The price of gold is rising — more in dollars than in euros, due to the depreciation of the US currency — as is that of bitcoin. Equities, too, are on the rise: the S&P 500 has already wiped out the losses associated with the tariffs mini-crisis. This in itself is a little odd, as gold and equities generally move in opposite directions. In times of growth, investors logically turn to equities, and when fears arise, to gold. Sovereign bonds are in trouble overall — as evidenced by the rise in yields — with US debt in the lead (read “Bessent's Crazy Gamble”), while real estate stagnates or declines, in the United States and in Europe.

How should we interpret these trends? Debt is in bad shape, especially its premium component, US Federal debt, due to Trump's budget deficit, which is becoming increasingly difficult to finance — we've talked about it. And real estate is a debt market — most acquisitions are made on credit — which suffers when rates rise. So, instead of arbitraging between various investments according to economic and financial data, we are witnessing the beginnings of a flight (but not yet a panic) from the bond market towards what has intrinsic value.

The sums involved are colossal: we now think in terms of trillions of dollars (US debt = $36 trillion). When capital movements are triggered, their power is earth-shattering. For the time being, transfers remain measured, but the points of departure and arrival are clearly visible.

In the world of crypto-assets, one term has gained some notoriety: flippening. It appeared in 2017 to describe the possibility of ether (ETH) one day overtaking bitcoin (BTC) in capitalization. Today, it's no longer talked about, as the gap is so wide and continues to widen. Some bitcoiners have taken up the term flippening to designate the moment when bitcoin will overtake gold in total value. But with a current ratio of 1:10, this prospect is still a long way off.

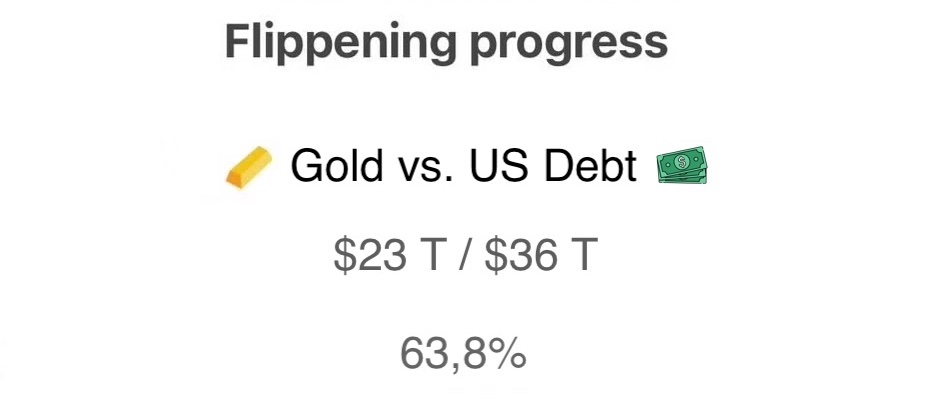

On the other hand, I would like to popularize a new flippening: when gold ($23 trillion for 216 000 tons in total in the world) will overtake the US federal debt ($36 trillion), to become the world's leading asset (the first homogeneous asset, real estate or the stock market designating a multitude of different assets). We're almost there!

Can you imagine the global upheaval such a tipping point would provoke? It could well happen sooner than we think, in a handful of years at most... Let's go for gold flippening on US debt!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.