In a speech in 2011 to the Empire Club of Canada and the Canadian Club of Toronto, Mark Carney, then governor of the Bank of Canada and present governor of the Bank of England, speaking of the international monetary system, said that the Minsky moment had arrived. A Minsky moment is a sudden major collapse of asset values, which is part of the credit cycle or business cycle. Such moments occur because long periods of prosperity and increasing value of investments lead to increasing speculation using borrowed money. Governor Carney said, “Debt tolerance has decisively turned. The initially well-founded optimism that launched the decades-long credit boom has given way to a belated pessimism that seeks to reverse it.” He also added, “As a result of deleveraging, the global economy risks entering a prolonged period of deficient demand. If mishandled, it could lead to debt deflation and disorderly defaults, potentially triggering large transfers of wealth and social unrest… History suggests that recessions involving financial crises tend to be deeper and have recoveries that take twice as long.”

Former Bank of England governor Mervyn King writes in a new book that, "Without reform of the financial system, another crisis is certain, and the failure... to tackle the disequilibrium in the world economy makes it likely that it will come sooner rather than later."

According to Mr. William White, former chief economist at the Bank for International Settlements (BIS) and now chairman of the OECD's Review Committee, as reported by the International Business Times, "global debts have built up to such an extent that the world is facing another financial crash, worse than the one in 2007-08. It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something.” Mr. White also added that, "The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up… The only question is whether we are able to look reality in the eye and face what is coming in an orderly fashion, or whether it will be disorderly." Not to forget the past chairman of the U.S. Fed, Ben Bernanke, who recently said that “the system is incoherent”, speaking of the international monetary system. Now these are not your typical fear-mongering gold bugs. These are insiders, recent past and present managers of the international monetary system.

