In an article from Reuters, Casey Hall and Amy Lv take a look back at the physical gold rush currently taking place in China, which is increasingly involving young people.

The rejuvenation of gold buyers in China is explained by the slowdown in the property market, the weakness of equities and the currency, as well as low bank interest rates.

Young Chinese, concerned about economic stagnation, are turning to gold as a financial refuge.

Uncertainties surrounding the growth prospects of the world's second-largest economy, affected by the COVID-19 lockdowns, reinforce this trend.

China remains the world's biggest buyer of physical gold, driving up global gold prices.

Chinese demand is likely to remain high next year due to slowing economic growth and falling foreign investment, weighing on the yuan.

A change in behavior is perceptible among young Chinese who, previously absent from this market, are now buying gold jewelry. Discussions on Chinese social media encourage gold accumulation, suggesting the purchase of small coins and one-gram "gold beans", even for those with modest incomes.

Faced with low bank deposit rates and uncertain financial markets, the Chinese see gold as a more reliable refuge. The economic crisis, the depreciation of the yuan and geopolitical uncertainties are fuelling this preference for gold as a safe haven.

The situation on Chinese markets is very mixed. The SSE Composite Index has stagnated since the Covid crisis:

This index clearly underperformed the Nasdaq over the same period:

US markets end 2023 on a high note.

Funds that had anticipated a recession this year were forced to cover their short positions, causing the most massive short squeeze in thirty years.

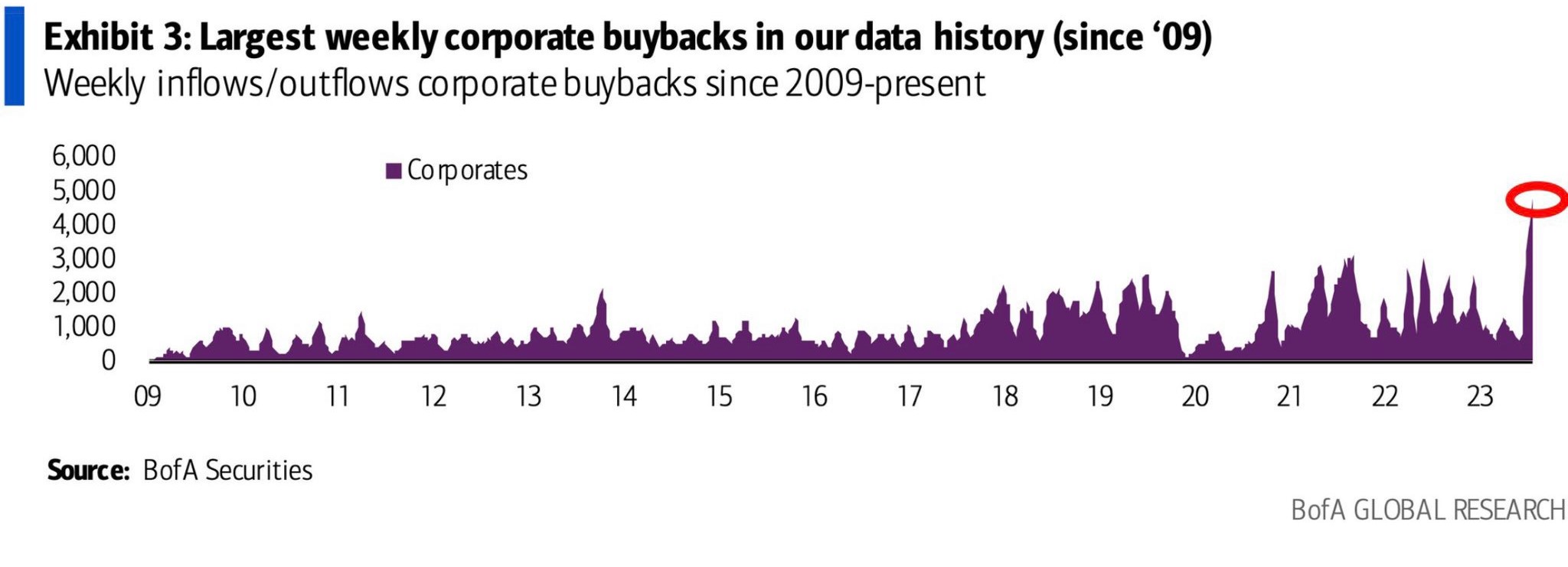

This short squeeze was amplified by the largest stock buyback program in history:

