For years now, emerging countries have been enjoying stronger growth than Western nations. Globalization, combined with the rise of China, has enabled these countries to achieve dazzling growth. Whereas in the past, periods of international crisis severely affected their economies, the situation seems to be gradually changing. This dependence, closely linked to the evolution of the dollar, is gradually disappearing, paving the way for a new global balance.

The idea of a divide between the “global North” and the “global South” remains an illusion. The European Union and the United States are among China's three biggest trading partners. Germany, for its part, remains the leading partner of Brazil and Turkey, while the United States holds this position in India, Mexico and Pakistan... The list goes on. For there are many links between the countries of these two poles, above all of an economic nature.

What is the “Global South” if not a vast, heterogeneous group? These are the main emerging countries, i.e. those whose influence has become international: first and foremost China, but also India, South Africa, Argentina, Brazil, Indonesia, Mexico, Malaysia, the Philippines, Pakistan, Turkey and many other nations.

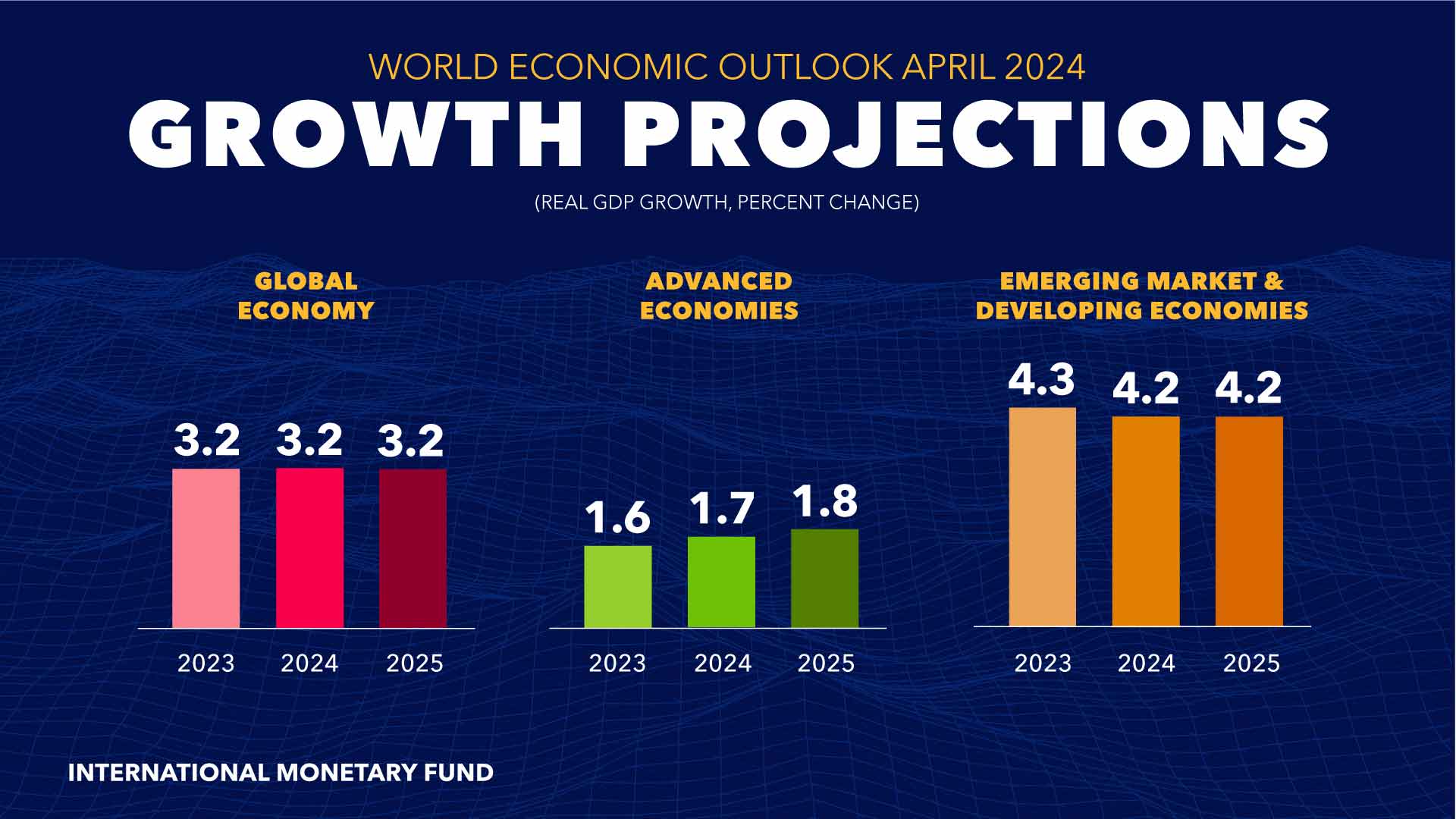

For several decades now, their growth has clearly outstripped that of the advanced economies. Of course, it's easy to say that slow growth in Western countries is hardly surprising for “advanced” economies. But with abysmal deficits on several fronts, including the budget and foreign trade (as in France, which has four simultaneous deficits!), and debt often in excess of 100% of GDP, their growth is essentially based on unsustainable foundations. Not to mention the fact that the Western economy as a whole has embarked on a headlong rush to recovery.

Emerging economies are now growing almost as fast as they did during the boom of the 2000s. At that time, their economies were driven primarily by China's boom and rising commodity prices. Today, the Chinese economy is faltering as a result of a policy of massive indebtedness and a crisis in the real estate sector. The country is even adopting a monetary policy similar to that of Western countries (pioneered by Japan in the 1990s), lowering interest rates and buying government debt. The Xi Jinping government is ceding its historic role as the workshop of the world to other Asian countries, whose growth is progressing rapidly and whose future looks promising.

China may not be as important an asset as it once was, but raw materials are just as important. Emerging countries have natural resources that advanced countries do not have, especially European states. Producers in abundant quantities, sometimes in a monopoly position, are taking advantage of rising commodity prices (particularly after the 2008 crisis and the Fed's accommodating policy) to support their development. This is because, in a way, they are providing advanced economies with the resources they need for their growth drivers, now that inflation is on the rise. Whether it's the lithium needed to manufacture green technologies and electronic chips, nickel for electric vehicle batteries, or copper for electrical cables and telecommunications equipment...

These resources are also assets for companies looking to relocate, attracted in particular by lower energy costs. While the health crisis has restructured supply chains around the world, many of these countries have become global production centers and are undergoing rapid industrialization. India, for example, has become a veritable technology hub; China, of course, is home to a global center for the manufacture of green technologies; Brazil has become a major player in agribusiness, Mexico an aerospace production center, Malaysia a key player in electronics and semiconductors, and so on...

