Last week, we told you why silver is set to explode because of tailwinds from the New Energy megatrend.

Silver is a key component in solar panels and electric vehicle batteries. And both of these will play an increasing role in the global shift towards New Energy that’s underway.

The bottom line is that silver’s crucial role in the green economy paints a very bullish picture for the metal.

Today, I’ll show you another reason why this overlooked metal is set to go much higher in the coming months.

Precious Metals Offer Wealth Protection

Like gold, silver is also a precious metal.

Many of those who own silver buy it for the same reasons they buy gold: to protect their wealth against negative real interest rates, rampant government debt, and money printing.

And right now, real interest rates are negative (when adjusted for inflation), meaning people are losing money on every cent they save…

And government debt has rocketed from $23 trillion at the start of 2020 to more than $28 trillion, funded primarily by the U.S. government’s unbridled money creation.

According to the Federal Reserve, M2 – a broad measure of the stock of U.S. dollars – rose from $15.41 trillion in January 2020 to $21.43 trillion in November 2021.

This means that more than 28% of the U.S. dollars in existence were printed in the last 22 months alone.

Precious Metals Are the Ultimate Form of Wealth Insurance

While money-printing is nothing new, the increase in the money supply to combat the after-effects of the COVID-19 pandemic and pay for the feds’ largesse is unprecedented.

And it’s bullish for both gold and silver.

Remember, these precious metals are the ultimate form of wealth insurance. They’ve preserved wealth through every kind of crisis imaginable.

An ounce of silver buys you about the same amount of bread today as it did in Roman times. And, if you want a more recent example, 20 ounces of gold will still get you a pretty nice car, as it would have about half a century ago.

The money-printing phenomenon is creating a glut of freshly printed money that’s yet to work its way through the global economy. When it does, it will create a bubble in gold and silver, as investors scramble for time-tested cash alternatives to protect their savings from inflation.

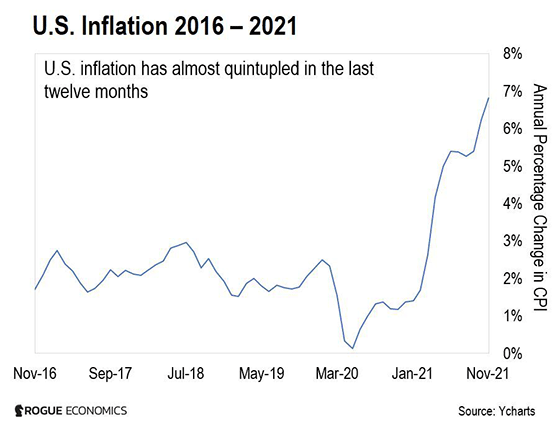

That hasn’t happened yet, but it will. U.S. inflation has shot up from 1.4% in January 2021 to 6.8% right now. And it’s showing no signs of a reversal any time soon.

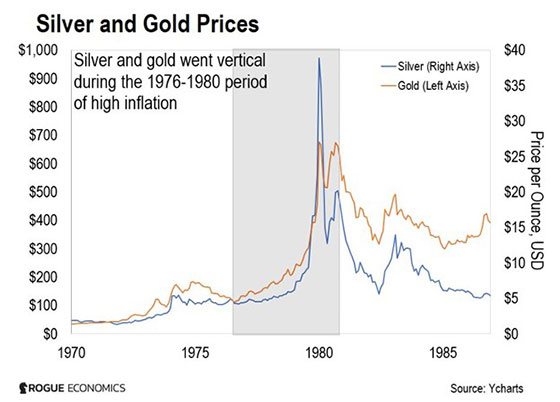

Now, have a look at this next chart. It shows silver (blue line on the chart) and gold (orange line on the chart) prices during the last period of rampant inflation, 1976–1980 (the shaded area on the chart).

In 1976, the inflation rate was 5.8%. By 1980, it had risen to a whopping 13.5%.

And you can see how the gold and silver markets performed. Gold gained 415%… with silver returning more than double that – 857%.

Why Silver Is Set to Outperform Gold Again

There are a couple of simple reasons why silver outperformed gold during that period of high inflation… and why we believe it will again during this one…

You see, around 80% of silver is mined as a byproduct of gold or industrial metal mining. As a result, the silver supply does not respond directly – or as quickly – to higher prices, the way the gold supply typically does.

This means shortages in supply (as demand increases, for the reasons we outlined in our essay last week) will lead to higher prices for silver.

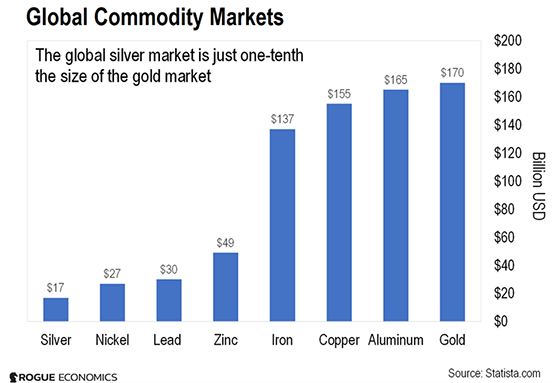

Then there’s the size of the silver market. The chart below shows how tiny silver is relative to other commodities.

You can see that the silver market is less than even the zinc market and the nickel market. And it’s just one-tenth the size of the global market for gold.

With a market this small, it only takes a small amount of money to push the price around. And large amounts of money can dramatically impact prices. This makes gold’s more volatile cousin prone to sharper upside explosions as money typically pumps into it when inflation is high.

Disconnect Between Potential and Price

And the best part is: Silver is still a bargain. It declined roughly 12% this year. This is a pretty dismal performance compared to the explosion in other commodity markets.

For instance, the S&P GSCI Commodity Index (consisting of 24 commodities from all commodity sectors) has gained about 42% year to date. Copper is up 26%, sugar is up 21%, and cotton is up 45%. Oil has done even better, appreciating 57% so far this year.

So silver is relatively cheap right now. In fact, the metal is currently trading well below its July 2020 price of roughly $27 – before the Fed’s printing press really went into overdrive.

In other words, it’s trading as if no money-printing has happened.

That’s another illustration of a disconnect our editor, Nomi Prins, has identified between the financial markets and the real economy.

It’s the biggest discovery of Nomi’s career. And knowing how to play it could help you find the biggest wealth-building opportunities of your lifetime.

Original source: Rogue Economics

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.