There is no better way to describe the international monetary system today than through the statement made in 1971 by U.S. Treasury Secretary, John Connally. He said to his counterparts during a Rome G-10 meeting in November 1971, shortly after the Nixon administration ended the dollar’s convertibility into gold and shifted the international monetary system into a global floating exchange rate regime that, "The dollar is our currency, but your problem.” This remains the U.S. policy towards the international community even today. On several occasions both the past and present chairpersons of the Fed, Ben Bernanke and Janet Yellen, have indicated it still is the U.S. policy as it concerns the dollar.

Is China saying to the world, but more particularly to the U.S., “The yuan is our currency but your problem”? China’s move to weaken the Yuan against the US dollar is in fact a huge response to America’s resistance to reforming the international monetary framework. It’s telling American policy makers that the longer they delay acting on reforming the international monetary system, the harder and longer they are going to make it for the U.S. to climb out of their trade deficit and depreciate their currency to where they need it to be.

China has been preparing for this moment for several years by accumulating gold through its central bank but also by using banks/corporations and individuals. It has in recent years signed several international agreements to bypass the US dollar in international trade and use preferably the Yuan. It has created an alternative World Bank (Asian Infrastructure Investment Bank) and a gold fund to invest in gold mining for more than 60 countries. The project is being overseen by the Shanghai Gold Exchange (SGE) and it is likely that the newly mined gold will be either traded on the SGE or be sold directly to the PBoC and other central banks. It has also bought a large amount of gold and kept the exact amount as secret as possible.

The international monetary system is in crisis and ready to collapse. It has been since at least 1971 but it seems we are very close to the end (within five years). The International Monetary Fund (IMF) is working discreetly to have the Special Drawing Rights (SDR) replace the US dollar as the international standard. Since the delinking of the dollar from gold in 1971, the US dollar has been the de facto international standard. The IMF itself makes no bones about its ambition to establish the SDR as the global reserve currency.

In a 2009 essay, Governor Xiaochuan of the People’s Bank of China (the Chinese central bank) also called for a new worldwide reserve currency system. He explained that the interests of the U.S. and those of other countries should be “aligned”, which is not the case in the current dollar system. Xiaochuan suggested developing SDRs into a “super-sovereign reserve currency disconnected from individual nations and able to remain stable in the long run”. What does he mean by “disconnected from individual nations”? The present SDR is a mathematical formula of the price of its composing currencies of “individual countries” with no backing whatsoever. Does he imply some kind of link to gold? That would explain many other statements in favor of gold by China’s officials and their aggressive encouragement of Chinese institutions and individuals to buy gold.

Julian D. W. Phillips, of Gold Forecaster, says, “What has become clear in the actions of the Chinese government and the central bank is that they are determined to accelerate the Yuan’s passage to a reserve currency, hopefully with the cooperation of the IMF, but if not, they will walk their own road.” However, this is not the final objective of China. Its target is to eliminate the “exorbitant privilege” of the dollar, not just to join the “club”. China doesn’t want to destroy the dollar, only to eliminate its “exorbitant privilege”.

