Gold is a highly liquid yet scarce asset, and it is no one’s liability. It is bought as a luxury good as much as an investment. As such, gold can play four fundamental roles in a portfolio:

- a source of long-term returns

- a diversifier that can mitigate losses in times of market stress

- a liquid asset with no credit risk that has outperformed fiat currencies

- a means to enhance overall portfolio performance.

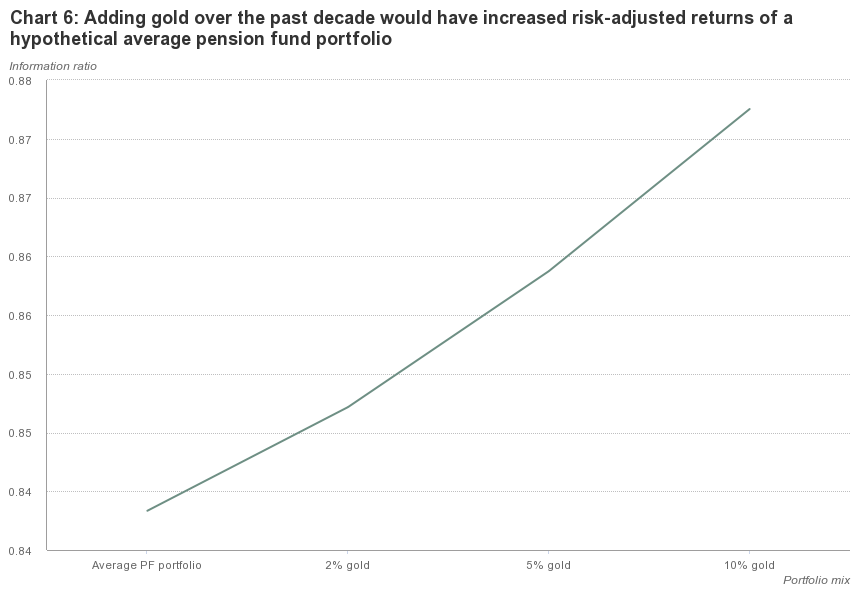

Our analysis shows that adding 2%, 5% or 10% in gold over the past decade to the average pension fund portfolio would have resulted in higher risk-adjusted returns.

Why gold, why now

Gold is becoming more mainstream. Since 2001, investment demand for gold worldwide has grown, on average, 15% per year. This has been driven in part by the advent of new ways to access the market, such as physical gold-backed exchange-traded funds (ETFs), but also by the expansion of the middle class in Asia and a renewed focus on effective risk management following the 2008–2009 financial crisis in the US and Europe.

Today, gold is more relevant than ever for institutional investors. While central banks in developed markets are moving to normalise monetary policies – leading to higher interest rates – we believe that investors may still feel the effects of quantitative easing and the prolonged period of low interest rates for years to come.

These policies may have fundamentally altered what it means to manage portfolio risk and could extend the time needed to meet investment objectives.

In response, institutional investors have embraced alternatives to traditional assets such as stocks and bonds. The share of non-traditional assets among global pension funds has increased from 15% in 2007 to 25% in 2017. And in the US this figure is close to 30%.

Many investors are drawn to gold’s role as a diversifier – due to its low correlation to most mainstream assets – and as a hedge against systemic risk and strong stock market pullbacks. Some use it as a store of wealth and as an inflation and currency hedge.

As a strategic asset, gold has historically improved the risk-adjusted returns of portfolios, delivering returns while reducing losses and providing liquidity to meet liabilities in times of market stress.