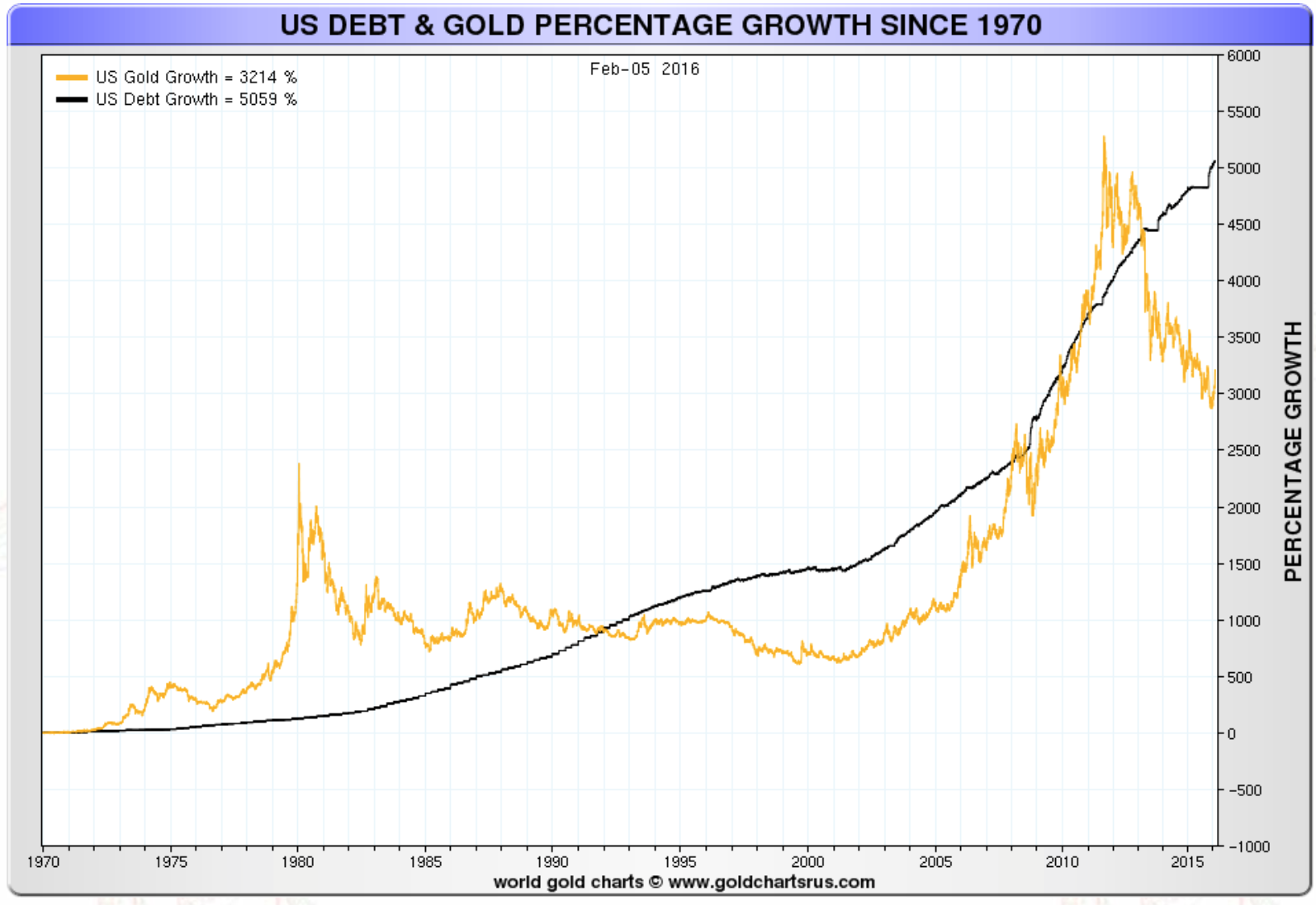

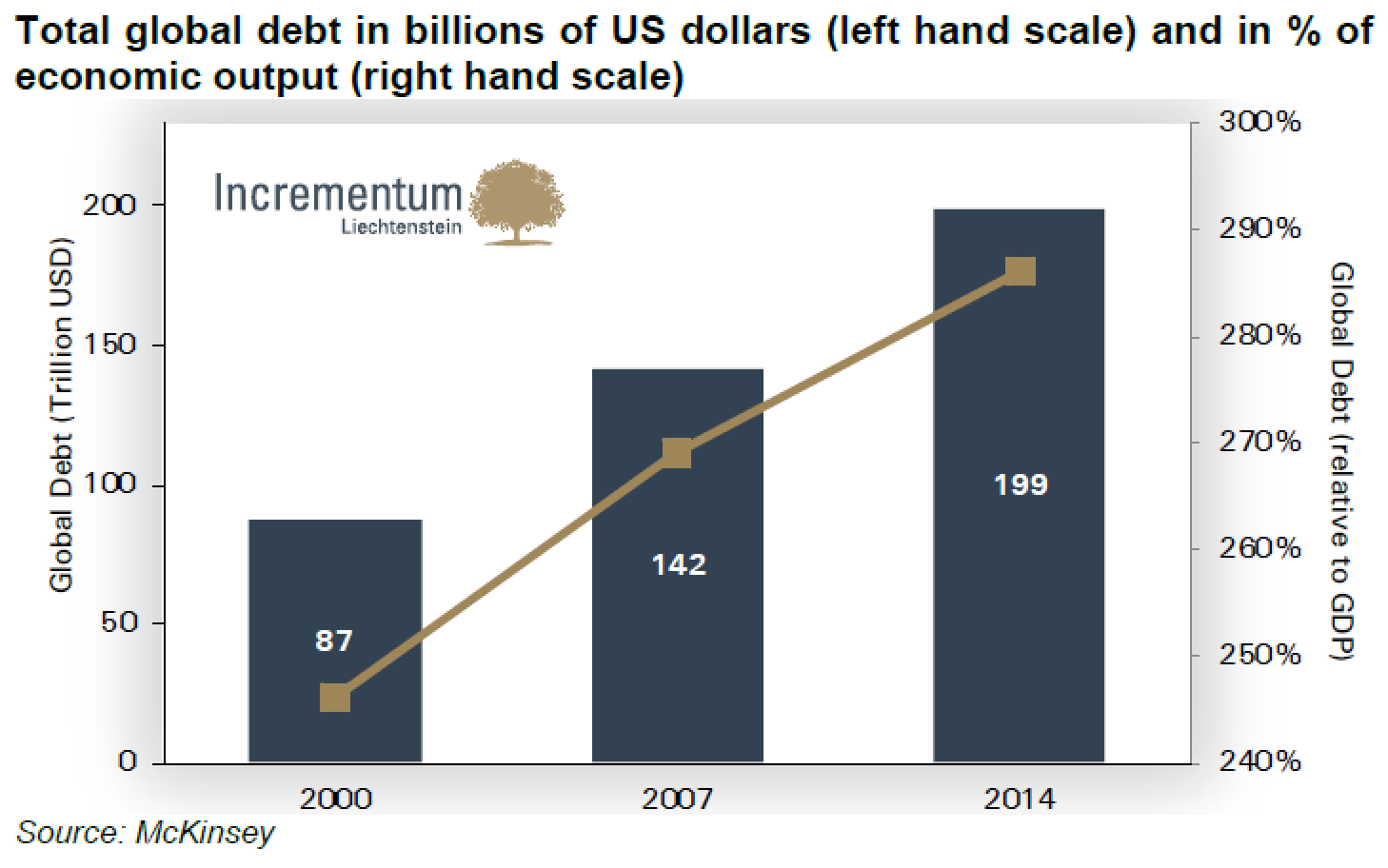

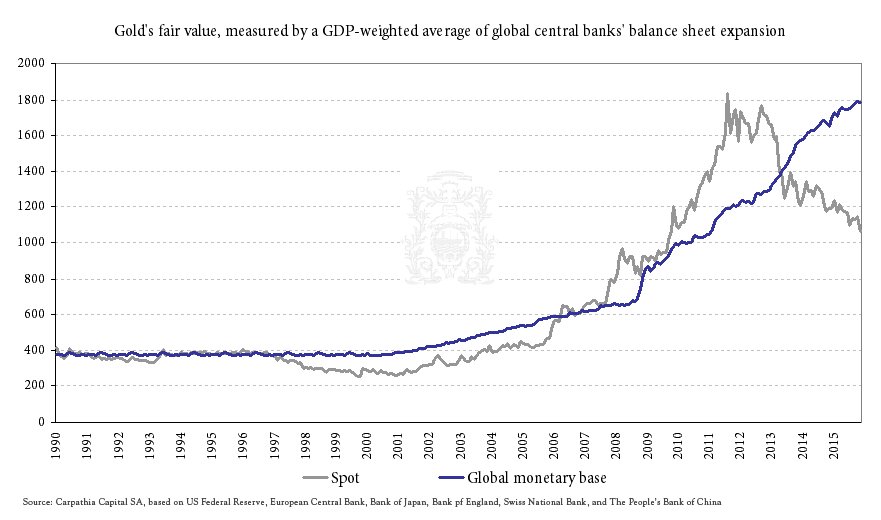

As you can see in the charts below, U.S. debt increased constantly since the collapse of the gold exchange system in 1971 and accelerated after the 2008 financial crisis. This is unsustainable. Worse is that it is not only U.S. debt but global debt. Since 2000 global debt more than doubled, and since the 2008 financial crisis, it increased by 40%. Fiat currencies depend on trust and when trust collapses they depend on state coercion and repression. In the last two years we have seen central bankers and economists proposing banning cash for the purpose of imposing negative interest rates or, in other words, to be able to confiscate savings without citizens being able to protect themselves.

But people are not stupid and we have seen recently a substantial increase in gold and silver purchases, going from the one-gram bar up to the 12.5 kg bar. Recent data also indicates a substantial increase in gold coin buying worldwide. At the same time developing countries’ central banks have been accumulating gold on a constant basis, trying to hedge their fiat Forex holdings and mostly in US dollars and euros. Ronald-Peter Stoeferle and Mark J. Valek, in the In Gold We Trust 2015 Report, say that, “As a market-chosen medium of exchange, gold is the antithesis to paper money. Debts are claims on future paper money payments.” And Prof. Antal Fekete says that gold is the ultimate extinguisher of debt. As people and central banks accumulate gold they are, at the same time, taking it off the market until at least the crisis ends with a reset of the international monetary system.

Prof. Fekete also says, “It is also ignored that the debt crisis is a direct consequence of exiling gold from the international monetary system. It cannot be replaced by the dollar or any other irredeemable currency. Under the dollar system debt simply cannot be extinguished.”

