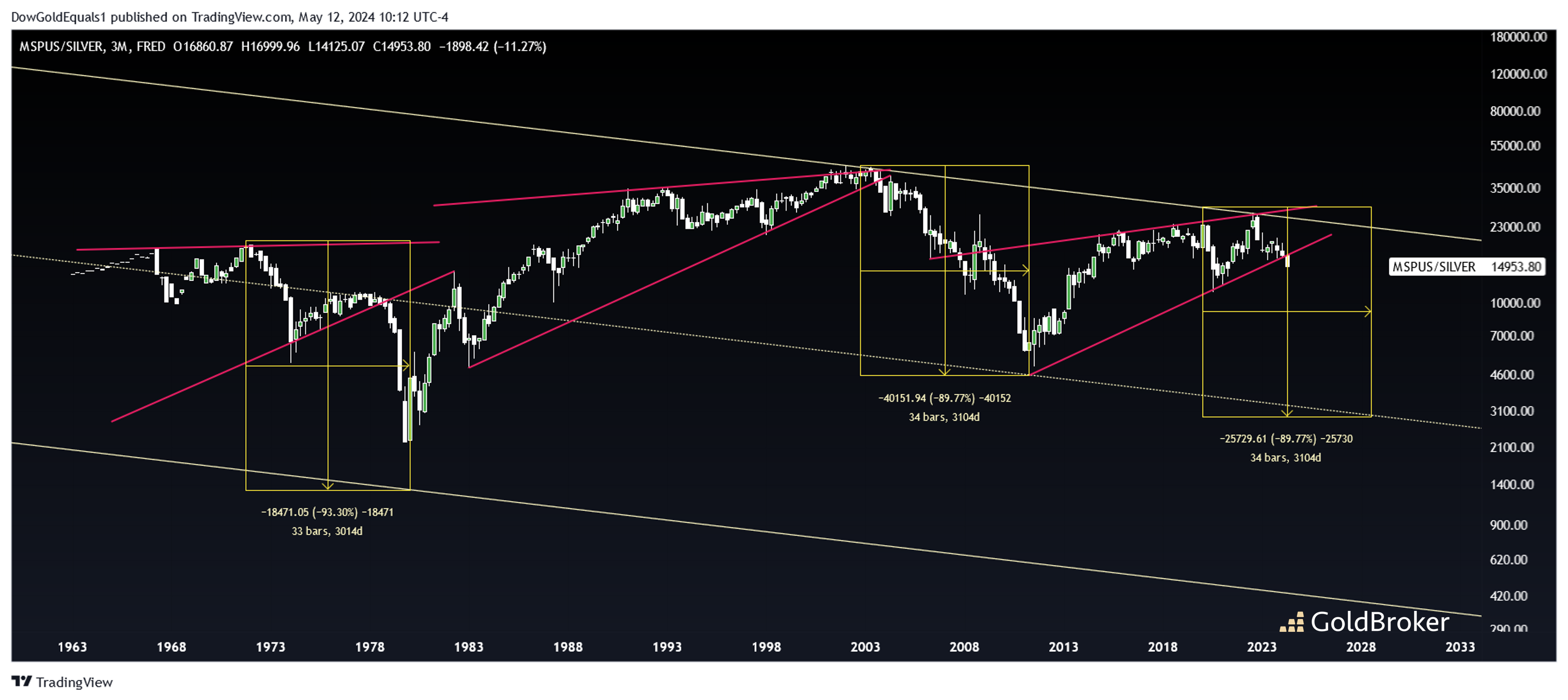

This week, we'll look at the ratio of the Median Sales Price of Homes in the United States to silver - or more simply put, the number of ounces of silver required to buy a home throughout history.

A couple of things should become immediately apparent when looking at the quarterly candlestick chart. First, the number of ounces of silver required to buy a home has varied wildly with two notable major crashes. From 1971 to 1980, the number of ounces fell from a peak of 19,798 to a low of just 1,327 - a 93% decline! Then from 2002 - 2011, the number of ounces fell again 90% from a peak of 44,729 to a low of 4,577. It should be noted that 2002 was an all time high for home prices measured in silver. In other words, home prices have been actually falling in real terms for more than 20 years!

The second thing that should be apparent from the chart is that home prices measured in silver have tended to trade within large rising wedges that have broken down and led to those substantial declines. We have currently just broken down from a third such rising wedge. If history is a guide, we could see another 90% decline from the top, or about 80% from the current level. Interestingly, the previous two declines took nine years from top to bottom. With the current top having occurred in 2020, that would put us at 2029. So, if you're planning to buy a home in the US in five years, the ideal savings vehicle may well be physical silver. History suggests that silver purchased today could increase your purchasing power by as much as 5X in 2029! A great way to look at it: your 20% down payment today in silver might buy the whole house before the end of this decade.

The second chart is a silver weekly candlestick update. The technical set up is as good as it gets, as the multi-year Inverse Head & Shoulders has a perfect backtest of the neckline and now targets north of $38 over the next couple of years. We also see a bull flag that is consolidating above the neckline, extremely bullish behavior, that targets the $35 range.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.