In his latest weekly report, analyst Luke Gromen points to a major transformation in the US bond market: Treasury yields are rising even as liquidity is being withdrawn from the market.

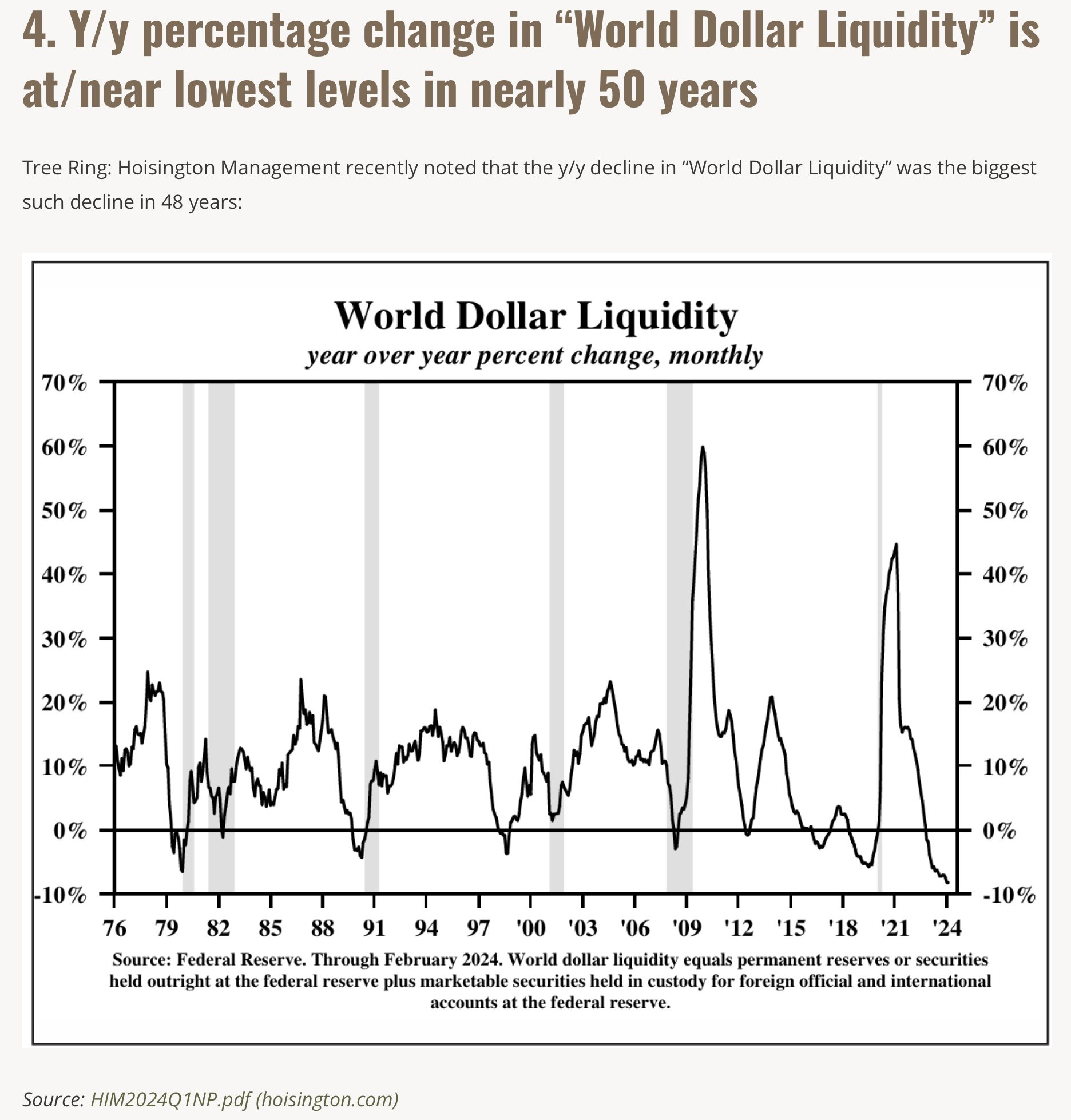

For the first time in 48 years, yields on 10-year US Treasuries have risen in response to an annual decline in global US dollar liquidity.

We've reached an extremely low level of dollar liquidity, but yields haven't reacted!

Normally, as dollar liquidity declines, yields would fall. Surprisingly, however, the opposite has happened in recent weeks.

What has changed since the last equivalent periods of liquidity withdrawal from the market?

This time, three indicators have changed the game: the debt/GDP ratio, the deficit/GDP ratio, and the US Net International Investment Position (NIIP)/GDP are so high that these liquidity withdrawals no longer have the same effect on rates.

Bond market participants are expecting an avalanche of new Treasury auctions. Given this abundance of future supply, it's understandable that rates are struggling to come down, even when liquidity is withdrawn.