Still in February we found out that Canada liquidated what little gold (3 tonnes) it still held in its foreign exchange reserves. Don Drummond, a former high-ranking bureaucrat at Finance Canada, who helped start the policy for Canada to gradually sell off its gold reserves, is quoted by CTV News as saying that the sale was intended to diversify Canada’s US$81.5 billion in reserves with various foreign currencies. How can you call this decision diversification when 60% of Canada’s reserves are in US dollars and the rest in currencies linked to the US dollar? Isn’t it this kind of diversification that produced the CDS crisis in 2008 that almost took the international financial system down? Canada’s Finance Department, according to CTV News, said also that the sale was part of a long-standing policy of diversifying its portfolio by selling physical commodities like gold in order to invest instead in assets that are more easily traded. The word “trade” comes up again. It sounds very much to me like gambling for short term potential profit as it was done in the ‘90s by hedging official gold reserves. Portugal’s citizens are paying dearly today for this gambling called “trading”.

Prof. Fekete says, "Gold that circulates inspires confidence; gold kept locked indicates lack of confidence”. As I mentioned above, gold is presently being accumulated and taken out of circulation. This indicates a lack of trust in the present financial system. Soon there will be no gold available at least at this ridiculous price. Once the international monetary system is reset then gold will start circulating again. Until then smart money is accumulating gold and silver outside of the financial system from the Chinese housewives to the rich Londoners and most of the central banks that don’t already have some, except Canada. Gold is money but especially so in extreme circumstances.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.