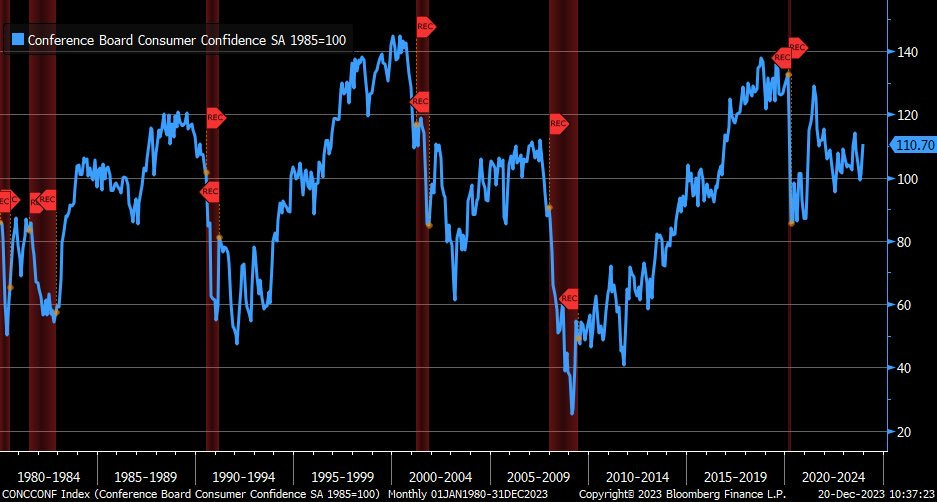

Rising markets are having a positive impact on consumer sentiment, which is regaining optimism:

The downturn in energy prices is helping to reinforce this optimism, with the cost of a gallon of gasoline falling back below $3 in many states.

While the Chinese seek to protect their savings, Americans continue to take on debt, and even show renewed optimism as the year draws to a close.

This renewed optimism, fuelled by an increasingly widespread belief in a soft landing for the economy, and the markets' outperformance of gold over the course of the year, are the main reasons for the lack of interest in physical gold in the USA.

In 2024, gold set an all-time record, but this performance went relatively unnoticed, unlike the recent highs of the market's leading stocks, which were widely publicized. Gold does not have the same value in the United States as it does in China, where its perception is different.

The Nasdaq has significantly outperformed gold this year, making it difficult to justify gold as a safe haven. All the more so as recession has been avoided in the US this year, and the Fed has raised its GDP growth forecasts for next year.

The current euphoria on the markets, which have reached historic levels of over-buying, makes American optimism particularly vulnerable in the event of a brutal downturn.

In Europe, the situation is markedly different: the energy crisis has had repercussions on economic activity, and it is surprising that gold is not even more widely regarded as a safe-haven asset, as it is in China.

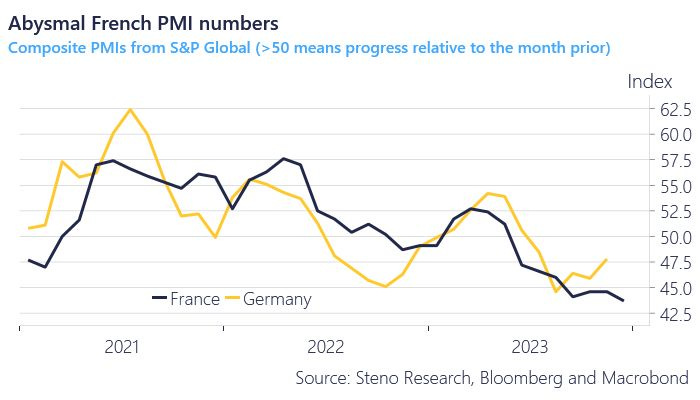

After Germany, it's France that's sinking into the red as 2023 draws to a close.

The manufacturing PMI fell again last month, signaling an increasing likelihood of recession:

Fears of a slowdown in Europe are not provoking the same reactions as in China: the rush to safe-haven investments, notably gold, is still far from materializing on a continent that has not experienced a currency crisis for several generations.

Concerns about the property market and the economic slowdown are encouraging young Chinese to invest in gold. For the time being, nothing of the sort is happening in Europe.

It will probably take a crisis affecting confidence in the euro for Europeans to adopt the same perspective as the Chinese regarding gold's role as a safe haven.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.