Hong Kong Exchanges and Clearing Limited (“HKEX”) launched dual-currency (USD and RMB pricing and settlement) physical delivery Gold Futures Contracts (“Gold Contracts”) through its subsidiary, the Hong Kong Futures Exchange (“HKFE”), on 10 July 2017.

HKEX acquired the London Metal Exchange (“LME”) in 2012 and, consistent with the vision drawn in its 2016-2018 Group Strategic Plan, aims to transform itself into a global vertically-integrated multi-asset class exchange. Commodities are one of the core pillars of HKEX’s four-pronged multi- asset strategy. The launch of the HKEX Gold Contracts is a clear demonstration of HKEX’s commitment to offer attractive commodity products in Asia.

Although the Hong Kong gold market has over 100 years of history, it still lags behind other global gold trading centres such as New York and London in term of benchmarking, liquidity, and completeness of product and service offerings. However, as a global financial centre located at the gateway of the world’s second largest economy and the biggest gold consumer — China — Hong Kong has the right ingredients to become an Asian gold pricing centre.

Given Hong Kong’s advantages as a free market and an entrepot trade centre, Hong Kong has an active physical gold trading market and enjoys the status as one of the major bullion markets in the world. In addition, being the largest offshore RMB centre, Hong Kong has a unique position in facilitating China’s RMB internationalisation. The introduction of physically delivered gold futures in Hong Kong would be a stepping stone to achieving this objective.

The fundamental market demand for gold trading in China together with the trading demand from the rest of the world, and the related risk management demand well position Hong Kong to build itself up to be an Asian gold pricing centre. In order for Hong Kong to cultivate a new gold pricing benchmark, it is necessary to form a well-functioning marketplace to link up the spot market and the futures market and to provide efficient channels to serve these markets in Hong Kong, and to complete the gold ecosystem to include other gold-related financial products and services such as gold leasing and related derivatives. The formation of the new Hong Kong Asian benchmark will be established naturally as the liquidity grows via these channels within the ecosystem.

Hong Kong gold market

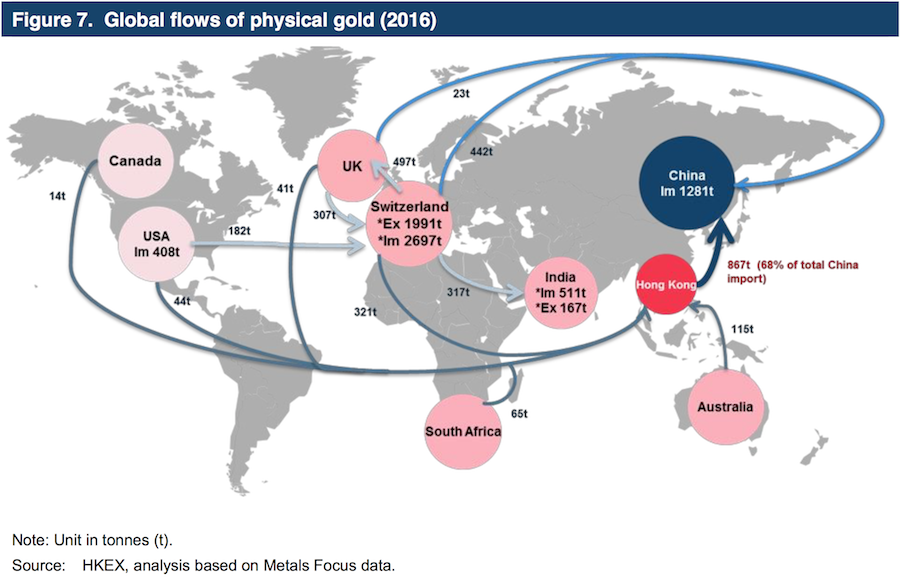

Hong Kong, with its proximity to the national gold fabrication centre of Shenzhen, is the main source of China’s gold imports, recording 8678 tonnes in 2016, accounting for about 86% of the China’s total gold imports.