1/ A source of returns

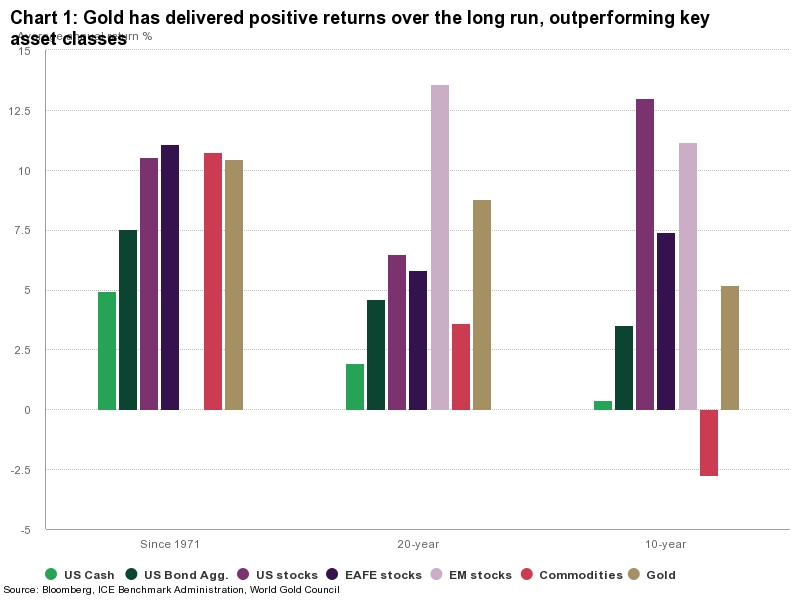

Gold is not only useful in periods of higher uncertainty. Its price has increased by an average of 10% per year since 1971 when gold began to be freely traded following the collapse of Bretton Woods. And gold’s long-term returns have been comparable to stocks and higher than bonds or commodities (Chart 1).

There is a good reason behind gold’s price performance: it trades in a large and liquid market, yet it is scarce.

Mine production has increased by an average of 1.4% per year for the past 20 years. At the same time consumers, investors and central banks have all contributed to higher demand.

On the consumer side, the combined share of global gold demand from India and China grew from 25% in the early 1990s to more than 50% in recent years.

Our research shows that expansion of wealth is one of the most important drivers of gold demand over the long run. It has had a positive effect on jewellery, technology, and bar and coin demand – the latter in the form of long-term savings.

Additionally, investors have embraced gold-backed ETFs and similar products to get exposure to gold. Gold-backed ETFs have amassed more than 2,400 tonnes (t) of gold worth US$100 billion (bn) since they were first launched in 2003.

And since 2010 central banks have been net buyers of gold in order to expand their foreign reserves as a means of diversification and safety.

Well above inflation

During the Gold Standard, and subsequently the Bretton Woods system, when the US dollar was backed by and pegged to the price of gold, there was a close link between gold and US inflation. But once gold became free floating US inflation was not its main price driver.

Sure enough, gold returns have outpaced the US consumer price index (CPI) over the long run due to its many sources of demand. Gold has not just preserved capital, it has helped it grow.

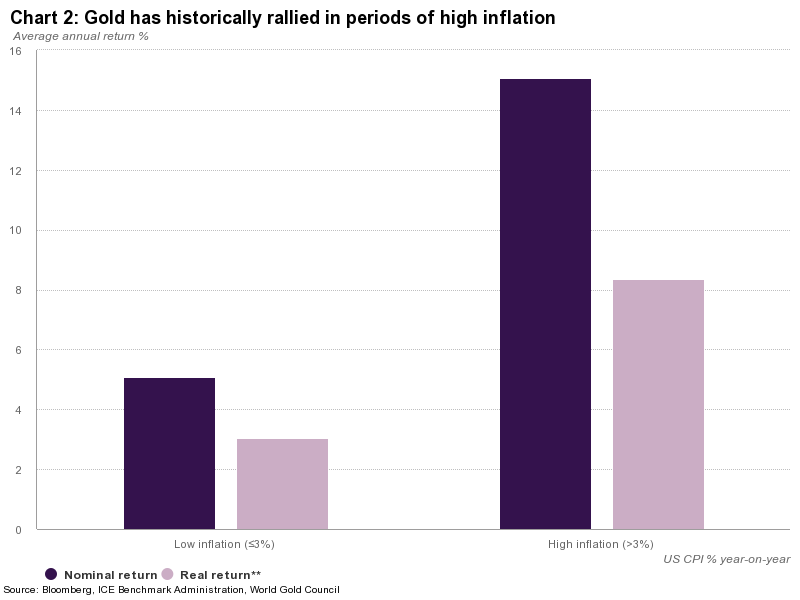

Gold has also protected investors against extreme inflation. In years when inflation has been higher than 3% gold’s price has increased by 15% on average (Chart 2). Additionally, research by Oxford Economics shows that gold should do well in periods of deflation.