Worse still, the Fed cannot excessively tighten USD liquidity without risking triggering a debt spiral!

Let's summarize the Fed's current impasse:

The US government is borrowing money by issuing Treasury Bonds, and despite the reduction in global liquidity, the yield on these bonds has risen.

This is unusual, as reduced liquidity usually leads to lower yields.

The current situation is explained by the high level of US public debt, deficit and obligations to other countries. This would complicate debt repayment if the Fed tried to reduce liquidity to control inflation.

This could trigger a debt spiral, where the government would be forced to borrow more to repay its existing debt, making the situation even worse.

The Treasury would then find itself trapped in this debt spiral, all the more so as US refinancing is carried out with increasingly shorter maturities.

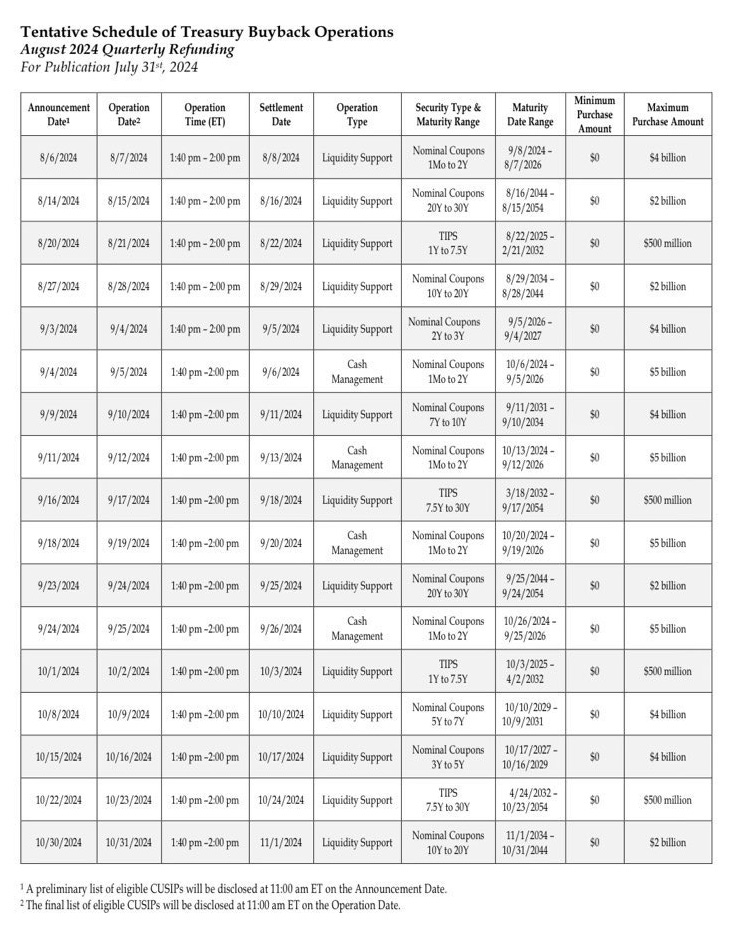

To relieve the bond market, the US government launched a Treasury bond buyback program in July.

The Treasury has published the timetable for its buyback program: operations began on August 6. Initially set at $15 billion, buybacks have been doubled to $50 billion:

The aim of these operations is to increase demand for bond products and revive a market paralyzed by the Fed's rate hike. In any case, this measure adds liquidity at a time when the Fed has been trying to withdraw liquidity from the markets to fight inflation.

What seems to be motivating the Treasury at the moment is to avoid at all costs the disruptions associated with the blocking of the bond market.

These measures, along with the reversal in Japan, seem to have succeeded in calming the markets in recent days.

But this week, it's China that is once again causing concern among analysts.

China's bank lending to the real economy has fallen for the first time in 19 years, marking a worrying turn of events that highlights why weak domestic demand has become a major obstacle to growth and economic recovery.

Although borrowing rates remain attractive, demand appears to be drying up, directly threatening Chinese growth in the months ahead.

The decline in consumption is already visible in the automotive market, which recorded sharply lower figures for July:

It would appear that China's real estate crisis is spreading throughout the economy.

The world's largest steel producer, China Baowu Steel Group, has warned that Chinese steelmakers are facing a prolonged crisis due to the collapse of the real estate market in China.

Weak demand has led to an overproduction of steel, driving down prices and resulting in losses for refiners.

Chinese steelmakers are turning to foreign markets to compensate, but are encountering trade barriers.

According to Baowu, the current situation is considered more serious than the crises of 2008 and 2015, despite attempts by Chinese decision-makers to revive the property market.

China's steel sector is devastated by weak demand and declining industrial production, while the collapse of the real estate market is crippling Asia's largest economy.