Hong Kong has been a significant centre for gold trading for over a century. As the Mainland China market opens up, Hong Kong also has a significant role as a centre for physical gold trading between China and the world.

The formation of the gold market in Hong Kong emerged upon the establishment of the Chinese Gold and Silver Exchange Society (CGSE) in 1910. Since the Hong Kong Government revoked its controls over gold imports and exports in 1974, the Hong Kong gold market has boomed. The Hong Kong gold market has now become an important gold investment and trading hub in Asia, connecting with the other time zones in Europe and the Americas. Given Hong Kong’s significance in global gold trading, the five major gold merchants from London and the three major banks from Switzerland have set up trading desks and branches in Hong Kong. With the strong participation from the foreign major bullion players, gold pricing in the Hong Kong market has made reference to the London benchmark ever since.

Is Hong Kong ready for physical delivery gold futures?

Although the Hong Kong gold market has over 100 years of history, it still lags behind other global gold trading centres such as New York and London in terms of benchmarking, liquidity, and completeness of offering in related products and services. However, as a global financial centre located at the gateway of China, the world’s second largest economy and the biggest gold consumer, Hong Kong has the right ingredients to become the Asian gold pricing centre.

Backed by the city’s well established financial market, this special mission can be accomplished by HKEX and the major financial institutions as well as relevant regulators working together to meet the needs of the market, to ride on the international gold market trends, and gradually increase the Hong Kong gold market’s pricing power outside the European and the American trading hours. With reference to the history development of the world’s major commodity markets’ pricing, the formation of a new pricing centre should meet two basic conditions :

(1) High fundamental market demand for trading and risk management

One of the key natural factors in forming a price benchmark is the need for large-scale physical trading activities. As shown in Figure 7, China imports about one-quarter of the world’s supply, and there is about 70% of such imports go through Hong Kong.

With such high volume, it is fundamentally sound to develop related derivatives market to serve the risk management needs as these markets developed in New York and London previously.

(2) A sound marketplace with effective usage of spot and derivatives market

In order for Hong Kong to cultivate a new gold pricing benchmark, it is necessary to form a well-functioning marketplace to link up the spot market and the futures market and to provide efficient channels to serve these markets in Hong Kong, needless to say the offering of other gold-related financial products and services such as gold leasing and related derivatives as the London and New York markets provide currently.

The golden opportunity for Hong Kong

During the past century, Hong Kong’s spot gold market has been very active, from refining, processing, inspection, to wholesale and retail, to trading and hedging. These constitute an impetus to Hong Kong’s gold import and re-export trade. However, the Hong Kong gold market has been opaque and retroactive, in which the physical trading volume has been traditionally linked to London gold as the basis for pricing benchmark due to the dominance of the London benchmark globally.

Even though the SGE and SHFE have dominated activities in the Mainland Chinese gold onshore market, due to differences in the laws and regulations between the onshore market and the offshore market, and the capital and gold import/export control, and the Mainland gold benchmarks cannot be referenced commercially from Hong Kong. Therefore, the HKEX has a unique timeframe and geographical advantage to develop the right products to serve the market needs.

It is the time for Hong Kong to act to gain the pricing power in one way or another. One of the effective ways is the launch of the dual-currency (USD and RMB pricing and physical settlement) physical-delivery gold futures products by HKEX. With the launch of the HKEX gold futures market, the picture of spot and futures trading in gold will be completed in Hong Kong. The ecosystem built up can be extended to connect Mainland China with the developed western markets in both spot and derivatives trading in gold by the major bullion players via various channels as they see trading opportunities across the market. The result of which would be the formation of the new Hong Kong Asian benchmark as the liquidity grows and as world recognition is being established.

In addition, LME, the London entity of the HKEX Group, also launched gold futures (along with silver futures contracts) on London on 10 July 2017. This will provide round-the-clock, dual-location coverage for gold futures trading to meet the commercial needs of the HKEX Group clients. This can enhance London gold trading via “financialising” and “futurising” the spot trading activities into the LME liquidity pool.

