The incident that occurred on the night of November 3 to 4 marks a silent but decisive turning point. What initially appeared to be merely a technical loss on a DeFi protocol – i.e., a decentralized finance platform where users lend, borrow, or exchange their cryptocurrencies directly without going through a bank – turned into a real stress test for the entire crypto liquidity system.

A decentralized finance protocol called Stream revealed an estimated loss of $93 million, or nearly a third of its assets under management. The fund managed approximately $285 million in loans secured by digital assets such as xUSD, xBTC, and xETH – tokenized versions of the dollar, bitcoin, and ether. In practice, Stream functioned as a lending platform: investors deposited stablecoins (often USDC or USDT) to generate a return, while others borrowed these funds by leaving crypto assets as collateral.

But the mechanism suddenly seized up. The value of the collateral deposited – notably xUSD, used as collateral on other protocols – collapsed. The fund found itself unable to return all of the deposits. Faced with this disaster, Stream suspended all deposit and withdrawal operations and hired the US law firm Perkins Coie LLP, represented by attorneys Keith Miller and Joseph Cutler, to conduct a full investigation into the causes and extent of the loss. In the meantime, investors no longer have access to their funds. Stream officials promise regular updates, but acknowledge that no accurate assessment of secondary losses is yet possible.

This default immediately contaminated part of the ecosystem. Several DeFi projects – including Elixir and Treeve – had placed a significant portion of their reserves in Stream. The stablecoin deUSD, issued by Elixir, was exposed to the tune of $68 million, or 65% of its total reserves. Treeve, through its scUSD stablecoin, was also involved in a complex chain of re-mortgages, using xUSD as collateral on other platforms (including Silo, Euler, and Mithras). These interconnections made contagion inevitable.

