All Empires die without fail, so do all Fiat currencies. But gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years.

In early 2002 we made major investments in physical gold for our investors and ourselves. At the time gold was around $300. Our primary objective was wealth preservation. The Nasdaq had already crashed 67% but before the bottom was reached, it lost another 50%. The total loss was 80% with many companies going bankrupt.

In 2006, just over 4 years later, the Great Financial Crisis started. In 2008, the financial system was minutes from imploding. Banks like JP Morgan, Morgan Stanley and many others were bankrupt – BANCA ROTTA – (see my article First Gradually then Suddenly, The Everything Collapse)

Virtually unlimited money printing postponed the collapse and since 2008 US total debt has almost doubled to $100 trillion.

Gold backing of a currency doesn’t always solve a debt problem but it certainly makes it more difficult for the government to cook the books which they do without fail.

Bonfire of the US budget books

So tricky Dick (Nixon) couldn’t make ends meet in the late 1960s – early 70s partly due to the Vietnam war.

Thus in 1971 Nixon, by closing the Gold window, started the most spectacular bonfire of the US government budget books. How wonderful, no more accountability, no more shackles and no more gold deliveries to de Gaulle in France who was clever to ask for gold instead of dollars in debt settlement from the US.

So from August 1971, the US embarked on a money printing and credit expansion bonanza never seen before in history.

Total US debt went from $2 trillion in 1971 to $200 trillion today – up 100X!

Since most major currencies were linked to the dollar under the Bretton Woods system, the closing of the gold window started a global free for all with the printing press (including bank credit) replacing REAL MONEY i.e. GOLD.

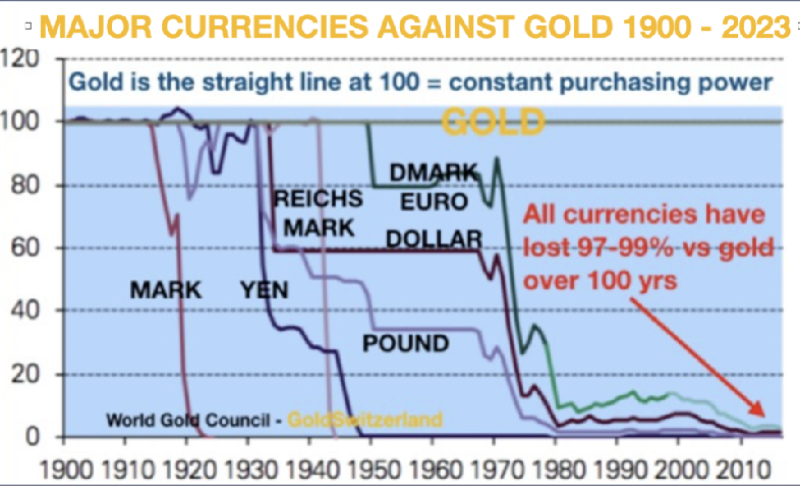

The consequences of this “temporary” move by Nixon is that all Fiat or paper money has declined by 97-99% since 1971.

The price of assets have obviously inflated correspondingly. In 1971 total US financial assets were $2 trillion. Today they are $130 trillion, up 65X.

And if we include off balance sheet assets including the shadow banking system and derivatives, we are looking at assets (which will become liabilities) in excess of $2 quadrillion.

I forecast the derivative bubble and demise of Credit Suisse in this article (Archegos & Credit Suisse – Tip of the Iceberg) and also in this one (The $2.3 Quadrillion Global Debt Time Bomb)..

Heads, gold wins – tails, gold wins

Luke Gromen in his Tree Rings report puts forward two options for the world economy which can be summarised as follows:

1. Dedollarisation continues, the Petrodollar dies and gold gradually replaces the dollar as a global commodity trading currency especially in the commodity rich BRICS countries. This would allow commodity prices to stay low as gold rises and drives a virtuous circle of global trade.

If the above option sounds too good to be true especially bearing in mind the bankrupt status of the global financial system, Luke puts forward a much less pleasant outcome.

And in my view, Luke’s alternative outcome is sadly more likely, namely:

2. “China, the US Treasury market, and the global economy implode spectacularly, sending the world into a new Great Depression, political instability, and possibly WW3…in which case, gold probably rises spectacularly all the same, as bonds and then equities scramble for one of the only assets with no counterparty risk – gold. (BTC is another.)”

