Oil has earned the nickname of black gold, especially since the crisis of the ‘70s and the explosion of its price. What is the relation between gold and oil? Is there one?

Gold holds an important place in society, all over the world. This metal has been used as a store of value and money for at least 5,000 years. The story of oil is not a recent one also. Petroleum was already exploited in the Roman province of Dacia, today’s Romania, and in China, 2,000 years ago. But it became an essential element of politics, society and technology at the beginning of the 20th century. The invention of the combustion engine was the trigger of the future importance of oil.

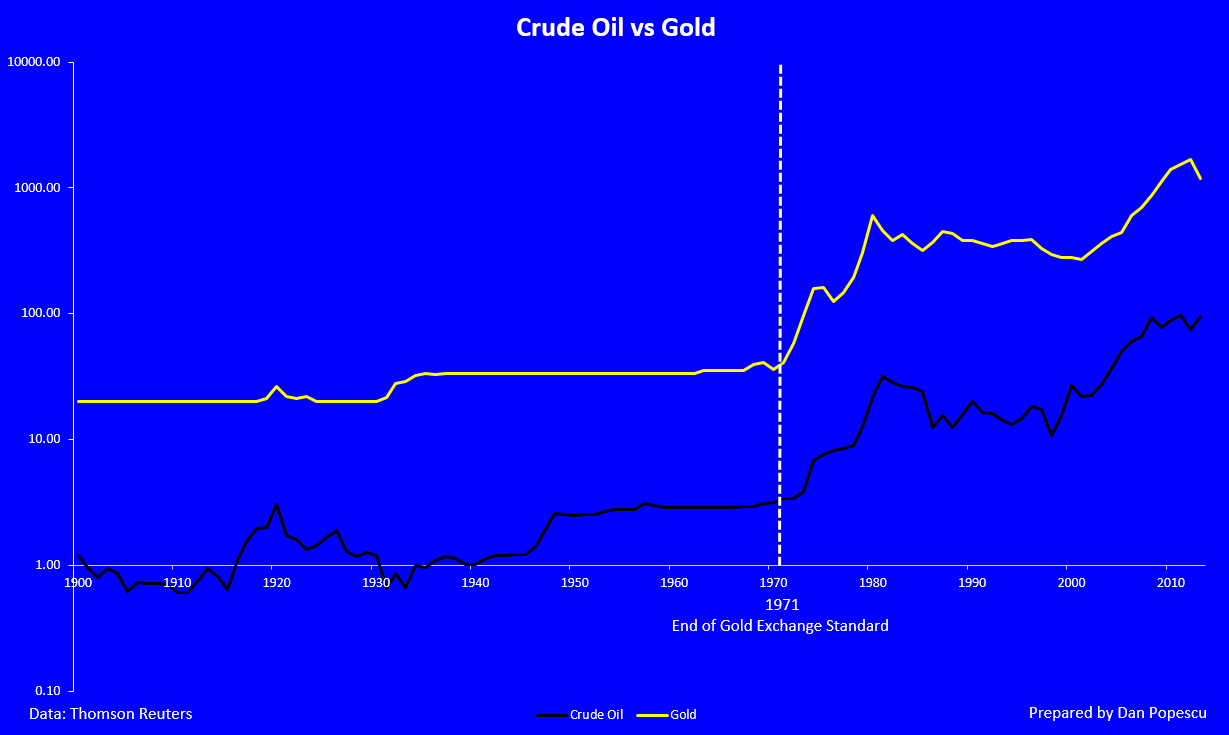

As we can see in the first chart, it seems that gold and oil prices have followed similar paths. From 1900 to 1970, the price of gold was fixed, whereas the price of oil fluctuated freely on the markets. Created in 1965, OPEC (Organisation of Petroleum Exporting Countries) started to intervene on the oil market to influence and manipulate its price, especially starting in 1970. With the end of the gold standard in 1971, the gold price also became free, but not entirely, because it remained under the influence and manipulation of the States.