As the gold futures (priced in both USD and RMB) market grows, more effective interactions between other related areas supporting the gold-trading ecosystem can be promoted. These areas include the interest rates, foreign exchange (FX) rates and gold-leasing markets. As the gold market ecosystem matures, along with an active gold futures market, this will offer fundamental support to the offshore RMB interest rate market, and ultimately RMB internationalisation. In the end, a new Asian gold benchmark can be formed naturally.

New market landscape

As stated above, given Hong Kong’s advantages as a free market and an entrepot trade centre, Hong Kong has an active physical gold trading market and enjoys the status as one of the major bullion markets in the world.

In addition, being the largest offshore RMB centre, Hong Kong has a unique position in facilitating the Mainland’s RMB internationalisation. The introduction of the physically delivered gold futures in Hong Kong is a stepping stone to achieving this objective as physical gold can be used as a “backing” for a fiat currency via an interest rate of RMB and leasing interest rate of gold mechanism similar to the current USD and gold relationship.

Product design and key factors for consideration

In order to meet customers’ needs, the following key factors were considered when the contracts were designed:

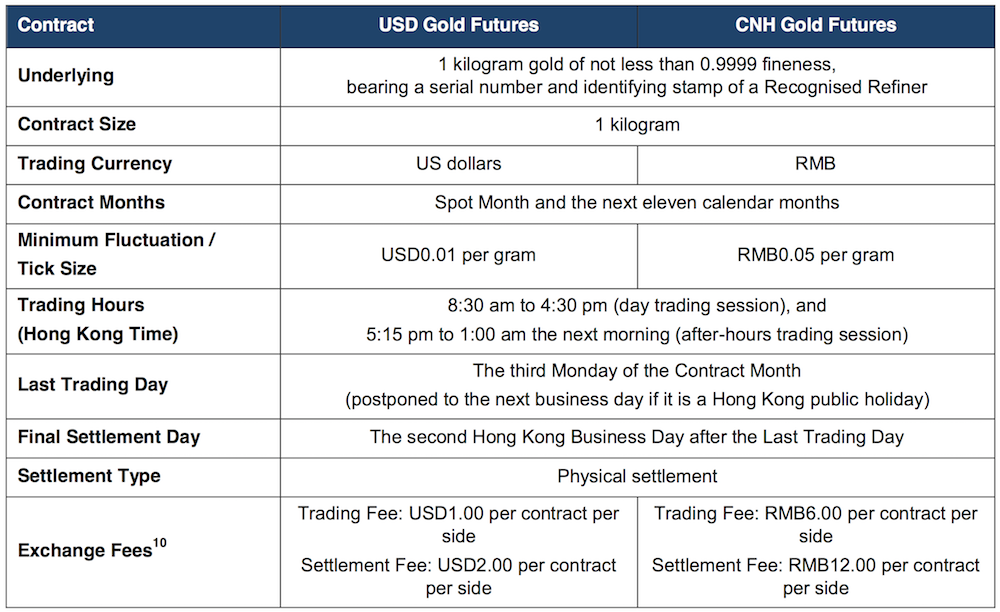

(a) Underlying and contract size — Gold not less than 0.9999 fineness and 1 kilogram is commonly traded by Asian customers, especially in Greater China; the physical delivery mechanism ensures market price converging to the real physical spot market to establish the new benchmark in Hong Kong, providing a robust risk management tool for the end users.

(b) Trading and settlement currency — The trading and settlement currency in USD and CNH will attract both USD- and CNH-based investors. The dual-currency Gold Contracts will generate an implied USD/CNH FX rate as the Gold Contracts have the same underlying. There will be arbitrage opportunities between this rate and other rates in the FX market, hence increasing the overall liquidity of USD/CNH while improving and smoothing out the forward curves among these markets.

(c) Contract months — The spot plus 11 following consecutive calendar months will cover the most liquid trading months in both international and Mainland futures markets and will provide the physical market with more hedging tools.

