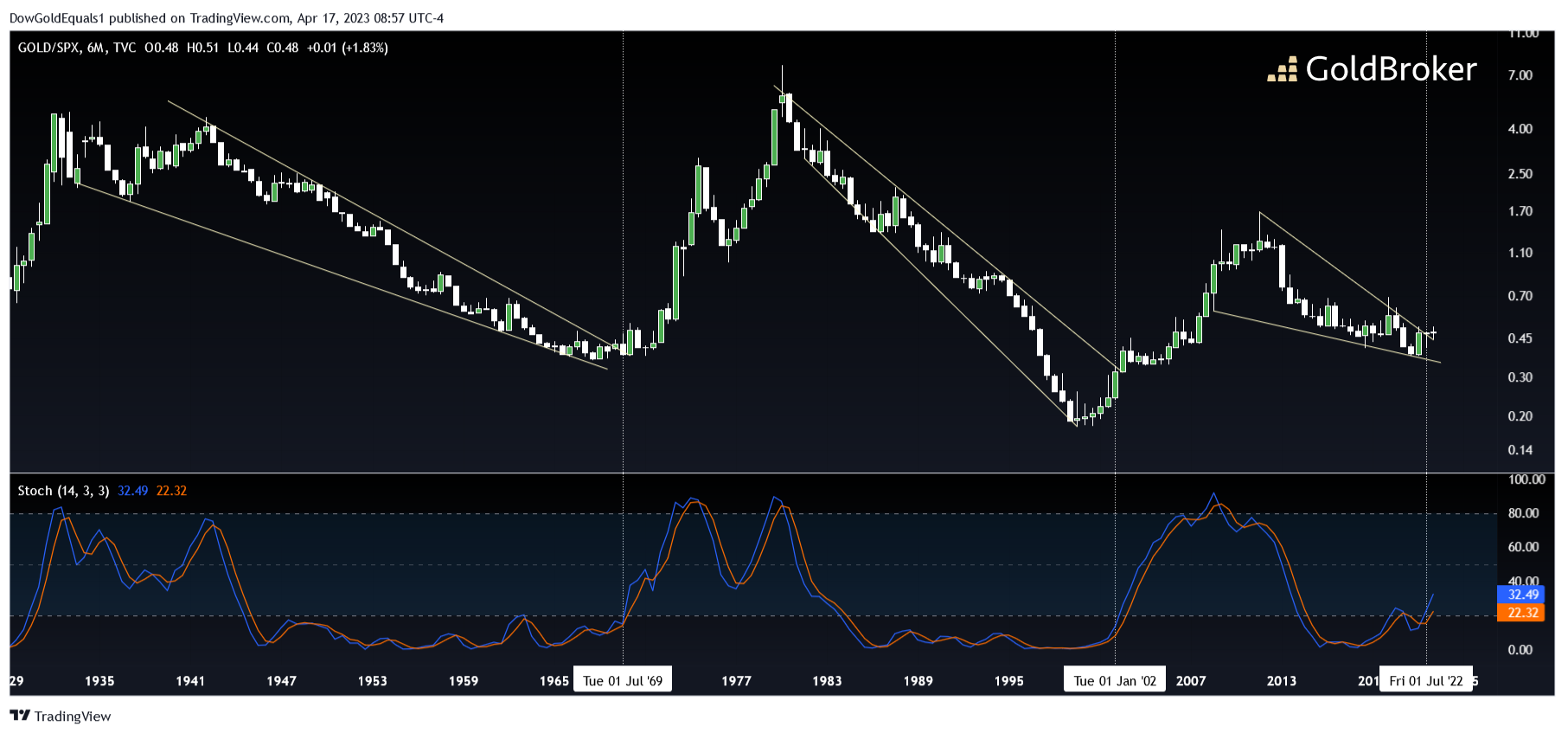

Gold/SPX

The Gold/SPX (S&P 500 index) ratio appears to be breaking out of its third major consolidation in the last 100 years. The first consolidation lasted approximately 37 years from 1935 to 1972, which resulted in Gold rising 25X from $35 to its 1980 blowoff top of $875. Gold/SPX's second major breakout occurred in 2002 following a 12-year consolidation. This corresponded with Gold's rise from $250 in 2000 to nearly $2,000 by 2011. Gold/SPX's most recent consolidation has been smaller than the first two, so we may not see as large a move in Gold this time, but I still expect price to rise multiples from today's level over the years ahead. This historic importance of the Stochastic bullish crossover of the 20 level adds fuel to this fire.

Silver/SPX

The Silver/SPX (S&P 500 index) ratio shows a similar story to that of Gold/SPX, as it too is breaking out of its third major consolidation in the past 100 years. Previous breakouts corresponded to Silver rising 37X from about $1.30 to $40 from 1970-1980; and 12X from about $4.00 to $50 from 2001-2011. And with a similar Stochastic set-up, one cannot help but be extremely optimistic about the future of the grey metal over the coming decade.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.