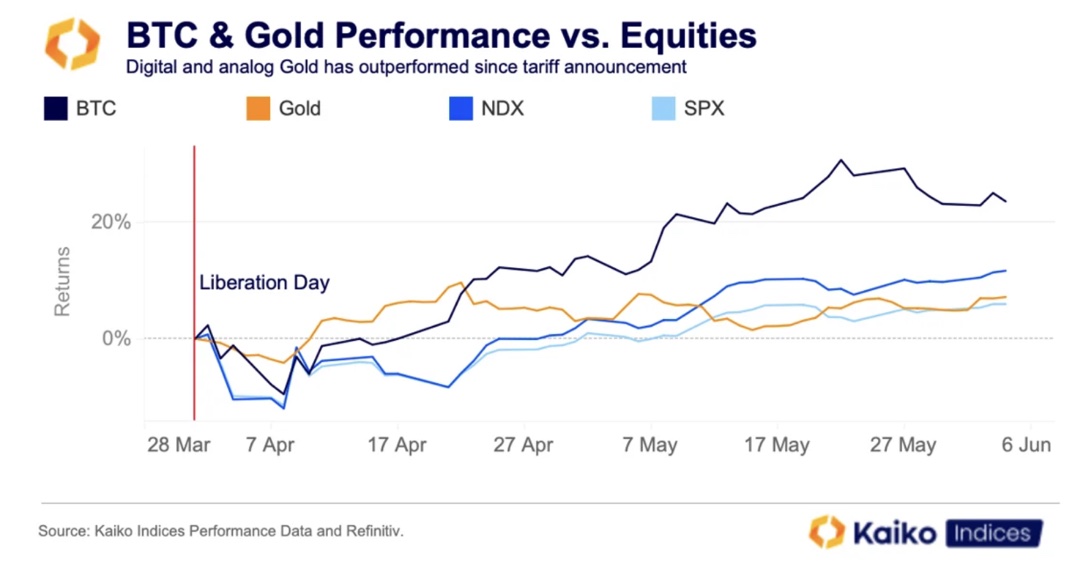

Wouldn't the two assets instead complement each other? That's the question raised by a research note from French company Kaiko, which specializes in aggregating data from cryptocurrency exchange platforms (“the Bloomberg of crypto”). It takes us a step further in a line of thinking we've already begun. The author of this note, Adam Morgan McCarthy, highlights the strong demand for these two assets in recent months — as evidenced by the rise in their prices — as well as their low correlation, both with each other and with equity markets.

This justifies considering them as complementary rather than competing. The low correlation between gold and bitcoin undoubtedly adds value to a portfolio, which will perform better (benefiting from the rising prices of both assets) and be more resilient (because of their low correlation, one rises when the other falls, to put it simply).