Yes, Bitcoin could go to $1 million as I have often said but it could also go to Zero if it is banned. Too binary for me and not a good wealth preservation risk in any case.

As Gromen says, there is a virtuous case and there is a vicious case for the world economy.

But above both cases shines GOLD!

So why hold the worthless paper money or bubble assets when you can protect yourself with Gold!

For the CBO bad times don’t exist

The US Central Budget Office – CBO – has recently made a 10 year forecast.

Obviously, the CBO assumes no depression or even a little recession in the next 10 years!

Isn’t it wonderful to be a government employee and have a mandate to only forecast GOOD NEWS!

And although the CBO forecasts a debt increase of $21 trillion by 2034 to a total of $55 trillion, they expect inflation to stay around 2%!

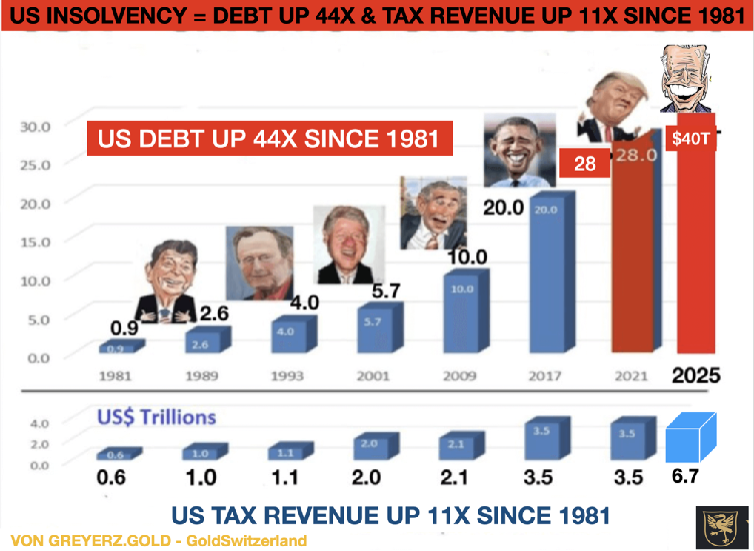

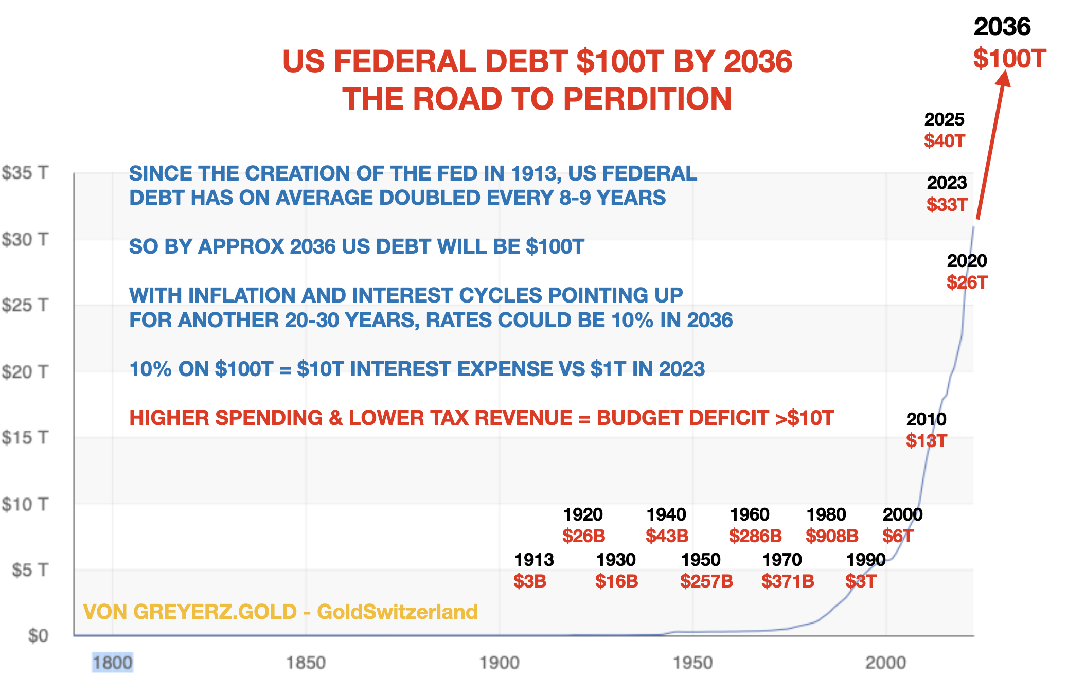

As I have stated in many articles, the US Federal debt has doubled every 8 years on average since Reagan became President in 1981!