Chart #1 : Crude Oil vs Gold

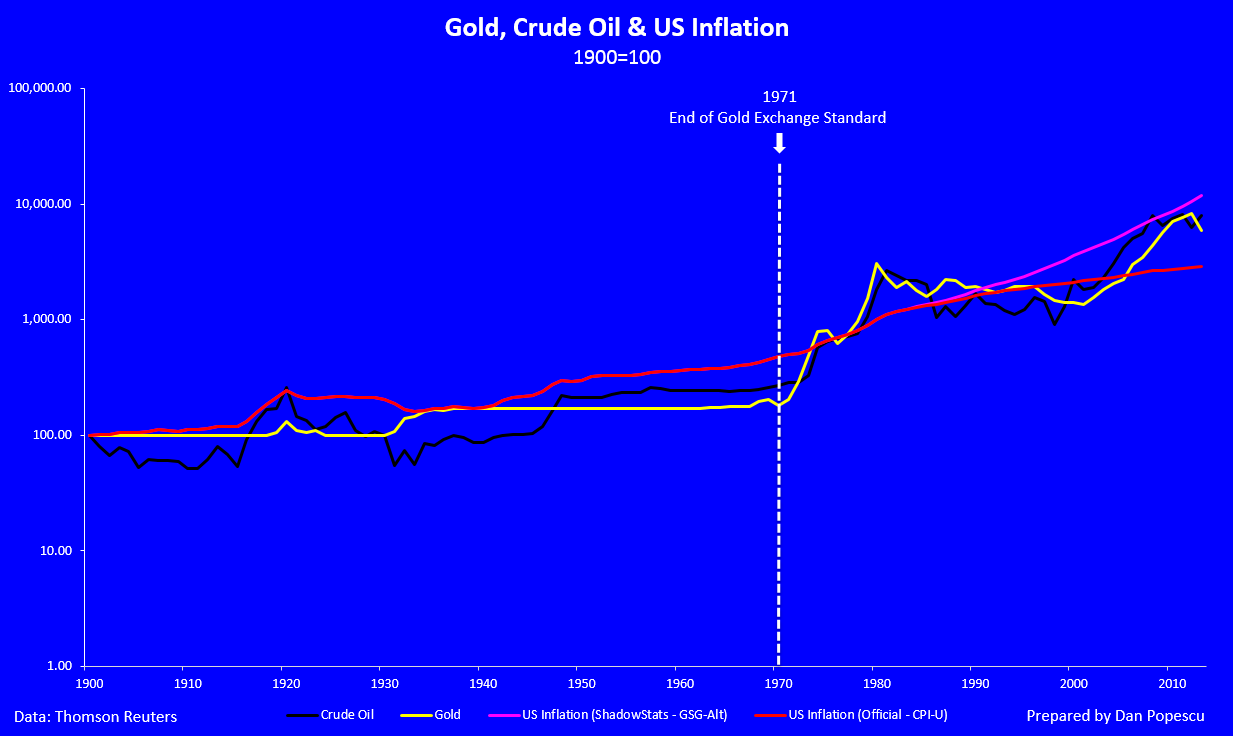

The main reasons that led the United States to abandon the gold standard were a deficit and debts that were rising out of control. The objective was to devaluate the dollar with inflation. We can observe, in chart #2, that both gold and oil have been following the inflation rate. Before 1971, when the gold price was fixed, it under-performed inflation and, as soon as it was freed, it quickly exploded, over-performing inflation.

Chart #2: Gold, Crude Oil and American Inflation (1900=100)