A high-quality, hard currency

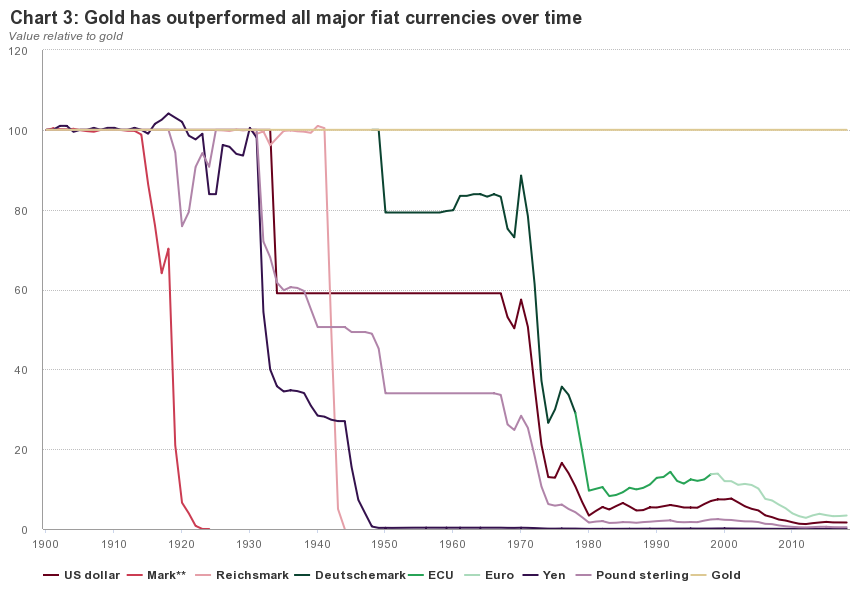

Over the past century, gold has greatly outperformed all major currencies as a means of exchange (Chart 3). This includes instances when major economies defaulted, sending their currencies spiraling down, as well as after the end of the Gold Standard. One of the reasons for this robust performance is that the available above-ground supply of gold has changed little over time – over the past two decades increasing approximately 1.6% per year through mine production. By contrast, fiat money can be printed in unlimited quantities to support monetary policies.

2/ Diversification that works

Although most investors agree about the relevance of diversification, effective diversifiers are not easy to find. Correlations tend to increase as market uncertainty (and volatility) rises, driven in part by risk-on/risk-off investment decisions. Consequently, many so-called diversifiers fail to protect portfolios when investors need it most.

For example, during the 2008–2009 financial crisis, hedge funds, broad commodities and real estate, long deemed portfolio diversifiers, sold off alongside stocks and other risk assets. This was not the case with gold.

Gold historically benefits from flight-to-quality inflows during periods of heightened risk. By providing positive returns and reducing portfolio losses, gold has been especially effective during times of systemic crisis when investors tend to withdraw from stocks. Gold has also allowed investors to meet liabilities while less liquid assets in their portfolio were undervalued and possibly mispriced.

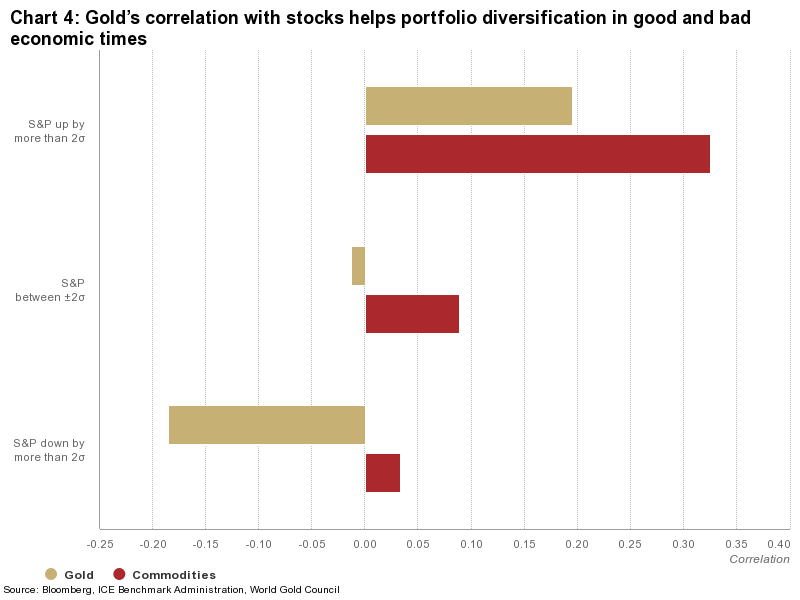

The greater a downturn in stocks and other risk assets, the more negative gold’s correlation to these assets becomes (Chart 4). But gold’s correlation doesn’t only work for investors during periods of turmoil.