I see no reason to deviate from that long term trend although there can be short term deviations. So based on that simple but historically accurate extrapolation, I could forecast the increase from $10 trillion to $20 trillion debt in 2009 when Obama took over from Bush Jr.

Extrapolating this trend, the US Federal Debt will reach $100 trillion in 2036.

With debts and deficits increasing exponentially, it is not unlikely that as inflation catches fire again, $100 trillion Federal Debt will be reached earlier than 2036.

Just think about a big number of bank failures, which is guaranteed, plus major defaults in the $2+ quadrillion derivative market. Against such dire background, it would be surprising if US debt doesn’t go far beyond $100 trillion by the mid 2030s!

Stock market bubble & leadership swaps

Investors and many analysts are still bullish about the stock market. As we know, markets will move higher until all investors, especially retail, are sucked in and until most of the shorts have liquidated their positions.

It has been a remarkable bull market based on unlimited debt creation. Nobody worries about the fact that 7 stocks are creating this mania. These stocks are well known to most investors: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

These Magnificent 7 have a total market cap of $13 trillion. That is the same as the combined GDP of Germany, Japan, India and the UK! Only the US and China are bigger.

When 7 companies are greater than 4 of the biggest industrial economies in the world, it is time to fire the management of these countries and maybe do a swap.

Gates, Cook, Musk taking over Germany, UK & France

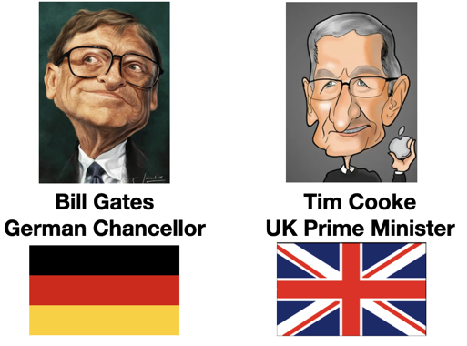

What about Germany’s Chancellor Scholz running Amazon. Or Rishi Sunak in the UK being in charge of Microsoft? How long would it take them to destroy these companies? Not many years in my view. They would quickly double the benefits for workers and increase debts to unsustainable levels.

But Germany and the UK would most certainly benefit from Bill Gates of Microsoft taking on Germany and Tim Cook of Apple running the UK. They would of course need dictatorial powers in order to take the draconian measures required. Only then could they slash inefficiencies, halve benefits and reduce taxes by at least 50%.

If the entrepreneurs just got a very small percentage of the improvement in the countries’ finances as remuneration, they would make much more money than they are currently.

Even more fascinating would be to see Elon Musk as French President. He would fire at least 80% of state employees and by doing that he might even get the militant French unions on his side and get the country back on its feet.

An interesting thought experiment that of course will never happen.

Why is everyone waiting for new gold highs in order to buy???

For almost 25 years I have been standing on a soapbox to inform investors of the importance of wealth preservation.