These countries also offer cheap labor. Their rapid demographic growth is highly attractive. Today, China, India and Russia together account for over 30% of the world's population. In a few years' time, the majority of the world's working-age population will be living in emerging markets. Through their high level of consumption, they represent a vital force for the domestic markets of the countries concerned.

These factors are enabling companies in emerging countries to record substantial profits, in addition to investing massively. This year, they are up by almost 20% (compared with only 10% for US companies, due to a stable facade), with margins rising steadily, whereas they are stagnating in most Western countries. In the years to come, all emerging countries are set to outpace growth in advanced economies.

The evolution of the dollar is also creating new changes that will benefit them. The inevitable decline in the value of the US currency, in both the medium and long term, is beneficial to their economic and financial health. This situation is already being reflected today, as the US central bank plans to cut interest rates in September. Given that 80% of world trade (especially raw materials) is traded in dollars, a weaker dollar makes goods and services cheaper for emerging countries, and pushes up their sales prices. By extension, gold and silver, held in increasing quantities by emerging countries (via their central banks), gain in value.

The fall in the dollar is reducing the weight of their US-denominated debt, and also boosting emerging market assets. Over the years, these assets have become increasingly attractive, thanks to their cheap valuations. They often outperform Western indices, despite the persistent appeal of the US market, boosted by the artificial intelligence craze and the US central bank's persistent liquidity.

The countries of the “Global South”, many of which are part of the BRICS alliance, have thus taken off in leaps and bounds, unlike in the past two decades. Their economic weight, now representing over a third of global GDP (i.e. more than the G7 countries), means that a simple slowdown in emerging market productivity could reduce global output three times more than in the early 2000s.

All things being equal, the balance of power is shifting. And for good reason: their economic assets are a diplomatic influence, just like the variable geometric positions of Western countries, creating a consolidation of the BRICS and all that flows from them. The current period bears witness to this: the fact that Ukraine receives unlimited support, while the poorest countries receive “development aid” and loans that plunge them even deeper into poverty, only accentuates mistrust of the West.

Nevertheless, their rapid development, characteristic of a new world taking shape, cannot mask a darker reality: these countries often remain prisoners of the debts they have contracted with Western financial institutions, such as the IMF and the World Bank. Although their political influence is growing, it is not enough to free them completely from these invisible chains, and keeps them at the mercy of a world order that they are striving to redefine...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.