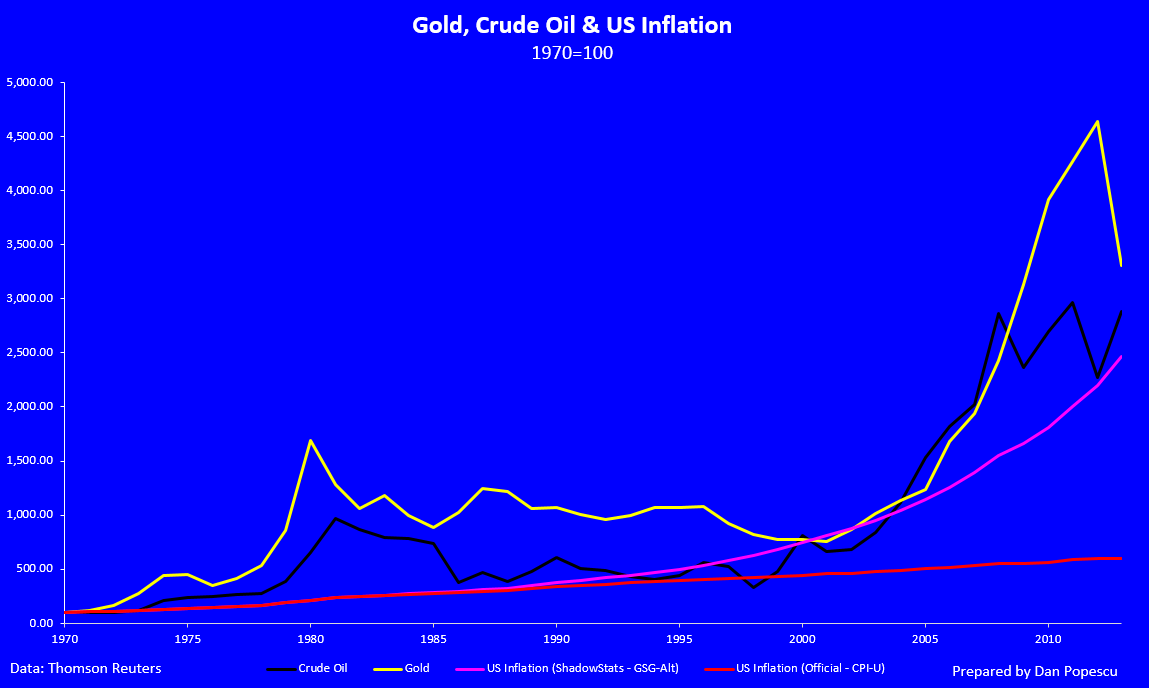

Let us now look at the evolution of the oil and gold prices since 1971. Gold and oil have remained not only above the official inflation rate, but also above ShadowStats’ one, which is calculated without the modifications brought by the American government in 1980 that under-estimate inflation.

Chart #3 : Gold, Crude Oil and American Inflation (1970=100)

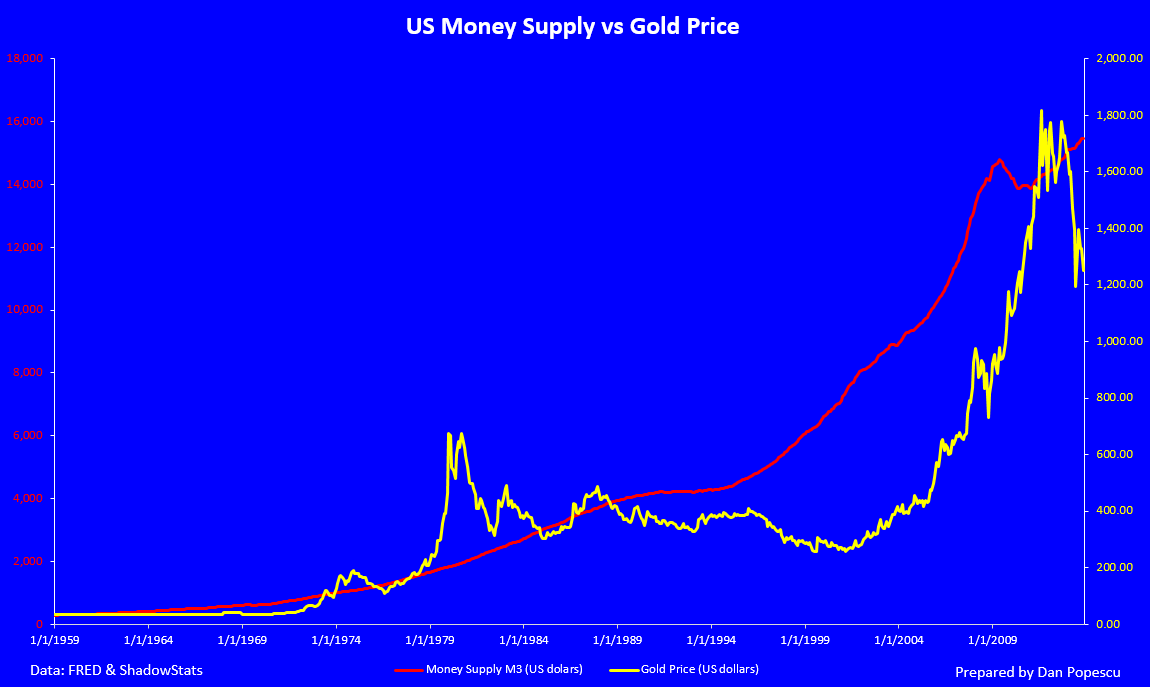

Oil is a commodity, but gold is mainly money. It follows the increase in money supply preceding inflation, as can be seen in chart #4. There is a delay between the moment when the money supply increases and the moment when we can observe its effects in the prices of products and services. Both gold and oil are affected by inflation, but gold also reacts to crises in the international monetary system because, today, it is mainly a reserve currency. We can observe that oil has tracked inflation, whereas the gold price has over-performed, in the dollar crisis of the ‘70s as well as in the 2008 financial crisis. This is due to the fact that gold is a monetary metal. Increases in oil prices are a cause of inflation, because it is such a major and essential ingredient for the functioning of the global economy.