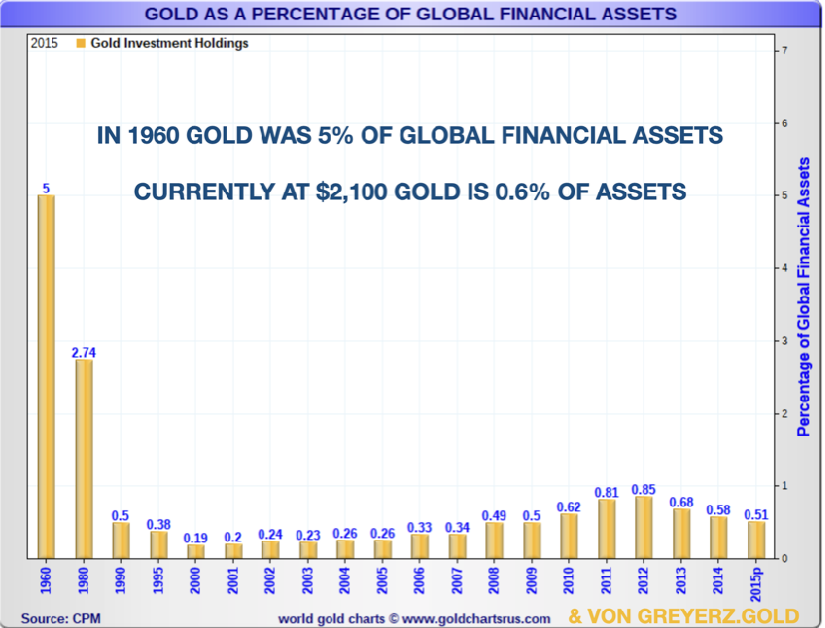

Still only just over 0.5% of global financial assets have been invested in gold. In 1960 it was 5% in gold and in 1980 when gold peaked at $850, it was 2.7%.

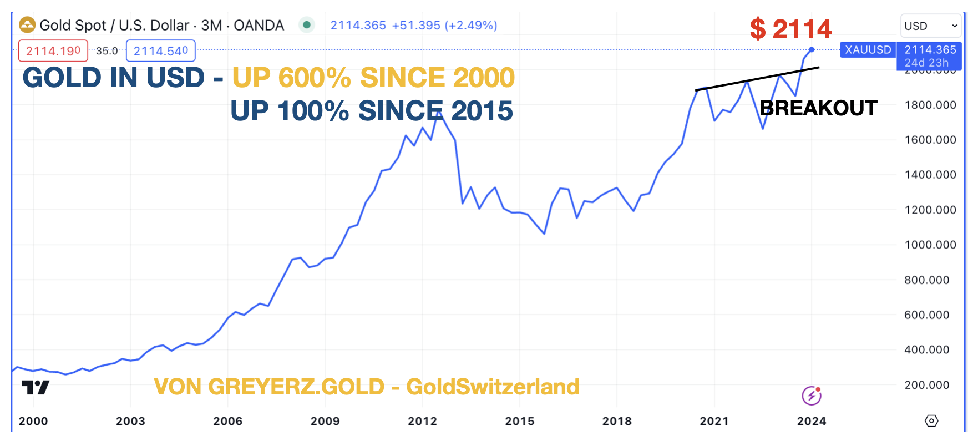

For a quarter of a century, gold has gone up 7- 8X in most Western currencies and exponentially more in weak currencies like the Argentine Pesos or Venezuelan Bolivar.

In spite of gold outperforming most asset classes in this century, it remains at less than 1% of Global Financial Assets – GFA. Currently at $2,100 gold is at 0.6% of GFA.

We have liftoff!

So gold has now broken out and very few investors are participating.

This stealth move that gold has made has left virtually every investor behind as this table shows:

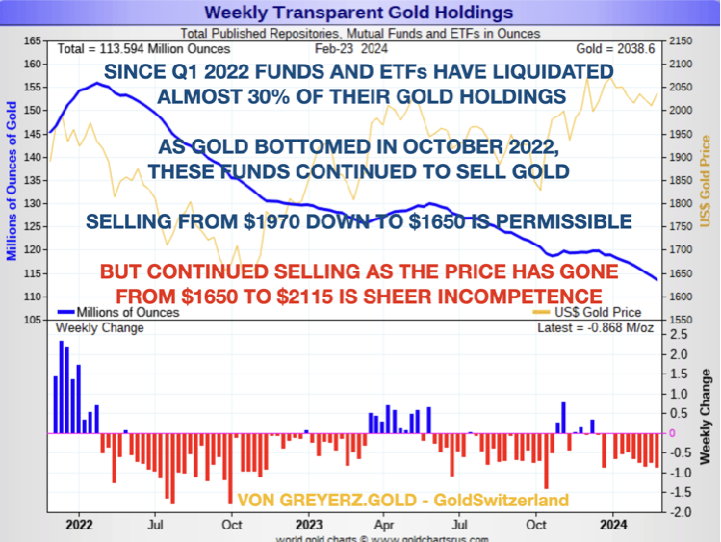

The clever buyers are of course the BRICS central banks. Almost all of their purchases are off market so in the short term it has only a marginal effect on the gold price.