For the time being, investors are turning to the US markets, awaiting more clarity on the anticipated sharp slowdown of the Chinese economy. Over the past two years, the Chinese market's underperformance relative to the US market has been particularly notable:

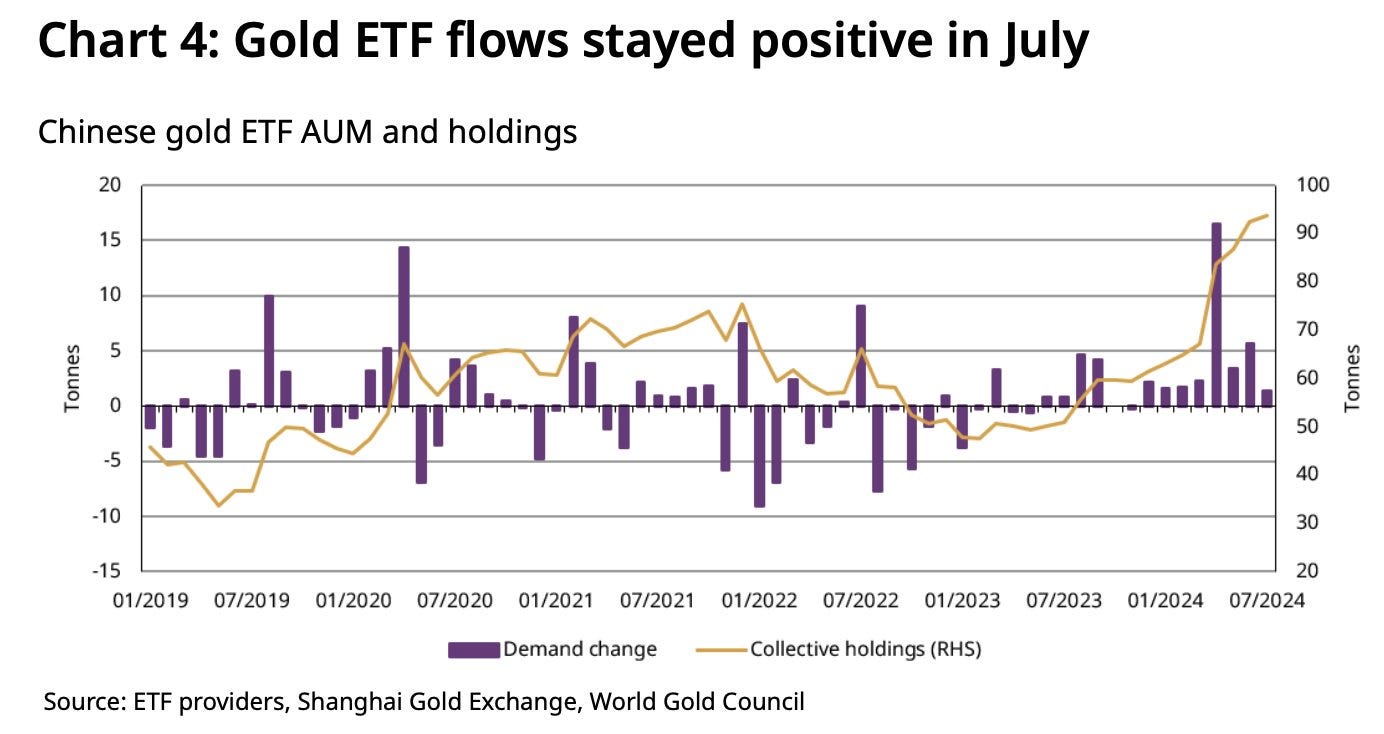

Fears of a deflationary wave originating in China are weighing on commodities and stimulating the accumulation of positions in gold ETFs.

Outstandings in these Chinese ETFs rose for the eighth consecutive month, despite increasingly high gold prices:

Gold premiums remained positive in China last week, supporting price levels, which reached a new all-time closing record on August 12:

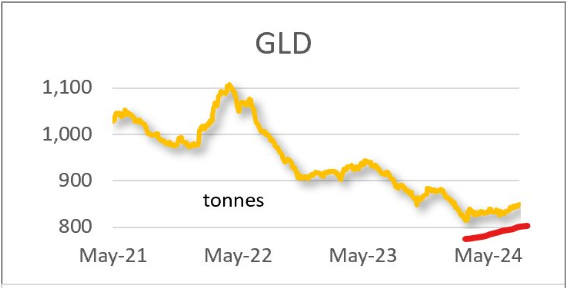

This gold record comes as demand for gold investments is just beginning to take off in the West.

According to data from the World Gold Council, global gold ETFs saw their biggest increase in outstandings since April 2022, after North American funds finally caught up with their European counterparts.

Notably, all regions recorded positive flows this month, with Western ETFs contributing significantly. The GLD ETF has begun to recover in recent weeks after an almost uninterrupted decline since 2022:

It will be important to monitor over the coming weeks whether the increased likelihood of recession in the US economy translates into increased demand for gold. In this case, physical gold would become THE safe-haven asset, as in China, in a shrinking economy.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.