Just days after Russian President Vladimir Putin laid out a new national security strategy (seemingly timed to coincide with the US Independence Day Holiday to underscore the general theme) where he elaborated on how Washington uses the dollar as a tool to wage economic warfare against its geopolitical adversaries, Russia's National Wealth Fund (NWF), a nearly $190 billion pool of capital derived from the country's vast oil and mineral wealth, has taken a critical step toward dumping all its assets.

RUSSIAN FINANCE MINISTRY SAYS IT HAS COMPLETED FX CONVERSION NEEDED TO SCRAP U.S. DOLLAR FROM THE NATIONAL WEALTH FUND

— First Squawk (@FirstSquawk) July 6, 2021

RUSSIAN NATIONAL WEALTH FUND AT $187.6 BLN AS OF JULY 1, OR 11.7% OF PROJECTED 2021 GDP - FINANCE MINISTRY

The news isn't exactly a surprise. Russian Finance Minister Anton Siluanov announced plans to dump all dollar-denominated assets from the fund's portfolio a month ago. Still, the alacrity with which the massive fund is moving ahead with its plans (trading tens of billions of dollars in FX is a laborious practice and can take time) shows that this wasn't an empty threat.

News that the fund has finished this critical step toward rebalancing its portfolio also coincides with Tuesday's jump in oil prices, triggered by the latest OPEC drama.

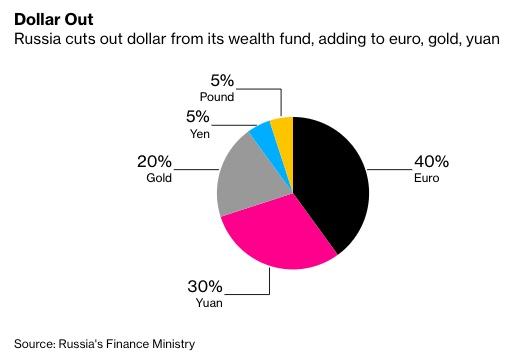

The NWF's holdings of the US dollar were reduced from 35% to zero, while the share of the British pound was lowered to 5%. The shares of the euro and the Chinese yuan were increased to 39.7% and to 30.4%, respectively. The share of the Japanese yen stands at 4.7% and the share of non-cash gold is 20.2%, the official statement by the Finance Ministry reads.

The ministry indicated that the yuan and the euro are seen as an alternative to the dollar “as the currencies of Russia’s leading foreign economic partners,” while gold is viewed as “an asset capable of protecting the NWF’s investments from inflationary risks.”

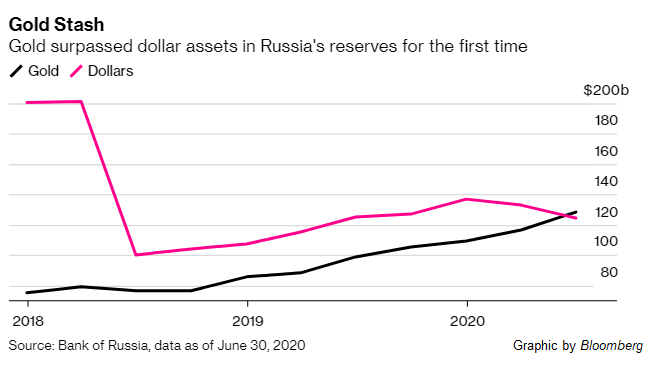

The sovereign wealth fund's decision is consistent with the Russian Central Bank, which has dumped dollar-denominated reserves in favor of gold.

As we have explained in the past, the trend of de-dollarization is a very real threat to the dominance of the greenback, which has ruled as the world's reserve currency since the end of WWII (when it officially supplanted the British pound).

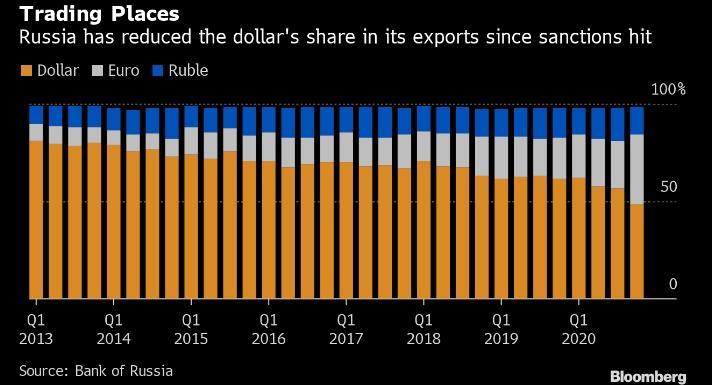

While the National Fund's decision to excise US assets from its portfolio is certainly alarming, it's only one piece of Russia's strategy to undermine the greenback. The dollar's dominance comes largely from its position as the global intermediary of choice for transnational trade. A few months ago, we reported that the share of exports sold in US dollar fell below 50% for the first time ever. It's a trend that's been in place since the Obama Administration imposed sanctions over the annexation of Crimea back in 2014.

And it's perhaps the single biggest threat, because if the dollar loses its special status as an intermediary for global trade, then international central banks will have less of an incentive to hold dollar reserves, since it will reduce the demand for dollars overall.

Original source: ZeroHedge

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.