FLATION will be the keyword in coming years. The world will simultaneously experience inFLATION, deFLATION, stagFLATION and eventually hyperinFLATION.

I have forecasted these FLATIONARY events, which will hit the world in several articles in the past. Here is a link to an article from 2016.

With most asset classes falling rapidly, the world is now approaching calamities of a proportion not seen before in history. So far in 2022, we have seen an implosion of asset prices across the board of around 20%. What few investors realise is that this is the mere beginning. Before this bear market is over, the world will see 75-90% falls of stocks, bonds and other assets.

Since falls of this magnitude have not been seen for more than three generations, the shockwaves will be calamitous.

At the same time as bubble assets deflate, prices of goods and services have started an inflationary cycle of a magnitude that the world as whole has never experienced before.

We have seen hyperinflation in individual countries previously but never on a global scale.

Currently the official inflation rate is around 8% in the US and Europe. But for the average consumer in the West, prices are rising by at least 25% on average for their everyday needs such as food and fuel.

A Calamitous World

So the world is now approaching calamities on many fronts.

As always in periods of crisis, everybody is looking for someone to blame. In the West most people blame Putin. Yes, Putin is the villain and it is his fault that food and energy prices are surging. Nobody bothers to analyse what or who prompted Russia to intervene, nor do politicians or main stream media understand the importance of history, which is the key to understanding current events.

In troubled times, everyone needs someone to blame. Many Americans will blame Biden who has both lost his grip on most US events as well as his balance. In the UK, the people blame Boris Johnson who has lost control of Britain since Partygate. In France the people are blaming Macron who just lost his majority in parliament, and in Germany people blame Scholz for sending money to Ukraine for weapons and money to Russia for gas.

This blame game is only just beginning. Political turmoil and anarchy will be the rule rather than the exception as the people will blame the leaders for higher prices and taxes and deteriorating services in all areas.

No country will be able to provide social security payments in line with galloping inflation. Same with unfunded or underfunded pensions, which will fall dramatically or even disappear totally as the underlying asset base of stocks and bonds implodes.

As a consequence, many countries will be anarchic.

Deflationary Implosion of Investment Markets

Stocks

The everything bubble has come to an end. It was only possible due to the benevolence of central banks in creating the most perfect manipulation of the instruments that they control, namely money printing and interest rates.

The result of free money has meant a trebling of global debt in this century to $300 trillion at virtually zero interest cost.

This has been real Manna from heaven for investors, both big or small. Everything investors touched went up and at every correction in the market, more Manna was produced.

For investors it was always “Heads I win, Tails I win.”

This Shangri-La of markets makes everyone an investment guru. Even a fool became rich.

Speaking to investor friends today, they might be slightly unsettled but see no reason why the long term bull trend won’t continue. As far as investors are concerned, Greenspan, Bernanke, Yellen and Powell have been their best friends and the Fed’s main purpose is to keep investors happy and rich. Therefore most investors are sitting tight in spite of 20% falls or more across the board. They will regret it.

So most investors are relying on being saved yet another time and don’t realise that this time it is really different.

As we know, it is NOT the fact that central bankers have done a volte face (about turn) in raising rates and also reversed quantitive easing into tightening which has led to investment markets crashing.

No, these geniuses running the Central Banks can never see anything coming before it is too late. Inflation hitting the world with a vengeance was clear to many of us for quite a while–but obviously not to the people running monetary policy. They are clearly not paid to see anything coming before it has actually happened.

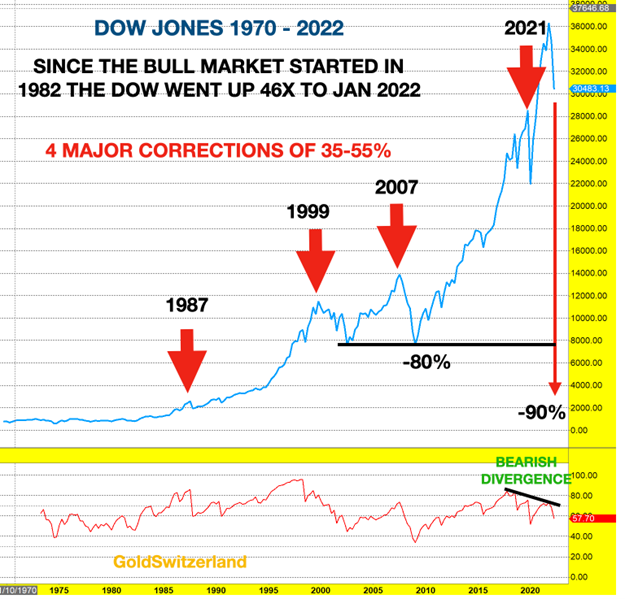

The chart below shows the Dow since 1970. In 1982, the current 40 year bull market started. Since then investors have seen a dramatic 46X increase in their stock portfolios.