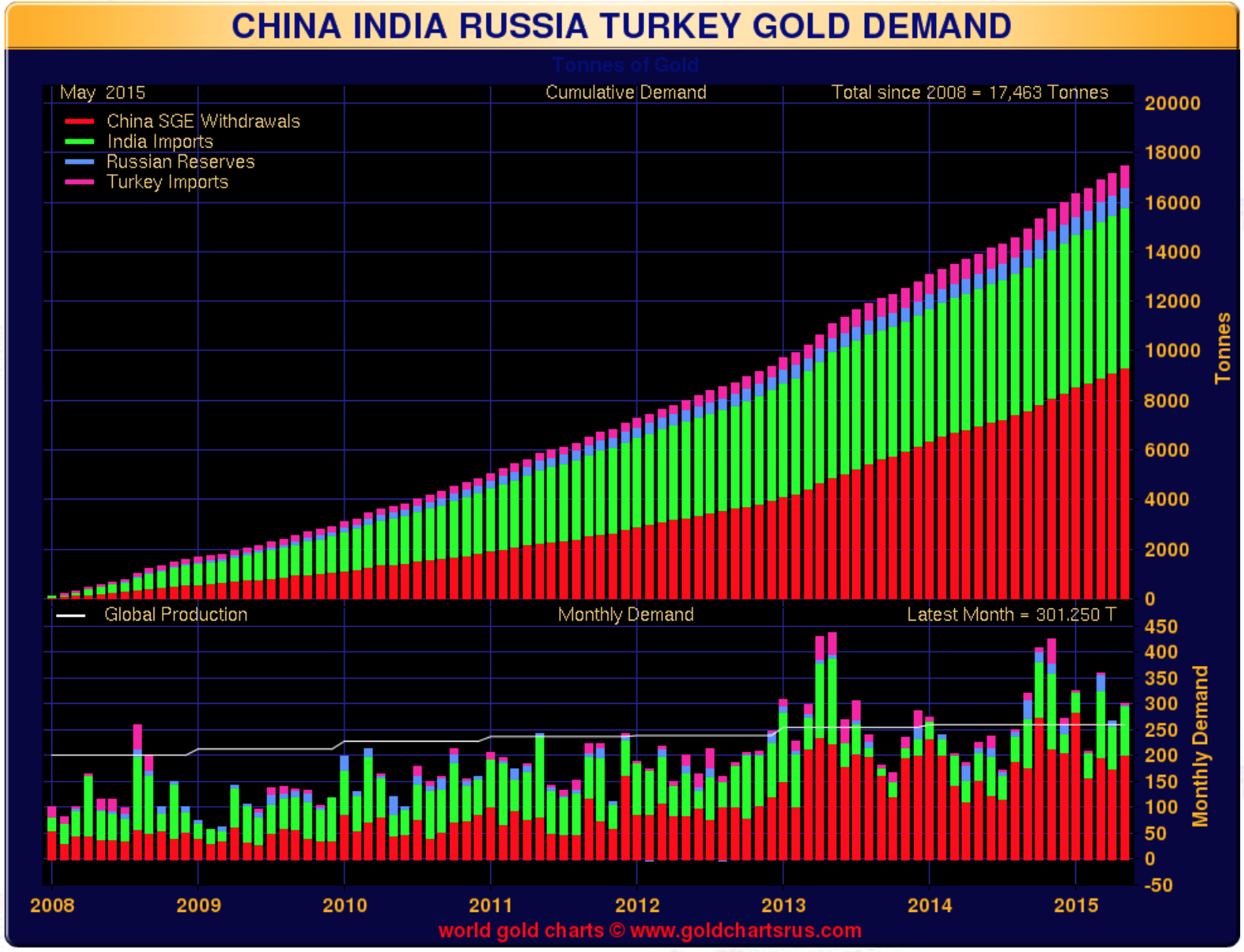

With a different approach, but also very aggressively and more so since the U.S.-EU sanctions that amplified the new cold war, Russia has also accelerated its gold buying. Russia and China have also started a new payment system to avoid the U.S. dominated and controlled international payment system. Elvira Nabiullina, Chairwoman of the Russian Central Bank, said, “Recent experiences forced us to reconsider some of our ideas about sufficient and comfortable levels of gold reserves.” Also in a recent CNBC interview, Ms. Nabiullina remarked on Russia’s increasing gold reserves, saying, “We base ourselves upon the principles of diversification of our international reserves and we bought gold not only last year but during the previous years. Our gold mining industry is very well developed and it is ready to supply gold.” Dmitry Tulin, who manages monetary policy at the Central Bank of Russia, said, "The price of gold swings, but on the other hand it is a 100% guarantee from legal and political risks." Russia is boosting gold holdings as defense against “political risks”.