Chart #4: United States Money Supply vs Gold Price

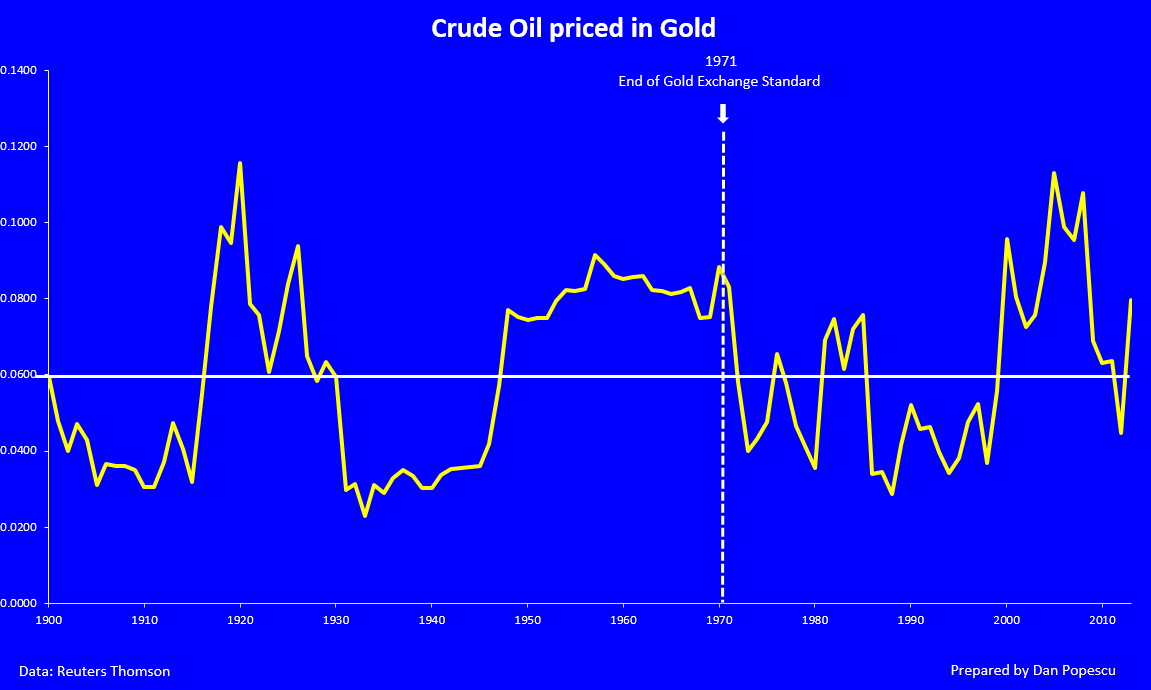

By calculating the price of oil in ounces of gold instead of US dollars, we eliminate almost all the inflation. Only fluctuations due to supply and demand remain for both (see chart #5). Outside of inflation, we can observe that the price of oil in ounces of gold does well in times of economic growth and not as well in periods of recession.

Chart #5: Crude Oil Priced in Ounces of Gold

Both gold and oil are traded in US dollars. Consequently, their price is linked to the strength of the dollar. Moreover, the strength of the dollar is determined by inflation. Therefore, it can be argued that prices of both share the same trend not because they mutually influence one another, but rather because their prices are influenced by a major common factor, inflation.

If dollars were to be abandoned as the sole currency for trading oil and if, gold also were not quoted solely in dollars, it would have a major effect on the demand for dollars, but it would not affect the relation between gold and oil. This seems to be the objective of several countries, but mainly China and Russia. The recent conflict between the United States and Saudi Arabia could trigger, if it gets worse, this disconnect between dollars and oil and dollars and gold.

The price of oil in ounces of gold plunged in 1973, when compared with 1971. In 1971, President Nixon abandoned the gold standard, which resulted in an increase in the price of gold and oil that reached $97.32/barrel in 1973. What would the gold price be today, based on historical ratios?