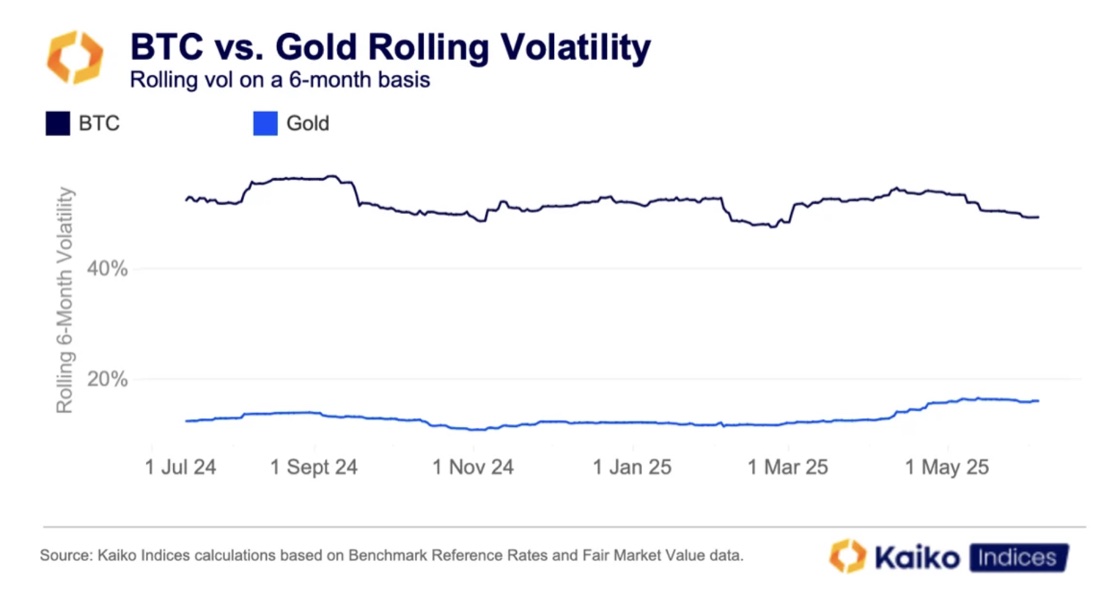

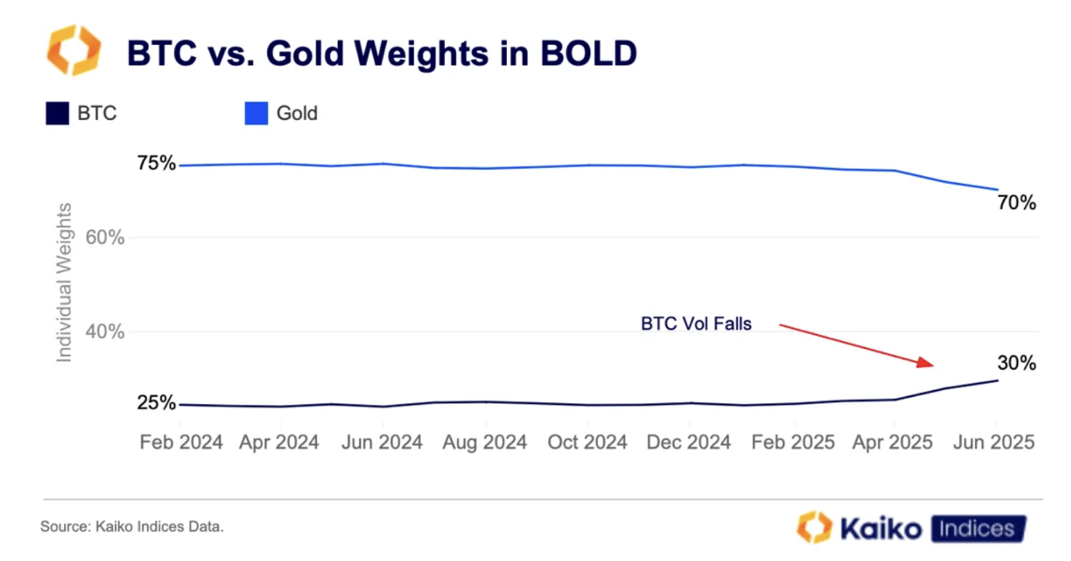

Such a product already exists: BOLD, an ETP (European ETF) combining gold and bitcoin, not on a 50/50 basis, nor according to their capitalization, but according to the inverse of their volatility. In concrete terms, bitcoin, which is more volatile, occupies a smaller share than gold, which is more stable. As a result, both assets contribute equally to the risk of the index, the share multiplied by the risk being the same for gold and BTC.

Bitcoin is more volatile than gold:

As a result, bitcoin has a smaller share in BOLD — around 25-30%, compared with around 70% for gold. These proportions are adjusted regularly according to the evolution of their respective volatilities.

The result: solid performance and greater stability.

As the research note states: “The structural similarities between bitcoin and gold, combined with both assets’ potential to hedge against currency debasement, provided the thesis for the BOLD index. At the same time, the assets’ unique responses to market events reinforce the benefits of combined exposure. Bitcoin has outperformed over longer periods and has begun to show safe-haven qualities. However, it still tends to behave like a risky asset during market turmoil, as we saw during the Japanese carry trade unwind last August. Bitcoin plunged around 20% during this period, while gold remained steady.”

It's a great idea for those wishing to build a gold + BTC portfolio that optimizes returns and security!

The BOLD ETP has 20 million assets under management, and the idea is catching on: “Several firms in the U.S. have filed to launch funds offering exposure to both assets. Return Staked is offering a BTC and gold ETF with exposure to equities as well, while Cantor Fitzgerald revealed plans last week for a gold-protected bitcoin fund,” says the Kaiko note.

Of course, we recommend acquiring physical gold rather than paper gold, as the latter is more uncertain in the event of a serious financial crisis. On the other hand, it may be relevant to follow the composition and evolution of BOLD, as a useful benchmark.

We can only agree with the conclusion of Kaiko's note: "As we enter a period where the two assets appear to be complementing one another rather than competing, these differences can be harnessed to create a form of 'volatility diversification'."

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.