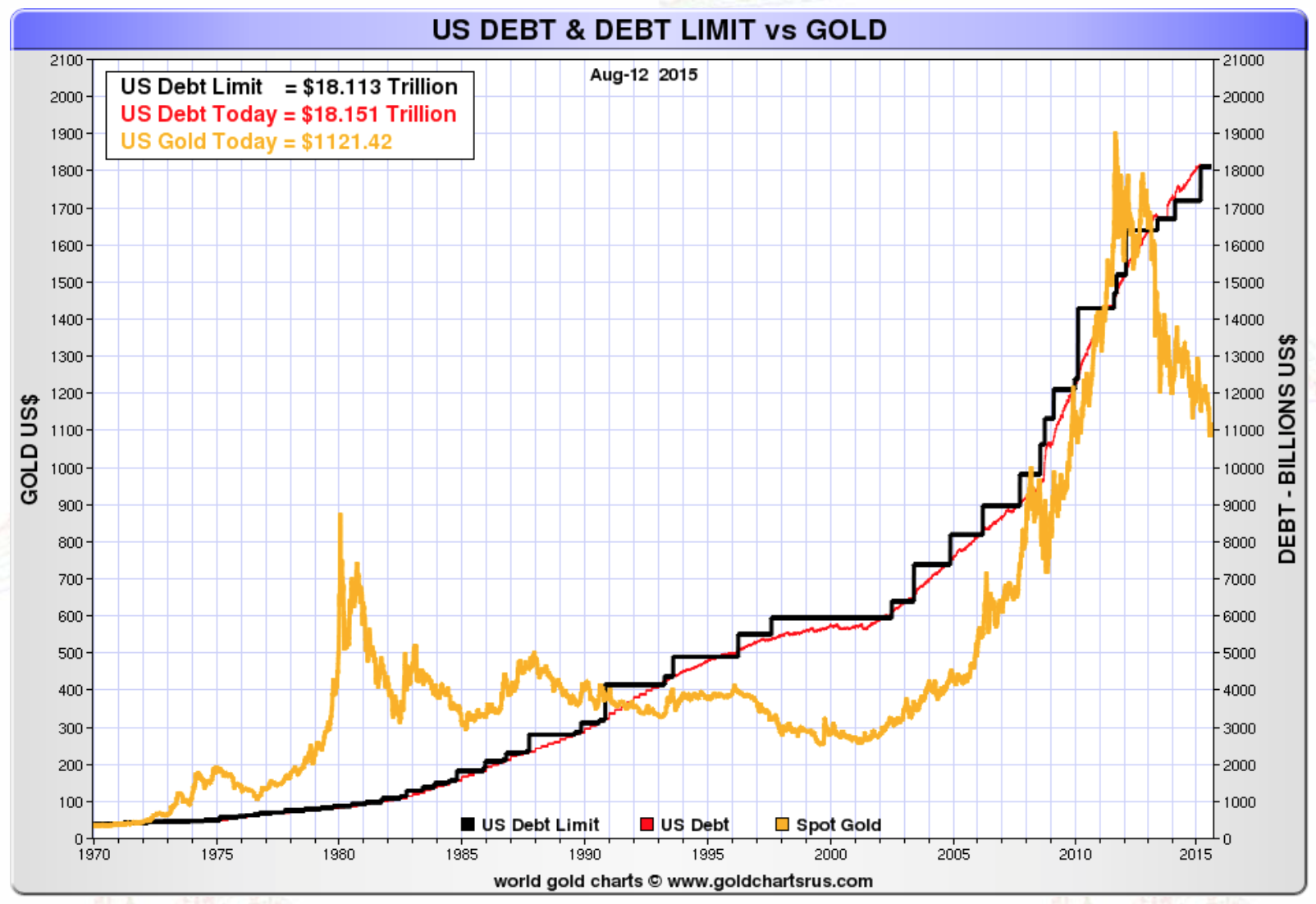

In 1997 Robert Mundell, Nobel prize of economics, wrote in an article, “The problem with the pure dollar standard is that it works only if the reserve country can keep its monetary discipline.” Aristotle said something similar 2,500 years ago: “In effect, there is nothing inherently wrong with fiat money, provided we get perfect authority and god-like intelligence for kings.” It is evident that since at least the collapse of Bretton Woods the U.S. has not kept its monetary discipline and has no intention to do it.

Dr. Mundell, in the same article, said, “The United States would not talk about international monetary reform … because a superpower never pushes international monetary reform unless it sees reform as a chance to break up a threat to its own hegemony … The United States is never going to suggest an alternative to its present system because it is already a system where the United States maximizes its seigniorage … the United States would be the last country to ever agree to an international monetary reform that would eliminate this free lunch (exorbitant privilege of the dollar)”. He seems to have been right. The U.S. is dragging its feet. The U.S. has not yet ratified the IMF reforms agreed even by the U.S. government in 2010. I doubt it will pass before the U.S. election at the end of 2016. This has upset not only China and Russia, but also the European Union and most of the international community.

During the 2008 crisis that almost succeeded in bringing down the current international monetary system, gold made a stunning comeback into the system. During the crisis, gold became the only accepted guarantee in order to get liquidity. What was significant was that after having been ignored for decades, gold was coming back into the international monetary system via settlements of the Bank for International Settlements (BIS). These transactions themselves confirmed that gold was coming back into the system. They revealed the poor state of the financial system before the crisis and showed how gold has indirectly been mobilized to support the commercial banks. Gold’s old emergency usefulness has resurfaced, albeit behind closed doors at BIS in Basel, Switzerland. Since the 2008 crisis both China and Russia have accelerated their purchases and accumulation of gold by any means possible as it can be observed in the chart below.

Since 2010 we have been in a G-0 world (no dominating power), in currency and gold wars and a new cold war. The world desperately needs a new world order and a new international monetary system. Will it happen after a major collapse and possibly war or through collaboration and consensus avoiding a war? It is evident to me that, as Dr. Mundell said in 1997, “Gold is going to be a part of the structure of the international monetary system for the 21stcentury, but not in the way it has been in the past.” What form will it take? It’s hard to say now. In this adversarial environment of a cold war and currency/gold wars I can hardly see a fiat monetary system succeed (fiat SDR). That requires trust and consensus at the international level between countries. A détente, disarmament and collaboration environment was there between 1990 (end of cold war) and 2008 (start of new cold war and currency wars), but no more.

In the conflictual environment we are now in, it looks more and more to me that gold will impose itself as the de facto money. Jim Rickards, in Currencies after the Crash, edited by Sara Eisen, said, “When all else fails, possibly including a new SDR plan, gold is always waiting in the wings as a stable, widely accepted store of value and universal money. In the end, a global struggle between gold and SDRs for supremacy as “money” may be the next great shock added to the long list of historic shocks to the international monetary system.” Any fiat SDR international settlement currency will only be postponing the inevitable “big reset” to some form of gold standard.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.