Faced with the resurgence of inflation, many players are brandishing the idea that rising prices are desirable because they would reduce the burden of debt, which is at historically high levels. While this theory seems incontrovertible at first glance (the loss in value of money caused by inflation reduces the cost of monthly payments), it omits many criteria necessary for the overall reduction of debt, including certain phenomena induced by inflation, which risk increasing the current level of debt...

How does a government's debt evolve?

The evolution of the government debt/GDP ratio is a somewhat complex mechanism, which does not simply depend on the budget surplus or deficit of a government in year N, as one might think.

Indeed, the debt-to-GDP ratio increases when the primary balance is lower than the stabilizing primary balance and decreases when the primary balance is higher than the stabilizing primary balance.

The primary balance is the difference between government revenues and expenditures excluding debt interest. It can be a surplus or a deficit.

The stabilizing primary balance represents the level of the primary balance that stabilizes the debt. The stabilizing balance = (r - g) * debt/GDP ratio, where r is the average interest rate on the debt (or "apparent rate" [1]) and g is the nominal growth rate (in value terms, i.e. without taking into account price increases).

The difficulty of stabilizing the debt lies in many phenomena, including the level of indebtedness. Indeed, the higher the level of debt, the higher the level of the primary balance that must be achieved to stabilize the debt. There is a risk of a "snowball" effect, since the exponential nature of interest rates feeds the debt itself.

Moreover, succeeding in maintaining the debt/GDP ratio, or even reducing it, does not simply require inflation... but depends on several factors:

- Level of primary balance

- GDP growth rate

- Level of inflation

- Average interest rate of the debt

- Level of debt of the country at time T

- Measures implemented according to political decisions (likely or not to increase the debt)

A theory drawn from a bad comparison

The idea that inflation would inevitably reduce the level of debt has its origins, in particular, in the considerable reduction in the public debt of governments in the aftermath of the Second World War. In 1945, after massive needs linked to the financing of the belligerents, the public debt of European countries and the United States as a proportion of GDP was around 130%, before falling to around 30% in the early 1970s (a decade marked by the two oil crises).

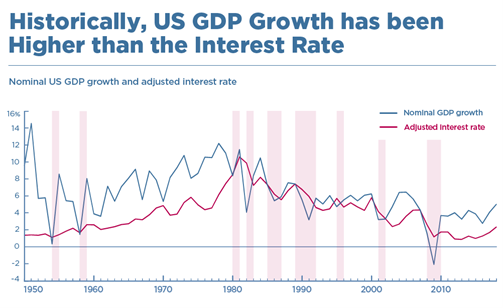

While inflation, which was extremely high between 1945 and 1949 (an annual increase of nearly 40%), and relatively high between 1949 and 1970 (an average increase of more than 5%), helped to reduce the overall level of Western governments' debt, GDP growth (excluding inflation), which averaged 6% per year between 1945 and 1970, also made a significant contribution.

Evolution of the nominal growth rate and the interest rate of the debt in the United States since 1950. (Source: PIIE)

However, this period is incomparable with the recent period. During what the French economist Jean Fourastié called the "Trente Glorieuses" - that is, the period 1945-1975 - the Western economy was characterized by full employment, relatively "moderate" levels of inequality (salaries were indexed to inflation), an unprecedented demographic increase (the baby boom phenomenon) allowing for a constant rise in demand, and significant state interventionism...

In this context, growth was significant and continuous; and the strong increase in prices after 1945, and moderate between 1949 and 1970, did not constitute a major issue for governments, and even became a secondary objective.

The financialization of the economy has reversed the situation

The financialization of the economy - accelerated from the 1980s onwards - has completely changed the sustainability of public debt.

In fact, due to the reforms of monetarist economists after the two oil shocks of 1973 and 1979, the primary mandate of central banks became that of price stability, characterized by a target of 2% annual increase. Since exceeding 2% was no longer desirable, the nominal growth rate was reduced.

On the other hand, these reforms ratified the possibility for governments to borrow from their central bank (borrowing can only be done on the financial markets), and the latter becomes independent of political power.

This change, of particular importance, exposes countries even more to the permanent fluctuation of interest rates. To maintain a "good credit rating" (in order to borrow at relatively moderate interest rates), governments must continually implement a policy that is considered "correct" by the markets - i.e., fiscal discipline - or else their borrowing conditions will worsen.

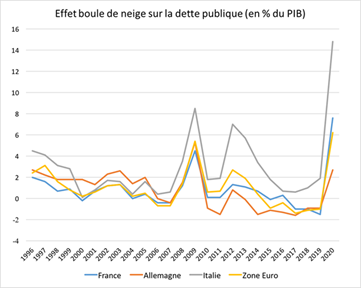

But when the western (and world) economy was plunged into a deep recession after the subprime crisis of 2007-2008, governments resorted massively to indebtedness, and then introduced austerity policies (increasing the tax burden and/or reducing public spending) in order to maintain their interest rates (so as not to be subjected to speculative attacks and an increase in the risk premium demanded by investors, as was the case in Greece, Portugal, and Spain). Such a policy, contrary to fiscal stimulus and the effectiveness of the Keynesian multiplier in times of crisis, accentuates the slowdown of their economy and increases the "snowball effect”.

