This week we'll look at long term charts of gold vs both the Consumer Price Index (CPI) and Producer Price Index (PPI). Both indexes are measures of ever rising prices (inflation), and when gold is outperforming these indexes, gold can be said to be rising in "real terms," meaning that your purchasing power is expanding. While CPI measures the end price of goods/services paid by consumers, PPI measures wholesale prices paid to producers. Each chart makes a compelling case that gold is about to do just that.

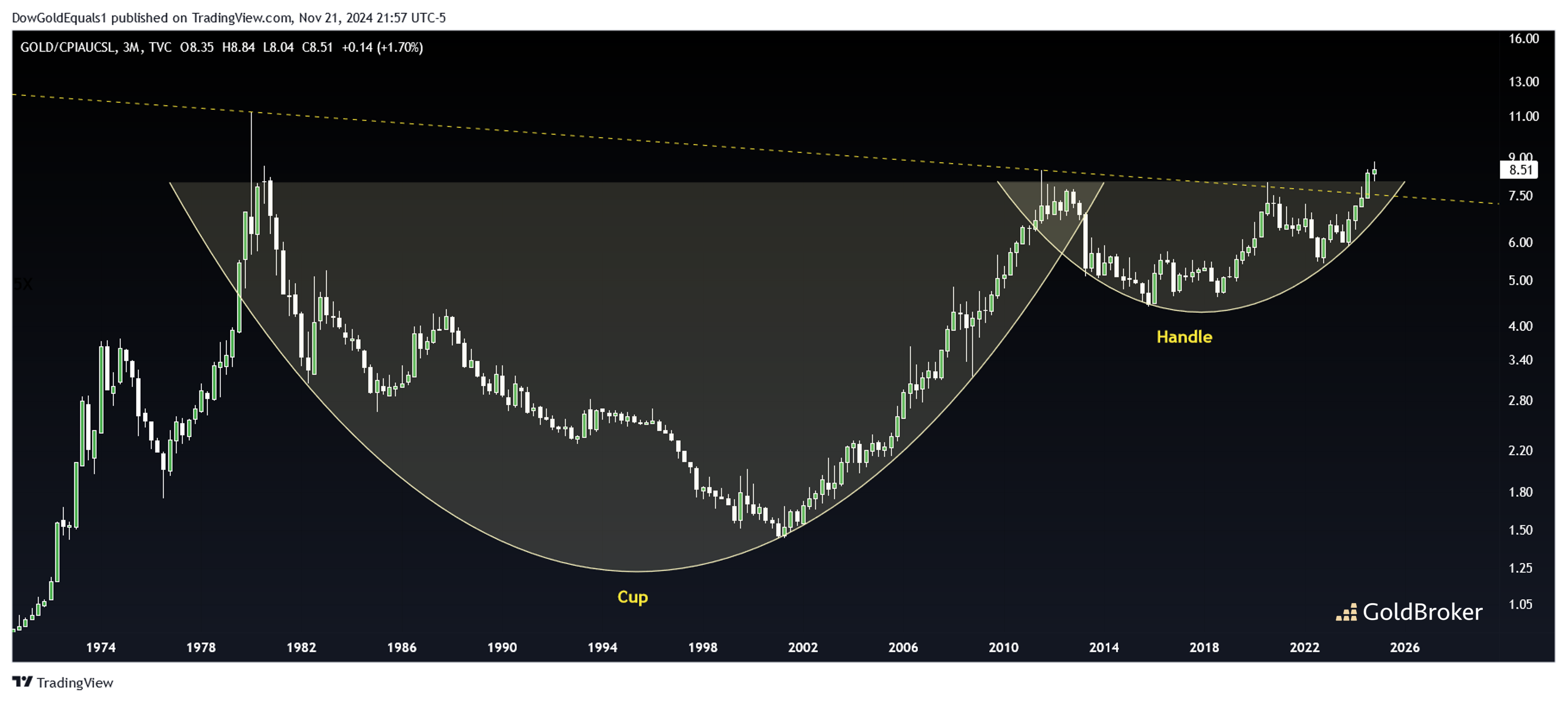

The first chart we'll look at is Gold/CPI. We last looked at the annual chart in May and noted the inflection point in which we found ourselves along a huge Cup & Handle pattern. This week we'll drill down to a quarterly chart and note that a big breakout indeed seems to be taking place from the long term descending resistance line. A chart like this should help gold owners sleep well knowing that, as consumer prices invariably rise due to future inflation, gold is poised to rise even faster because we can expect this chart to rise impulsively higher from this very large, elegant technical pattern.

The second chart of Gold/PPI should look pretty similar to Gold/CPI because the two indexes show similar inflationary trends. I could have drawn a similar Cup & Handle here, but instead I want to draw your attention to a couple of other things. First, we can see that Gold/PPI has just eclipsed its 1980 All Time High in the last few months and now appears to be backtesting that high - an extremely bullish sign. Second, we can see this chart defined as three very large broadening wedges going back fifty years. Breakouts from the first two wedges led to impulsive moves higher of about 150-200%. Should the third wedge also break higher, we can expect a similar impulsive move.

If you've ever wondered whether rising gold prices will be enough to keep up with inflation, these charts should put you at ease. Not only will gold keep up, it looks to rise much faster than inflation inself.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.