The $1,180 bottom acted like it was butter being cut through by a hot knife in October, due to the spectacular and unexpected strength in the dollar. But this time, contrary to what happened when the $1,525 support was broken in April 2013, breaking this support hasn’t led to self-feeding selling cascades. On the contrary, we came right back up, which is a good sign. It is as if we were touching more solid ground. Gold is being sold under its cost of production, which has investors asking themselves serious questions.

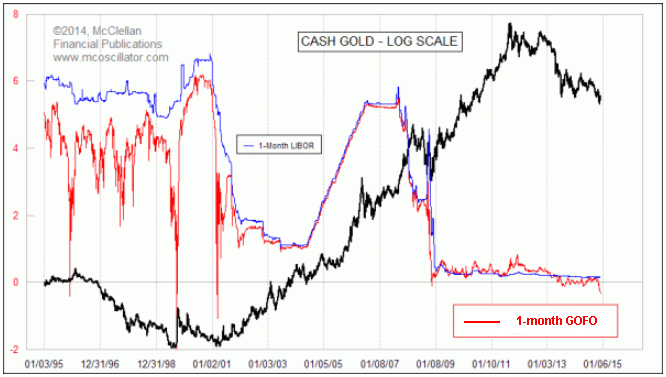

Gold is in backwardation, sentiment is historically negative, but this process of gold price destruction on the paper markets goes on... How much gold do the central banks have to recuperate still? What is behind those never-ending attacks? For how long will there be physical gold available? These are the only questions that matter to me but, sadly, I have no answers for them. I am still amazed to see those attacks happening with so many commercials, the smart money, positioned on the long side, and with such a negative GOFO (backwardation), which indicates a shortage of the metal at these prices. And for silver the situation is even worse!

The GOFO has become largely negative, thus indicating a coming shortage of physical gold or, at the very least, fear of a coming shortage. Each time there has been this kind of backwardation, the market started a big rally or a trend reversal.

As we stand now, practically all markets have gone astray. By ‘astray’, I mean they have drifted from their intrinsic valuations which should reflect the reality of the economy. Control of the markets by the U.S. financial elite has never been so radical. Look at oil, for instance: The Americans have succeeded in convincing the Saudis not to reduce their production in spite of a quasi-crash from $107 a barrel to $73 since July. This reflects more than just the rise of the dollar.

Are they planning to bring the Russians to their knees, whose economy is so dependent on the price of oil? After having convinced the Indian government to curb gold’s buying fever in 2013, just before the now historic attacks on the paper gold market, the Americans are now convincing the Arabs to drown the world in oil. There is an economic war and a monetary war going on, and alliances are being created. Some feel they are siding with the strong ones, but they may regret their choice when the dollar enters its final collapsing phase.

The Dow Jones Industrial Index is on an upward trend built inch by inch by an invisible hand since the October trough. And this has entertained the notion of a considerable “wealth effect” in the American middle class and blind faith in an economy with self-fulfilling prophecies with the help of the Fed’s money printing press. And the dollar is showing spectacular strength since the Fed stopped buying Treasury bonds and the Russians and the Chinese started the “de-dollarization” of the world! It’s a miracle! ... Of course, the dollar has no intrinsic strength; it’s the other currencies plunging following bouts of new monetary printing around the world.

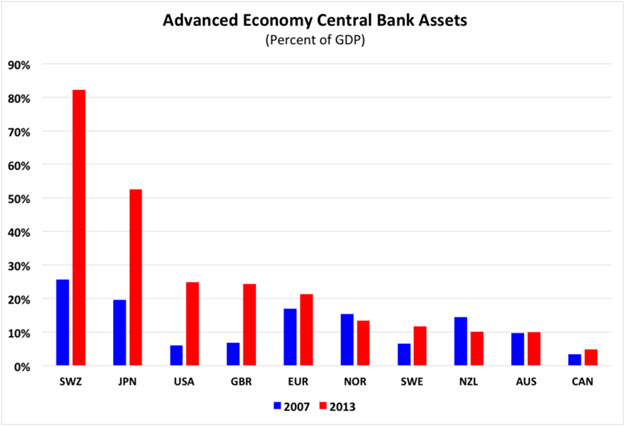

Even in Switzerland, the central bank’s balance sheet has exploded since 2007, going from 25% to 80% of the country’s GDP! Awash with euros, the SNB will also regret its choice later on. But are central banks still sovereign in this world? The Swiss will regret having voted NO to the Swiss Gold Initiative (November 30) this coming Sunday. Because, in view of the very aggressive media campaign against the initiative by all the newspapers and political parties, the YES side doesn’t stand a real chance (as of writing this, the NO vote won, two days ago). The Americans will probably launch more attacks on the gold market right after the vote to take advantage of the deception, but November’s trough should hold, in view of the current backwardation.

The Federal Reserve, with its $4,000,000,000,000,000 of new money “printed” since the 2008 crisis, almost looks like a choir boy, since its balance sheet “only” represents 25% of GDP. Alternately, central banks around the world are printing money to pay their debts via sneaky under-reported inflation, almost invisible in official numbers, and to foster inflationary mechanisms, without which the whole banking system would collapse.

As the monetary mass has kept growing since 2011, the price of gold has plunged, in dollar terms, and has had to withstand obvious, programmed and well-timed attacks in order to inflict maximum technical damage and lead to automatic selling by speculators, weak hands and trend followers. The markets are under total control: the Fed does not want another crisis like in 2008, because the banking system couldn’t take it and it would mean total chaos. And the media, as one, repeat the central bankers’ mantras and the bubble keeps growing, and growing, and growing...

In such an environment, much more dangerous than the tech bubble of the late ‘90s and the U.S. real estate bubble in 2007, complacency is always at a maximum. Prudent investors who are positioned against the market are still being branded as idiots but, when the markets exhale their last breath, their collapse may be extremely brutal and totally uncontrollable by the world’s central banks. I would bet heavily that monetary printing will go into supersonic mode and that manipulation to keep the gold price as low as possible will be untenable, given the buying frenzy that will take over the market. But for now the 2013-2014 elastic band, stretched to the point of breaking, risks at any moment to snap back in the faces of those who have gone massively short on the paper gold markets!

We may recall the importance and respectability of gold as money, as cities such as New York were literally growing out of the ground, when "La Belle Époque" was all the rage in Europe, until the start of World War I. The banking system was then infinitely more simple and honest, and savings kept their purchasing power in terms of gold. One can only wonder what happened to our current world, a world that has profound hatred for gold and unconditional love for all paper things coming from Wall Street, the Fed and the central banks around the world!

But the current moral decline, in the larger sense, has probably reached an extreme which will later lead to a global awareness of imbalances, and to an unavoidable correction, as History has taught us in the past. A new era of prosperity shall not begin without a total reform of the actual monetary system and a radical re-sizing of the financial sector in relation to actual wealth produced. Gold will play a role in restoring the world’s sanity and extinguishing the debt, just as it did in getting the world out of barbarism in the Middle-Ages by minting gold coins during the Italian Renaissance.

The current hatred for gold, stoked by the mainstream media, has reached a peak today, but extremes never last and cycles always complete their revolution.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.