There have been four frightening corrections of between 35% and 55%. I remember well the first one in October 1987. It was Black Monday and I was in Tokyo for the listing of Dixons in Japan, the UK FTSE 100 company I was Vice-Chairman of. The market crashed 23% on October 19th and over a 12 day period the Dow was down 40%.

Not the best timing for a listing on the Tokyo stock exchange.

If we look at 1987 in the chart below, we can see that the massive fall we experienced at the time is hardly visible.

Another very important technical factor on this chart is the bearish divergence on the Relative Strength Index – RSI. Since 2018, I have pointed out that the RSI on this quarterly chart has made lower highs since 2018 as the Dow has made new highs. This is a very bearish signal and will inevitably result in a major fall of the Dow as we are now seeing.

My long standing forecast of a 90% fall in stocks in real terms has not changed. This fall is no bigger than the 1929-32 one with dramatically worse conditions today both in debt markets and in the global magnitude of the bubbles . Just a return to the 2002 and 2009 lows would involve an 80% fall from the top.

The Wilshire 5000 representing all US stocks has lost $11 trillion or 23% since the beginning of 2022. See chart below. Additional trillions have been lost in bond markets.

Bonds

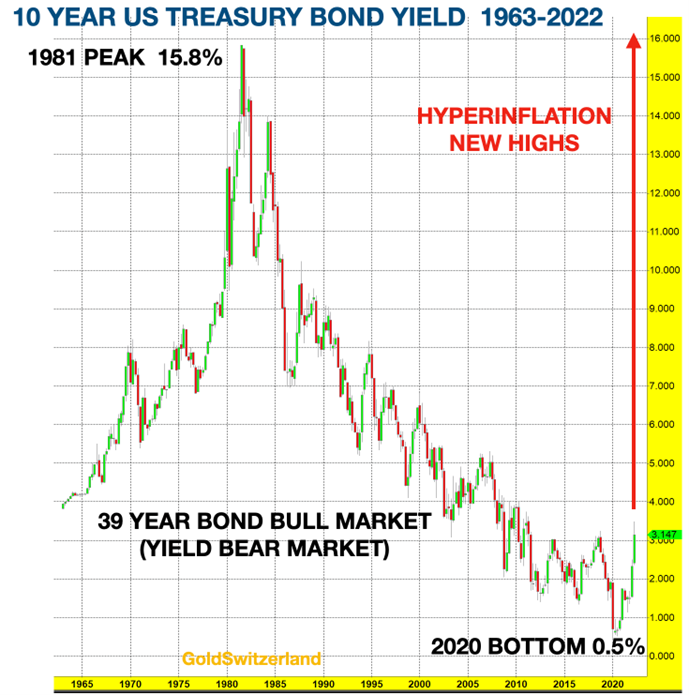

The 39 year bull market in bond prices (bear market in interest rates) has now come to an end. In fact it ended in 2020 at 0.5% having fallen all the way from 15.5% in 1981.

I expect rates to surpass the 1981 level as the biggest debt market in history implodes.

Many debtors, both sovereign and private will fail and bond rates will reach infinite levels as bond prices collapse.

This implosion of bond markets will obviously have major repercussions for the financial system and markets with banks and other financial institutions defaulting.

After more than a decade of long struggle to raise inflation up to 2%, central bankers like Yellen and Lagarde got the shock of a life time with official inflation rapidly surging to over 8% with real inflation probably around 20-25% for most people.

This increase in inflation was such a shock to the Bank heads that they were in denial for many weeks, calling it transitory.

These Fed and ECB chiefs have this uncanny ability not to see anything that they haven’t projected. And since they never project one single market trend correctly, they will inevitably always take the wrong road.

They would be more successful it they just rolled the dice. Over time they would then at least have a 50% chance of being right. Instead they have a perfect record of being 100% wrong.

As I state over and over again, central banks should not exist. The laws of nature and supply and demand would do a much better job at regulating markets. Without central banks and their manipulation, markets would be self correcting rather than the extreme peaks and troughs that the banks create.

The absurdity of central banks’ disastrous manipulation is clearly exposed in credit markets. We have for years had credit surging with rates being around zero or negative.

It is obvious to any student of economics that high demand for credit would lead to a high cost of borrowing. These would be the obvious consequences of supply and demand in a free and non-manipulated market.

The inverse would clearly also be the case. If there is no demand for credit, interest rates would come down and stimulate demand.

I wonder what they teach students of economics today since no market functions properly with the current blatant manipulation. I suppose that our woke society is rewriting the books also in economics just as they have done with history.

I would hate to be a student today under those conditions.

Investment Markets – Nowhere To Hide

So what are the consequences of these calamitous times?

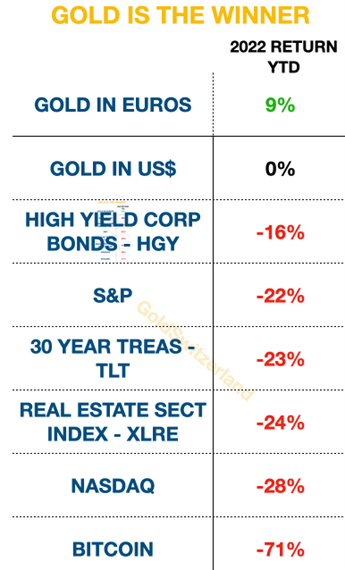

Well, in 2022 virtually every single investment class is down around 20%, as the table below shows. And the era of successful dip buying has ended as everything is collapsing.