Due to its dual nature as a luxury good and an investment, gold’s long-term price trend is supported by income growth. As such, our research shows that when stocks rally strongly their correlation to gold can increase, driven by the wealth effect and, sometimes, by higher inflation expectations.

3/ A deep and liquid market

For large buy-and-hold institutional investors, size and liquidity are important factors when establishing a strategic holding.

Gold benefits from its large, global market. We estimate that physical gold holdings by investors and central banks are worth approximately US$2.9 trillion (tn), with an additional US$400bn in open interest through derivatives traded on exchanges or over-the-counter.

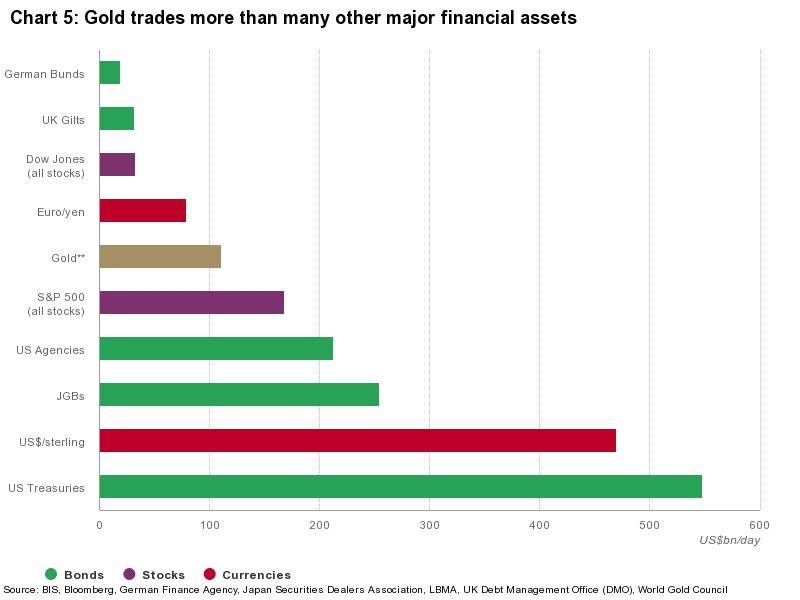

In addition, the gold market is liquid (Chart 5). Gold trades between US$50bn and US$80bn per day through spot and derivatives contracts over-the-counter. Gold futures trade US$35–50bn per day across various global exchanges. Gold-backed ETFs offer an additional source of liquidity, with the largest US-listed funds trading an average of US$1bn per day.

4/ Enhancing portfolio performance

The combination of all these factors means that adding gold to a portfolio can enhance risk-adjusted returns.

Over the past decade, institutional investors with an asset allocation equivalent to the average US pension fund would have benefitted from including gold in their portfolio. Adding 2%, 5% or 10% in gold would have resulted in higher risk-adjusted returns (Chart 6).

But studying simulated past performance alone of a hypothetical average portfolio does not allow us to evaluate how much gold investors should add to a portfolio to achieve the maximum benefit.

