Wo ist mein Gold? (Where is my gold?)

In 2012, Venezuela repatriated 160 tonnes of gold stored in Canada, Europe and the United States. The same year, the Bundesbank asked to audit the gold held by the Fed during the Cold War. After the Fed refused, officially for security reasons, the Bundesbank demanded the repatriation to Germany of 300 tonnes of gold, on a total of 1,536 tonnes stored in the U.S.A. But that will take until 2020 to complete this request! By the end of 2013, only five tonnes of that gold have been restituted by the Fed.

If that gold hadn’t been lent or leased to banks to play on the financial markets (or to manipulate its price), it would only be a matter of a few secured jumbo jets to repatriate the gold within a few months. But a large part of this gold is not in New York anymore, and the Fed must buy some time to avoid other repatriation requests showing up on their desk. Central banks are aware of these shenanigans and some of them are just worried about ever recuperating their gold. So, might as well ask for it while the empire is still standing!

All in all, the Bundesbank is looking to repatriate 700 tonnes stored abroad. Both Holland and Switzerland might join the list of repatriation requests. The wind is turning and the Fed is starting to sweat...

Meanwhile, Russia and China keep accumulating gold bars in their central banks vaults. A year ago, a Chinese official was saying that their central bank’s gold buying must be done softly, so as not to provoke a excessive hike in its price that would impede gold buying by the Chinese consumers (did it slip his tongue?). Not only is the central bank of China accumulating gold (without reporting it) to be ready when the dollar fails, but it’s encouraging the Chinese to do the same. Quite a contrast with the West! It should be no surprise that the Chinese rushed toward physical gold in 2013, eclipsing all their previous buying records and surpassing the Indians, whose hands have been stupidly tied by their government. If one follows the gold trail, one will find the countries preparing to dominate the world tomorrow...

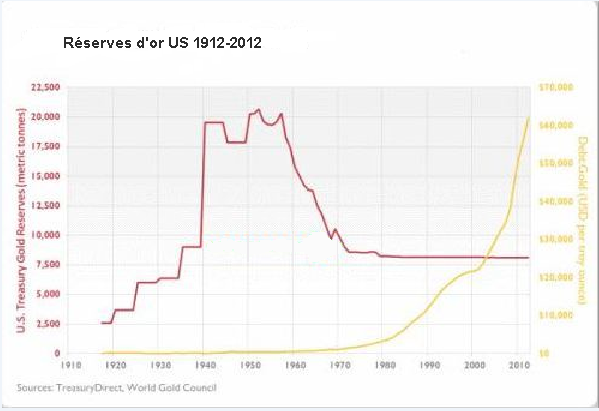

In red : Official Fed Gold Holdings. In yellow, Federal Debt / Gold Holdings Value ratio. Debt is exploding and the Fed’s gold backing of it is dwindling. The dominant empire is living above its means and its gold is leaving for Asia.

What remains of the 8,133 tonnes of U.S. gold supposedly in Fort Knox? The last inspection dates back to 1953 and there was no external expert authorised during the inspection, and only 5% of the bars were tested. In 2009, a fake american-made gold bar was detected by Hong Kong bankers and, according to some sources, those would often be used by Fort Knox to mask the missing bars leased on the market. That particular gold bar would have been sent by mistake...

Hadn’t they tried to entirely demonize gold at the end of the ‘90s, as shown by the massive European central banks’ gold sales? Was it thought that they could definitely get rid of gold at a time of dollar supremacy? The unexpected rise (for the Fed officials) of the price of gold must have caused them quite a headache!

Ach ! Wo ist mein Gold !?

It is no more a secret that, in this world of extreme financial leveraging, physical gold may be allocated to several clients at once, in order to free this capital to play on the financial markets and get better yields. And when these clients want to get a hold of their gold, il will be like a game of musical chairs with very few chairs! On the COMEX paper gold market in New York, there is only one available ounce of physical gold for every 110 ounces of paper gold in circulation. Since this market is one for speculators rarely requesting delivery of gold against the futures contracts, the music can still go on for a little while... until physical gold becomes more desirable than paper gold.

The loss of confidence towards central banks and their gold reserves constitutes the first step of the end game between physical and paper gold. Then investors will lose confidence in certain ETFs like GLD. And the game will end finally with the loss of confidence in the current fiat money system and the countries issuing those currencies (monetary crisis).

>> READ PART 3: MYSTERIOUS 2013 SPRING SMASHDOWN OF THE GOLD MARKET

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.