What is history’s greatest illusion? Is it the Indian Rope Trick or is it performed by Houdini or maybe David Copperfield. No, this is an illusion which is so big that the whole world has fallen for it. Virtually every individual in the Western world and also many in the East believe in this illusion.

The illusion is so big and really so obvious but still nobody can see it. The reason nobody can see it is because nobody wants to see it. Everybody prefers to be under the illusion that the emperor has clothes although he is totally naked.

Later in this article I also will talk about the King Solomon and the importance of the number 666 for gold and silver investors.

WEWORK AND WELOSELOTSOFMONEY

Before we talk about the big illusion, let’s look at one of the many mini-illusions that has emerged in this century. The name of the company should really be “WeLoseLotsOfMoney” but they have chosen another name which is just as bad, namely “WeWork”.

I have learnt since I was a young man that when you work, you are supposed to earn money. But this is a company that in this modern era is based, on as they state, “elevating consciousness” and not on something as mundane as making money. Because this company really seems totally unconscious. How else can they make losses of $500 million, $900 million and $1.9 billion in the last three years and lose still more this year. The management is valuing the company at $47 billion but few people agree with them. So what do they do? They rent out office space on short term leases whilst they have long term lease obligations of almost $50 billion. A very dangerous mismatch.

The founder and CEO has already sold shares for $700 million. Sounds that he doesn’t believe what he is preaching. This reminds me of a company in the UK during the South Sea Bubble era in the 1720s that was raising money for a new venture. They had no activity and no detailed plans. The prospectus just said that their purpose was to make money. Well at least that is a better goal than losing billions like WeWork.

GLOBAL WEALTH OF $325 TRILLION WILL IMPLODE

And this is sadly the case with the world as a whole too. Soon, we will discover that virtually all wealth is built on an illusion. Because global wealth around $325 trillion was never real but just an illusion based on fake or manufactured money. As global debt of $250 trillion implodes, so will the assets that were supported by this debt. In addition there is at least $1.5 quadrillion of derivatives that will totally disappear into a black hole. This will make the asset devastation exponentially greater.

The destruction of assets when all this is finished will mean that in real terms, stocks, bonds and property values will lose on average probably 90-95%. Many paper assets will disappear totally whilst some hard assets will fare a bit better.

Since most people in the West have debt, they will not suffer terrible losses but the problem will be if they borrowed money against their houses, they will be left with negative equity. The wealthy who have most of the wealth in the world will naturally see the biggest losses.

GOVERNMENTS WILL NOT SAVE THE WORLD THIS TIME

The big problem for most people is that they live under the illusion that they will be saved by governments or the central banks. Because for decades, governments have always stepped in, printed more money to prop up stock or bond markets, for social security, pensions and saved failing banks and businesses. Since governments have access to endless free money through money printing, there have been unlimited resources to solve every financial problem that arises. And now with $17 trillion of debt with negative interest, government is also being paid for borrowing money. What an absurd world.

But it will lead to even greater absurdity before it is over. Because now with negative rates, governments can borrow more than ever, and will! Many investors will do the same thing and invest millions or billions into projects that are just marginally profitable. So with negative rates, governments and central banks are not solving the debt problem of the world but exacerbating it. By trying to solve a debt problem with more debt, the problem will grow exponentially before it implodes.

In the end, no one will buy the debt of course. Why should you buy a debt paper from a government that will either not repay it at all or with money which has lost at least 99% of its value.

THE NON-ILLUSORY ETERNAL ASSETS

There is of course one asset class which is not an illusion but very real. It has an intrinsic value, is nobody else’s liability and has been money for thousands of years. I am talking of physical gold and silver of course.

Precious metals are absolutely essential to hold as protection and insurance against the coming destruction of assets. There is still less than 1/2% of world financial assets in physical silver and gold. Neither individual investors, nor institutions have yet woken up to the fact that there is this wonderful investment that you can hold which over time has always maintained purchasing power whilst all paper money has always gone to ZERO. And sadly most investors won’t realise the importance of gold and silver for their economic survival before it is too late.

As I have pointed out a few times lately, the precious metals have now started the next phase in the bull market that began in year 2000. After a six year correction we have moved to new highs in gold in most currencies except for the dollar. So it is only a matter of time before also gold in dollars makes new highs above the $1,920 high in 2011. It could happen later this year or early in 2020.

BULL MARKET HAS JUST STARTED BUT CORRECTIONS WILL BE VIOLENT

In the very strong metals bull market, which we will experience in coming years, it will be very difficult to time corrections since the big risk will be to miss the upside moves. There will of course be violent corrections, especially in silver, but they will be rapid and quickly reverse. Last week we saw such a correction. For long term holders they are irrelevant. But if you are not fully invested, they give an excellent opportunity to purchase metals. The current correction could last one or two weeks maximum. Price wise we will probably not see much lower levels than today.

Thereafter I expect a very strong move lasting into the year end and continuing in 2020. Gold at $2000 by the year end is not impossible with silver above $30. But wealth preservation investors must remember that holding metals is much more important than focusing on whatever level gold and silver reaches by a certain time. I am only giving these potential targets to indicate that the metals are now in a phase or cycle when the moves to the upside are likely to be significant.

KING SOLOMON GOLD 666 AND SILVER

I have a few times talked about $666 in connection with silver. Some investors are superstitious and either like to change the number to 665 or 667 or talk about 666 as Luciferian.

My long standing minimum forecast for gold is at least $10,000. If we assume that the gold/silver ratio goes back to its long term historical average of 15 (82 today), that would give a silver price of $666. People who think that this figure is ominous have read the wrong chapter in the bible.

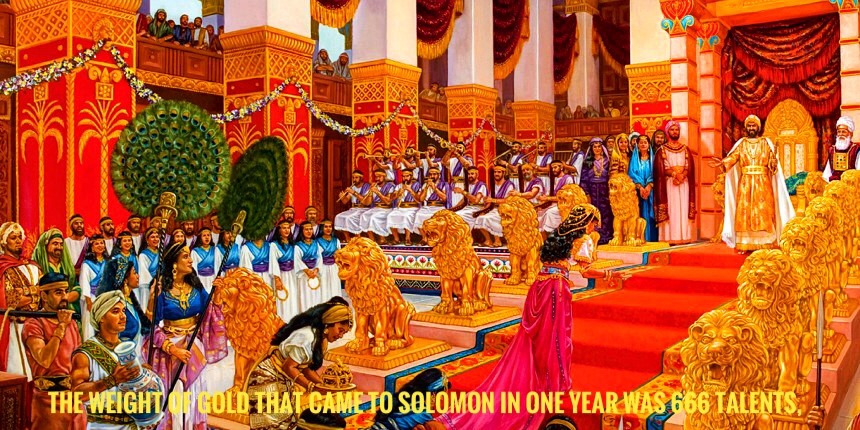

666 is a very important figure for precious metals in the bible. Let’s go to: 2 Chronicles 9:13

“The weight of gold that came to Solomon in one year was six hundred sixty-six talents of gold.”

666 talents of gold is 22 tonnes which today is worth over $1 billion. This was the amount of gold that King Solomon received in payments and gifts. Thus 666 is a very important figure in the bible for precious metals investors rather than the inference that some think about.

So follow the wise King Solomon and collect as much gold as you can afford, whether that means one gramme every month ($50) or much bigger amounts. For the very few Venezuelans who did before their money was destroyed, it saved their lives.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.