According to SRSrocco Report, gold prices based on historical oil/gold ratios, with an oil price of $102.03 (as of Feb. 21, 2014), are:

1981-2000 (18.6 ratio) = $1,897.76

1971-1980 (15.9 ratio) = $1,622.28

1961-1970 (20.0 ratio) = $2,040.80 (gold price was fixed)

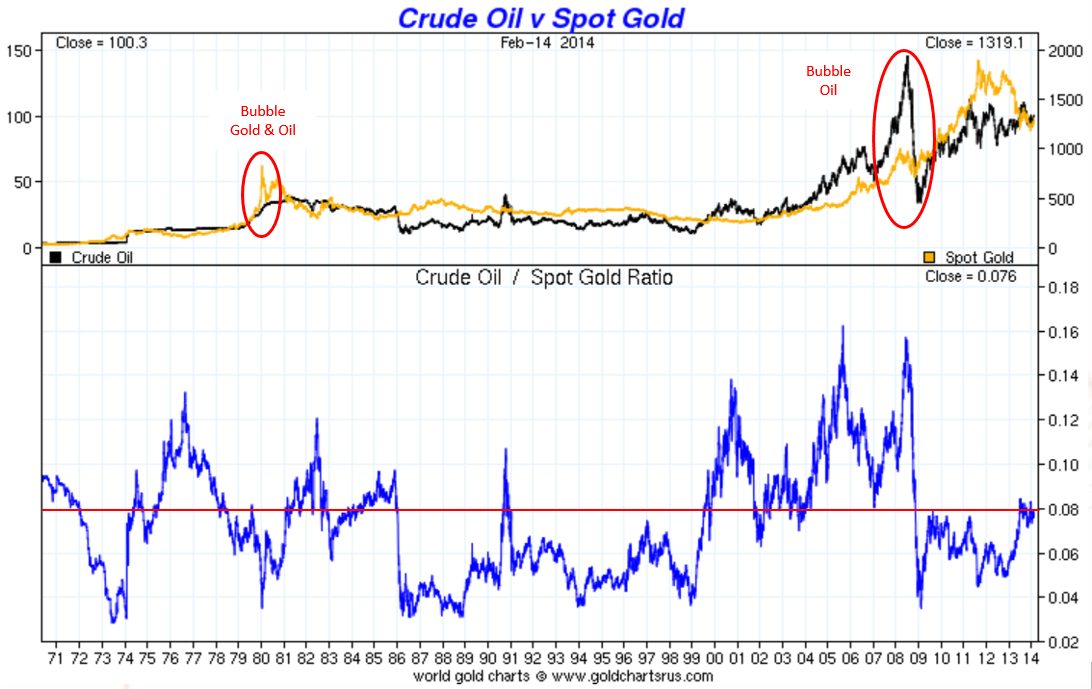

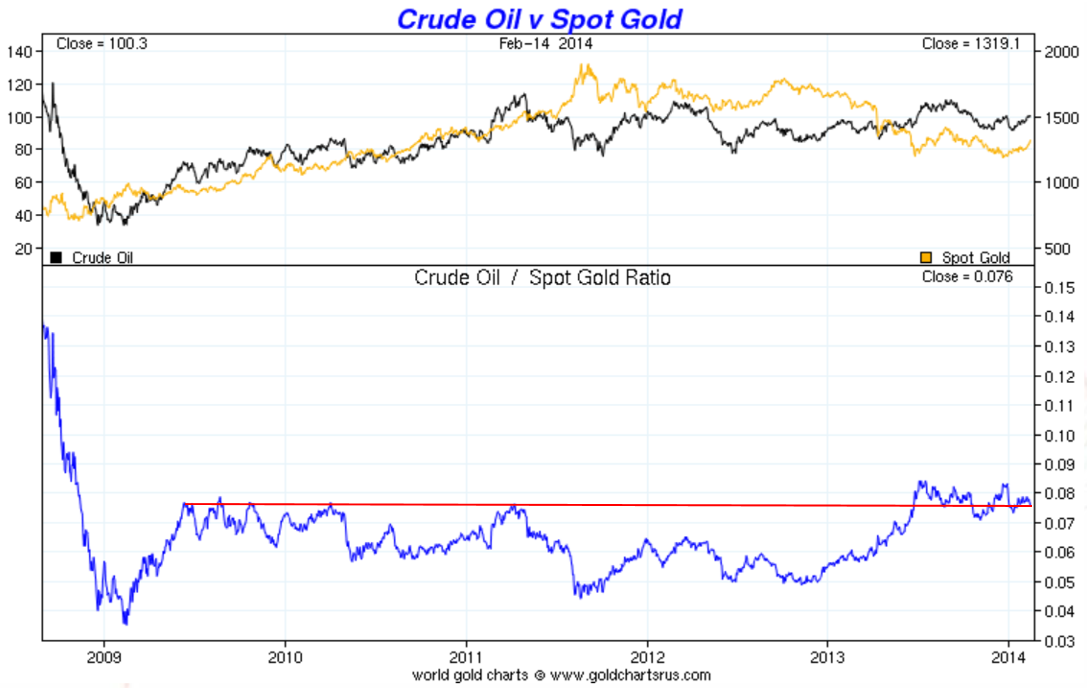

Today, the price of oil in ounces of gold seems within historical limits, whereas the price of gold should be around $1,760.02. We can also observe that, during the 2008 financial crisis, the gold price fell just a little while the price of oil tumbled really hard (chart #6).

Chart #6: Oil vs Gold Since the End of the Gold Standard in 1971

Chart #7: Oil vs Gold Since the 2008 Financial Crisis

According to the World Gold Council, for the last five years (until October 2013), gold’s performance (75.3%) was almost the same as oil’s (75.7%). The annualised composite growth rate for oil and gold was the same, 11.9%. The volatility of annualised returns (in US$) was 21.5% for gold and 18.7% for oil. The correlation on five years of returns in US dollars between gold and oil was only 0.38%.