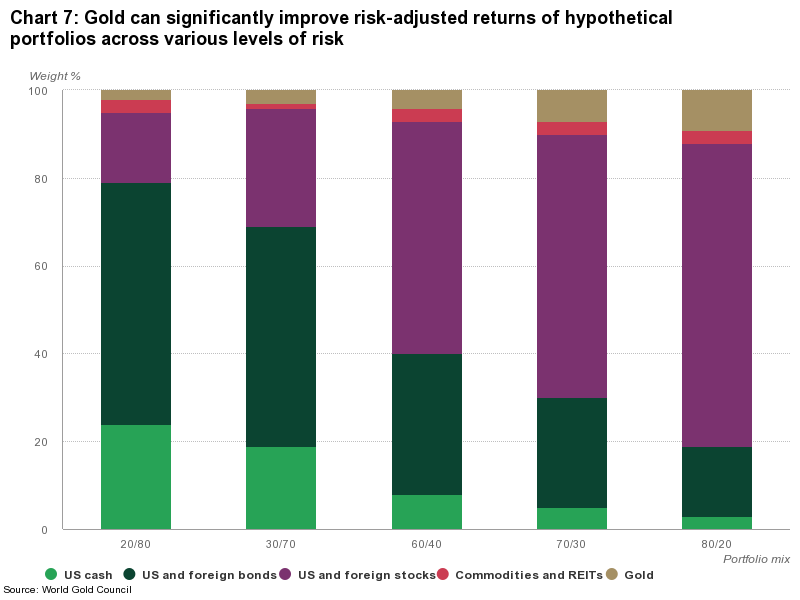

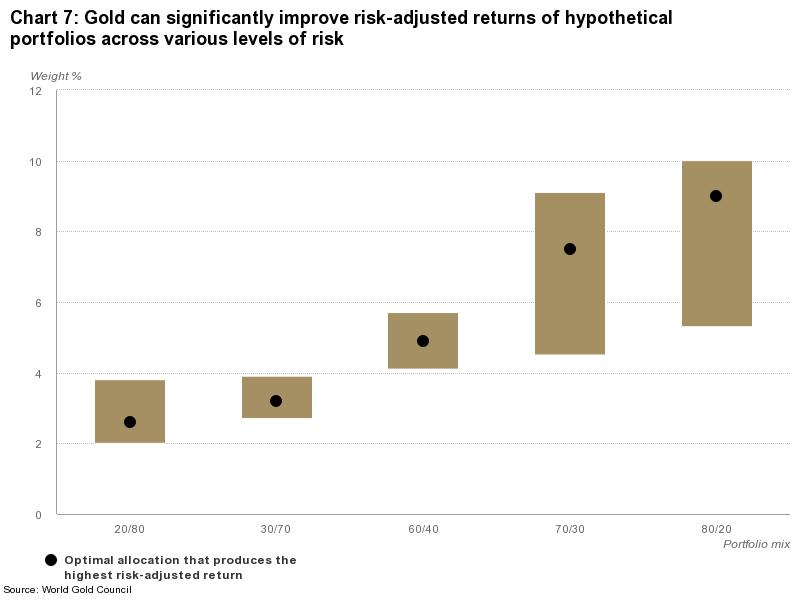

Asset allocation analysis indicates that, for US dollar- based investors, holding 2% to 10% in gold as part of a well-diversified portfolio can improve performance even more (Chart 7). Broadly speaking, the higher the risk in the portfolio – whether in terms of volatility, illiquidity or concentration of assets – the larger the required allocation to gold, within the range in consideration, to offset that risk.

The analysis shows that gold’s optimal weight in hypothetical portfolios is statistically significant even if investors assume an annual return for gold between 2% and 4% – well below its actual long-term historical performance (Chart 7).

Our research shows that this is also the case for investors who already hold other inflation-hedging assets, such as inflation-linked bonds, as well as for investors who hold alternative assets (e.g., real estate and hedge funds).

Gold goes beyond commodities

Gold is often lumped together with the commodity complex by investors and investment practitioners alike. Whether as a component in a commodity index (e.g., S&P Goldman Sachs Commodity Index, Bloomberg Commodity Index), one of the securities in an ETF, or as a future trading on a commodity exchange, gold is viewed as a part of this complex.

Gold undoubtedly shares some similarities with commodities. But a detailed look at the make-up of supply and demand highlights that differences outnumber similarities:

- the supply of gold is balanced, deep and broad, helping to quell uncertainty and volatility

- because gold is not consumed like typical commodities, its above-ground stocks are available for continuous utilisation

- gold is used for many purposes and purchased all around the world, reducing its correlation to other assets

- gold is both a luxury good and an investment, resulting in more effective downside portfolio protection.

Gold’s unique attributes set it apart from the commodity complex. From an empirical perspective, including a distinct allocation to gold has improved the performance of portfolios with passive commodity exposures.

Original source: World Gold Council

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.