As we approach the beginning of the biggest wealth destruction in history, it is timely to turn to the wisdom of one of the great philosophers. Plato (428-348 BC) stated:

“The greatest wealth is to live content with little”

And this is the lesson that most people in the world will need to learn the hard way in coming years. We are now at the end of an era which has created unreal wealth for a few and massive debt for most of the world. As all the bubble markets in stocks, bonds, property and other financial assets implode, together with the debt that has fuelled it all, 100s of trillions of dollars will just vanish and never return. The consequences will be both shocking and devastating for most people.

WE COME WITH NOTHING AND LEAVE WITH NOTHING

It is interesting how few people, especially in the West, heed the wise words of Plato. We all come into this world alone with absolutely nothing and we leave the world in the same way – alone with nothing. And in between most people try to accumulate as many possessions as they possibly can although we can take nothing with us when we leave. I have recently had discussions with a couple of different friends who have expressed content with what they have and are in no need of amassing material wealth. These are both people of great intellect and integrity and also with many interests which are both stimulating and free. It is refreshingly uplifting to meet such people who are totally contented with their lives.

Interestingly, both these people are holding gold. Most people, clients or friends, we know who own gold, do not hold it in order to become wealthy. They do it because they see the unprecedented risks in the world, in markets and in the financial system. They see gold as the best form of insurance or wealth preservation against these risks. Anyone who buys gold to make short term gains has misunderstood the purpose of holding physical gold.

Gold is not a “get rich quick” investment. The people who buy gold when it goes up and sell when it goes down are just opportunistic speculators. They don’t understand the purpose of holding gold. Gold is not an investment. Gold is money and the only money which has survived in history. Over time, gold assures stable purchasing power. One ounce of gold buys a good quality suit for a man, just like it did 2,000 years ago.

WHERE HAS ALL THE PAPER MONEY GONE?

Paper money is gradually disappearing in country after country. I was recently in Sweden and there the Eastern European beggars are all almost gone. Why you wonder. The reason is that cash has virtually disappeared in Sweden and nobody carries cash. So there is no money for the beggars. Many shops don’t accept cash, even low value shops like bakers only take credit cards. In many EU countries, the maximum daily withdrawal is EUR 1,000 and cash transactions over that amount are illegal. In Venezuela, bank accounts of many ordinary people are frozen to “Fight Terrorism”.

So it is only a matter of time before cash disappears altogether. This gives the authorities around the world total control of money and we hear that banks around the world are preparing for this. When the next financial crisis starts, it will be very easy to turn off cash machines and to block all transactions by credit card of say more that 100 dollars or euros daily. At some point, private cryptocurrencies will also be banned and replaced by government cryptos.

ONLY GOLD IS MONEY

“Money is gold and nothing else” said J P Morgan in 1912. Again this time, the only real money that will survive is gold. The Greek philosopher Aristotle who was Plato’s student defined what sound money must be:

- Durable

- Portable

- Divisible

- Intrinsically valuable

Only physical gold fulfils all these criteria and this is why gold is the only surviving currency in history.

As I stated in last week’s article, physical gold is today confused with paper gold. The gold price is today determined by a false paper market which is likely to fail in the next few years. At that point we will know the real price of gold.

WILL FINANCIAL SYSTEM SURVIVE?

The stocks in the banking sector are giving us a clear warning that the financial system is unlikely to survive in its present form. Many bank stocks are down over 90% since 2007. Deutsche Bank for example is down 94%. Looking at the European Banking Index STOXX 600, it has lost 75% since 2007 and only in 2018 it is down by 1/3. The index has never recovered from the last crisis and as the chart shows, prices have been going sideways at the bottom. This is a very bearish sign which indicates that this chart will soon crash again and the European banking system with it.

2007-9 SOON BACK WITH A VENGEANCE

The continuation of the 2007-9 crisis is just around the corner. Governments and bankers around the world have managed to postpone the inevitable for 10 years. That will result in a crisis of a much greater magnitude. This time around there is not much margin for lowering rates since they are already negative or very low in most countries. And the coming money printing on a global scale is very unlikely to save the system. The fake financial system based on credit and printed money will soon be revealed. Finally the world will soon realise that it has been living on a lie as printed money can never create wealth. Printing money is like piling Pelion on Ossa. Thus a fruitless effort just like it was for the Centaurs in Greek mythology to pile one mountain upon another to reach heaven and destroy the gods.

THE FALL OF THE DOW / GOLD RATIO – AN OMINOUS SIGN

The best illustration of what will happen in the next few years as wealth is destroyed is the chart of the Dow – Gold ratio. When this ratio goes up, it means that the Dow is going up against gold and when it goes down that gold is gaining against the Dow. Stocks bottomed against gold in 1980 as the gold price reached $850. Subsequently stocks rose strongly as gold fell to $250 at the end of the 1990s. The Dow then fell 87% against gold from 2000 to 2011.

We have since 2009 seen a strong stock market and lower gold. In spite of that the Dow is still down 52% against gold since 1999. The correction now seems to be over and we have seen the ratio fall 14% since October 2018 as the Daily black chart below for 2018 shows.

The long term fall which started in 1999 is now likely to resume in earnest. A stock market crash is imminent. The ratio reached 1 in 1980 which means that the Dow and Gold were at the same level around 850. We are likely to at least reach the trend line which is at 0.75 but probably overshoot and see the ratio below 0.5. This means that the gold price will be at least twice as high as the Dow. Whether that is $20,000 gold and 10,000 Dow, time will tell. It could also be $50,000 gold and 25,000 Dow with hyperinflation.

It is of course impossible to forecast the exact level but what is clear is that stocks together with most assets will decline dramatically in real terms which means against gold.

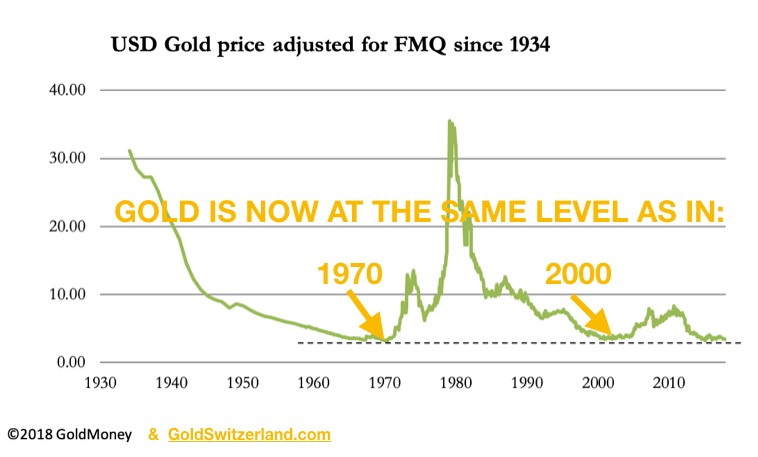

GOLD NOW AS CHEAP AS IN 1970 AND 2000

Finally let us look at the gold price adjusted for real money supply or FMQ (Fiat Quantity Money). As this chart below shows, the gold price is now at the same level as in the late 1960s and early 1970s ($35) before Nixon closed the gold window. Gold is also at the level where it was at the turn of this century around $300. What this clearly shows is that gold on any criteria is severely undervalued whether it is against money supply or stocks.

But the reason for owning gold should not primarily be based on the incredible undervaluation but on the fact that gold represents the best insurance as well as the ultimate wealth preservation against the imminent collapse of most assets and also of the financial system.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.