In just a few days, the global financial system found itself in deep trouble. Summer's calm and carefree mood almost made us forget that the global economy has been on a razor's edge for years. In just three weeks, over $6 trillion in stock market value has evaporated, despite the lull of recent days.

This turmoil has been the subject of much debate. For some, it is the result of poor US employment figures and the risk of slowing growth. For others, it was the rise in Japanese key rates and the soaring yen that triggered massive liquidations of carry trade investments (borrowing a low-interest currency to invest in a higher-interest one), the source of the international movements.

But a single spark is enough to start a fire, especially under current conditions. The recent upheavals cannot be understood solely in terms of current events. They need to be seen in the context of a broader structure: the headlong rush of a financialized economy ready to go into crisis at any moment, whatever the trigger.

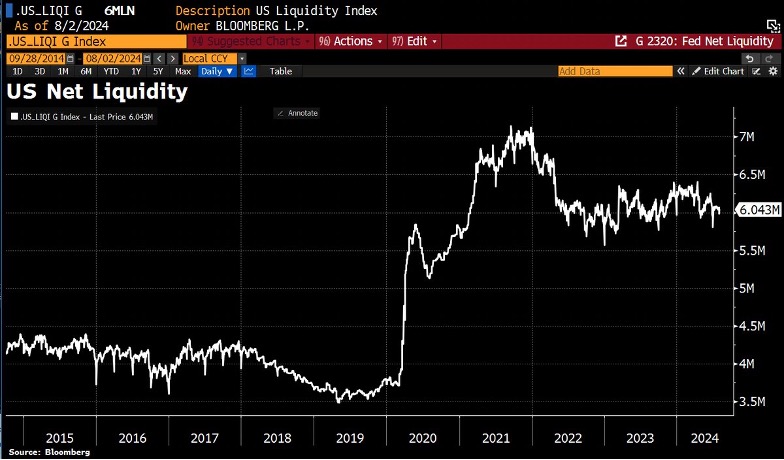

Today's markets are extremely fragile, incredibly dependent on injections of liquidity from central banks, which at the same time enable them to rescue states in near-bankruptcy and companies in poor health. This has been going on since the 2008 crisis, which was never really a crisis at all. Although it was presented as such, it should not be forgotten that, only a few months later, the situation was back to normal. The permanent fall in interest rates and the "whatever it takes" creation of successive asset repurchase programs made it possible to postpone the consequences of a major financial crash (and at the same time drive gold to new heights...) Since then, markets have no longer been based on "fundamentals" but on the volume of liquidity continually poured in. And every time there is a banking panic or risk of crisis, central banks abuse their historic role, using debt to keep the world economy ailing, like a terminally ill patient under palliative care.

Without this long-term analysis, we'd forget what's essential…

Conditions are ripe for bearish movements

Let's get to the heart of recent events. Many elements were in place for such a panic. And, as is often the case, it's the United States in particular that we need to focus on. The US economy is now entering a period of great fragility, with a tense job market and rising unemployment (from 4.1% to 4.3%), inflation still present (around 3%), an economic slowdown, and above all, a reduction in the Federal Reserve's balance sheet, leading to a drop in liquidity. In addition, August is traditionally a period when markets are less liquid, as trading volumes are reduced, accentuating volatility (summer is also often a good time for "bank stress tests" to assess - unsuccessfully - the stability of financial systems). Finally, the US central bank is preparing to cut interest rates earlier than expected, which in theory should be welcomed by the markets (as it would offer more favourable borrowing conditions). On the contrary, it is leading to a loss of confidence in monetary policy and its ability to control inflation, which is perceived negatively by investors.

When so many conditions are in place, the liquidation of 75% of the world's carry trade, following a change in monetary policy by a central bank (in this case, the Bank of Japan) that had been cornered for years, naturally triggered international repercussions. With the historic fall, initially, of the Japanese indices, the world's stock markets recorded major losses. This was particularly the case in the USA and in technology stocks such as Nvidia, which plummeted after months of being the plaything of high-yield, high-interest markets. Its consorts, the "Magnificent Seven" combined, also continue to wipe out, over a month, more than $100 billion every day... With the financial system a house of cards, European stocks are recording massive losses, particularly those in the luxury goods and automotive sectors, while demand from China is slowing.

What can we expect in the coming months?

Today, the situation seems to have returned to normal, but normal no longer exists. In an article published earlier this year, we presented the economic outlook for the year 2024, showing that three factors would manifest themselves: the international economic situation would deteriorate, a financial crisis would occur, and gold would reach new record highs. As we approach the final months of the year, each of these elements is taking shape. In order, the advanced economies are weakening, particularly Europe and its Franco-German engine. On the one hand, Germany, like many European countries, has revised its growth downwards (from 1.4% to 0.2%), and the French economy is treading water (0.3% in the last quarter). As for the United States, GDP is slowing more than expected and the risk of recession is increasing.

Secondly, the current stock market crash (which isn't really a crash at all) is just a prelude to what lies ahead. Advanced economies are as fragile as they come, as witnessed by the ever-increasing global public and private debt. This debt, which is impossible to repay at a time when real interest rates are now positive, can only be paid off by severe economic and financial penalties, or by the decision to cancel the debt with a stroke of the pen, at the risk of triggering a crisis here, too (as money is now created by debt, this would mean the almost total disappearance of money in circulation). In time, markets will have to bend. Or rather, central bankers will be forced to declare themselves losers, while inflation persists.

Gold, for its part, continues to rise in this pivotal period, playing its role as an insurance policy against instability more than ever. The structural factors contributing to the yellow metal's rise (central bank purchases, inflation, geopolitical tensions, abysmal budget deficits, etc.) continue to serve as a springboard, especially as the Fed is set to lower interest rates, thereby causing the dollar to fall. Gold, no longer dependent on the greenback, is also beginning to move away from commodity prices, which are set to fall over the coming months. The yellow metal has risen by almost 30% over one year, 20% over six months, and around 5% over the last month! In the coming weeks, expectations of an upward trend are now shared by everyone, from investment banks to asset managers, not forgetting the monetary institutions which are still buying as much as ever (and sometimes in a concealed way, as China is doing to acquire it at a very attractive price).

In any case, recent events teach us one thing for sure: if all it takes is a poor US employment report and a modest Bank of Japan rate hike to send the Japanese Nikkei index plummeting by 12% in a single day, European and US indices by 5-10%, and cryptos by more than 10%, there's every reason to believe that another announcement could create an unprecedented flash crash. All this is taking place against an extremely tense geopolitical backdrop, with historic tensions between Israel and Iran, an escalating war in Ukraine and its consequences (on the energy and food markets, etc.), and violent social and political movements in the UK and Bangladesh.

But these events are not isolated; they are part of the same structure. They are symptoms of a financialized economy which, having reached the end of its cycle, hides its fragility in a variety of ways. On the economic front, with very high debts, sluggish growth, high spending and falling revenues. On the political and geopolitical front, with a weakening of democracy, a rise in authoritarianism, a growing grip on individual freedoms and international tensions. And finally, on the social front, with an historic rise in inequalities and divisions of all kinds.

Understanding that these elements are not separate, but form part of the same framework, is a fundamental condition for looking to the future, at the risk of remaining trapped in a world that has become more unpredictable than ever.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.