Product applications and users of HKEX gold futures

The value proposition of introducing the Gold Contracts for investors include but are not limited to the following:

(a) To facilitate the Mainland and international investors’ access to the gold market via a robust trading hub at HKEX in an Asian time zone;

(b) To provide hedging and risk management options for investors and end users;

(c) To provide more investment options for the growing offshore RMB deposits; and

(d) To attract investors who prefer gold exposure in their portfolio.

The potential users and customers of the Gold Contracts are:

(a) Physical players such as gold refiners, fabricators and jewellers who need to hedge gold price risk;

(b) Financial players such as banks and funds who utilise the futures market to link with

their gold-related investment products, and arbitrageurs who trade price disparity between onshore and offshore markets i.e. between New York, London, Shanghai and Hong Kong markets and deploy other trading strategies for FX and interest rate disparity; and

(c) Other investors and traders who have an appetite for gold exposure.

HKEX GOLD FUTURES CONTRACT SPECIFICATIONS

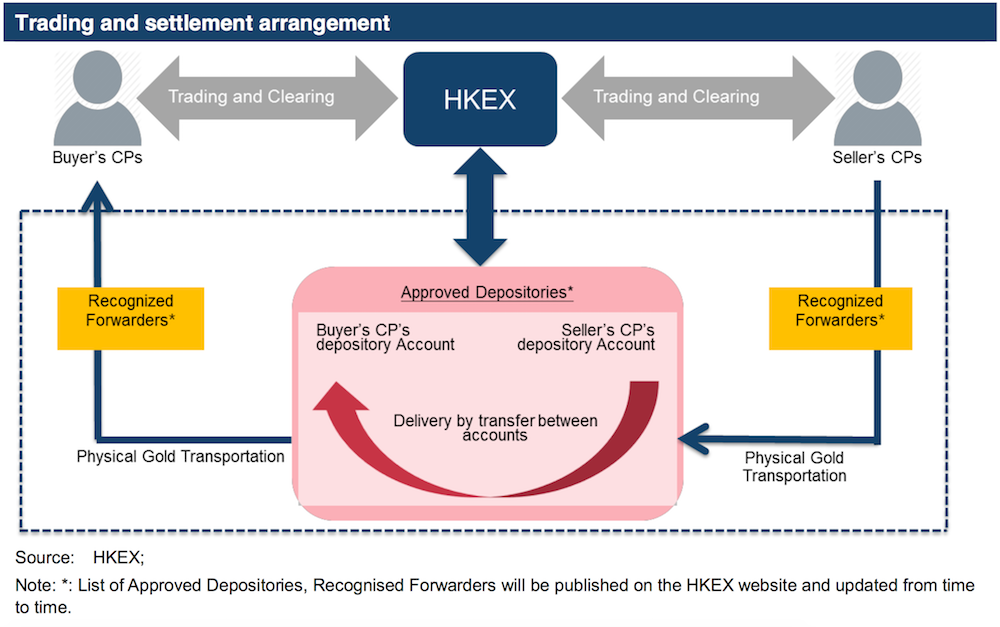

TRADING AND SETTLEMENT ARRANGEMENT

CHAIN OF INTEGRITY

In order to build and maintain a robust and sound mechanism for the quality of the gold bars delivered into the HKEX market, a chain of integrity which is vital in the bullion market globally is formed as below to protect the Exchange and its members.

HKEX requires all Deliverable Metals to be certified by a Recognized Refiner and must be accompanied by documentation issued by the HKCC Participant or its Recognized Forwarder, evidencing that the Deliverable Metals have been shipped or transported to an Approved Depository by a Recognized Forwarder from another Approved Depository, a Recognized Assayer, Recognized Refiner or a Recognized Depository.

Brink’s Hong Kong Limited is appointed as the first Approved Depository to support physical settlement of the gold futures contracts. All HKCC Participant who wants to take/make physical delivery are required to open storage accounts with Brink’s.

The latest lists of the Recognized Forwarder, Recognized Assayer, Recognized Refiner and Recognized Depository will be published on HKEX Website.

Original source: HKEX

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.