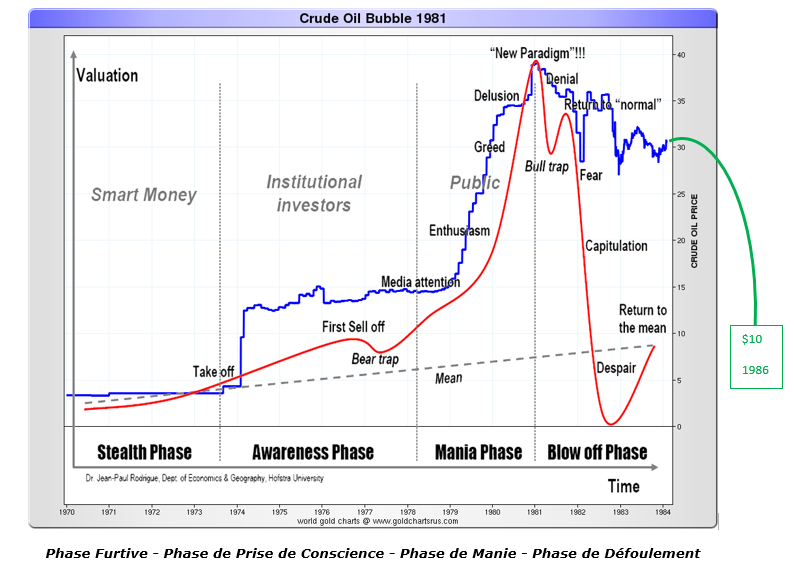

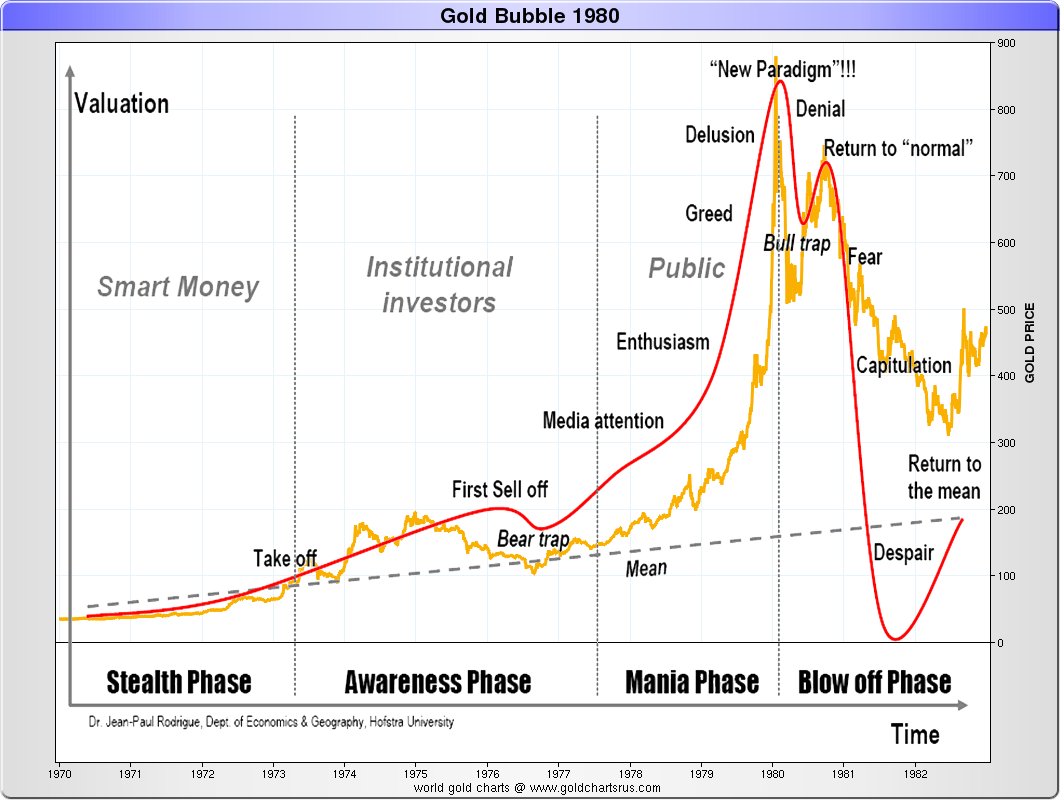

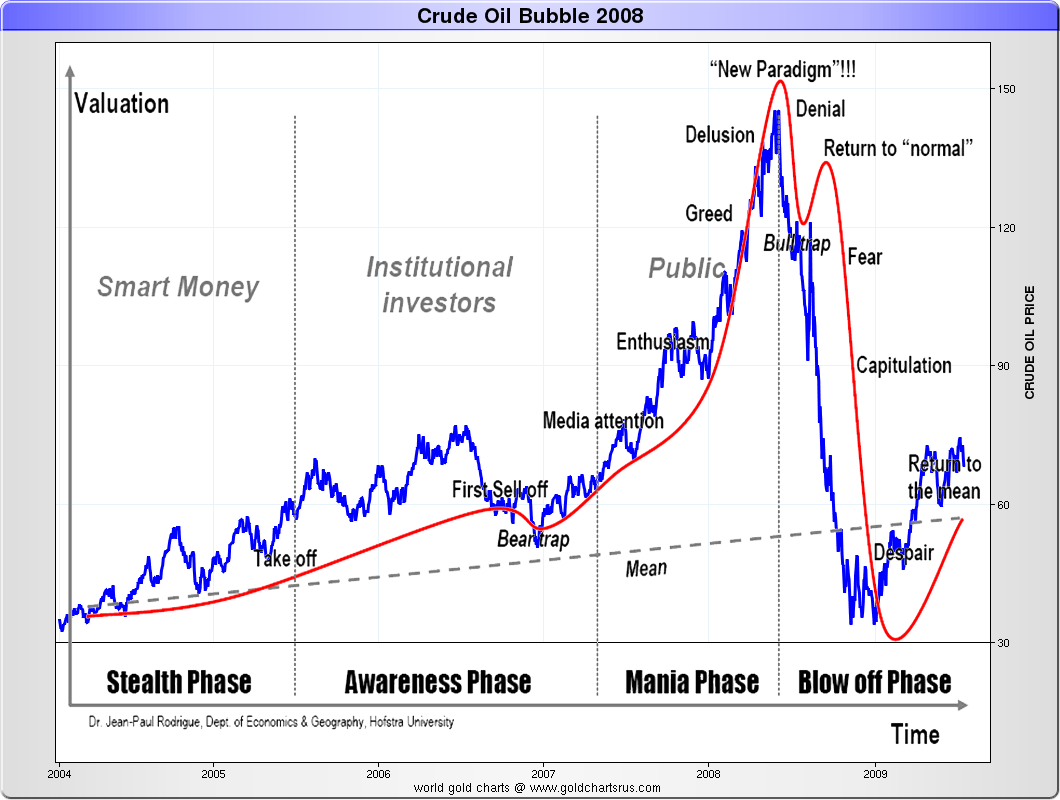

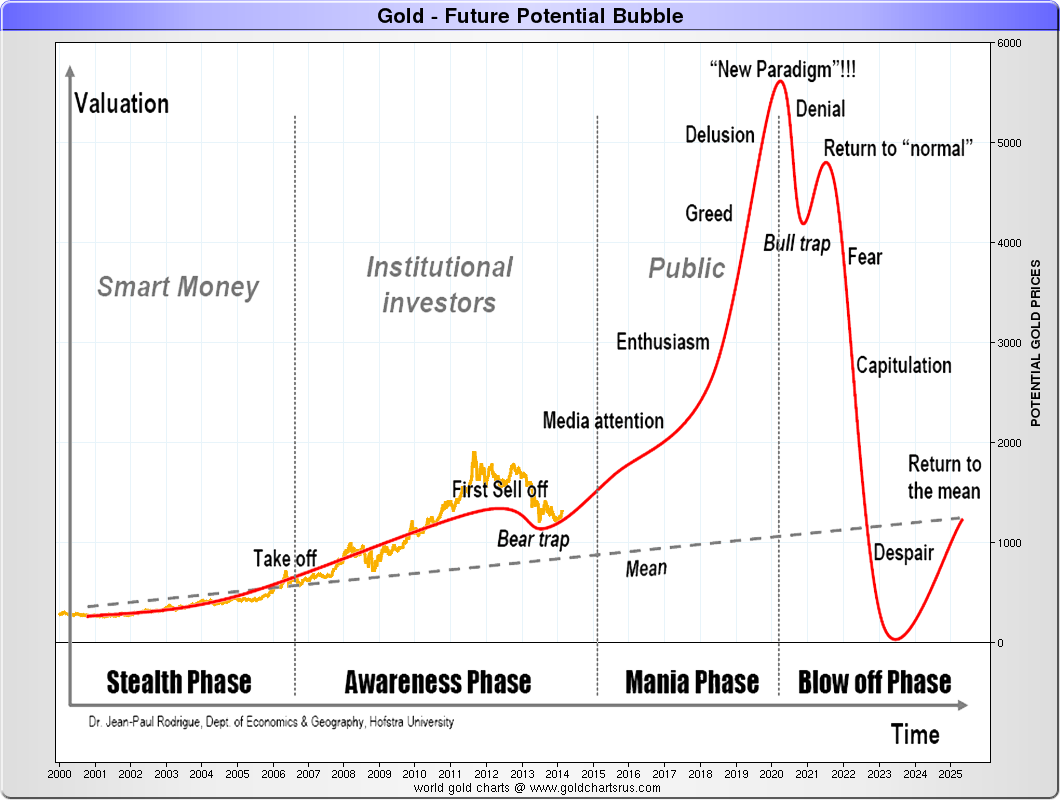

Let us now compare the three speculative bubbles of gold and oil since 1970: We see that oil (chart #8) and gold (chart #9) were in a speculative bubble in the ‘70s, whereas in 2008, only oil (chart #10) fits the typical speculative bubble model. However, we should notice that the oil bubble of the ‘70s fits only the bullish phase of the model, whereas the bearish phase took much longer to work itself through, reaching $10.42 only in 1986. Could this be due to manipulation by the oil cartel (OPEC) to slow down its fall? I believe so. As far as gold is concerned (chart #11), it seems to be, since 2000, only at the end of the awareness phase’s bear trap that will lead to the mania phase this year or the next at the latest.