With panic in markets and already some blood in the streets, investors are paralysed. They hope that the Fed and other central banks will save them but they fear that it might be different this time. This is just the very beginning. Much more panic and blood to come.

Both private and institutional investors are totally lost. All sectors are falling together. There just is nowhere to turn.

Just look at the table below:

Gold in euros as well as gold in most other currencies have had a positive return in 2022 so far.

But just look at the rest – from Corporate Bonds to Treasuries to Stocks, Real Estate, Tech Stocks and Cryptos etc they have all seen double digit losses in 2022 from 16% to 71%.

And nobody realises that this is just the beginning.

The majority of investors are totally paralysed. They are all hoping for the rapid April-2020-style recovery but they will be very, very disappointed. IT JUST WON’T COME!

Investors are neither mentally nor financially prepared for what is coming.

The selling we are currently seeing is just marginal. Most investors are staying put and will ride the market down by 50% or more before they realise that this is serious. And at that point they will hope and pray since they will believe it is too late to get out.

Sadly no one will understand that it is really different this time and that most asset classes will fall by 90% or more in real terms.

Epic Super Bubbles Always Have An Unhappy Ending

Epic super bubbles can only end badly. But no investor has the experience of such a massive implosion of bubbles because it has never happened before in history.

I have discussed the consequences in many articles, and they will be devastating.

Sadly Cassandras are never taken seriously until it is too late. This time will be no different.

And don’t believe there is anyone there to help. The Fed, which has reacted at least 10 years too late in tightening, will not save investors. Instead, they will offer more pain in the form of higher rates and more tightening.

Yes, of course the Fed will react at some point and in panic lower rates and inject fake money into the system. But that will be much too late. Also, no amount of fake money can save a system which is morally and financially bankrupt.

A morally and financially bankrupt western world has created this coming calamity, and we will now have to suffer the consequences.

Sadly, this this is the only way that it can end. A rotten and debt infested system can only end in a calamity.

Debts will implode and assets will implode. Society will not function nor will social security, pensions etc. This will create human suffering of a magnitude, which will be devastating for everyone.

Global population will also come down dramatically. In the mid 1800s there were 1 billion people on earth with very slow growth for the previous thousands of years. Then population exploded over the next 170 years to 8 billion. A chart that look like a spike up normally always corrects up to 50% down. The reasons for a reduction of world population are obvious: Economic collapse, misery, famine, disease and wars.

Such a singularity event is necessary for the world to clean up the rotten system and start a new era with green shoots and stronger moral and ethical values.

Wealth Protection As A Necessity

For the few people who have assets to protect, physical gold and some silver will perform much better than all conventional asset markets which will collapse. That trend has already started as the table above shows.

Stocks will tank and commodities will soar.

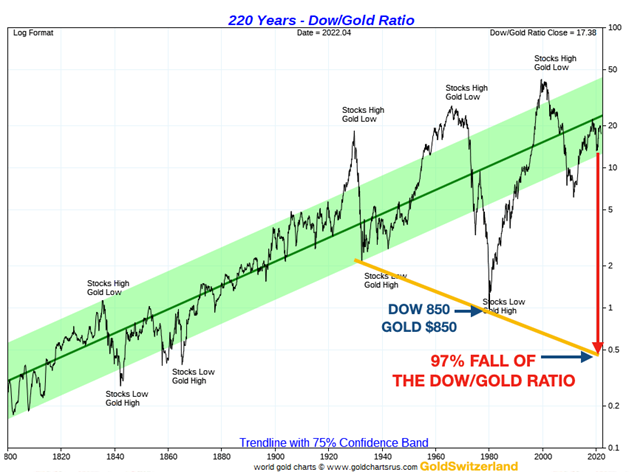

For investors this is best illustrated in the Dow/Gold Ratio. This ratio is currently 16.5 and is likely to find long turn support at 0.5. Reaching that target would involve a 97% fall of the Dow relative to gold. Sounds incredible today but bearing in mind the circumstances this level is certainly possible. See my article.

An 0.5 Dow/Gold ratio could for example mean Dow 5,000 and Gold $10,000

Gold – The Ultimate Insurance Against Wealth Destruction

Anyone who has experienced hyperinflation also knows that the only money that survives such a calamity is gold. I met a year ago a man from former Yugoslavia who recognised me and told my friends who were with me that physical gold saved his family from total devastation. My friends sadly did not take his advice.

But remember that any protection or insurance must be acquired before disaster hits you.

Your most important assets are your brain, heart and soul. There are always opportunities for individuals who apply those assets wisely.

And as always in periods of crisis, being with and helping family and friends is your most important task.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.