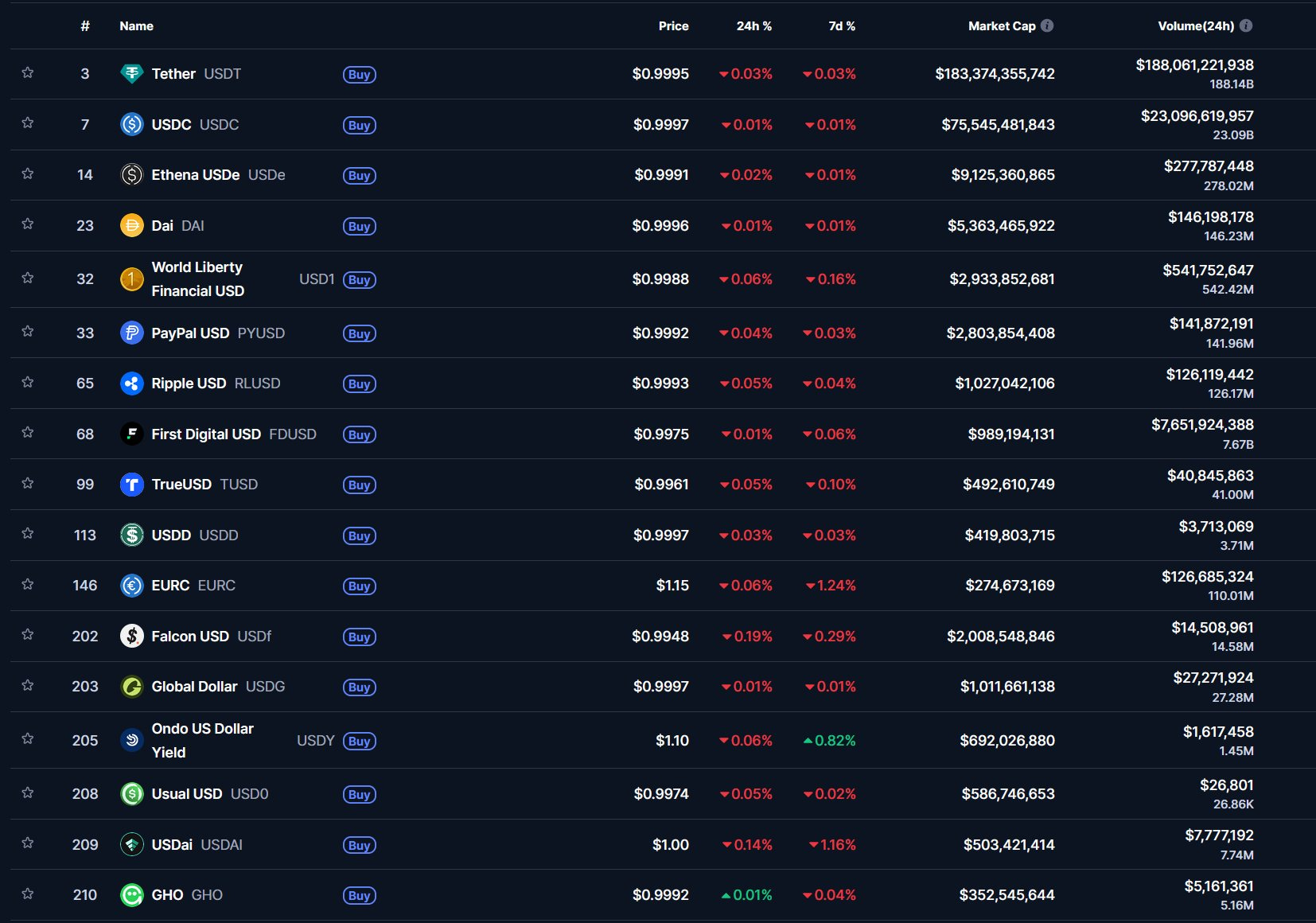

Within a few hours, all the major stablecoins had faltered. USDT (Tether), supposed to be worth one dollar, was trading at around 0.996, USDC (Circle) at 0.995, and even stablecoins known for their robustness, such as DAI, FDUSD, and TUSD, fell below 0.998. This seemingly minor dip is unprecedented: it is the first time since 2018 that all of the top 10 stablecoins have lost their parity with the dollar at the same time.

This widespread “de-pegging” illustrates the structural fragility of the system. Stablecoins are no longer actually backed by dollars deposited in banks, but by other digital tokens serving as collateral on interconnected platforms. These guarantees are often themselves borrowed, reused, or placed in leveraged products. The result is a closed system where liquidity circulates without ever touching real dollars. When one of the links – in this case, Stream – breaks, the whole structure shakes.

This crisis of confidence strikes at the very heart of the system. Binance, which holds the majority of global liquidity in stablecoins, is at the center of concerns. The volume of USDT there has grown by nearly 50% in one year, from around $83 billion to more than $125 billion in capitalization. Yet despite this massive injection of “liquidity,” bitcoin has remained remarkably stable. In other words, nearly $60 billion in “new dollars” have been created in the ecosystem without causing the slightest price increase in the asset that is supposed to be the main beneficiary.

This paradox suggests that this liquidity is not real: it is endogenous, created within the crypto system by issuing stablecoins that are not backed by tangible reserves. If these flows represented genuine external capital inflows, bitcoin would logically have surged. Their ineffectiveness proves that liquidity is just an accounting illusion, recycled from one protocol to another.

Binance now acts like a fractional reserve bank: part of the deposits are reinvested or tied up, which limits its ability to honor all withdrawals simultaneously. Signs of tension are multiplying: delays in USDT and USDC withdrawals, unusual spreads between Binance and regulated platforms, abnormally high volumes on BTC/USDT pairs indicating preventive outflows to bitcoin. These are all signs of a digital bank run, where loss of confidence precedes loss of liquidity.

This crypto stress is compounded by already high tension in the money markets. The SOFR, a barometer of interbank financing costs, remains stuck at around 4.27%, 15 basis points above the IORB, despite the Fed's key rate cut at the end of October. This gap reflects a structural shortage of dollars: every player, from hedge funds to DeFi protocols, is looking to borrow cash against collateral. And the more the value of this collateral (such as stablecoins) falls, the more demand for real cash intensifies – which further drives up the cost of financing.

On Tuesday morning, in the aftermath of the panic, the VIX – an indicator of volatility – jumped more than 20%, crossing 20.5 points, before falling back to +10% under the effect of reflexive buying. Equity funds, financed mainly by fundraising rather than repos, bought back the dip without any real macroeconomic analysis. But these rebounds remain superficial: selling flows linked to deleveraging dominate, and the share buybacks authorized since this week are insignificant compared to the mass of positions forced to liquidate.