Chart #8: Oil’s 1981 Speculative Bubble

Chart #9: Gold’s 1980 Speculative Bubble

Chart #10: Oil’s 2008 Speculative Bubble

Chart # 11: Possible Future Gold Speculative Bubble

Today, oil constitutes possibly the most important commodity in the global economy, and gold is the only physical reserve currency without counterparty risk that is not debt. Changes in oil prices are quickly taken into account in the measures taken by government regarding inflation, thus leading to monetary policy changes that have major impacts on the economy. Since gold is physical liquid money and oil is an essential commodity for the economy, it is normal that they correlate negatively in real prices. When the economy goes well, demand for oil increases, whereas demand for gold diminishes. However, if inflation hits, the nominal prices of both assets increases at the same time with inflation (charts #1 and 2). Let us not forget that inflation brings down the value of the medium of exchange (dollar, euro etc.) but not the value of gold or oil.

Let us not forget also that today, still, gold and oil prices are manipulated: gold by central banks and oil by OPEC. What do they gain? Well, it is in OPEC’s interest that the price of oil goes up, but not too much, so not as to hamper demand, whereas central banks have an interest in gold not moving up too fast to avoid having people abandon their fiat currencies (dollar, euro etc.). However, there are limits to those manipulations, and I think they only achieve slowing down the normal course of things.

More charts:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.