But now the squeeze has started as my good friend Alasdair Macleod explains so well on King World News. The Comex was never meant for physical deliveries but only for cash settlements. But now buyers are standing for physical delivery. We have also seen last month major exports of gold from the US to Switzerland. These are either Comex 400 ounce bars or US government bars sold/leased and sent to the Swiss refiners and broken down to 1 kg bars for onwards export to the BRICS. These bars will never return again even if they are only leased and not sold.

The above process will one day bring panic to the gold market as there will be nowhere near enough physical gold for all the paper claims.

So for any gold investors who don’t hold physical gold in a safe jurisdiction, I suggest that they quickly move their gold to a private vault where they have personal access, preferably in Switzerland or Singapore.

So NO FRACTIONAL GOLD OWNERSHIP, NO GOLD ETFs or FUNDS and NO GOLD IN BANKS!

At least not if you want to be sure to get hold of your gold as the gold squeeze starts.

Gold is on the cusp of a major move

Having just broken out, gold is now on its way to much, much higher levels.

As I keep on saying, forecasting the gold price is a mug’s game.

What is the purpose of predicting a price level when the unit you measure gold in (USD, EUR, GBP etc) is continually debasing and worth less every month.

All investors need to know is that every single currency in history has without fail gone to ZERO as Voltaire said already in 1727.

Since the early 1700s, over 500 currencies have become extinct, most of them due to hyperinflation.

Only since 1971 all major currencies have lost 97-99% of their purchasing power measured in gold. In the next 5-10 years they will lose the remaining 1-3% which of course is 100% from here.

But gold will not only continue to maintain purchasing power, it will do substantially better. This is due to the coming collapse of all bubble assets – Stocks, Bonds, Property etc. The world will not be able to avoid the Everything Collapse or First Gradually then Suddenly – The Everything Collapse as I wrote about in two articles in 2023.

Yes, gold is on the cusp of a major move as:

- Wars continue to ravage the world.

- Inflation rises strongly due to ever increasing debts and deficits.

- Currency continues their journey to ZERO.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth.

Gold as cheap as in 1971 or 2000

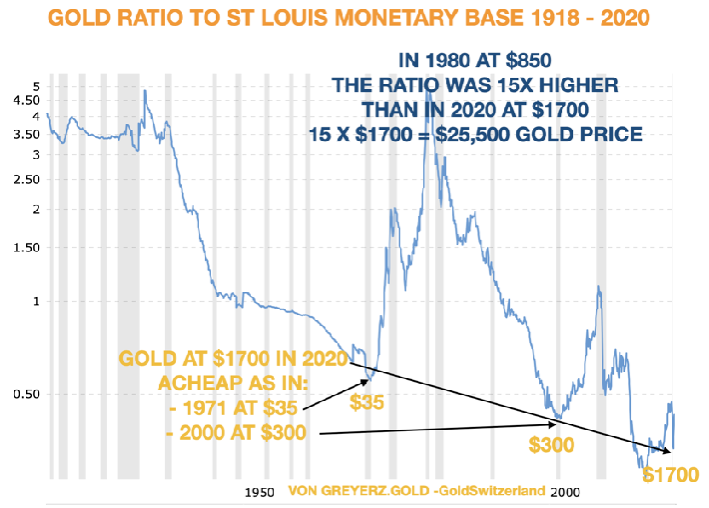

The chart below indicates that gold in early 2020 at $1700 was as cheap as in 1971 at $35 and in 2000 at $300 in relation to money supply.

At this point we do not have an updated chart but it is our estimate that the monetary base has probably kept pace with the gold price meaning that the level in 2024 is similar to 2020.

So let me repeat my mantra:

Please jump on the Gold Wagon while there is still time to preserve your wealth.

The coming surge in gold demand cannot be met by more gold because more than the current 3000 tonnes of gold per annum cannot be mined.

THUS THE ONLY MEANS TO SATISFY THE COMING GOLD MANIA IS THROUGH MUCH HIGHER PRICES.

Original source: VON GREYERZ AG

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.