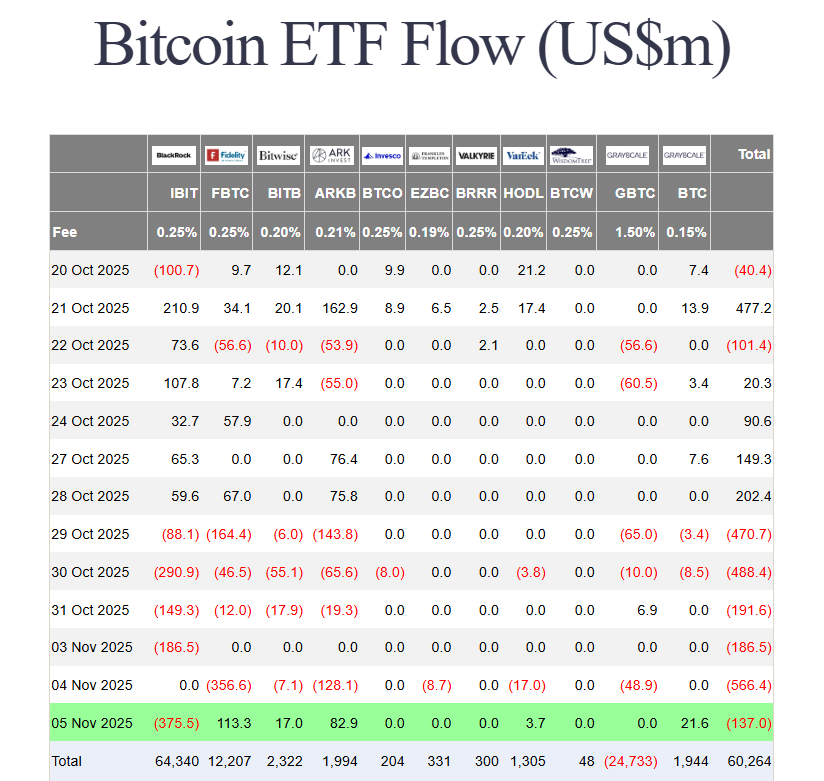

On Wednesday, bitcoin stabilized around $103,000 thanks to spot ETF purchases after six days of outflows. According to Farside Investments, positive flows were concentrated at Fidelity (+$113 million) and Ark Invest (+$83 million), contrasting with the simultaneous outflow of -$375 million at BlackRock (IBIT). These flows helped to halt the downward spiral and give the spot market some breathing room.

But this stabilization remains technical. Much of the support observed comes not from human investors, but from algorithmic bots operating on platforms. These programs automatically buy small volumes of BTC to smooth volatility or arbitrage between markets: some ensure ETF liquidity, others exploit price differences between platforms. On the surface, they appear to be “supporting” Bitcoin; in reality, they are merely temporarily cushioning the shocks. If financing conditions tighten, these bots withdraw immediately, leaving the market without any real depth.

Behind this facade of stability lies a structural problem: the cost of carrying. Spot Bitcoin ETFs must tie up cash as collateral and pay custody fees, while holding an asset that yields nothing. However, with SOFR close to 4.2%, this opportunity cost becomes significant: every dollar invested in a Bitcoin ETF yields 0, but costs 4% per year if invested in Treasury bills. Added to this are approximately 0.25% in management and custody fees. This context explains why ETF flows, even when positive, do not trigger a sustained rebound: investment remains penalized by the high cost of financing. As long as short-term rates remain high, ETFs will serve as technical support, not as a bullish driver.

Signs of stress persist: stablecoin derivatives such as USDe (Ethena) and USDT₀ (Plasma) are unwinding rapidly, evidence that confidence is eroding even in “safe” copies of Tether; big players, starting with Justin Sun, are now leaving their funds off platforms, fearing a freeze or a digital bank run. The tokenized liquidity that supported the ecosystem is evaporating, revealing an extreme dependence on dollar liquidity and internal arbitrage.

In other words, the tension in cryptos is far from over. It is not cyclical, but structural. The system has become accustomed to recycling the same liquidity without external input, financing itself on virtual collateral, and relying on bots to maintain the illusion of depth.

Bitcoin, which briefly fell below $104,000, no longer reflects just an unwinding of carry trades, but an internal crisis of digital collateral. The paradox is now clear: while Tether's market cap has jumped 60%, Bitcoin has only gained about 5% over the year.

At the same time, the gold price exceeded $4,000 per ounce, attracting protective flows amid a weakening dollar and geopolitical tensions.

In other words, it was gold, not bitcoin, that served as a safe haven. This disconnect between the growth in stablecoin assets and the stagnation of bitcoin raises questions: if USDT volumes are increasing without reflecting real capital inflows, it means that liquidity is being recycled in a loop, without backing from the dollar. The crypto system behaves like a pyramid of interconnected assets where trust, not cash, supports valuation.

A sustained collapse of stablecoins would trigger a chain reaction of liquidations: sales of bitcoin to obtain cash, a rise in SOFR, and a gradual freeze on withdrawals. The only way to break this spiral would be a massive buyback of bitcoins – a kind of “crypto QE” – to restore the value of the collateral. But neither Binance, which is limited by regulation and whose mobilizable reserves are less than $20 billion, nor the U.S. Treasury, which is paralyzed by the shutdown, can take on this role.

In this context, only one asset escapes the logic of chain collapse: physical gold. Whereas stablecoins depend on an issuer and bitcoin depends on the liquidity of platforms, gold needs no counterparty. It is no one's debt, is not based on any code, and requires no third party to exist. This is precisely what makes it a bulwark against digital bank runs.

Gold remains liquid in all circumstances. It cannot be frozen, suspended, or erased. When crypto and financial markets falter under collateral pressure, its value reflects widespread mistrust. Unlike bitcoin, it does not depend on any promise: its scarcity and permanence make it the only absolute liquidity. In a world where convertibility can disappear overnight, holding gold means freeing oneself from the chain of dependencies that weakens all markets.

The looming digital bank run is not just a technological crisis: it calls into question the very notion of liquidity and trust.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.