Snowball effect on public debt (difference between the average interest rate on the debt and the nominal growth rate). (Source: The Other Economy)

The Eurozone experienced this situation head-on [2] during the sovereign debt crisis of the early 2010s. In order to limit the snowball effect, the ECB intervened by implementing a so-called "non-conventional" monetary policy to support the indebtedness of member states by reducing the level of long-term interest rates. This support made it possible to stabilize the indebtedness of the governments, albeit at the cost of a considerable increase in inequality.

The singularity of the current period: a challenge for public finances

Given the current level of inflation (over 10% in the Eurozone in November), one might think that rising prices would easily reduce public debt by increasing the nominal growth rate.

However, unlike during the "Trente Glorieuses", inequality is now at historically high levels, unemployment has reached 8% in the Eurozone (and not 2% as in 1950), and growth has been sluggish for more than two decades (averaging around 2% annually).

In this context, in the face of soaring prices, governments are resorting to various social measures to protect the purchasing power of households (as shown by the French government's €170 billion package by 2027 [3]), central banks are raising their key interest rates in an attempt to curb inflation (the ECB has raised rates several times since the summer of 2022, and plans to continue to do so), and markets are demanding higher and higher interest rates given the tightening of their borrowing conditions and the real decline in bond yields. Thus, these factors contribute to the increase in debt.

In addition, unlike the period 1945-1975, a relatively high level of bonds issued by governments are now indexed to inflation (in France, this amount is estimated at about €250 billion, or 9% of the total debt [4]). Inflation then leads to a proportional increase in the amount of interest on these loans, and ultimately contributes to the increase in public debt.

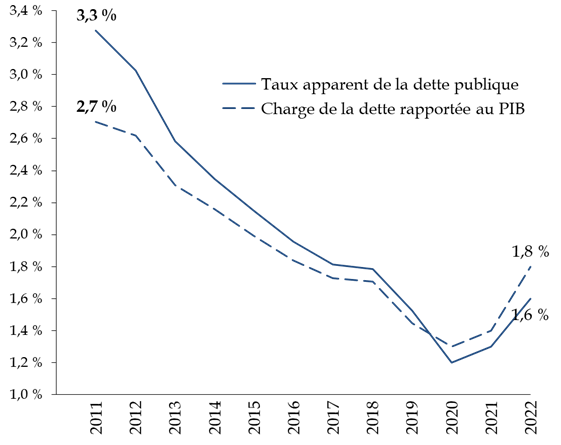

For all these reasons, if the stabilizing balance becomes a stabilizing deficit given the current level of inflation, the primary balance is deeply impacted by the increase in primary expenditure (primary deficit estimated at 3.2% of GDP in France in 2022), and the debt burden increases, in the short term as well as in the medium and long terms, in the face of rising interest rates.

While the public debt/GDP ratio will decrease somewhat in 2022 in France (estimated at 111.9%) as a result of a primary deficit below the stabilizing deficit (driven by the increase in inflation, which was 6.2% in November), the debt/GDP ratio is expected to stagnate in 2023, or decline by a very small amount.

Change in the apparent public debt ratio and the debt burden as a percentage of GDP in France over the period 2011-2022. (Source: Senate, Amending Finance Bill for 2022)

Although it is difficult to predict the future ratio of government debt to GDP in the medium term (given the multitude of factors at work), it is clear that the situation is likely to get worse, given the dilemma facing the ECB (and more broadly, that of Western central banks): Tighten its monetary policy and precipitate a financial crisis (which will lead to an increase in public and private debt) or let inflation evolve at the risk of a collapse in confidence and explosive social tensions (while knowing that inflation does not necessarily reduce public debt)?

In short, it is not so certain that inflation reduces public debt these days...

More than ever, to break this spiral, governments must resort to innovative proposals, such as the cancellation of public debt held by the central bank, proposed during the health crisis. From the Babylonian era to Germany in the aftermath of the Second World War, episodes of debt cancellation are numerous and frequent. They allow not only to erase the evils of history, but also and above all, to prepare the future of future generations too long forgotten.

Notes:

[1] The apparent public debt ratio is the ratio between the debt burden in year N and the debt stock in year N-1

[2] The United States has not suffered the same consequences because it takes advantage of the hegemony of the dollar (the dollar being the world's reserve and exchange currency) to considerably increase its public debt without this necessarily worsening its borrowing conditions.

[3] Les Échos : « Le coût du bouclier tarifaire sur l'énergie s'annonce plus lourd que prévu » https://www.lesechos.fr/economie-france/budget-fiscalite/le-cout-du-bouclier-tarifaire-sur-lenergie-sannonce-plus-lourd-que-prevu-1879721

[4] "Inflation-Linked Bonds Blow Up In Our Face": https://goldbroker.com/news/inflation-linked-bonds-blow-up-in-our-face-2791

See data from Agence France Trésor : https://www.aft.gouv.fr/en/oateurois-characteristics. The total government debt in France is about €2.562 trillion. So €250 billion corresponds to about 9%.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.